New research by The Boston Consulting Group’s Center for Consumer and Customer Insight shows that the Internet is having a measurable and growing impact on media consumption, and that will have significant ramifications for traditional media companies, both print and electronic. The disruption of the media industry in India will play out differently than it has for companies in other national markets, but Indian media providers that do not address the coming changes will find themselves no less severely affected.

The Changing Media Consumer

Internet penetration is expanding quickly in India. The number of users is expected to more than double, from about 200 million in 2014—roughly 16 percent of the population—to at least 400 million, and potentially as many as 550 million, in 2018. More and more of the new consumers will be rural and will span multiple income groups. Already, Internet penetration has increased from 19 percent in 2012 to 26 percent in 2013 in tier 2 cities; in tier 3 and 4 towns, it increased from 18 percent to 27 percent over that time frame. Penetration also rose significantly among all income groups except the least affluent.

The impact of digital technology on media consumption in India shows the power of the Internet to disrupt traditional industries by changing the way consumers go about their daily activities—even when penetration rates are still relatively low. The average consumer today spends three to five hours a day with media, with remarkable consistency across location, gender, age, and occupation. Digital consumers already spend 35 percent of that time online. And while digital consumption is lower in rural areas and lower-income classes, it already far outpaces print consumption and is rapidly approaching TV consumption levels across all demographics.

Men, urban dwellers, younger people, and business executives are particularly heavy digital-media consumers, but more interesting is the fact that even people aged 46 to 55 in second-tier towns (where Internet penetration is only 27 percent) are spending about a third of their media consumption time online. Women trail men in digital consumption by 10 percentage points in urban areas (40 to 30 percent) and a much lower percentage of women in rural areas are online (15 percent compared with 39 percent of men), but this gap is expected to close in the coming years.

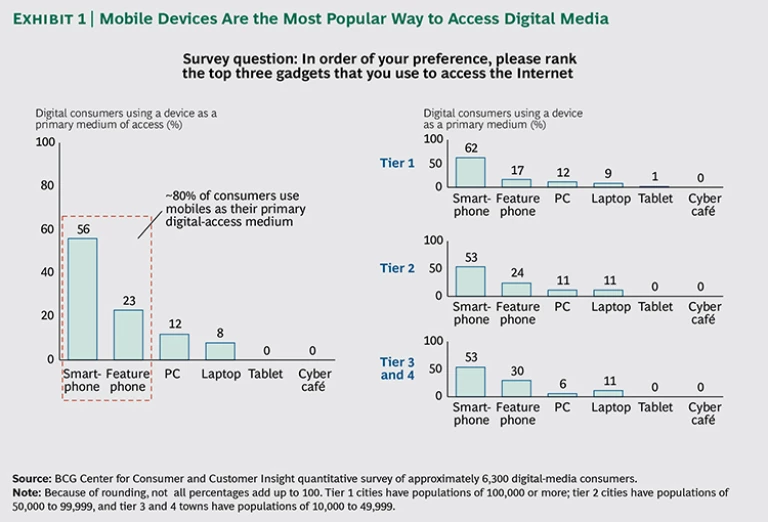

Most urban connected consumers are looking at small screens, often while on the move. Mobile devices are the most popular means of consuming media: 56 percent use smartphones; 23 percent, feature phones. The use of feature phones is highest in rural areas. (See Exhibit 1.) Nationwide, only 20 percent of connected consumers use PCs and laptops. We expect the percentage of smartphone users to rise in the coming years as more people gain 3G and 4G access and more lower-priced smartphones reach the market. This is a significant trend for traditional media companies to bear in mind when developing digital strategies. The experience of watching video or reading a newspaper on a smartphone or feature-phone screen is very different, of course, as is the challenge of presenting video or display advertising.

Digital consumers spend most of their media budget on expenses related to broadband access, such as purchasing a phone and a data plan. Their spending on print is limited and higher only in smaller cities, where multiple subscriptions are common.

