This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds.

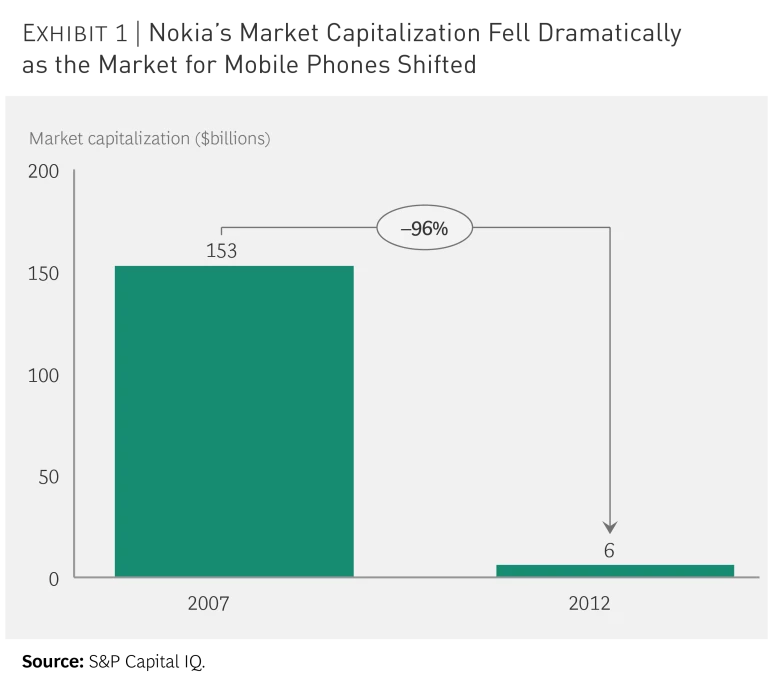

Nokia has transformed itself many times in its 150-year history, starting as a paper mill in Finland in 1865 and then moving into other industries and other countries. It didn’t settle on phones and networking equipment until the 1980s, when mobile technology took off. In 2007, the company was a dominant player in mobile phones, with a 40% global market share thanks to superior technology and enormous scale advantages. Just five years later, however, Nokia was in a severe crisis: its market capitalization had dropped 96%. (See Exhibit 1.) The company was burning cash, and operating losses were more than $2 billion in the first six months of 2012 alone.

In response, Nokia launched a dramatic, bet-the-company turnaround. The first big strategic question was the fate of the mobile-phone business. In the war of the mobile ecosystems, Apple’s iOS and Google’s Android were rapidly capturing larger and larger chunks of the market, and it started to seem unlikely that Nokia’s Windows Phone strategy would save the company. Instead, Nokia decided to sell its mobile-phone business to Microsoft, announcing the divestment as part of a $7.2 billion deal in September 2013.

After the divestment, Nokia was a portfolio of three fairly different businesses: network infrastructure, mapping services, and technology and patent licensing. This brought the company to its next big strategic decision: Should Nokia develop itself as a portfolio company, or should it focus its activities?

Should Nokia develop itself as a portfolio company, or should it focus its activities?

The network infrastructure business was Nokia’s largest. But from 2007 onward, Nokia had been operating it as a 50-50 joint venture with Siemens and had planned to reduce its involvement by preparing the unit for a full spinoff and IPO.

But in 2013, sensing opportunity, Nokia decided to take full control of this unit by buying out Siemens. Why? The joint venture agreement was coming to an end, and one of the parties would need to assume full ownership, with all the risks and rewards associated with it. Nokia’s move proved to be a success—over the next two years, Nokia turned the networks unit into the new core of the company, creating several billions of dollars in shareholder value.

Nokia turned the networks unit into the new core of the company, creating several billions of dollars in shareholder value.

