As digital technologies and changing buying behaviors reshape B2B marketing and sales, the long-standing challenges of generating demand and managing leads are becoming much more complicated. In response, more companies are turning to demand centers, centralizing demand generation and lead management to take advantage of scale economies and deepen the technical and analytical skills needed to orchestrate customer buying journeys. The tech industry is leading the charge, but companies in other sectors—including industrial goods, health care, and financial services—are starting to build out their automated demand generation and lead acceleration capabilities as well. Companies that can effectively build these capabilities will be able to reach new and existing customers earlier and more affordably in the buying journey, boosting growth at lower cost.

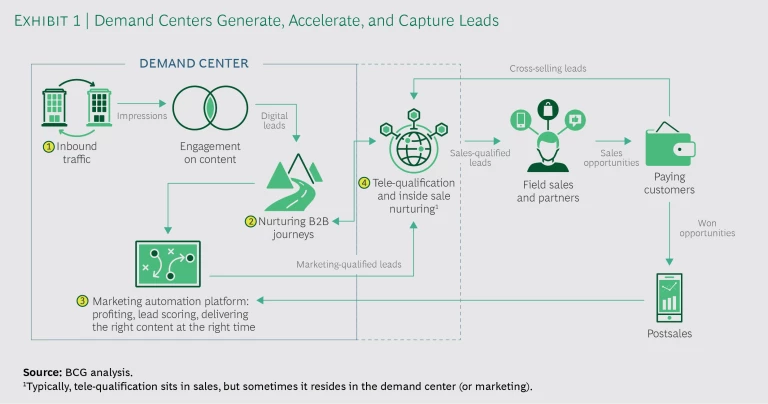

Centralized, automated demand generation and lead management are not new concepts; marketing automation platforms have been around for a decade, for example. But the fast-rising expectations of B2B buyers with respect to digital engagement and interaction are pushing companies to orchestrate personalized, seamless buying journeys that bridge digital and real-world channels and accommodate many different products, industry sectors, and customer personas (such as business decision makers, researchers, procurement experts, and finance officers). Demand centers, which combine centralized digital demand generation with informed sales response, can play a pivotal role in guiding these journeys across organizational divides. (See Exhibit 1.) When done well, they can produce impressive results. We have seen companies achieve increases of 20% to 50% in inbound leads while reducing the cost per lead by more than 30%. Twofold to threefold increases in conversion rates (from initial lead capture to close of deal), improvement by 10 to 30 percentage points in total new marketing-generated revenue, or increases in sales growth of up to 1.5 times the current growth rate, and gains in return on marketing spending of 30% or more are not uncommon.

That said, for many companies, the cross-organizational mission of demand centers represents a transformational change—a complete rethinking of the business’s go-to-market approach and supporting capabilities. This transformation often requires extensive coordination of technology, data, business processes, and expertise across marketing, sales, and customer success. Not surprisingly, many organizations struggle with the transition. Here’s how leaders do it.

A New Center of Demand…

The primary job of marketing and sales has always been to generate or identify buyer interest, engage and develop that interest into demand, convert demand into sales revenue, and then nurture the customer relationship to promote loyalty. Complicating this task today is the need to manage customer interactions across multiple fragmented channels—online and offline, direct and indirect—along the purchase journey. Moreover, customers’ seamless and increasingly personalized B2C experiences with the likes of Amazon, Netflix, and Starbucks are influencing their expectations in the B2B market. Meeting these higher expectations is a big challenge. (See these BCG articles: “How Digital Leaders Are Transforming B2B Marketing,” April 2017; “Bringing Your Digital B2B Sales Up to Speed,” August 2017; and “Mobile Marketing and the New B2B Buyer,” September 2017.)

Although demand centers are not new, several factors are combining to cause more companies to consider them. Key among these are the growing importance of scale (which is driven by the need for more technology, automation, and data) and the expertise necessary to manage these tools. In addition, the need for improved cross-organizational coordination—particularly in the form of leveraging digital technologies and data-driven intelligence to identify, nurture, and qualify demand and to close deals—puts a premium on the ability of demand centers to facilitate alignment and collaboration across the marketing and sales divide. (See “Building an Integrated Marketing and Sales Engine for B2B,” BCG article, July 2018.) Companies are increasingly looking to the concept of centralized demand management to create a differentiated capability to engage buyers and drive revenue growth.

Demand centers typically combine the expertise-based capabilities of a center of excellence with the executional support of a shared services organization. Ideally, companies build them around a clear scope of services, which they deliver via well-defined, consistent, and scalable processes and then support with expert talent, state-of-the-art marketing and sales technology, and advanced data and analytics. The demand center enables the company to provide the personalized and seamless end-to-end buying journeys that customers are looking for (these almost always start online in marketing and usually end offline with direct sales engagement), combined with systematic performance measurement and revenue attribution so sellers can learn from experience and improve over time. An effective demand center ensures that the company properly executes the customer journey across internal functions and customizes the experience by product, industry vertical, persona, buying stage, and customer behavior or action.

