From 2010 through 2014, the consumer durables sector created significant value for shareholders around the world. Increased consumer demand in the US and an expanding middle class in emerging markets—many members of which are either making purchases for the first time in some durables categories or spending more on those purchases—helped spur sector growth and create positive tailwinds for durables manufacturers over this period.

In 2015, The Boston Consulting Group conducted its annual study of the total shareholder return (TSR) of nearly 2,000 publicly traded companies in 27 industry sectors, of which 47 were in the consumer durables sector. (See Value Creation for the Rest of Us, the 2015 BCG Value Creators report, July 2015.)

During the five-year period from 2010 through 2014, the durables companies in the sample returned an annualized TSR of 21%.

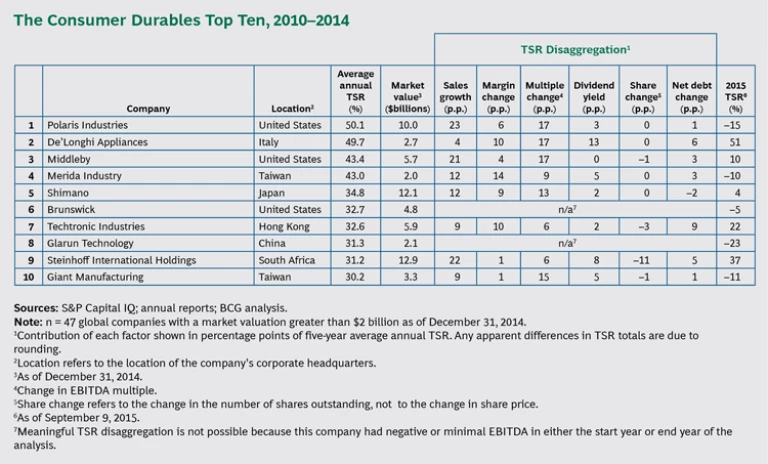

Compared with last year, the top-ten durables companies generated value from a wider range of TSR drivers. In the 2014 report, multiple change was the biggest value-creation driver for eight of the top ten companies (and a significant driver for the remaining two). Yet the majority of this year’s top performers distinguished themselves primarily through strong sales growth or improved margins. (See the exhibit, “The Consumer Durables Top Ten, 2010–2014.”)

One element that remains consistent, however, is the degree of churn among the best performers in the durables sector. Just three companies remain among the top ten from the 2014 rankings: Middleby (third in this year’s list), Brunswick (sixth), and Techtronic Industries (seventh). One explanation for this churn is that the market value of companies in the durables sector is generally lower than that of companies in other consumer sectors, and smaller, nimbler companies with the right strategy can position themselves for rapid growth and value creation. The cyclical nature of many durables segments, along with two-speed growth across mature and emerging markets, has also created an opportunity for nimble companies to rapidly rise in—or drop out of—the rankings.

How Nimble Companies Can Create Value

Being nimble does not mean chasing fads or constantly reacting to volatility in the economic cycle. Companies that follow a consistent, long-term strategy for value creation—while actively monitoring and adapting to the changing consumer and competitive landscape—can capitalize on new opportunities faster than their competitors. In our analysis of this year’s top performers, we observed that leading companies take several actions to win by remaining nimble.

Invest in disruptive innovation. Like companies in other sectors—such as consumer packaged goods and telecom, media, and technology—durables manufacturers are increasing their rates of innovation to keep pace with evolving consumer behaviors. The top performers in this year’s list have been able to anticipate consumer trends and build up a pipeline of innovations that allow them to increase their market share and become less dependent on the economic cycle for growth. A good example is Polaris Industries, a US-based manufacturer of off-road vehicles, which was the top TSR performer in the durables sector from 2010 through 2014. Polaris has rolled out a steady stream of innovative new vehicles over the past several years: 31 models in 2014 alone. The company invests roughly 4% of sales in R&D, which is higher than average for the sector. As a result, Polaris generated 23 percentage points of value creation through sales growth, more than any other company in the durables top ten.

A particularly ripe area for disruptive innovation is digital technology. From new marketing tools to online sales channels to the industrial Internet and advanced manufacturing technologies, digital is creating novel ways for durables categories to generate a competitive advantage. For example, many new household products now include sensors that can track usage; adapt to changes in temperature, pressure, or motion; and even diagnose problems and anticipate repairs, in order to prevent more expensive failures later on. In addition, the ability to connect multiple products into the broader ecosystem known as the Internet of Things can exponentially increase the benefits for customers.

