It is the question every company in every industry is asking: How do we win in the digital era? But there is another question that businesses should—but too often don’t—ask first: Are we even positioned to win? For many established companies, success in the digital age will require change, not just in how they work but often with whom they work as well. It will mean adopting unfamiliar approaches. And it will mean taking new risks to avoid the biggest risk of all: being mired in old ways of operating and thinking, while more nimble competitors take the lead.

As many companies are discovering, those nimble competitors are already making their mark and gaining ground. And in keeping with the pace of the digital era, they’re doing so quickly. How are German businesses positioned to win? In many cases, not as well as they could be. But the good news is, that can change.

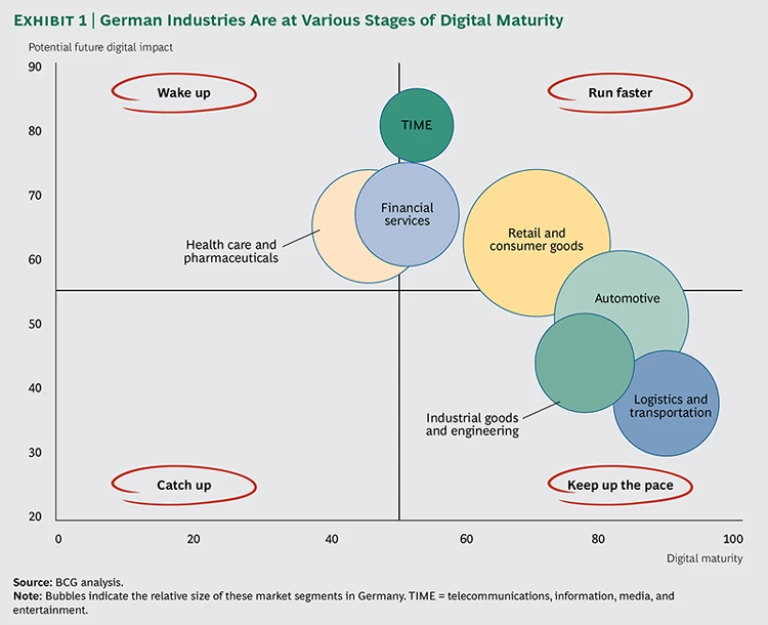

To help German companies understand how they stand relative to global best practices and what they should be thinking about as they move forward, BCG developed a digital index to identify the industries that are leading the digital charge, those that are lagging behind, and those that fall somewhere in between. Our analysis also assessed how digital is expected to affect the future of the seven major industry sectors we examined. (See “Our Methodology.”) The goal was to drill down on where different sectors have demonstrated strengths and weaknesses, where they need to keep the momentum going, and where they have to fill in the gaps.

OUR METHODOLOGY

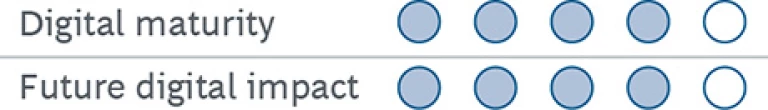

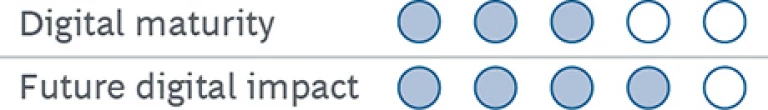

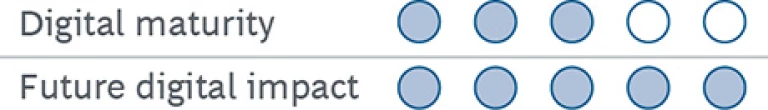

BCG’s index focuses on two key dimensions of digital’s impact on German industries:

- Digital Maturity. How do specific industries compare with global best practices? Are there sectors where Germany already leads—or has fallen worrisomely behind? For each industry, we looked at four core elements that together give a good picture of how the country is positioned to leverage digital: the customer interface; innovation; operations and processes; and corporate functions and IT platforms.

- Future Digital Impact. How will digitization change individual sectors to 2020? Which industries can expect the most dramatic transformation?

We evaluated seven German industries, covering some 70 to 80 percent of the DAX and MDAX stock indexes:

- Retail and consumer goods

- Automotive

- Health care and pharmaceuticals

- Financial services

- Logistics and transportation

- Industrial goods and engineering

- Telecommunications, information, media, and entertainment

For each industry, we followed a common methodology. We compared practices observed in Germany—everything from how digital channels are being used to improve the customer experience to the extent to which digital trends are being translated into new business models—with global best practices. We also interviewed nearly two dozen global experts and looked at hundreds of company assessments, country rankings in market studies, and data from industry organizations, statistical institutes, and global research and advisory firms.

We scored the industries, on a scale from 0 to 100, on each element of digital maturity, with the grades representing how close each sector approaches the current global leader. The scores for future impact (also on a scale from 0 to 100) reflect how much change digital is expected to spur by 2020.

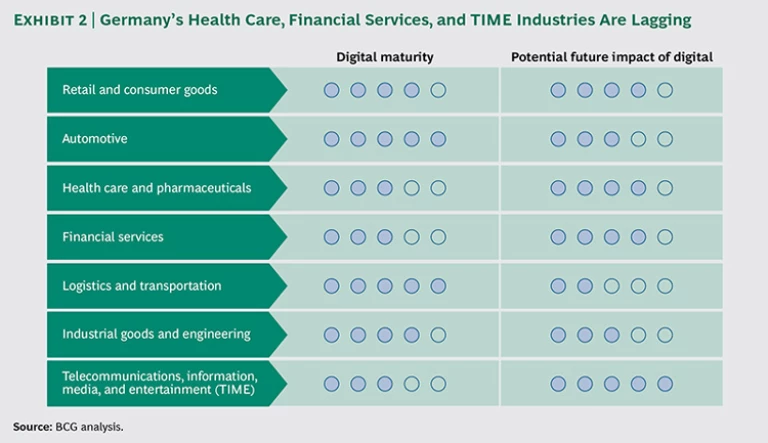

As expected, the seven industries did not score equally. (See Exhibit 1.) Germany’s automotive sector and logistics and transportation industry are already well positioned from a digital perspective, although they will need to work to maintain that edge. But health care and pharmaceuticals, financial services, and the telecommunications, information, media, and entertainment (TIME) industry lag well behind global best practices and will require significant effort just to catch up. (See Exhibit 2.)

There were differences, too, in the potential future impact of digital on the seven industries examined. We anticipate further upheaval in the TIME sector, which has already experienced dramatic change. Financial services, health care and pharmaceuticals, and retail and consumer goods should likewise undergo notable shifts. Logistics and transportation is likely to see the smallest degree of change, in part because this sector already makes heavy use of digital technologies and processes, but also because much of its value creation lies in the movement of physical goods.

The sectors where digital maturity is relatively low but the potential future impact is high will be under the greatest pressure to step up their game. Thus, companies in financial services, retail and consumer goods, and TIME will have to act quickly if they are to adapt to the coming changes, defend against new challengers, and exploit the opportunities that will be theirs to seize.

