Now, it’s TV’s turn. Having reshaped the print media and music industries, digital disruption is now sweeping through the rest of media in similar fashion, rendering traditional video distribution models outmoded. The industry is rife with talk of “cutters” (consumers who drop pay TV altogether), “thinners” (those who actively manage their cable bills to pay less), and “nevers” (consumers who see no need to sign up for pay TV in the first place). (See The Digital Revolution Is Disrupting the TV Industry, BCG Focus, March 2016; “The Future of Television: Where the US Industry Is Heading,” BCG article, June 2016; and “How Telcos Can Become Video’s Next Big Star,” BCG article, June 2016.) Around the world, “TV” viewing is moving away from linear formats and toward digital, on-demand consumption. Consumers increasingly watch what they want at times, in settings, and on devices of their choosing.

For most media companies trying to adapt to the change, the big issue is technology—specifically, the digital platforms and technical skills necessary for traditional media companies to play in the new game. And it’s not just any game, but a fast-moving, rapidly evolving contest in which digitally enabled capabilities such as the speed to market of new functionality (options for integrating advertising, for example) and instant adjustments to consumers’ use of content (such as social media integration) are as critical to success as traditional creativity and content production.

Broadcasters and pay TV networks have a strong asset in the content they produce and distribute, but they must embrace the technology enablers that tech companies employ if they are to stay relevant to audiences and take advantage of today’s opportunities. Most are hampered by legacy IT systems that struggle to meet digital demands. Media companies need to transform their core technology to stay in the game.

Current Industry Dynamics

In the first wave of digital disruption, traditional media companies and properties, especially in print media, found their distribution models disintermediated, their content “de-monetized,” and their subscription and advertiser bases demolished. Some never recovered; others responded with new content offerings and business models built for digital distribution. (See “The New News on Print Media Transformation,” BCG article, June 2016.)

The second wave of disruption has the TV and video industry squarely in its sights, and it is propelled by powerful forces. Significant advances in technology and high-quality streaming content have led to enormous increases in audience numbers. By 2018, online video will likely account for nearly 80% of fixed-data traffic and close to 70% of mobile traffic. Research has found substantial declines in traditional TV viewership among younger consumers in many developed markets around the world. The rise of digital “superplatforms” such as Facebook, Google, Amazon, and Apple, which have made strong moves into video distribution and content production and acquisition, is another force for change. The tech giants possess powerful combinations of capabilities: the financial strength to make big investments, the ability to build and deploy technology at scale, deep expertise in molding the user experience, access to massive user bases, and high flexibility in devising monetization models.

How Media Companies Can Respond

Traditional video distributors have good opportunities to play in this new game, but they need to combine their critical advantage (content creation) with a data-driven approach to content distribution and consumption. Media companies need to be able to match specific content with the most appropriate audiences, channels, and monetization models—and then monitor performance and make adjustments based on real-time data about who is watching and what their relevance to advertisers is.

From a technology (and business) perspective, this is no small change. To make the transition to a digital marketplace, media companies must overhaul the capabilities of their technology function. Essential to this transformation is a commitment to empower IT to move up the value chain, from simply executing business requests or instructions to playing a new leadership role at the intersection of business innovation and technology, particularly with respect to digital offerings, business models, and processes. More than half of the employees at the tech superplatforms and at leading OTT players such as Hulu and Netflix focus on their business’s technology and product agenda. Traditional TV companies can’t afford such R&D armies, but they still need to adopt a mindset that puts technology at the center of attracting new viewers by developing and distributing content that is relevant either to big audiences or to niche segments.

Digital Offerings and Business Models. It’s no longer enough to deliver a hit show or a popular live event. Content distributors today need to manage a seamless user experience across multiple devices with very different formats and capabilities (TV, laptop, and mobile devices, for example), as well as to offer device-specific use cases for content. At a basic level, especially for younger viewers, a smartphone is now a viewing device (as well as a TV remote control and a device for voting on content or registering program feedback on social media). The TV itself can integrate social media and provide local storage for time-shifted consumption. New devices and technologies, such as wearables and virtual reality, up the ante considerably.

