In the movie Moneyball, Billy Beane, the coach of the Oakland Athletics baseball team, transforms the way Oakland trades players, replacing the judgment of experienced scouts with statistical analyses of players’ performance. This allows the team to buy players who are undervalued by baseball insiders and sell players who are overvalued. Despite its small budget, Oakland enjoyed a record run of 20 victories in 2002, following this change in approach. The statistical techniques employed by Beane have since become standard in baseball.

This is but one example of a general trend. In recent decades, many decisions that were once left to the judgment of experienced practitioners are now informed by analytics. From sports to advertising to policing, we are seeing a shift from gut feel to statistical science.

Price setting is no exception. With advances in the ability to collect, store, and rapidly analyze data, many businesses have made great improvements. The “dynamic pricing” of airline flights and hotel rooms is probably the most familiar example. But advanced pricing techniques are being adopted by an ever-expanding variety of businesses.

Not yet in commercial lending, however. Loan prices are the result of negotiation between business clients and the bank’s relationship managers (RMs). And where prices are set by negotiation, science has generally made fewer inroads.

Often the negotiators themselves are the obstacle. The old scouts at Oakland initially resisted Beane’s statistical approach. Similarly, many RMs are reluctant to follow a more scientific method, which would require them to change their ways and can make them feel that their discretion and experience are undervalued. Line managers often doubt that science can be applied to the art of negotiation and, being removed from the client, hesitate to prevent RMs from making excessive discounts—which are encouraged by compensation schemes that reward RMs for volume rather than returns.

This approach causes inconsistency and forgone revenue. In our work with commercial lenders, we see wide disparities in loan pricing—a difference in spread of up to 200 basis points for similar loans—and high rates of fee waiving. But these problems can be remedied by the disciplined use of statistical analysis.

Because customers vary in the value they place on commercial loans and the associated services provided by their banks, they also vary in what they are willing to pay. Banks can set optimal prices by identifying the customer characteristics that go along with price sensitivity. And with the right training, tools, incentives, and governance, RMs can consistently achieve those prices.

Shifting to best practice in commercial loan pricing takes time and leadership focus, but it requires only modest capital expenditures and a minor increase in operating costs for ongoing training and price sensitivity analyses. The increased revenue—in our experience, between 7% and 10%—goes straight to the bottom line. With increased regulatory burdens and subdued demand, these are profits that commercial lenders cannot afford to forgo.

Standard Pricing Techniques

There are two common approaches to pricing commercial loans, both of which have shortcomings that leave money on the table. The first is cost-plus. In commercial lending, this usually means setting the price that delivers a target rate of return on capital. It’s done by adding a margin to total costs (including capital costs) sufficient to hit the target.

Such cost-based pricing avoids the underpricing of high-risk loans. But it does not set optimal prices, because it ignores variations in the lender’s market position and in borrowers’ price sensitivity. The fixed “plus” added to the cost will usually be either too high or too low. Consequently, opportunities to make profitable sales to price-sensitive customers will be lost, as will opportunities to make larger profits from customers who are not price sensitive.

The second popular approach is to rely on market benchmarks—that is, observed market pricing for specific types of loans. But such benchmarks do not suffice for optimal price setting. They reveal how prices vary with some loan features or with competitive intensity in the local market, but not with the price sensitivity of individual borrowers. And because benchmarks tend to be averages of a range of prices, they are not true indicators of what the market can bear. Relying solely on benchmarks risks creating a false assumption that prices cannot go above these levels. Organizations that use benchmarks as targets often achieve below-market prices because of discounting by RMs.

Taking Account of Price Sensitivity

The cost-plus and market benchmark approaches do have some use, however. Prices must generally exceed costs and not lie well above the expectations created by competitors. Within these bounds, however, lenders should aim to vary interest rates and fees according to the price sensitivity of borrowers. To estimate price sensitivity, banks have traditionally relied on RMs’ understanding of their customers. This is still important. But the intuition of RMs is insufficient and sometimes unreliable. Before it comes into play, regression analysis can be helpful.

The first step is to identify the drivers of price sensitivity. Sensitivity cannot be observed directly but actual pricing can be. By considering like-for-like loans and comparing pricing achieved for customers with various characteristics, a bank can understand what makes its commercial-lending customers more or less price sensitive. Some of these drivers are relatively obvious, such as the size and risk of the loan. But others may come as a surprise to lenders.

It is also critical to ask borrowers what they value and how that affects their willingness to pay. Honest responses require the absence of the customer’s RM. Even then, the answers cannot be taken at face value. But appropriately solicited, customer feedback is a valuable supplement to statistical analysis.

These findings allow lenders to remedy the errors to which the simple benchmarking and cost-plus approaches are prone. Instead of targeting a market benchmark, lenders can target a price that internal data tells them can be achieved for customers with the relevant characteristics.

Achieving the Target Price

Once target prices have been determined, achieving them depends on RMs’ success in negotiation. This is where things often go wrong. No RM enjoys seeking higher prices from customers, and a number of misconceptions provide a rationale for avoiding the pain.

