For many telecommunications operators, the good times are gone, but the challenges, it seems, aren’t going anywhere. Revenues are on the wane, competition is on the rise, and burgeoning data traffic requires costly network upgrades just when cash flow is under pressure. Little wonder, then, that more and more telcos are getting the message: a changing market calls for changes to the business model.

To be sure, telcos are taking some sound, battle-tested steps. They are embracing network sharing, for example, and striving to reduce complexity—a significant source of costs—in their offers. But the most successful transformations—those in which telcos don’t just keep pace with competitors but step out ahead—require pulling unproven levers, too.

One such lever is cross-border synergies—an approach that has been tried before and has been disappointing before but still warrants a fresh look. Even in their earlier failures, telcos were onto something: the need to boost scale.

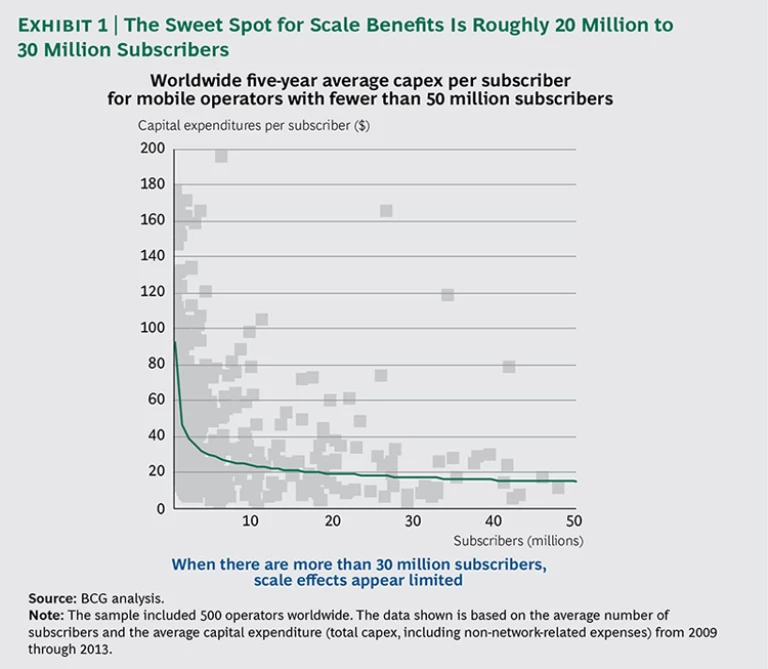

Many network-technology costs are largely independent of operator size: the more subscribers a telco has, the more it can spread costs around. To get the optimal scale dividend, however, telcos need a lot of subscribers. Our analysis of the sweet spot for realizing cost benefits puts the number at roughly 20 million to 30 million subscribers. (See Exhibit 1.) However, most national markets—particularly those in Europe, the Middle East, and Africa—are just too small to support such numbers. Indeed, in many countries, even the market leader has fewer than 5 million subscribers. Yet for a telco with an international footprint, 20 million to 30 million is a subscriber level that might be attainable once the telco looks beyond its national borders.

Why is now the time to pursue international synergies? For one thing, there are lessons in those previous disappointments. What’s more, technology has changed. Recent advances have made it easier to centralize networks and IT platforms. But it is just as important that cross-border consolidation can provide a valuable assist to overall transformation efforts. It fosters more standardization and less customization, helping to reduce complexity. And it can play a central role in lowering the cost base.

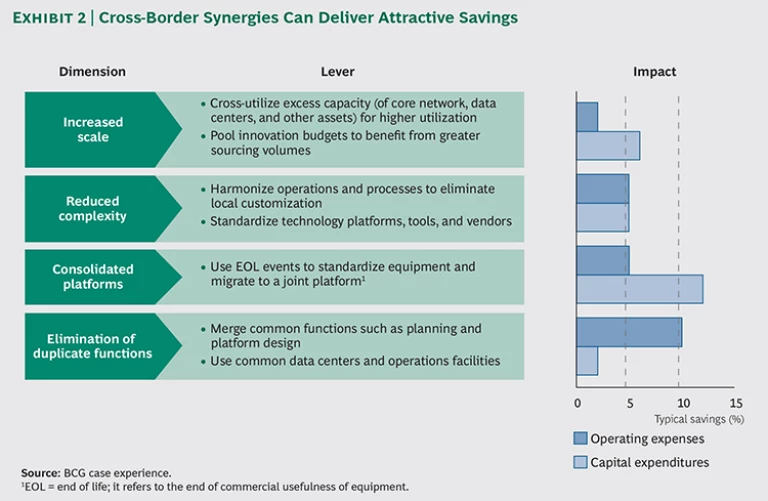

Building on the lessons of the past and the technologies of today, we have developed a fresh approach to cross-border synergies, one that can bring telecom operators annual capital-expenditure, or capex, savings of 3 percent or more—and a 15 percent improvement in free cash flow after five years. Indeed, the benefits—increased scale, reduced complexity, consolidated platforms, and elimination of duplicate functions—are almost equally distributed across operating-expense and capex domains. (See Exhibit 2.) A cross-border platform can even boost shareholder value by increasing profitability at the group level.