Evolving Consumption Patterns

Digital has a strong impact on all aspects of media consumption, with usage increasing as users gain digital maturity and more content options become available. This is a key indicator for future consumption, which we expect to grow quickly. Indian consumers currently spend only about one-third of the time on media that their U.S. counterparts do, leaving plenty of room for expansion.

Consumers who have been online less than a year spend 30 percent of their media-consumption time on their devices, but after a year the percentage of digital consumption jumps to 34 percent, and after three years, it jumps again, to 39 percent. Those with more than five years of digital experience spend 42 percent of their media-consumption time on digital devices. This shift comes primarily at the expense of television. Print consumption remains relatively constant as digital consumption increases. As one user told us, “When I started accessing the Internet, I was not aware of all media available on digital. It’s only of late I have realized how convenient watching movies and serials online is, and [I now] spend a lot of time online.”

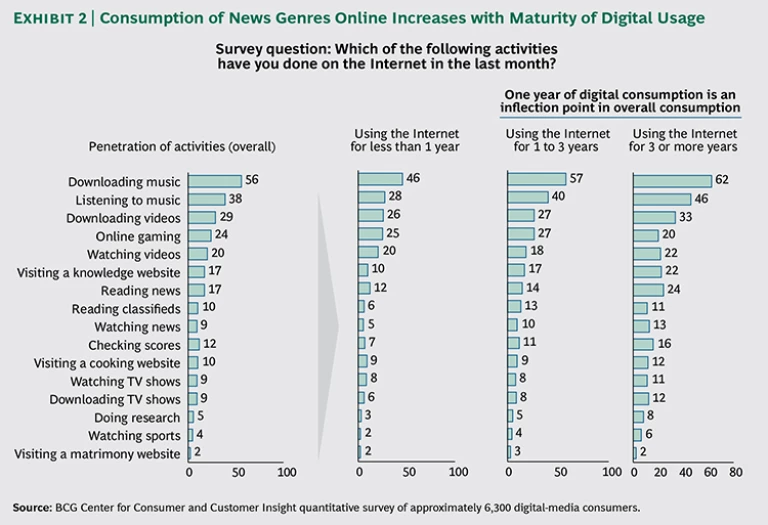

Downloading and listening to music are the most popular digital activities, followed by downloading videos and online gaming. This is hardly surprising given that most of these are online-only activities. But reading and watching news, checking scores, and accessing knowledge websites show significant increases after the first year of Internet use. (See Exhibit 2.)

Several categories of consumption, including classified and job-related advertising, searching for knowledge material, and real estate research, have already migrated substantially online. More than 80 percent of consumers—both English and vernacular-language readers—prefer digital channels to access this content.

As digital consumption increases, Indian consumers discriminate among different types of media for various types of news and entertainment. For more than a quarter of consumers, print remains the preferred outlet for local news, Bollywood news and gossip, and international news. Consumers recognize that newspapers do a good job of delivering these types of content, and for the moment at least, there is much more print than digital content for non-English speakers.

Consumption is becoming a shared experience for many. Social interaction, pictures, blogs, and videos are growing in importance. Websites and apps such as Google, Facebook, and YouTube are often first destinations for digital consumers. As one user put it, “Friends talk about [politician and former chief minister of Delhi] Arvind Kejriwal. It is important for me to know what is happening so that I can participate.” Said another, “I do search on Google but read news on Yahoo because it has a lot of photos.”

Consumers have good recall for many Indian digital brands. However, very few consumers pay for digital media. In general, consumers equate paying for data with paying for content, and they believe that any content they seek can be found for free online, which, owing to lax intellectual-property laws, is often the case.

The Opportunity for Media Companies

As digital penetration increases, three primary trends will likely play out:

- Overall media consumption will increase, driven by a rising amount of time spent on digital consumption.

- Consumer spending on data plans will rise because most new users will be consuming on their mobile devices.

- With increased digital usage, more media companies will offer digital alternatives, further propelling the overall shift to digital-media consumption.

Traditional media players have an inherent opportunity to take advantage of these trends, and those that move quickly are likely to establish an advantage (assuming they provide a good product) in user familiarity and loyalty. For example, there is a big opening for a digital vernacular destination that cuts across genres, especially as penetration rises in lower-tier cities. Approximately 60 percent of all consumers read vernacular print, and the percentage is even higher in nonurban areas.