Shaping and Mastering a New Competitive Landscape

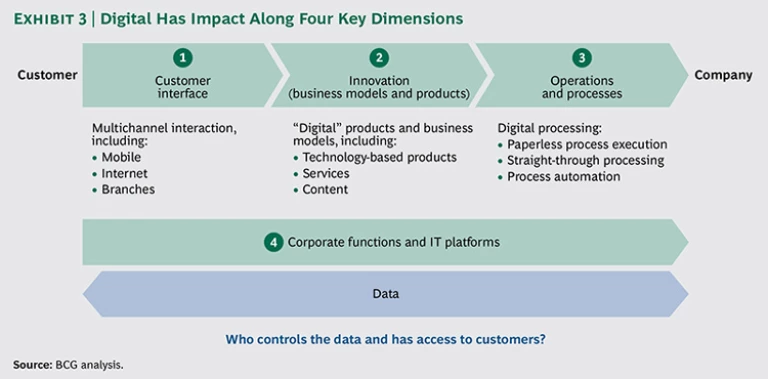

While our analysis was intended to help German businesses in particular, the findings should be of value to any company that is seeing the world around it change rapidly and knows that it may need to change rapidly, too. The examination of global best practices demonstrates clearly, and for some companies perhaps worrisomely, how digital can affect—and is already affecting—businesses along four dimensions. (See Exhibit 3.)

- The Customer Interface. Digital technologies can provide businesses with new customer touch points—the channels through which companies and customers interact with one another—including mobile apps, self-service portals, and social media. What makes these touch points so powerful is that they give companies a direct and exclusive link to customers and potential customers, allowing them to promote products and services, strengthen relationships and loyalty, and learn more about their customers.

- Innovation. Digital opens the door to new offerings and novel business models. In-car sensors, for example, have enabled some large automotive insurers to base premiums on actual driving habits, rewarding (and attracting) good drivers by offering them better rates. Digital innovation can lower the barriers to new markets and even new industries. Technology companies like Apple and Google, for instance, have been able to piggyback new payment systems on the mobile technologies for which they set the standards—potentially taking a big piece of the pie away from traditional payments players.

- Operations and Processes. By streamlining processes that directly affect their customers, companies can improve response times, service, and customer satisfaction. While this may not be disruptive, it can strengthen one’s market position. Robotic process automation, for example, allows software to replicate repetitive, rules-based tasks traditionally performed by employees—even when accessing and communicating with multiple systems are required. Such technology frees up the workforce for other tasks and provides easy scalability when business volumes change on short notice. Technologies like SAP HANA, meanwhile, can analyze data flows to optimize processes.

- Corporate Functions and IT Platforms. Digital enables businesses to improve the back-office support processes that do not directly affect customers but nonetheless play a role in how efficiently a company runs. Specialized start-ups now offer advanced services that plug into a company’s existing IT platforms—for example, software that analyzes and scores job applications coming into an HR portal. Skillful use of these technologies can improve workforce planning, spur faster and better interaction with suppliers, and facilitate knowledge transfer, among other things. Digital processes also make possible shared-service centers that can consolidate accounting, HR, procurement, and other processes for far-flung subsidiaries.

The analysis also shows the essential role that data—specifically, access to data—plays in the digital era. Data helps businesses see patterns—in everything from consumer preferences to equipment performance—and gain insights that can be integrated into products, offers, and business models. A retailer might know that a shopper frequently purchases baby care items. It might also know, thanks to in-store sensors and GPS technology built into mobile phones, when that consumer is physically present in its store. The retailer could then send on-the-spot offers for baby-related products. This kind of marketing is especially effective because the consumer receives an offer at the very moment that he or she is in a position to make a purchase.

When companies control data and have a direct channel to consumers, they can trigger thinking or behavior in ways that benefit themselves and their customers. But when they don’t, what they have is risk—risk that they will be unable to seize key opportunities and that other players will.

In the financial industry, new entrants are providing consumers who manage multiple accounts with an alternative to using multiple websites. Apps like Numbrs, from the Swiss start-up Centralway, provide an aggregated view of all of a customer’s accounts, along with the ability to perform transactions and receive alerts. Now the customer touch point no longer belongs to the financial institution but to the app itself. For banks, losing that direct interaction can mean losing opportunities to promote products and deepen customer relationships. Meanwhile, Numbrs—which currently covers some 3,500 German banks—gets access to valuable data on user transactions and behavior.

Such disruptive change is not hypothetical. Uber and mytaxi have changed the way people use taxis; Airbnb has changed the way they book lodging in a new city; Netflix and Maxdome have changed the way they watch movies and TV. What’s made all this possible is the savvy and often bold use of new technologies. But these upstarts also succeeded because other companies, working from more traditional playbooks, were too slow to see the possibilities—and the dangers.

Below we look at each of the seven industry sectors in order of industry size.

Retail and Consumer Goods

Already, digitization has reshaped Germany’s largest industry—and changed the rules of the game. While brick-and-mortar retailers typically need to realize a 30 percent gross margin to operate profitably, online players like Amazon can make money at just 10 percent. And because they can sell the same goods for less, they can woo customers—and loyalty—away from more traditional players. Little wonder, then, that online markets in Germany achieved a compound annual growth rate of 17 percent between 2008 and 2012.

Not all product categories have fared equally, of course. For certain high-end offerings, the kind of personal assistance available only—for now, at least—in the physical world still gives off-line sellers an advantage. But with e-commerce expected to grow rapidly over the coming decade, even those retailers will likely see their market share falter, unless they can integrate compelling digital capabilities into their own businesses.

Digital Maturity. Overall, German retailers and consumer goods companies rank relatively high in their use of digital channels. About 13 percent of all commerce is now transacted online or via mobile—less than in the UK, the global leader, at 20 percent, but more than in many other developed nations. And Germany ranked eleventh out of 50 countries (behind the UK and Japan, but ahead of France and Spain) on BCG’s 2013 e-Intensity Index, which measured the relative maturity of Internet economies.

Yet there is much variation among companies within the sector. Some are quite advanced. Adidas, for instance, enables visitors to its website to tailor products to their own specifications, such as shoes with distinct colors and patterns. Some major consumer companies, meanwhile, have started to exploit a range of touch points, from websites to mobile apps to social media, to interact with consumers—although most are proceeding cautiously, mindful of their dependence on retailers. But many other companies, particularly brick-and-mortar retailers, have little more than a bare-bones online presence, if that. Often the logistics of Internet transactions prove a challenge. (See “Getting a Lock on Logistics.”)

GETTING A LOCK ON LOGISTICS

For retailers that have long done their business in the physical world, e-commerce can bring some vexing complications. That’s a lesson Germany’s leading drugstore, dm-drogerie markt, learned while watching its main competitors launch e-commerce efforts—and rack up losses. The problem: high logistics costs. Online customers weren’t used to paying for shipping. But products like cosmetics and cleaning supplies typically have low margins. So when retailers covered the shipping costs themselves, their chances for commercial success plummeted.

Yet dm—which has some 1,250 locations in Germany—found a surprisingly simple approach to reducing these costs. Instead of taking fulfillment and shipping into its own hands, it developed a partnership with a company that had already mastered online logistics: Amazon.com.

Amazon buys and sells dm’s private-label products, a model that lets dm leverage Amazon’s core competencies—and customer base—while avoiding costly outlays itself. The end result: dm can profitably sell even low-margin products online. Meanwhile, the greater production volumes required to serve new online customers mean potential economy-of-scale cost advantages, which dm can leverage in all its sales channels.