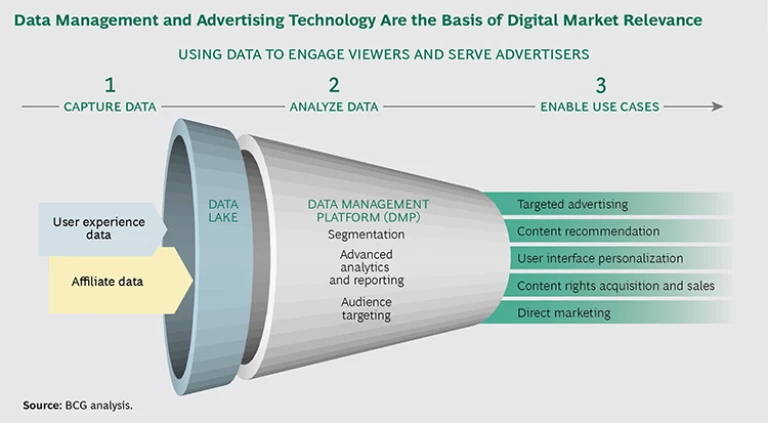

At the next step up the ladder, media companies need to maintain or increase their relevance to consumers by using captured and analyzed data to personalize their content offerings and the user experience and to deliver relevant viewers to advertisers. (See the exhibit, “Data Management and Advertising Technology Are the Basis of Digital Market Relevance.”) The middle of the content market—midquality content produced for a mass-market audience (where the traditional video value chain concentrated most of its content production efforts)—is getting squeezed while the top and bottom ends thrive. The massive increase in streaming video has simultaneously reenforced the importance of top-quality content in a cluttered world and enabled the superserving of endless niche audiences’ almost infinitely narrow interests and desires. We expect that over time viewership will bifurcate, moving toward big hit “water cooler” programs on one end of the spectrum and a long line-up of niche content—appealing to small, but passionate audiences—on the other. But to serve such audiences, media companies must master the collection and use of data. All of the tech superplatforms, from Amazon to Netflix, use big data to help direct content production and distribution. Knowing what appeals to customers, on the basis of internal and external data, will soon become an essential part of engaging viewers and serving advertisers.

Like their print media brethren, other media companies need to master new technologies and techniques in digital advertising, such as programmatic buying and selling of ad space and time. Well established in tech and print circles, programmatic buying is fast gaining traction in mobile and video, too. According to some reports, about a quarter of all programmatic transactions involving ads take place on mobile devices. Programmatic spending on TV ads was only $50 million in 2014, according to eMarketer, but the research firm projects that spending will increase to $11.5 billion by 2019—about 13% of the total US TV ad market. We believe that as media companies harness more consumer data and apply advanced analytics to their core business, new targeting opportunities will emerge that could drive even faster growth. For example, both Sky Media and Viacom have launched data-driven ad products in the last two years, and both are growing fast.

Digital Business Processes. Delivering content is no longer a linear process, and making money is no longer a simple matter of selling advertising time, subscriptions, and content rights. Media companies today must be able to work across multiple distribution channels and types of monetization, which include transaction-based, advertising-supported, and subscription-based models. The economics for the latter two are scaling up quickly, and media players need to work across all of them flexibly, right down to the individual program level.

In addition, media companies have a big, multifaceted business opportunity in the fast-emerging field of branded content. (See Branded Content: Growth for Marketers and Media Companies, BCG Focus, July 2015.) At the very least, they need to meet the growing demands of consumers and advertisers by integrating native ads seamlessly into consumers’ interactions with media and by working with brands to develop creative content for distribution through media platforms.

All of these distribution channels and business models require highly efficient (and integrated digital and nondigital) planning processes and tools. Media companies must learn to flexibly integrate brands into their own offerings, integrate their own offering into other platforms, and maximize the monetization of both. They must manage integrated digital advertising processes to enable efficient cross-channel and platform-based advertising operations. The ability to see—quickly and comprehensively—how different kinds of content perform in different channels and settings is becoming essential. The availability of content rights and options for distribution and monetization must be readily visible to the product, editorial, and scheduling teams. To serve all of these new needs, access to and insights from internal and external data will become more important than ever as the basis for real-time decision making.