These benefits are especially compelling because of the one thing that isn’t going to change anytime soon: the need for operators to reinvent—and reinvigorate—the way they do business.

Setting the Stage for Synergies

We expect that, initially, telco executives might have some trepidation about international synergies. After all, most previous attempts at cross-border consolidation resulted in higher costs or lower savings than expected.

But just why did those projects fail? Technological limitations are part of the answer. Networks that had been built in the 1990s just weren’t capable of efficient and economical cross-border operation. They certainly weren’t designed with centralization in mind. But there were also problems in the way that cross-border projects were implemented. More to the point, there were common problems. The following difficulties appeared time and time again:

- The effort required to accommodate each country’s particular requirements led to delays. Many legacy telco products and processes had been highly customized for local markets. Commercial priorities and roadmaps typically differed, too. So right off the bat, operating groups had a long list of multimarket business requirements to meet. As a result, a one-size-fits-all solution was never lean and simple: it was bloated and complex. Worse, requirements frequently changed during implementation, with one country and then another asking for tweaks. Delays, costs, and complexity were all ratcheted up.

- Changes required by one country had negative impacts on service in another. Local customization had another undesired consequence for some shared platforms: a change requested by one country caused features used in another not to work correctly—or not to work at all. In one case, a shared machine-to-machine platform was modified to meet the requirements of a global automotive company that was a strategically important customer for one telco subsidiary. Unfortunately, the changes caused outages for customers in other countries.

- Local costs increased in response to countries’ discontinuation of one or more joint-platform services. At the outset, a cross-border platform might run, say, 20 services, with subsidiaries in each country subscribing to all 20. But over time, some countries, seeing disappointing traction for certain services, might discontinue those services. So countries that started out with 20 shared services might wind up with just a handful of services that are actually shared. The result: a platform that is too costly and too complex for any single participant.

There are other common problems. It’s hard to get governance right, particularly as the number of countries involved grows. And then there is the potential for vendor lock-in. Using a single-service platform can mean working with one vendor, which can create dependence on that vendor, as well as vulnerability to climbing fees for support and maintenance. Disappointing performance can be hard to turn around, too, given the difficulty of replacing, or simply sparking some fear in, a firmly entrenched vendor.

By taking an approach that avoids these pitfalls, telcos are far more likely to realize the potential of cross-border synergies. This optimized approach is supported by three core pillars: standardization, deploying new technologies, and collaboration between the technical and commercial sides of the business.

Focus on Areas That Allow for Standardization

As past failures demonstrate, customization has been the scourge of cross-border projects, triggering delays and increasing costs and complexity. But telcos should be questioning—and reducing—their need for customization regardless of their cross-border aspirations. One of the critical tenets of overall business-model transformation is that companies should drastically reduce product-driven complexity.

Although we are starting to see simplified offers, there remains a strong belief in the industry that local markets require customized products, services, and marketing. It is surprising that this is thought to be true even for markets that are quite similar. In a cluster of countries with common characteristics, local tweaks are still the rule. A global, or even regional, perspective, which is prevalent in many other industries, rarely exists on the local-operator level.

So how can cross-border projects break through this customization impasse? One idea is to think a bit smaller. Instead of replacing legacy platforms with comprehensive systems that must meet every business requirement of every local operator, telcos should set a less ambitious—and more attainable—goal. They should group fewer countries together and focus on capabilities that are conducive to standardization. Once this platform is up and successful, operators can gradually add to it.

To achieve that success, we recommend the following steps:

- Prioritize areas that best lend themselves to standardization. Some of the biggest failures in cross-border projects were the result of telcos’ attempts to consolidate their most localized customer-facing IT systems—for example, highly customized customer-relationship-management and billing platforms. Such projects should go to the bottom of the to-do list or, perhaps, be struck from it altogether. Only commercially harmonized services should be delivered from centralized cross-border platforms. These services need not be identical, but the differences should be implemented using a localization-at-the-edge approach. The idea is to avoid customizing the core or central application and instead localize the front end (for example, a user interface or smartphone app) or customize using modules or subprocesses that access a common core functionality.

- Start with the quick and easy wins. Not all past efforts have disappointed. A few European operators—for example, Deutsche Telekom, Orange, Telenor, and Vodafone—have implemented regional innovation centers with some success. Shared-service centers (for business voice services) have been successfully established by Deutsche Telekom and Telenor, among others. Telcos have generated value, too, from consolidated procurement. But the opportunities don’t have to end there. Centralized-planning functions can be quick and easy wins. Some engineering functions—for example, system qualification and vendor preselection—also work well on a group level. Access engineering and implementation planning, however, generally require significant micromarket knowledge. The key is to determine which resources—for example, the personnel that troubleshoot the network and configure systems—can easily be shared.