Digital is also completely changing the way consumers research, shop, and buy many durable goods. Tools such as mobile commerce, location-based technology, and social-media platforms are blurring the line between online and off-line channels and creating new opportunities for durables manufacturers to develop relationships directly with end users. Digital technology is also providing more data, such as customer purchase history, product usage patterns and even social-media activity. This allows durables companies with big-data capabilities to develop deeper customer insights, create better forecasts, and constantly refine the products and services they sell. It also allows any durables companies that have traditionally sold through distributors and retail chains to connect more directly with consumers through new mobile applications or e-commerce platforms.

Among this year’s top performers, Steinhoff International Holdings—a South African furniture manufacturer—has invested heavily in e-commerce, which is a key strategic growth driver for the company. For example, one of the company’s European brands rolled out an online shopping platform that links its existing store network to an already efficient supply chain. The new e-commerce platform allows the company to offer seamless online and off-line shopping experiences. It also provides a template for other brands in the portfolio to follow.

Win in high-margin segments. Another way that top performers can be nimble and create more value is by shifting their product portfolios toward higher-end segments. This strategy taps into customers’ willingness to trade up during a recovering economic cycle. The willingness to trade up increased from 2012 to 2013 in several durables categories, such as washers and dryers (8 percentage points), other large home appliances (a gain of 7 percentage points), consumer electronics (7 percentage points), and furniture (4 percentage points). (See The Resilient Consumer: Where to Find Growth amid the Gloom in Developed Economies, BCG Focus, October 2013.)

For example, De’Longhi Appliances—which operates established brands De’Longhi, Kenwood, Braun, and Ariete—finished second on this year’s list, and has made a strategic shift to higher-end goods. The company supported this shift through a relatively high investment in advertising and promotion (approximately 10% of sales) and R&D (roughly 2% of sales). De’Longhi makes the popular Lattissima Nespresso pod-based coffee machines, priced from $300 to $600, but it is also the world leader in selling higher-end full automatic coffee machines that retail for as much as $3,000.

Similarly, Merida Industry, a Taiwanese bicycle manufacturer that finished fourth, was able to generate one of the highest total increases in sales and margin growth over this period (26%) by focusing on a growing premium bike segment: some of the company’s bikes sell for up to $12,000. Merida has been able to establish a premium position by consistently emphasizing its German design and engineering heritage (even though its bikes are manufactured in Taiwan). It also sponsors professional riders to generate marketing buzz among amateur cyclists and to push development engineers for further innovation as they get feedback from the company’s athletes.

Squeeze greater productivity from operations. Many durables companies launched one-time cost-reduction initiatives during the economic downturn. But top performing companies were able to drive greater productivity through the cycle by constantly reassessing their cost competitiveness as labor and input costs changed and by investing to raise their manufacturing and supply chain capabilities to world-class levels. For example, Techtronic Industries—a Chinese manufacturer of branded power tools and floor-care products—generated 14% of its TSR from improved margins, more than any company in the top ten. Techtronic has continued to invest in automation and lean manufacturing, and it has taken concerted steps in the areas of global purchasing and value engineering to improve its productivity and cost performance over time.

Similarly, De’Longhi opened one production facility in Romania and a second in China, which allowed the company to significantly reduce production costs. As a result, De’Longhi generated 10 percentage points of TSR through improved margin performance—more than twice the value generated from sales growth.

Leverage M&A for growth. While organic growth is one approach to value creation, the right M&A deals can also unlock value, often by allowing a company to leverage its core strengths while also moving quickly into an adjacent segment. According to BCG research, active buyers that regularly scout the market and use M&A to strengthen their portfolios or to expand into new territories are much more likely to create value than companies that do so only sporadically—if at all. Middleby, a US manufacturer of commercial kitchen equipment and residential appliances, is a good example. The company has a strong track record of making acquisitions and integrating them into its operations. In particular, Middleby has strategically targeted the beverage segment, which has allowed the company to build out its portfolio beyond cooking equipment. In late 2014, for example, it acquired Concordia Coffee, giving Middleby a strong foothold in the market for commercial coffee equipment.

If past trends hold true, the top value-creating companies of the past five years in consumer durables will likely not top the list in the next five years. We believe that the winning durables players will be those that are nimble enough to capitalize on emerging opportunities. By focusing on these priorities—disruptive innovation, high-margin segments, greater operational productivity, and M&A—companies can position themselves to improve their financial performance, outperform their peers, and reward investors.