Germany has fared less successfully in digital innovation—coming up around the global midpoint. New services and business models have been fairly scarce. One reason may be the relative dearth of start-ups (which traditionally drive such innovation), but it’s also true that established players in Germany haven’t been as experimental as their peers elsewhere. They aren’t as quick to try new things. For example, so-called click-and-pick—where shoppers assemble a cart of purchases online and then pick them up at a physical store—has gained significant traction in France and the US (where a large percentage of Walmart’s online orders are now collected in-store). QR-code shopping has been put to profitable use in South Korea (where Tesco has installed “virtual shelves” in subway stations, enabling commuters to schedule deliveries by scanning product codes with their smartphone). Services like these are few and far between in Germany.

Future Digital Impact. We expect to see major changes in the customer interface in the coming years, with significant consequences for companies. Interaction via mobile and social networks will grow, particularly as these channels become more tightly integrated with company websites and apps. Already, leading global e-commerce players are taking advantage of this trend, enabling shoppers, for example, to inform Facebook friends of purchases they have made (complete with links to the products, should those friends be interested in buying them, too).

The use of big data to identify patterns in a consumer’s browsing and shopping history will also expand. This will enable retailers to create increasingly customized offers that resonate with individual customers. The timing of these offers will continue to improve, too. As the use of smartphones grows (average monthly smartphone traffic worldwide will jump from 579 MB in 2013 to 2.7 GB in 2018, according to Cisco’s 2014 Mobile Data Traffic Forecast), more consumers will be able to receive offers when they are physically present in a store. Smartphones will also enable in-store navigation, with retailers locating the precise position of a customer and providing turn-by-turn directions to a specific product.

But if German companies are to take full advantage of data and the tools to analyze and use it, they will need to overcome consumer concerns about how personal information is used—concerns that tend to be greater in the European Union, and within Germany in particular, than in Asia and North America. While a new generation of digital-savvy consumers will ease this burden somewhat, companies will still need to be good stewards of data, clearly spelling out how personal information is used (and sticking to those uses). They’ll need to make sure consumers understand that they will be receiving something in return for sharing data (such as personalized recommendations or offers). And, as much as possible, companies should give customers control over what—and when—information is collected and used.

For retailers, the need to move faster and deeper into digital channels is all the more urgent given the risk of losing their traditional consumer touch points. New market entrants offering tools like shopping “crawlers”—which scour multiple sites for optimal prices—will make it harder for retailers to maintain the extended interactions that strengthen customer relationships. At the same time, suppliers will increasingly leverage digital, creating and enhancing their own touch points with consumers via online, mobile, and social-media channels. In a 2012 survey of more than 200 consumer goods executives, 41 percent said they expected to sell products directly to customers in the coming year, up from 24 percent in 2011. Without the right digital game plan, many companies may find that yesterday’s partners have become their rivals—and successful ones at that.

Automotive

The German automotive industry—particularly its passenger-car segment—is well positioned in the use of digital technologies. Manufacturers are realizing improvements in assembly, the sales process, and the customer experience. Car buyers are benefiting from new capabilities—and ease—in researching and configuring vehicles. And crucially, digitization is spurring a new generation of innovative, differentiating in-car features. Some of these enhance safety (such as lane assist, which senses when a car is veering out of lane and automatically steers it back in line); others provide driver conveniences (including real-time traffic information or digital map updates); and many do both (like dashboard displays that guide drivers into tight parking spaces).

Progress has been slower, however, in internal processes for managing the organization. Enterprise resource planning, for example, still tends to be handled by outdated legacy systems, so companies aren’t reaping the efficiency dividends that the latest technology can bring (efficiencies that new players, like Tesla, enjoy because they don’t have to manage legacy IT).

Looking ahead, we expect cars to become increasingly “intelligent,” capable of feats like autonomous driving and vehicle-to-infrastructure and vehicle-to-vehicle communications (so a car knows when to slow down because of an accident ahead). Meanwhile, the use of in-car sensors, along with analytics that turn data into insight, should spur new business models in areas from insurance and entertainment to diagnostics and preventive maintenance. But these developments pose both an opportunity and a threat, since they can spur digital-savvy outsiders to cross into the automotive sector. Companies like Google and Apple have a lot to gain by getting access to a dashboard display. They could steer drivers to everything from garages to restaurants (which would pay fees for being spotlighted) and even to music for sale, boosting their own bottom line while potentially keeping the sector’s established players from doing the same.

Digital Maturity. German automakers have actively embraced digital channels like the Web and mobile apps. Premium brands, in particular, have developed a significant presence on social media, with BMW and Mercedes Benz each boasting more than 18 million “likes” on Facebook (by contrast, top US and Japanese competitors like GM, Honda, and Toyota have yet to approach 5 million). And German carmakers are leveraging these channels in sophisticated ways, creating communities in which products are discussed, information is shared, and customer relationships are strengthened.

Yet while 95 percent of consumers now use online resources, at least among others, to learn about vehicles, just under a third of Germans say they would buy a car through the Web. The good news is that German automakers are well ahead of the curve in using digital technologies to improve traditional sales channels. Audi, for example, is employing advanced audio and video capabilities in “virtual showrooms,” where full-size, customer-configured models are projected on digital “walls,” with sound systems even simulating engine noises. This enables the company to showcase a variety of cars and configurations without requiring vastly greater physical space.

Digitization has also enabled German car companies to bring greater personalization to the sales process—and differentiate themselves in the process. At premium brands’ assembly plants, for example, each car has a unique identifier specifying every feature and option it should have, allowing for an unprecedented level of customization. These digital IDs enable automakers to know exactly what parts will be needed and when. Shared with suppliers—via improved interfaces and data links—the information ensures that parts are delivered in the right sequence, at the right time. So even as customization is enhanced, efficiency is improved. Moreover, technologies like pick-by-voice and pick-by-light guide workers in installing specific parts as cars pass through the factory.

In other areas, however, digitization lags. Dealers have yet to use mobile devices linked to customer relationship management systems, as salespeople in other industries increasingly do. Automaker apps rarely give users the ability to schedule maintenance appointments or receive reminders for routine checks. Big-data capabilities aren’t being used to understand a customer’s buying patterns—insights that could help companies target offers.

What the German automotive industry is doing well is leveraging digital to create innovative products and business models. German automakers are at the forefront in developing autonomous driving, and they are actively pursuing new ancillary businesses like car sharing—a business made possible by digital technologies, including mobile apps that show where available cars are located and that let users reserve them.

Future Digital Impact. With buyers well informed through digital channels, the role of dealers will shift. Instead of converting customers, they will focus on negotiating prices and arranging test drives. Mobility patterns are likely to change, too. Car sharing, for example, means not only buying fewer cars but also driving less, as the cost of a trip becomes transparent and spending €10 just to get to the store possibly triggers second thoughts. At the same time, automakers that participate in car sharing—as BMW is (together with Sixt) in DriveNow—have an opportunity to get their brand front and center with drivers and sow the seeds for a future purchase.

The data generated by in-car sensors and systems will create even bigger risks and opportunities. If carmakers make this data more accessible, tech-savvy third parties could develop all manner of innovative services. That could help sell vehicles, but it could also give players from outside the industry more control over in-car systems and, potentially, a bigger slice of the revenue pie. (See “The Connected Car.”) To compete, automotive companies will need more than traditional manufacturing skills. Capabilities in areas like analytics and mobile communications are increasingly important, and outsiders that have those skills are standing by. To realize the full potential of the digital era, German automakers will need to extend a hand to new partners—without opening up a market to new competitors.