TV Companies’ Technology Constraints

Most TV distributors are ill prepared for this new world. They are not organized to orchestrate digital and innovation efforts or to spin fast innovation cycles. Many lack both the necessary technology and people who possess the requisite digital knowledge and skills.

To help companies get their arms around the extent of the transformation they need to undertake, we use a framework we call the Digital Transformation House. (See “The Digital Transformation House for Media Companies.”) By setting out the digital issues, processes, and capabilities that media companies need to address, the framework helps companies meet the digital needs of their customers while ensuring operational agility and efficiency.

THE DIGITAL TRANSFORMATION HOUSE FOR MEDIA COMPANIES

Media companies need to adopt a change management mindset if they want to capture the full power of digital technologies. This means enabling the technology function to move up the value chain and occupy a new role at the intersection of innovation and business. Over time, the technology function should take on a critical role in managing and controlling the company’s digital capabilities.

For companies managing complex transformation programs, the Digital Transformation House framework can prove helpful. (See the exhibit below.) The framework provides a clear focus on the core offerings, underlying business models, and critical capabilities (such as agile development, data management, and third-party integration) necessary to build the digital foundation. To promote organizational adoption, accelerators that integrate a digital mindset and strengthen company performance should back the digital transformation program.

These challenges are surmountable, but only if business and IT leaders work together and make sometimes difficult decisions, which in our experience often fails to happen. In many cases, IT departments within media companies focus on isolated transformation initiatives (mostly in the course of introducing new technologies or offerings), instead of devoting their attention to modernizing core technology operations that constrain digital transformation. In many instances, current restrictions on digital transformation in media-company IT functions are rooted in siloed departments and assets. Although most media companies have added a digital technology unit to their IT department, only a few have merged their digital units with the business’s core media technology function.

In addition, companies typically tie their technical operations support too tightly to individual product lines or specific technology stacks, which increases complexity and leads to a high level of redundant skills and assets. Decentralized structures often fail to give the technology organization a clear mandate to bundle forces to bring the best corporate and digital strategies to life. Like many other media companies, one leading European commercial broadcaster found itself trapped by technology stacks built on monolithic architectures and using complex, out-of-date, custom-built applications with little standardization or openness in their interfaces. The underappreciated role of IT governance made efficient mitigation even more complex: business and technology functions were poorly integrated, and third-party providers were not tightly managed.

Such combinations of complexity and constraints can lead to several operational and organizational problems. Companies have limited operational agility and effectiveness in applying their core IT capabilities. They have too little scale and lack the ability to protect against failure. They often suffer from high maintenance costs and blurred responsibilities for the introduction of new requirements. Addressing new application requirements becomes a complex undertaking, sometimes calling for major additions to the technology stack, which further increases complexity in the IT landscape and accumulates technical debt that must be addressed in the future.

The Five Levers of TV Technology Transformation

Overcoming these systemic constraints requires a comprehensive transformation of the core tech function. The goals are straightforward: enable agility and adaptability; push standardization and simplification of the application landscape and IT infrastructure; build new capabilities; and manage the growing ecosystem (within and outside the organization). The devil lies in the details of execution. In our experience, five levers are available to media companies.

New Architecture. New digital architecture significantly increases the level of standardization in the application landscape and IT infrastructure, and permits flexibility where needed. Companies can centralize core media operations around a modular or even microservices concept based on distinct functionality, maximizing effective use of agile development and continuous delivery to implement new functionality fast. These capabilities are highly relevant to core media company operations, such as file transfer, content processing, editing, scheduling, rights management, content management, subscription management, quality control, archiving, and storage. New forms of architecture combine centralized horizontal application layers for joint usage across traditional and digital media production, and distinct vertical services to meet specific business requirements. An end-to-end workflow management system integrates vertical (specific) and horizontal (shared) applications.

