This is the first in a series of articles published as part of The Boston Consulting Group’s 2015 Value Creators report. The full report will be published in spring 2015.

The question on many investors’ minds in recent years has been whether the current expansion in global equity markets can be sustained—and if so, for how long. If 2014 is any indication, the answer may be that expansion will continue for some time to come. In 2014, global equity markets slowed somewhat but still delivered healthy returns. The MSCI All Country World Investable Market Index of total shareholder return (TSR) was 9.9 percent. Although this result was down about 16 percentage points from 2013’s extraordinary 26 percent, 2014 was the third consecutive year (and the fifth out of the six years since the global financial crisis) that the MSCI Index has delivered TSR at or above the long-term historical average.

Of course, single-year TSR performance can be hard to interpret and is not necessarily a good predictor of long-term performance. Nevertheless, last year’s result, coming immediately after the extraordinary performance of 2013, suggests that equities continue to be an attractive asset class and that the recent expansion is proving to be reasonably robust. (See "The Flight to Equities Continues", BCG article, February 2014.)

The Boston Consulting Group recently analyzed the 2014 TSR of more than 6,000 companies across 44 markets. There were four key findings:

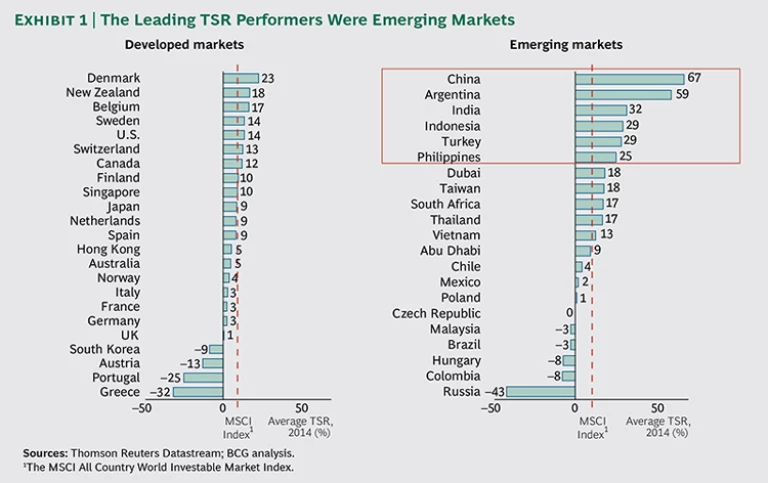

- Once again, emerging markets delivered the highest TSR, taking the top six spots and eight out of the top ten market spots. However, it is important to distinguish between those emerging markets that delivered high TSR because they were rebounding from a previously low base (for example, China) and those that have delivered consistently high returns in recent years (for example, the Philippines).

- Smaller markets, led by Denmark, delivered the highest TSR among the developed economies. Among the larger developed economies, only the U.S. was able to deliver above-average TSR in 2014. Last year’s big winner, Japan, dropped below the market average. And major European economies such as France, Germany, and the UK saw markets stagnate.

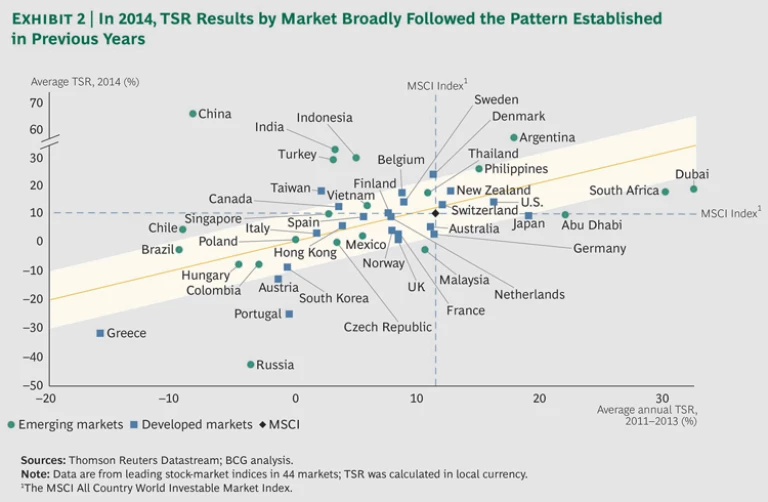

- With a few notable exceptions such as China, 2014 TSR performance by market broadly tracked the previous three-year trends. In other words, leaders continued to lead, while laggards continued to lag. This finding raises the question of whether global equity markets have achieved an equilibrium point, with momentum continuing along the trajectory established in the relatively low-growth economic environment after the global financial crisis.

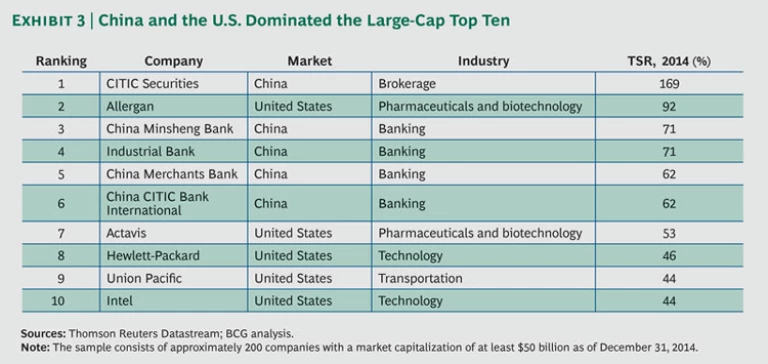

- Finally, the list of the 2014 top ten large-cap value creators was shaped by two fundamental trends: China’s massive rebound from being one of the worst-performing markets in 2013 to become the best in 2014 and the continuing recovery in the world’s leading developed economy, the U.S. Companies from these two countries dominated the top-ten list.