THE CONNECTED CAR

On one level, BMW’s ConnectedDrive service is a tool for enhancing safety. Should an accident occur, the system—which continually monitors in-car sensors—automatically initiates a call for assistance, even transmitting location and vehicle information (such as the side on which impact occurred and which airbags deployed). ConnectedDrive also helps improve driving style, analyzing vehicle data—including acceleration, braking, and gear changes—and sharing tips for more efficient driving.

On another level, ConnectedDrive shows how a versatile digital platform can power a host of innovative, compelling applications. By wirelessly connecting the car to a smartphone app, the service lets drivers locate their cars, lock and unlock doors, and remotely preset the air-conditioning level. It also enables teleservices. A direct connection to the car allows the driver’s preferred BMW Service Partner to collect sensor data and schedule maintenance. And it provides concierge services at the touch of a finger: 24/7 call center agents can find and book a hotel room and even push the relevant location data directly to the vehicle’s navigation system.

Health Care and Pharmaceuticals

For Germany’s health care industry, the prescription is clear: digital capabilities need more attention, development, and adoption. While certain areas within the sector, such as medical equipment, are technologically advanced, overall the country lags behind the global leaders—in some respects, worrisomely so. The main problem is how data is—or isn’t—being used. Realizing digital’s full potential will depend on greater access to and more sharing of medical information. This will enable a holistic approach to treatment in which doctors, hospitals, and insurers can see and act on a patient’s entire medical history. It will also help spur innovative solutions and business models.

Digital Maturity. Currently, the use of digital channels by patients and providers in Germany is limited—and well behind the Nordic countries and the US. There has been no wide-scale deployment of national patient portals, such as Sweden’s My Healthcare Contacts, which lets individuals schedule appointments, access test results, and renew prescriptions on their computer or mobile device. Even the largest German pharma companies have relatively small followings on social media. And the use of digital health apps and monitoring is only nascent—with some notable exceptions. (See “A Shot of Adrenaline for Remote Health Management.”)

A SHOT OF ADRENALINE FOR REMOTE HEALTH MANAGEMENT

Telehealth may sound futuristic, but the basic premise isn’t new. The idea is to combine telecommunications and electronic health information in ways that enable remote diagnostics and treatment. One of the more notable successes has been the Health Buddy platform from Bosch Healthcare, a subsidiary of Germany’s Bosch Group.

Bosch’s goal was to improve postdischarge care by remotely capturing medical data from a patient and sending it back to the physician for evaluation. But there were several challenges. The system’s core element—a patient-operated device that would collect vital signs—had to be easy to use. Sufficient data had to be captured to enable diagnoses in patients who could not be physically examined. And the system had to be able to flag cases that required urgent intervention.

The solution Bosch devised was a simple, four-button device that could gather vital signs directly from health monitors, including blood glucose meters and blood pressure monitors. This information would be sent to an application on the physician’s desktop, with data that suggested elevated risk color-coded for quick identification.

According to a 2013 survey by Bosch, 93 percent of patients using Health Buddy—which has now been in production for more than a decade—say they are satisfied with the system, and 87 percent believe they are better able to manage their medical conditions.

A primary reason for this cautious approach to digital is the concern of many Germans about how their medical data is collected and used. Even within Europe, where skepticism about data sharing tends to run high, Germany (along with Spain) stands out for the sensitivity of its population. Meanwhile, uncertainty about the interpretation and impact of new data regulations—as well as what rules may come in the future—has left many providers and investors in a holding pattern when it comes to developing digital channels.

These challenges are also hindering the development of new products and service models. In other nations, cutting-edge applications are already emerging. For example, the French pharma company Sanofi has developed an integrated platform for diabetes management that links a patient’s blood-glucose meter to an app on his or her smartphone, allowing glucose levels to be tracked over time and shared with health care professionals. In Germany, the limited use of big data and mobile technologies is hindering such innovations.

Another problem is the lack of incentives in Germany for end-to-end optimization of health care delivery. Both hospitals and insurers try to optimize service from their own perspective: to reduce their costs and improve their efficiency. But there is very little exploration of how to optimize overall outcomes.

Given these challenges, it’s not surprising that access to comprehensive patient information also lags in Germany. While digital technologies are well established in German hospitals and the country is home to some of the world’s premier high-tech medical equipment manufacturers (such as Siemens and Dräger), there is very little cross-sector digitization. A hospital may have a highly detailed MRI scan on file, but an off-site specialist often has no simple way to see it. There is no central repository for X-rays or records. This can lead to unnecessary duplication of medical tests and exams—driving up costs and increasing risks to patients.

Future Digital Impact. We expect digitization to have a significant impact on the health care and pharmaceutical sector in the coming years. Mobile health applications—the mHealth market—should be a particularly fertile area for new products and business models. For providers, mobile apps will enable remote diagnostics and improve data access (letting physicians check on a patient’s status at the bedside or from the road). For patients, apps will let them monitor their health, manage appointments, and communicate with health care professionals remotely.

The pace of innovation will quicken over the next several years, with the mHealth market expected to achieve 6 percent compound annual growth between 2013 and 2020. Similarly, hospitals will increasingly embrace online tools and patient interfaces, with the global market for patient portals and telehealth tools seeing annual growth of 13 to 16 percent between 2012 and 2020.

How these trends play out in Germany will largely depend on how the nation addresses concerns about data use and privacy. Greater clarity on the practices that statutes allow or restrict is needed, but companies must also give patients greater visibility into and control over how their medical data is being collected and shared. If the industry shows that it can be a trusted steward of sensitive information, greater centralization and exchange of data will be possible. This, in turn, will encourage investors to loosen the purse strings for promising technologies, products, and new businesses.

Financial Services

The digital transformation of financial services has not been as fast-paced in Germany as it has been elsewhere, particularly in Asia and the US. For banks, physical branches continue to play a key role in operations. For insurers, personal interaction remains at the core of their service model. And while innovative new offerings—personalized according to customer preferences and behavior—are gaining traction in other countries, they are relatively rare in Germany.

Why the cautious approach? For one thing, the sensitivity of financial information heightens concerns about its use. Regulators have enacted strict rules on data collection and use, while consumers have expressed skepticism—sometimes strenuously. In addition, existing banking and insurance processes do get the job done, so the incentive for change can be lacking. Finally, German banks and insurance companies tend to have complex IT steering processes that hinder agility, making it challenging to respond to, and quickly differentiate themselves from, competitors and new market entrants.

The financial services industry in Germany has to step up its digital transformation and show that it can be a responsible, transparent steward of sensitive personal information. Once it does, it will be able to optimize processes and reduce running costs—a major concern for branch-based banking. Germany has some catching up to do, but it’s still early days—with plenty of potential to be realized and competitive advantage to be gained.

Digital Maturity. While banks in the United Arab Emirates and New Zealand, for example, have already launched “virtual branches” that let customers perform banking transactions and even get assistance via Facebook, such shifts to digital channels have yet to be seen in Germany. Similarly, online investment portals and finance-oriented communities are rarely used. One obstacle may be the language barrier: most of these sites are in English. But even for basic transactions on a bank’s own website, Germany lags. Today, some 40 to 55 percent of banking transactions in Germany are performed online, compared with 70 to 80 percent in the Nordic countries.