Transition to Agile. Rapid time-to-market and fast provisioning of new functionalities are essential in digital media, especially for consumer-facing applications, but not all IT functions are ready to move (or iterate) at digital speeds. In the near term, pursuing a dual-speed IT function can be a useful transition strategy for media companies—so long as everyone concerned understands that this is a transitional phase. (See “The End of Two-Speed IT,” BCG article, August 2016.) The longer-term future of IT is one speed: all-agile, since agile has again and again proved its ability to get products to market and to deploy systems quickly at minimal risk.

Agile development and continuous delivery concepts enable fast delivery cycles and smooth deployment while ensuring that products match user requirements (and adjusting them quickly when they do not). Agile development methodologies also promote close interaction between business and technology departments, and the tightly managed iterative approach brings more flexibility to the development process. Although core systems, such as media resource planning, that don’t need new functionalities every two weeks can continue to operate at their own speed for a while, in the long run the inefficiencies of maintaining two parallel IT structures will become more pronounced. A complete switch to agile methodologies will make more sense for media companies at some point.

Cloud Introduction. The introduction of cloud-based solutions, such as software-, systems-, and platform-as-a-service, can help the technology function move toward creating digital value. We see a strong push for cloud transformation in global and local media players, especially with regard to “applications of record” and enterprise IT. Cloud-based solutions offer multiple benefits over company-hosted platforms, systems, and software, including lower implementation and maintenance costs, more-flexible cost management in the face of fluctuating user numbers, and enhanced cross-business-unit collaboration through standardized processes.

Increasingly we see media companies that run high-volume streaming services use cloud-based services to manage the need to scale up for peak periods. Some OTT providers have fully shifted transcoding, encoding, and storage infrastructure to the cloud. Netflix has demonstrated how efficient a cloud-only storage scenario can be. We expect the shift to the cloud to continue as a strong trend.

Data Management. Perhaps no technology function is more important—or more capable of delivering value—than data management. If data management is to deliver value, however, a clear vision must guide the function, and the company must manage the data as a strategic asset, rather than simply as customer or viewer information. This means that a team, department, or division has to own the data, ensure its quality, and actively manage its value. Attracting the right talent and paying attention to the right technology are especially critical. Today, most data management activities lack cross-unit coordination and depend on isolated technology assets; as a result, countless opportunities go unspotted or overlooked.

Smart data management lets media companies perform four crucial functions:

- Monitoring content performance across all consumer touch points

- Introducing end-to-end performance management to enable editorial and creative teams to instantly assess customer reception of content packages and new offerings

- Complementing well-performing content with best-fit advertising

- Engaging in constant content ROI monitoring and making real-time adjustments as required

In our experience, successful media companies build their data management capabilities step-by-step over time, starting with understanding their data assets and how they can add value, and then defining clear-cut use cases. Typically the first priority is targeted advertising, followed by personalized digital services and data-based content acquisition.

Digital Governance. Dealing with increased complexity and sustaining a new level of business-IT interaction require a more active and encompassing IT governance function. Companies can follow a number of best practices in this area. These include a close alignment between business and technology with formal and documented request management processes; near real-time budget monitoring and managed financial flexibility; and establishment of a single point of responsibility for key topics and tools. Business and technology should jointly prioritize requirements, and there should be an ongoing process to review changes in the environment and the need to align or realign roadmaps.

Companies also need to develop strong and efficient policies and processes for integrating partners who can help fill internal gaps and address future needs. The flexibility to make effective use of a combination of core internal skills and capabilities and external expertise and resources, especially when the need arises to scale up quickly, will be a differentiator. Tightly managing external partners (setting clear expectations and defined service levels, for example, and establishing close interaction and communication models) is key.

Adapting to the kind of disruption that is now taking place in media is no small order for any business. Adapting at digital speed while maintaining day-to-day operations is tougher still. But media companies that don’t move fast will find themselves left behind. Media is becoming a digital game, and data and technology are setting many of the new rules. Companies that do not transform their IT will soon have a hard time playing.