Emerging Markets Lead the Pack

In 2014, emerging markets continued to deliver the highest annual TSR, with China claiming the top spot (67 percent), followed by Argentina (59 percent), India (32 percent), Indonesia and Turkey (29 percent), and the Philippines (25 percent). (See Exhibit 1.) Among the developed economies, the big winners were Denmark (23 percent), New Zealand (18 percent), and Belgium (17 percent).

Among the larger developed market economies, only the U.S. (14 percent) was able to deliver above-average TSR in 2014. By contrast, the strong resurgence of the Japanese capital market in 2013 (making it the top developed economy that year, with a TSR of 59 percent) waned in 2014; TSR in Japan dropped to 9 percent, nearly a full percentage point below the global average. Meanwhile, major European economies such as France (3 percent), Germany (3 percent), and the UK (1 percent) saw markets stagnate owing to sluggish growth and the continuing instability in the euro zone.

The continuing problems of the euro zone crisis are responsible for two big TSR losers among the developed economies: Greece (a negative TSR of 32 percent) and Portugal (a negative TSR of 25 percent). And Russia, where equity markets suffered from a perfect storm of declining oil prices and increasing economic sanctions, is not only the worst-performing emerging market on our list but the worst-performing market in our entire sample with a negative TSR of 43 percent.

Equilibrium Point?

To put these results into a broader context, we compared 2014 TSR performance by market with the performance of each of these markets in the previous three years. Exhibit 2 plots the average TSR performance of the 44 local stock markets for 2014 and the average annual TSR for the three-year period from 2011 through 2013. This longer-term view lends itself to three main insights.

The first insight is that 2014 TSR by market broadly tracks the previous performance in the majority of the markets we studied. In other words, most markets that delivered strong TSR in the previous three years continued to do so in 2014 and those that did not perform well in the prior three-year period likewise did not perform well in 2014. This finding suggests that global equity markets may have achieved an equilibrium point, with momentum continuing along the trajectory established in the economic environment after the global financial crisis, characterized by low growth and low interest rates.

The second is that, seen from a longer-term perspective, the most impressive performance has been that of the markets in the upper-right quadrant of Exhibit 2—that is, markets that have beaten the MSCI Index average both in 2014 and in the previous three-year period. In this respect, the 2014 performance of the emerging markets Argentina, the Philippines, Abu Dhabi, and Dubai may be more meaningful than that of China, because it represents the continuation of a longer-term trend, whereas China’s strong 2014 performance reflects the fact that China’s equity market is rebounding from its very poor performance in 2013, when it delivered the third-lowest TSR (a negative 12 percent) among the 44 markets we track each year. Similarly, among developed economies, the strength of the U.S. and smaller markets such as Switzerland and New Zealand is especially striking.

The third is that there are some exceptions to the overall trend, and they are important. As mentioned earlier, China is a major outlier. So too, in the other direction, is Japan. After delivering a double-digit annual average TSR of 19 percent during the 2011 through 2013 period, Japan fell back to below the market average, reflecting weaker economic growth in 2014 than forecasters had expected. A similar pattern can be found, to a lesser degree, in Germany. After delivering market-average TSR in the period from 2011 through 2013, Germany, with a TSR of 3 percent, delivered less than one-third the global average TSR in 2014—a result that may indicate that the struggles of the euro zone are beginning to affect investor confidence in the German market.

Finally, all three of these observations help interpret the list of the top ten large-cap value creators for 2014. (See Exhibit 3.) Chinese and U.S. companies make up the list. The leading Chinese companies are all from the country’s financial-services sector (including the 2014 leading value creator, Chinese broker CITIC Securities, which delivered an astounding TSR of 169 percent), and it’s likely that their presence on the list is primarily an artifact of the overall rebound of the Chinese market. By contrast, the U.S. companies on the list are from a range of industries such as pharmaceuticals and biotech, technology, and transportation—reflecting companies and sectors that are benefiting from the steady recovery of the U.S. economy.

Cautious Optimism

As always, one must be extremely careful about drawing unequivocal conclusions from single-year TSR performance, which by itself is a poor indicator of long-term value creation. There is no guarantee that the markets, companies, or sectors at the top of the 2014 list will be there next year. Only time will tell whether Chinese equity markets are on a sustainable path or merely experiencing a short-term bubble, or whether last year’s strong but slowing TSR performance worldwide represents a forward trajectory with momentum or the beginning of a broader slowdown.

Among the questions that we will track in the coming year are the following:

- What type of value creation strategies are allowing companies in even the weakening local equity markets to beat not only the local-market average but also the global TSR average?

- What can we learn from those companies that have been not just one-year winners but top value creators over the entire five-year period from 2010 through 2014 that we will track in our 2015 Value Creators report?

- Finally, and perhaps most important, which companies are delivering superior value, not merely because they are benefiting from positive macroeconomic trends but also because they are transforming their own internal value-creation capabilities?

We will be exploring these and other questions in our 2015 Value Creators report, to be published in spring 2015.