Another area for improvement: developing insights from digital transactions. With today’s big-data tools, a user’s online activity can be analyzed to identify preferences and needs, leading to personalized offers and new opportunities for growth. Yet in Germany, these techniques have been used sparingly. Rarely, for example, will a bank suggest investments based on a client’s online behavior. Once again, the main reasons are strict data-privacy regulations and consumers’ concerns about exactly how companies are using their information.

Given this backdrop, it’s not surprising that potentially disruptive business models are uncommon in Germany. But they do occur. With the ReiseApp, Allianz has recently stepped into the “on the spot” insurance market pioneered in Japan. Under this model, location data from a user’s smartphone is used to identify relevant sales opportunities. Someone crossing a national border, for instance, might receive an offer for trip insurance on his or her mobile phone.

In their internal processes, German banks have implemented a high degree of automation. But here, too, there is room for improvement. The cost-to-income ratio—a measure of how much banks spend to run their operations—is higher in Germany (at 73 percent) than in the Nordic countries (68 percent) and the UK (48 percent). This indicates that those other regions may be making better use of automation to run more efficiently.

A final challenge lies in the way financial institutions interact with—and rely on—external service providers. Because of the high costs of developing their own IT processes and the slow speed at which it is done, companies often reach out to external providers to put a platform in place and implement service. Each time they need a new function, the process repeats. The result is an array of platforms from different providers—and higher costs, greater complexity, and less flexibility than would result from a single integrated platform to which new applications can be added as needed. If financial institutions are to make the most of automation, they need to abandon this piecemeal approach.

Future Digital Impact. For the banking sector, increasing use of digital channels will bring significant changes—and benefits—in the years ahead. Chief among them is cost reduction. Today’s prevailing operating model, based on networks of bank-owned branches, is expensive, and banks have been under pressure to rein in costs. By moving transactional activities to the Web and to mobile apps, they can shift their branches to a more advisory role, with a reduced workforce. Indeed, by 2018, such a shift would reduce costs by up to 40 percent from current levels.

Insurers will see less impact from digital. In part, this is because their cost structure is different from that of banks. Insurers typically employ only part of their sales force directly; independent contractors account for the rest. Also, while standardized insurance products—such as car insurance—lend themselves to online sales, complex offerings, such as health insurance, are more dependent on “live” sales assistance. Yet insurers can bolster customer relations—and loyalty—through digital channels that offer unique tools. (See “A Portal to Differentiation.”)

A PORTAL TO DIFFERENTIATION

When carefully designed, digital channels enable companies to enhance their interactions—and their relationships—with customers. That message is starting to be heard by German insurers.

Two major providers, Allianz and CosmosDirekt, have designed advanced customer portals, websites that not only offer services that formerly required a phone call or office visit but add new capabilities as well. Both portals offer time-saving and increasingly popular conveniences like Web-based claim reporting and contract administration tools.

But each also adds something new to the mix. Allianz provides the Allianz Protect online safe, an individual, secure storage space for digital documents. CosmosDirekt offers a cobrowsing capability that allows agents to view the information a customer enters (but not modify it) in order to provide better assistance.

These types of services help companies differentiate their digital channels, making them more compelling for users—and more difficult for competitors to replace.

Harder to predict is the extent to which German financial institutions will leverage digital in new products and business models—and the success they will see. Globally, we expect much more personalization in financial products and services. And in Germany, too, there is enormous potential to be tapped. Personalization can drive use of a company’s website and mobile apps, reducing the appeal of aggregators and helping companies maintain their touch points with customers. But banks and insurers must first allay concerns about data privacy.

Finally, advanced-analytics tools have the potential to improve credit scoring and risk analysis, significantly affecting the bottom line. These tools can be a particular boon to German multiline insurers, which are better positioned to create—and gain insight from—a 360-degree view of their customers than the monoline insurers prevalent in the US and the UK. But once again, reaping these rewards will require changing consumers’ attitude toward data use.

Logistics and Transportation

If any industry has been a showcase for how Germany can lead in digital transformation, it is the logistics and transportation sector (covering warehousing, shipping, postal and parcel services, and rail and road transportation). From a digital perspective, this is arguably the country’s most advanced industry, with automation and paperless processing already utilized to a high degree—and paying dividends.

One indicator of that payoff: Germany’s number-one ranking in the World Bank’s 2014 Logistics Performance Index (LPI), which gauges the logistics “friendliness” of different countries (based on surveys of global freight forwarders and express carriers). On criteria directly affected by digital technologies—such as tracking and tracing, competence, and timeliness—Germany ranked at or near the top. German companies operate some of the most advanced logistics facilities in the world and are piloting cutting-edge technologies.

The big question is what comes next. While increasing volumes of goods will spur further automation, we expect digital to have limited additional impact through 2020. That might seem counterintuitive, given the industry’s full-on embrace of digitization, but this is a sector where a large part of value creation is in the transport of physical goods. Until 3D printing is more fully developed and deployed on a wide scale—something we don’t anticipate in the near term—that’s not likely to change.

Digital Maturity. For German logistics and transportation companies, electronic data exchange has become an important element of their customer interfaces, enabling an increasing proportion of shipments to be managed digitally and spurring faster and more accurate deliveries. Electronic air waybills (e-AWBs) let air freight companies reduce delays caused by misplaced paper AWBs. They also mean fewer errors, since data is entered once instead of being re-keyed at various points in the shipping process. (See “Paperless Skies.”)

PAPERLESS SKIES

Weather, mechanical problems, and congested skies can all delay the delivery of air freight, but one of the biggest bottlenecks is perhaps more surprising: paperwork. Even as digital processes gain traction, the amount of paper still required on a global, industry-wide basis each year could fill 80 Boeing 747-400 freighters. Reducing paper—and gaining the attendant cost and efficiency benefits—is a key goal of Lufthansa Cargo’s eFreight initiative.

At the company’s Munich hub, all air freight can now be shipped without traditional paper air waybills. Lufthansa says that its e-AWB process can save a customer with a monthly volume of 1,000 AWBs up to €1,000 per month, thanks to lower administrative burdens (such as filing and archiving). It also reduces the time needed for handling documents by 50 percent and for storing and updating AWBs by 80 percent. The process improves quality, too, since the same information no longer needs to be re-entered—and potentially misentered—at various points in the shipping process.

With the Munich airport now fully e-AWB-ready, Lufthansa plans to expand the program globally. Ultimately, cargo leaving any Lufthansa airport will be managed paperlessly—and more efficiently.

Yet in a couple of key aspects, the logistics industry has not moved to realize digital’s potential. This sector has never known much about its customers. Customer relationship management is not widely employed, and most companies have not looked for the sort of usage patterns that have helped businesses in other industries (like retail) proactively sell to their customers. Nor has the sector embraced the idea of shared service centers, which have enabled other industries to consolidate platforms for administrative processes in areas like HR, finance, and accounting.

In the public sector, ambitions are growing steadily. Within the EU, 90 percent of customs declarations are now submitted digitally, and a single EU-wide electronic customs system is expected to be completed by 2024. But the efficiencies of digitization will be realized only if the customs authorities of other countries, particularly key trading partners like China, likewise adopt electronic data exchange.

Similarly, there is room for improvement in the use of self-service platforms, such as online freight exchanges that bring together carriers and freight forwarders (agents that arrange the transport of goods on behalf of customers). While Germany is relatively strong in this area, the US leads the field.