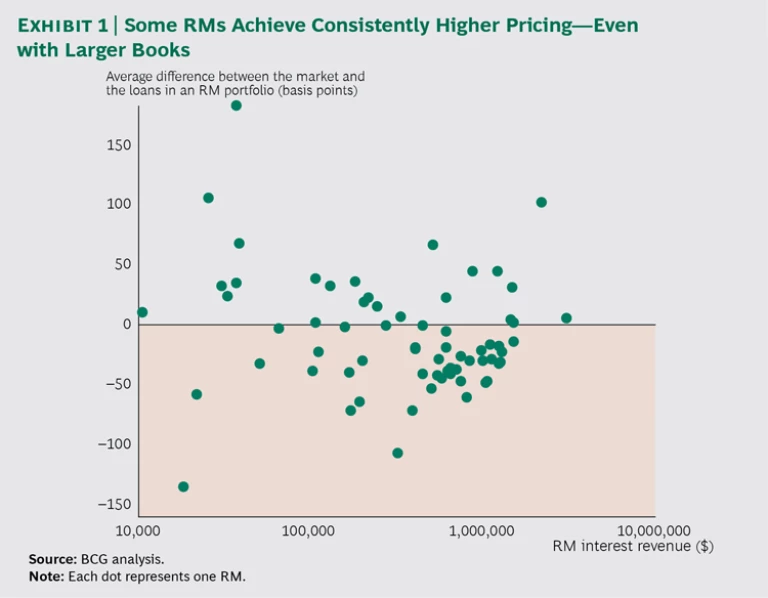

One misconception is that commercial loans are commodity products for which price differentiation is impossible—that is, banks are price takers rather than price makers. In fact, commercial loans have a number of moving parts that can be adapted to the particular borrower. And the loan is often part of a wider relationship in which borrowers receive valuable advice on how to structure their borrowing and reassurance about funding over the long run, including during tough times. Many of our clients’ customers tell us that they do not buy on the basis of price alone. Moreover, actual outcomes prove that better pricing is not impossible. On similar loans made to similar borrowers, some RMs achieve consistently higher pricing than others. (See Exhibit 1.)

Another impediment to achieving target prices is a tendency among RMs to overestimate customers’ price sensitivity. This is especially pronounced where origination and other fees are concerned. RMs waive fees more than 50% of the time, claiming they will break the deal. In fact, customers say they are more sensitive to interest rates than to fees, which they see as a cost of doing business. Clients will usually accept fees if the RM explains their rationale. Nor should RMs be overly fearful of losing customers. It is an old adage of price setting that if you are not losing any business, your prices are too low.

Getting the Best Out of RMs

To overcome RMs’ natural resistance to increasing prices, line managers must become powerful advocates for the scientific approach. Coaching line managers is thus critical, showing them “what good looks like” and arming them with probing questions that can help them make RMs hold the line and achieve target prices.

Four enablers can help develop and sustain performance:

- Training is important not only to show RMs that their reluctance to seek higher prices is unfounded, but also to give them practical help in overcoming it. As in any sales business, commercial bankers need negotiation training and ongoing coaching.

- A tablet- or Web-based pricing tool can provide RMs with consistent guidance during price setting and capture data that helps fine-tune target setting and monitor performance.

- RMs need the right incentives. If the performance measure used to determine bonuses considers only the volume of lending, that will encourage low pricing. Incentive schemes should also include measures such as rate realization and fee incidence.

- Governance is crucial. RMs should have pricing discretion within specified limits, if only because some drivers of price sensitivity can be identified only in the field. When RMs want to price outside those limits, a clear escalation process should kick in—up to team leaders if the request is within their pricing discretion, or up to the segment head if yet more discretion is required. The escalation process does more than control performance. It creates a healthy tension that eventually pulls RMs toward the bank’s desired approach to pricing. Over time, the number of escalations naturally declines.

This rules-based approach makes pricing fairer, with similar customers treated similarly, while also improving average margins.

Moving to Best Practice

How should banks go about moving to best practice in commercial loan pricing?

The first step is a diagnostic. This reveals where prices and practices are falling short and where the biggest opportunities lie. It invariably reveals huge disparities in the pricing of like-for-like loans, with no plausible explanation other than RM performance.

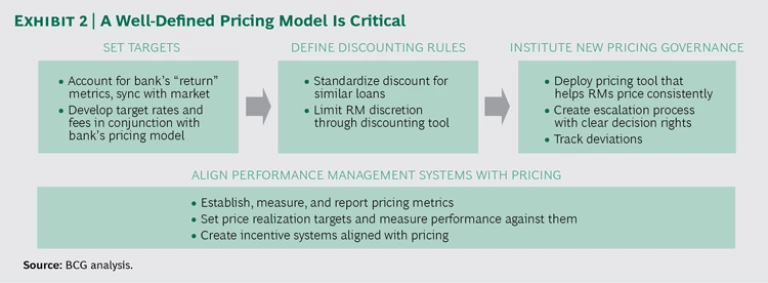

The next step is to design the new pricing model, drawing on insights from customer interviews so that the factors to which customers are most sensitive get the most weight. (See Exhibit 2.) Then the new approach is introduced to RMs and put into practice. A good way to start is a pilot with selected RMs. Pilots are an opportunity not just to iron out kinks in the model but also—and more important—to overcome resistance by demonstrating results.

It’s essential to explain the pricing model’s rationale to the RMs involved in the pilot, along with the analysis behind the targets. The model must not be a “black box”; the RMs should have an opportunity to probe it by playing around with hypothetical scenarios. In our experience, this helps build the confidence they need in their conversations with customers. It may even be helpful to provide RMs with “scripts” to use when answering common customer questions. RMs must also learn how to use the pricing tool. Finally, learning about the escalation process will give them an early signal that leadership backs the program and will make tough decisions.

Altogether, transitioning to the advanced pricing approach should take well under a year, even at large banks. Some benefits should be seen as soon as the pilot commences; the full benefits will take three to five years to realize as the portfolio is worked through.

As the success of Billy Beane’s 2002 Oakland Athletics showed, while the cost of moving from intuition to statistical science is small, the upside can be large. The challenge is to integrate all the key components: analytics, customer feedback, pricing tools, RM coaching, governance, and incentives. Piecemeal or inconsistent efforts will realize less than a third of the potential 7% to 10% increase in commercial lending revenues. What other low-cost initiative promises such benefits?