The full extent of Nokia’s grand plan for the network infrastructure business was revealed in 2015, when Nokia announced its intent to acquire Alcatel-Lucent. With this industry-shaping $16.6 billion acquisition, Nokia expanded from a mobile-network provider to a full-service network infrastructure provider (including such services as IP routing and optical networks), and it strengthened its presence in North America. During the same year, Nokia further sharpened its focus by selling its mapping business to a group of German car companies (including Audi, BMW, and Daimler) for $3 billion.

Despite the repositioning to a full-fledged network infrastructure provider, Nokia decided to retain its patent and technology licensing business in order to continue its legacy of innovation and reinvention. In addition to housing the majority of Nokia’s patents, the unit focuses on innovating in areas such as virtual reality and digital health. Although the unit accounted for less than 5% of Nokia’s revenue in 2016, it generated 22% of the operating profits and, according to analysts, accounts for an even higher share of the company’s valuation.

To illustrate how drastically Nokia has changed in this journey, one can look at Nokia’s workforce: from the start of the turnaround through early 2017, the company turned over 99% of the employee base, 80% of the board, and all but one member of the executive team. Chair of the board Risto Siilasmaa, who took over in May 2012, at the height of Nokia’s troubles, described the journey as follows: “It has been a complete removal of engines, the cabin, and the wings of an airplane and reassembling the airplane to look very different.”

Rajeev Suri, a long-time Nokia Networks employee who took over as president and CEO in mid-2014 to execute the strategic plan of the newly formed Nokia, described the effort to analysts: “We launched a new strategy, made all of the key product transition decisions and aligned those with customers, fostered the common culture, and more. All of which underlines the point that when you know which direction you should be heading, you can move faster and more effectively, and we have done that.”

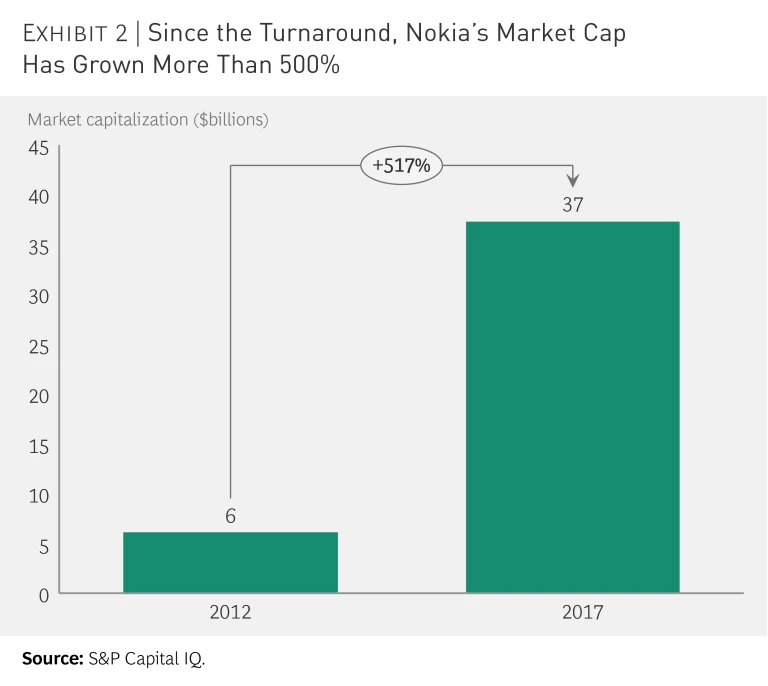

Nokia transformed itself from a nearly bankrupt mobile-device manufacturer to one of the world’s leading network infrastructure and technology players. Its market capitalization in July 2017 had increased more than 500% since the low point in July 2012. (See Exhibit 2.)

This transformation—from walking dead to thriving in a new core business—is unlikely to be Nokia’s last. But this success shows that the company is able to navigate massive disruptions, reorient itself, and come back even stronger. Today, Nokia is again the pride of Finland and the most valuable company in the country. It is well positioned for the next chapter in its long history.