In general, however, German companies are driving much of the innovation in logistics. They are incorporating, in compelling ways, technologies like radio frequency identification, near-field communication, and even augmented reality. While some of these are still under development—such as an augmented-reality system that guides warehouse workers to the products they need to pick—others are already in wide and successful use. Germany’s 2014 LPI score for tracking and tracing is the highest in the world, thanks to digital technology that lets customers locate their goods en route in real time.

German logistics companies are also highly automated, helping the industry achieve the fourth best LPI score for timeliness and the third best score for competency. Facilities are among the most advanced in the world. At Hamburg’s Container Terminal Altenwerder, for example, a fleet of 65 automated vehicles—guided by radio signals and GPS—enable ships to be loaded and unloaded more efficiently.

Future Digital Impact. Through 2020, any additional impact of digital technologies on the sector is likely to be limited. This is largely because the areas where digital will bring the biggest changes account for only a small percentage of the overall market—such as value-added services, which make up just 15 to 20 percent of the industry’s total value creation. Overall, this is a sector that is built around physical transportation and the infrastructure it requires. As a result, digital’s impact won’t be as dramatic as it will be in other industries, at least for the next decade or so.

In those areas where digital will bring change, its impact will vary. We expect to see important improvements in administrative functions, such as the management of truck fleets, but these changes are likely to be incremental. Manual work may experience greater disruption. Automation and electronic data exchange—replacing paper documents with end-to-end digital processes—will increase as technologies evolve and shipment volumes grow. This will let companies do more with a smaller workforce. And work-forces will get smaller still if robotics advance to the point where machines can do all the warehouse picking, including the smallest, most difficult-to-retrieve items. There’s no doubt that this will happen; the question—like much else about the sector’s digital future—is when.

Industrial Goods and Engineering

Automation, analytics, and digital technologies have become important and differentiating elements of Germany’s industrial goods and engineering sector. Many suppliers, for instance, now let their customers configure parts directly on the Web. Sensors built into German-made machinery help monitor performance and identify problems. And the country is home to some of the most innovative and influential players in automation. While Germany may not be the global leader in industrial digitization (some best practices belong to the US and Japan), it is certainly well positioned.

Germany is also positioning itself for the future. The government has contributed some €200 million to the nation’s Industrie 4.0 initiative, which seeks to spur the creation of “smart” factories that operate largely by themselves. These technologically advanced facilities will feature cyberphysical systems—sensor-laden machines that gather and process data in real time in order to, in effect, replicate cognitive processes. For example, a cyberphysical system on an automobile assembly line might measure a window as the vehicle passes, detect that it is broken, and trigger a pause so the window can be replaced. According to Germany’s National Academy of Science and Engineering, the next generation of automation could bring as much as a 30 percent increase in industrial productivity. Clearly, demand will be strong for the tools that bring this about.

Digital Maturity. German industrial goods companies are increasingly incorporating digital tools into their customer interfaces. Online configurators have proven particularly popular and are now found on many supplier websites, especially in the machine-building sector. These tools let customers choose and configure the part they need (selecting, for example, the shape, connectors, and options that meet their specifications). Configurators enable easy (and mass) customization, but they also present an opportunity for suppliers, which can differentiate themselves—and attract new business—by incorporating innovative features into these Web-based tools.

Increasingly, industrial goods are shipping with built-in sensors that collect and transmit data on usage and performance, in real time or near real time. This data can be utilized in almost limitless ways, such as to regulate operating parameters in machinery or remotely monitor performance. (See “Spotting Trouble Before It Happens.”)

SPOTTING TROUBLE BEFORE IT HAPPENS

With the Siemens Remote Service Platform for connectivity and remote access, equipment operators can learn where trouble may lie ahead. By detecting performance patterns that presage problems—such as a part that may be wearing down—the system allows remedial action to be taken quickly and proactively.

Servicing of high-speed trains, for example, can be done when actually needed, instead of on a set schedule, minimizing disruptions and deploying technicians more efficiently. Meanwhile, analysis of data from sensors and diagnostic systems—covering everything from engine performance to wear and tear on wheels—helps identify not only problems but ways in which components could be improved in future designs.

Data links between machine and manufacturer also facilitate remote service. Software fixes and updates can be sent directly to equipment in the field, eliminating the need to dispatch technicians. Today, more than 100,000 Siemens-made medical devices—including MRI and ultrasound units—are linked to the Remote Service Platform, which monitors and services the equipment from a central location. All told, more than a quarter of a million systems and facilities—everything from trains to gas turbines—are connected to the platform, with some 45 percent of Siemens’ service operations performed remotely.

These new uses are important because they can help companies offer unique, compelling services to customers. For example, a jet engine manufacturer could use data from on-board sensors to identify and even predict performance issues. From patterns in the data, it might determine that a part could soon fail and arrange to ship a replacement. This not only keeps downtime to a minimum but might also spur a new business—and new revenues—in proactive maintenance.

Industrial automation is another German strength. Some of the most advanced production facilities in the world are in Germany—such as the Siemens factory in Amberg, where machines and computers handle roughly 75 percent of the work autonomously. Indeed, German companies are at the forefront of developing and providing new automation technology. Of the total annual revenues of the world’s top 15 automation companies, Germany’s contribution ranked second only to that of the US.

Future Digital Impact. We don’t anticipate a major reshaping of the customer interface in the near term. Instead, we expect to see current trends—like online configuration—steadily develop. It’s also likely that more automation and connectivity will be built into industrial goods and that remote support will receive greater emphasis. More machines will be able to check automatically for software updates and implement fixes sent directly from the manufacturer. (Software, which on average accounted for some 30 percent of a product’s engineering in 2012, will be an increasingly important component of industrial machinery.)

As 3D printing evolves, it could have a significant impact on the core businesses of industry players by enabling product extensions not economically or technically feasible today. For example, products that have traditionally been sold in standardized form could be more easily customized—whether at the factory or on the ground at sites around the globe—by printing out the necessary part variations.

An array of new products and business models are likely to emerge, particularly as German companies develop their expertise in sensor-laden machinery (and in using the data it generates). In the next five to ten years, companies will begin integrating data-enhanced automated production techniques into their factories and production lines. The Industrie 4.0 initiative may build on this further, ushering in a new generation of innovative technologies that could be commercialized.

Harder to gauge is the role that standardization will play. Currently, the automation sector is quite fragmented, with proprietary systems the norm. Integrating different systems from different manufacturers, such as a warehousing technology from one vendor and a production technology from another, is generally difficult if not impossible to do. This is a big contrast to the Google ecosystem, where defined APIs ensure easy integration. If the industrial goods sector opened up its platforms, it could create a “Linux of automation,” which would likely spur faster, more widespread innovation.

Also unsettled is digital’s impact on internal processes. Right now, many administrative processes are paper based, rely on out-of-date platforms, or require significant manual intervention. So as the sector continues to digitize its products, business models, and customer interfaces, it should make sure not to neglect the less glamorous stuff.

Finally, while digital technologies will have a significant impact on production, assembly, and repair, they are far less likely to bring disruptive change to engineering. To a large extent, this is a function of success: computer-aided design and simulations are already standard in product design. And engineering will always require the one resource that no technology can replace: human brain power.