We do not foresee Indian print companies experiencing a significant shrinkage in revenues as digital influence increases, at least in the short term, which is a big difference from the pattern seen in other markets, such as the U.S. The question is more one of opportunity: can publishers translate off-line print dominance into digital attraction as consumers gain digital maturity and show a growing preference for news consumption online?

There also appears to be plenty of scope for traditional companies—both print and television—to stake out digital territory with ancillary genres in the short term and core news genres in the long term. Indian consumers are loyal to brands—they already go to print sites as a primary destination for searching news and to TV channel sites for TV shows and information. Existing media brands should consider expanding their presence to the digital medium to tap this loyalty and maintain relevance with existing readers and viewers as well as to attract a new audience.

Media companies looking to move into digital will have to come to grips with the fact that consumers do not want to—and more significantly, do not see the need to—pay for content. They also want a social or shared experience online. Advertising-supported content-delivery models may work, as they have in other markets. But to provide advertisers with a sufficient audience, content companies may have to help boost usage.

There is an opportunity to create bundled offerings in which both operators and content owners benefit. So-called sponsored data plans, which shift the cost of accessing social networks or other content from the consumer to the content company or the network operator, are one model to explore. These plans are available in multiple emerging markets, including India, and have resulted in double-digit growth in access.

One telecommunications company has shown substantial success at building mobile-data usage, increasing its revenues at twice the rate of the market, by revising its pricing and marketing with the goal of positioning itself as a leader in data as well as voice usage. The company revolutionized pricing by offering 3G “data packs” that put the price and value benefits of these offers in stark contrast to traditional “pay as you go” 2G plans. At the same time, it changed its marketing from emphasizing Mbps to focusing on uses. The data packs were organized around access to information on popular pastimes such as cricket and movies as well as social-networking and video apps such as Facebook and YouTube.

Implications for Advertisers

Substantial percentages of advertising spending in multiple categories have already moved online. One-third or more of ad spending for air travel; computers, laptops, and tablets; air-conditioners; other consumer durables; and cars is now devoted to digital channels. In some categories, the digital share approaches 50 percent. Categories such as financial services, mobile devices, scooters and motorcycles, and small appliances all experienced significant increases in online versus off-line share from 2012 to 2103. It is no surprise that these are the same categories in which our research shows increasing digital influence on the purchase process.

Almost 35 percent of digital spending goes to search advertising and another 30 percent to display advertising. Significant and growing shares (13 percent and 10 percent) are spent on social media and mobile, respectively. More and more fast-moving consumer goods companies are using social media to deepen consumer engagement with their brands. Mobile ads are useful for reaching consumers in areas that are not well served by other media. Some marketers are segmenting online and off-line spending by type of product and target market. The digital share of the ad budget for a typical luxury sedan, for example, could be 25 to 30 percent, while the comparable share for an economy model could be approximately 5 percent. Similarly, digital ad spending for higher-priced mobile devices is much greater than for low-priced phones.

Digital advertising is still in its early days in India. Smart advertisers and their agencies can learn a lesson from the experience of more developed markets and begin to take steps now to avoid the complexity and inefficiencies that have plagued campaigns in the U.S. and the UK and to employ the advanced techniques available today that can result in far greater campaign effectiveness. (See Efficiency and Effectiveness in Digital Advertising, BCG Focus, May 2013, and Adding Data, Boosting Impact: Improving Engagement and Performance in Digital Advertising, BCG Focus, September 2014.)

Digital’s disruption of the Indian media landscape will only pick up speed. The changes will play out in uniquely Indian fashion, but there is little question that consumption patterns will change—some radically—and that the industry will look much different in just a few years’ time. Big opportunities are already presenting themselves for companies, both traditional and start-up, that move quickly. Those that do, and those that are willing to experiment and innovate with new delivery models, can attract a fast-growing user base in the near term and establish a strong digital advantage for years to come.