- Consolidate platforms for not more than two or three countries. The more countries included in a shared platform, the more likely there will be demand for customization. If participation is limited to just a few countries, it is easier to create a group with similar business requirements, facilitating standardization. It’s worth noting, for example, that the aforementioned successful shared-service centers were deployed in small, homogeneous country clusters.

Deploy New Technologies and Services

In past cross-border initiatives, technology proved more a hurdle than a solution. But new technologies make it far easier to deploy shared networks and services. The shift from legacy Synchronous Digital Hierarchy architecture to optical Internet Protocol (IP) networks, for example, allows for a centralized platform for providing services to customers. Network Functions Virtualization (NFV), meanwhile, enables services—such as IPTV or business voice—to run through shared applications on standardized, cloud-based servers, eliminating the need for customized, on-site hardware and allowing for faster time to market. Finally, Software Defined Networking (SDN) can centrally manage the connectivity layer, supporting full centralization of operations and providing affordable, massively scalable bandwidth.

What this all boils down to is an ability to centralize and automate much of what it takes to run a network and create an infrastructure that is easier to share and scale. Telcos that aggressively deploy these technologies will be well positioned to realize cross-border synergies. But there are a couple of caveats.

First, no matter how enabling these technologies are, complexity—the “kryptonite” of shared platforms—is still driven by the level of local customization. Indeed, if anything, these new technologies can potentially open the door to more customization. When network functionality is moved to cloud-based applications, traditional hardware and software restrictions are removed. This enables nearly limitless customization, making it all too easy to go overboard with local tweaks.

The good news is that telcos should be reducing complexity in product offerings and thinking through the transition to technologies such as NFV and SDN. So the efforts they make in their overall business transformation can boost their cross-border efforts as well. For example, one way to reduce complexity and improve time to market is to replace legacy services with new offerings delivered through an over-the-top (OTT) model. This approach enables highly standardized services that require only “light” network integration (preferably through standardized application-program interfaces). It also fits in well with the idea of localization at the edge. An OTT service might have a common application core, with local customization achieved through the front-end app that accesses it.

Second, as many operators have discovered, legacy vendors don’t always provide adequate next-generation solutions. In such cases, the approach taken by companies in other sectors—the likes of Facebook and Google—can be instructive: you can design your own architecture by using commodity hardware that is operated by open-source code and putting your own apps on top of it. This method also helps reduce dependence on a single vendor.

Jointly Transform Commercial and Technical Operating Models

Cross-border programs are the ultimate team effort, and unless all stakeholders are on board, efforts can be torpedoed quickly. It is vital, then, to include all critical managers and decision makers who represent not only the participating countries but also various areas within the organization. One idea is to bring everyone together for a telco conclave—generally, a week or two of meetings—and hold discussions until the required alignments have been reached. But no matter what mode of interaction is chosen, certain imperatives are crucial:

- Include commercial functions in planning and decision making. Although it might seem tempting for the network and IT side to go it alone (international synergies, after all, are mostly related to technology), this approach presents risks. Resistance from the business side (seen, for example, in a reluctance to relinquish control of firewalls and network security to a regional organization) can easily doom a cross-border project.

- Establish a project management office. A good way to keep cross-border initiatives on track and to jointly address changes in commercial and technology operating models is to establish a strong and empowered cross-functional project-management office.

- Tackle governance and financial topics early on. Governance can be especially difficult in cross-border projects. Optimizing on a regional level may sometimes cause temporary—or even lasting—suboptimization on the local level, triggering pushback from local players or actions that serve particular interests but negatively impact the regional group. Such challenges have been addressed in adjacent industries— for example, IT services. IBM, for instance, successfully “forced” a global service model by mandating that 70 percent of required design and development activities be sourced from a global delivery center; exceptions would be permitted only with top-management approval. The key is to implement a strong governance approach and to create the framework early. Similarly, questions related to, for example, shared decision making, taxation, transfer pricing, and cross-charging must be addressed at the outset.

Although market conditions continue to challenge telcos, operators do have a number of new, if unproven, means for dealing with them. In the months ahead, The Boston Consulting Group will publish articles exploring more of these levers—such as the use of big-data analytics to optimize network operations. But as telcos evolve along with the market, development of cross-border synergies is a particularly good place to start. They not only provide scale benefits and help lower the cost base, they also spur telcos to embrace standardization—and cut the cord on complexity. Cross-border synergies don’t only create leaner, more agile networks and IT; they also promote leaner, more agile—and ultimately more successful—telcos.