Telecom, Information, Media, and Entertainment

Germany’s TIME industry may not have gotten off to the fastest start in the use of digital technologies, but it is gaining ground. This has been a welcome development, as digital technologies offer the sector vast potential for disruptive change that can benefit industry players and customers alike.

But there is still much that the industry needs to sort out. While German companies have become more active and even more experimental, there are significant differences in strategies and practices. These are most apparent within the media sector. Although some major players—like Axel Springer and Hubert Burda—now generate more than 40 percent of their revenues from digital initiatives, others are still in the low single digits. Indeed, for media companies, an aggressive transition from traditional to digital business models isn’t always a no-brainer. Those older models are often very profitable, while digital models typically mean lower margins. As German companies are discovering, realizing healthy top-line growth in digital (something many have done) is not the same thing as making real money (something that few, so far, have achieved).

For German telecom companies, a key challenge has been infrastructure. Right now, broadband coverage is not ubiquitous, largely owing to the cost of bringing fiber optics to rural areas. In Next Generation Access (NGA) technologies, Germany ranked just twenty-sixth in Europe for fiber-to-the-home coverage, according to the European Telecommunications Network Operators Association’s 2014 Annual Economic Report, with coverage extending to just 4 percent of households. Even in less advanced NGA technologies, Germany lagged, coming in twelfth for VDSL (with 32 percent household coverage).

But there’s good news, too. With its recently approved Digital Agenda 2014–2017, the German government seeks to bring high-speed connections to rural and urban areas alike by 2018. It also aims to spur more digital entrepreneurship. Making a digital expansion a national priority is a promising and crucial step.

Digital Maturity. Digital channels are not as developed in Germany’s TIME sector as they are in some other nations, particularly the US, the UK, and the Nordic countries. In media, for example, US-based companies started earlier and can draw on a market large enough to provide the scale that digital initiatives need to succeed. The momentum, however, has been building, with many German players now actively embracing digital, and most sizable media companies (such as Springer, Burda, and P7S1) experimenting with international setups and cooperation to drive sufficient scale.

But there is plenty of room for improvement. Some telcos and cable operators still lack mobile-optimized websites. And German TIME companies have been less aggressive than some of their global peers in mining customer data on their own IT systems.

The picture is more complex when it comes to digital products and business models. Many TV broadcasters have extended their product portfolios in only limited ways, with much of the German market for streaming video, for example, served from abroad (Zattoo is based in Switzerland, Magine in Sweden). But this is not simply a matter of German players sitting on the sidelines. Major broadcasters like P7S1 and RTL are realizing relatively high margins with their traditional businesses, so migrating to digital offerings like over-the-top services and video on demand does not seem like an urgent priority.

Nonetheless, German companies are increasingly deciding that now is the time to start an active migration to digital. Telcos, for instance, while still realizing most of their revenues from connectivity, are also investing in media services. One example: Deutsche Telekom’s “Entertain to go” service lets subscribers store personally recorded TV programs in the cloud and then view them on their laptops, tablets, and smartphones.

The way in which companies are implementing digital initiatives is also changing. In the past, media companies, for instance, would put content online but generally leave it unchanged from the offline version. This approach wasn’t unique to Germany; the major US newspapers generally did the same thing. In fact, the online innovations and new formats introduced in the US—such as the use of video and interactivity—were piloted by smaller, more dynamic upstarts like the Huffington Post. Now, however, as electronic newspaper circulation grows in Germany (on average, it more than doubled year over year between 2012 and 2014), the nation’s media companies are finally starting to differentiate their online and off-line versions.

About one important question there is still much debate: Should online and off-line businesses be separate or integrated? A digital-only entity, unconstrained by the traditional business, would be more agile and freer to think outside the box. Yet a tighter integration of selected functions—such as ad sales, customer relationship management, and content acquisition—makes a lot of sense, too. How to strike the optimal balance between autonomy and integration is a key challenge for the sector.

Future Digital Impact. More than any other industry, the TIME sector has been and will continue to be transformed by digital technologies, services, and business models. Digital channels will become increasingly important: media companies will bring more content online; telcos will add more services that go beyond traditional connectivity offerings. Companies will also dig deeper into data—from both internal and external sources—to better understand and do business with their customers.

This transformation in progress creates a window of opportunity. For example, while video consumption on tablets and smartphones will continue to grow, the vast majority of viewing, at least in the near term, will still be centered on the TV screen. The rise of Internet-enabled smart TVs is therefore likely to dramatically change media consumption habits—spurring, among other things, consumers’ embrace of video on demand. German companies can cater to these emerging preferences by offering new ways to consume and interact with content. To do so, they will need to think carefully about how and where digital fits in their business. And they will need to find the optimal formulas to monetize their new offerings—something that has been a particular challenge for some media formats, such as newspapers. (See “Getting on Top of the Paywall.”)

GETTING ON TOP OF THE PAYWALL

Years after they began making content available online, print media companies still struggle with monetization. Part of the challenge is consumer expectations. In their initial forays onto the Web, publishers generally made their news stories and magazine articles available at no cost, which readers got used to. Then there’s the impact of pay models on advertising. If media companies charge for content, will that reduce online advertising revenues? If it does, will subscriber fees compensate (and ideally, overcompensate) for the loss?

Publishers have been trying a variety of methods to monetize content. Generally these fall into two categories: “hard” paywalls, where readers have little or no access without paying, and “soft” paywalls, where some content remains free and some is available only to paid subscribers. Within the industry, there has been much debate as to which is the better model.

Axel Springer, the German publisher of Europe’s largest-circulation newspaper, Bild, has taken yet another approach, based on the idea that what readers really value, and are willing to pay for, is unique content. So instead of putting all content behind a paywall, or making decisions that often seem arbitrary—to readers, at least—about what is free and what isn’t, Axel Springer’s BILDplus relies on a “value added” criterion. Content that has a differentiating element—such as exclusive photos, multimedia elements, or in-depth investigative reporting—is available only to subscribers, while more generic pieces remain free.

Although online traffic did decrease after the company introduced the paywall in mid-2013, overall advertising revenues increased by nearly 9 percent from 2013 to 2014. And subscriber numbers have been growing as well. Six months after launching BILDplus, Axel Springer announced that more than 150,000 customers had signed up for one of three plans, which range in price from €4.99 to €14.99 per month. By October 2014, there were 240,000 subscribers.

It may be too early to call the new model a success; compared with a traditional print subscription, at €30 to €40 per month, BILDplus may seem like a bargain for readers and a bad deal for Springer. On the other hand, compared with free content, it fares quite well. But one thing is certain: by taking a more nuanced, deliberative approach to paywalls, BILDplus is an example that other media companies will want to examine—and watch.

In a way, the scope of the opportunities that digital presents may be the industry’s greatest challenge. It’s tempting to think big, but a more focused effort will often bring greater success. Many telcos, for example, have grand plans for digital services, but there are some areas where smaller, over-the-top players—with their nimble, entrepreneurial approach to innovation—may be better positioned to lead development. Telcos, like the other players in this industry, will have to decide where to concentrate their own initiatives, where to partner with others, and where to cede ground.

Creating and Maintaining the Digital Momentum

Digitization’s impact, on individuals and industries alike, is hard to overstate. Businesses, in particular, must explore uncharted ground. The prize may be large, but so are the challenges. No two industries will fare alike, but one thing is clear: no matter how far along a company is in its digital transformation or how much success it has already seen, it needs to step up its game. If established businesses don’t uncover and pursue the opportunities, new entrants will. If digitized businesses take their foot off the gas, other players, perfecting and expanding and experimenting with business models, will overtake them. In the digital era, dramatic power shifts aren’t just possible, they’re already happening.

So how can a company be the disrupter instead of the disrupted? It starts with the CEO asking some crucial questions:

- What is the impact of digitization on my business? Digital technologies and processes can bring transformative change in five key ways: by addressing unmet customer needs (including latent needs that the company—and even customers themselves—may not realize exist); by enhancing products and services; by embedding new technological capabilities; by changing the company culture and the ways in which employees are recruited, acclimated, and retained; and by making processes faster and more flexible.

- What should my company’s digital ambition be? How broadly or aggressively a business should embrace digitization depends on both the industry and the specific company. In some cases, the best approach might be to focus on customer-centric business models in order to provide a new customer experience. In others, it might be to mine data for insights that can lead to competitive advantage and even new revenue streams. In still other cases, digital might be a means to further simplify a process. Finally, for some businesses, the right way forward might be to completely transform the company.

- How can my organization be transformed into a digital business? In the digital era, success is not just the product of new ideas, new technologies, or new business models. It is spurred by—and requires—a different kind of organization: one that encourages innovation and experimentation, and that develops and taps new skills and integrates them into the business.

These are formidable questions and the answers aren’t always obvious. But some general practices—applicable to all industries—can help guide the way:

- Think about the four key areas where digitization can have a significant business impact: the customer interface, innovation, the optimization of operations and processes, and corporate functions and IT platforms. Homing in on the best opportunities to differentiate oneself from competitors requires a deep understanding of customer needs. Strengthening and expanding customer touch points is a good way to develop and fine-tune that understanding. For example, by offering feature-rich websites, compelling mobile apps, and a robust social-media presence, businesses can learn more about their customers’ behavior and preferences.

- Stay abreast of new technologies and trends, such as the Internet of Things, big data, automation, mobile communications, and social media. Depending on the industry, the list may be a long one. But only by understanding the tools and currency of the digital age can companies put them to effective, innovative use.

- Understand and manage the value of data. By collecting and analyzing data, businesses can identify patterns in everything from how customers shop to how products perform. Those patterns can lead to insights that, in turn, can focus development efforts, enable personalized recommendations and marketing campaigns, and help businesses deduce their customers’ needs.

- Think about digital investments like a venture capitalist, who typically sees innovation through the lens of business disruption. What are the areas where one’s own business—or the businesses of one’s customers—can be disrupted? For example, a chemical company might want to understand how digital is changing the car industry in order to understand potential opportunities. This is a particularly important for business-to-business companies searching for new ideas.

- Be more agile. In the digital age, decision-making and development processes need to be faster than ever. Not only must businesses identify—and exploit—rapidly evolving technologies and opportunities; they also are likely to brush up against smaller, more entrepreneurial companies that are used to moving quickly. These new entrants have often mastered agile methodologies; they stress experimentation and short development cycles and tolerate failure. They also know that an organizational structure that fosters this approach is essential, and they develop (or recruit) professionals with the skills that the new digital tools require and build a culture in which employees are challenged to innovate. A digital center for excellence is one way to help an organization develop these agile modes of doing business.

Getting Off to a Strategic Start

Most companies can draw on only so much time, budget, and resources as they ramp up their digital efforts. So they need to place their bets wisely. A quick and highly visible “lighthouse project” can showcase the value that digital can bring and help motivate the organization to reach for more.

Many different types of initiatives make for a good starting point: new products or services, new modes of customer engagement, and new analytical capabilities, to name just a few. But even the starting point can trigger a host of complexities. A digital initiative ultimately affects almost all parts of a business, so it’s important to understand its potential impact, particularly on processes and workflows, people and skills, and technological capabilities. Digital initiatives also need to be accompanied by an appropriate organizational setup.

As many companies have discovered, that first initiative is a lot easier when you go into it knowing your strengths and weaknesses. Developing an internal or independent assessment of the company’s position is therefore crucial. Such a “digital health check” helps identify the right trade-offs in prioritizing your efforts.

Remember, too, that a digital transformation is a continuing process. So once multiple initiatives are in progress, the full portfolio should be reviewed frequently in order to see how they can benefit from improvements in technology. It may also be necessary to reprioritize efforts in order to account for unexpected developments in the digital world.

The German Challenge

The need for agility highlights an extra challenge for German industries. The “fail often, fail fast, fail cheap” concept is far more ingrained among US start-ups than among German companies, where risk averseness and perfectionism are the norm. These traits have long served Germany well, but now companies must embrace the experimentation, rapid cycles, and even failure that the digital era demands.

There are several areas where the traditional “German way” may present hurdles to achieving a leadership role in digitization. These areas should be focal points for examination—and, where applicable, change—by German industry, policy makers, and society.

Infrastructure. Fast, readily available access to the Internet is a core driver of the digital era. Germany’s digital infrastructure is still a work in progress, and many nations are further along. Plans by the government to bring ubiquitous coverage to the country are a welcome step—one that needs to be encouraged, assisted, and implemented.

Investments. As a share of GDP, German investment in research lags behind that of other high-tech nations like Japan, Sweden, Finland, and Israel. One problem is a still-nascent venture capital environment. Only a handful of German VC firms can boast funds exceeding €100 million, and about half of German founders rely on foreign VC firms, particularly from the US, where the VC community is far larger. Not surprisingly, Germany’s start-up scene lags, too. The Startup Ecosystem Report 2012, from Startup Genome and Telefónica Digital, found that Berlin is still at an early stage of development when it comes to start-ups, and funding tends to come more from banks than from VC firms and technology accelerators.

Innovation. As the US has shown, a thriving start-up scene spurs not just innovation but a broad network of entrepreneurs, managers, and angel investors. Together they serve as mentors and resources for promising new businesses. The US also benefits from close relationships between businesses and universities. Such collaboration is far less common in Germany. Even small steps—like facilitating networking and reducing the bureaucracy involved in starting a company—could help boost German innovation.

The Mind-Set on Data. Concerns about how personal data is used are particularly acute in Germany. This suspicion must be overcome if German industries are to truly embrace, and be empowered by, the digital era. Transparency and clear articulation of data policies are vital. But so too is giving customers choices about how their personal information is used, and making sure that they get—and know they are getting—benefits in return for sharing their data. Only by being good data stewards will companies be able to put that information to innovative and profitable use.

No doubt, German industries have their work cut out for them in the new digital landscape. Even those sectors that are well along—like the automotive and logistics industries—have to keep the momentum going. But it is work that can bring a vast and multifaceted payoff. Digitization can help German businesses meet customer needs in compelling ways, improve their own competitive standing, and lead their markets in new and exciting directions just waiting to be explored.

Acknowledgments

The authors are grateful to the following colleagues for reviewing and providing insightful feedback on the industry analyses: Georg Beyer, Karalee Close, Andreas Dinger, Frank Felden, Gero Freudenstein, Michael Grebe, Christian Greiser, Benjamin Grosch, Markus Hepp, Stephan Heydorn, Rolf Kilian, Til Klein, Markus Lorenz, Andreas Maurer, Michaël Niddam, Jens Riedl, Michael Rüßmann, Just Schürmann, Javier Seara, Joachim Stephan, and Niclas Storz.