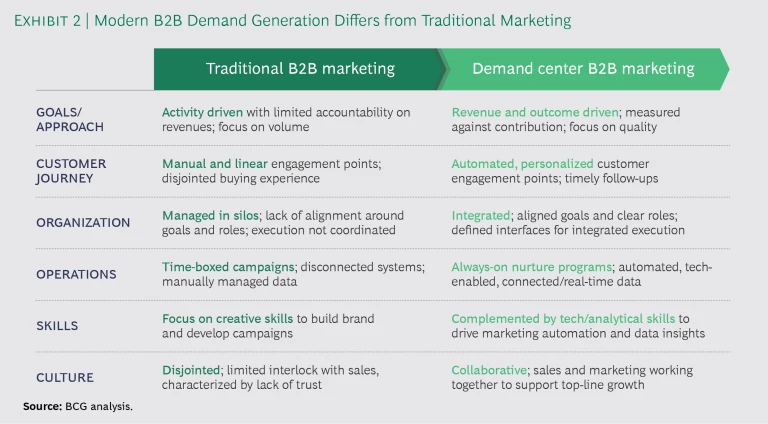

The demand center approach differs fundamentally from the traditional B2B marketing and sales go-to-market model. (See Exhibit 2.) An effective demand center transforms marketing from a sales support operation into a revenue-generating engine focused on such outcomes as pipeline contribution and sales growth. Done right, demand centers yield multiple benefits.

Organizational Alignment. A demand center’s purpose is to break down organizational silos. Full marketing and sales buy-in is a prerequisite; but with that commitment in place, demand centers facilitate organizational alignment around objectives, roles, and execution plans, fostering more seamless and efficient customer engagement.

Complexity Management. Demand centers orchestrate the core marketing and sales demand generation processes, and they develop and support the underlying infrastructure and data, with the goal of reducing organizational complexity. For example, handoffs between marketing and sales, which are not well executed in many organizations, become invisible to the buyer as the demand center helps design the key interfaces and ensures consistent monitoring and execution of all interactions. The demand center is also in a better position to help develop a common data strategy across marketing and sales, including identifying and measuring performance across key touch points on the buying journey. The demand center is also better positioned to facilitate the data integration across silos that is necessary to assess end-to-end performance and generate customer insights. Demand centers can help companies make the transition from fragmented, disjointed customer journeys to integrated, personalized journeys that can scale with digital engagement.

Marketing Efficiency. Demand centers promote the development of more integrated, critical marketing and sales infrastructure, such as the marketing automation platform, the sales CRM, the content management system, and predictive analytics platforms and models. They also underpin the creation and execution of more consistent, repeatable, and scalable cross-functional processes, such as marketing and sales planning, customer journey design, campaign development and execution, and performance measurement. Collectively, these enhancements produce significant marketing efficiencies.

Improved Measurement. Demand centers advance the implementation of standardized, consistent performance metrics and dashboards to measure marketing and sales performance across the entire purchase funnel. A demand center is also well positioned to capture data and use advanced analytics to attribute revenue to its source, enabling companies to better understand the relative contributions of the various activities and spending that helped generate it. Armed with a better understanding of the relative importance of drivers of revenue, companies can adjust their marketing strategies, execution, and spending to optimize returns.

Optimization of the Go-to-Market Approach Across Segments. Demand centers open the way for more efficient and scalable methods of serving smaller customers. They can also support account-based marketing (ABM) approaches for larger customers by enabling better account planning and prioritization, building out ABM tool sets, facilitating marketing and sales integration and communication, and measuring ABM program performance.

Major companies such as Microsoft, Oracle, and Salesforce.com have embraced the demand center approach (though they may use different terminology) and have reported strong results, including revenue growth that outpaces growth in marketing costs, improved marketing efficiencies (such as cost per lead and customer acquisition cost), rising conversion rates, improved customer buying journeys, and higher returns on media spending. One global software player that we worked with doubled its marketing-attributable cloud revenue and cut its cost per lead by 30%. Another global tech company more than doubled its percentage of new marketing-driven revenue, from 20% to more than 50% of the total, while doubling or tripling conversion rates.

…Requires a Demanding Business Transformation

The transition from a traditional go-to-market approach to a technology-enabled one can be tough. It requires investment to build automation capabilities and sufficient volume to yield the advantages of scale—one reason that demand centers historically have been a greater focus for larger companies. It also requires a certain level of organizational will to maintain the necessary attention to detail and execution over an extended period as the business expands its capabilities.

Multiple details related to organization, people, technology, data, and operations require attention. For example, many companies need to expand their core skills beyond brand building to include technology and analytical capabilities to support the rising importance of digital marketing and automation. They need to create operational capabilities for leveraging technology and real-time data and analytics to move from individual campaigns to a model based on always-on communication and customer nurturing. They must also build a common marketing and sales culture rooted in collaboration and mutual respect, with aligned objectives focused on revenue growth and profitability.

Implementing demand centers becomes much more complicated for companies that rely heavily on going to market with partners. Many struggle with marketing and sales coordination internally, and coordinating with independent organizations dramatically increases the complexity. Some companies address this issue by building closer relationships with fewer partners, including investing jointly in technology integration, data sharing, and full funnel measurement, while playing a larger role in generating leads for partners.

In our experience, companies most often stumble—sometimes fatally—in a handful of areas. The first is in trying to achieve full alignment and support across the marketing, sales, and customer success functions. Another is in articulating a clear vision and strategy for the demand center—what it will encompass and what steps are necessary to manage the complexity of designing and executing this new model—and then, on the basis of this vision, deciding where and how to build the centralized demand management capability. Many companies also fail to invest in developing a systematic and reliable measurement system, hindering efforts to understand the drivers of marketing performance and to know what’s working and what’s not. Finally, some companies do not anticipate the significant change management elements of the transformation and, as a result, struggle to fully realize the value that a demand center can bring.

A Better Demand Center

Because establishing a demand center can be internally disruptive, smart companies use sound planning and careful execution to minimize distractions while maintaining the organization’s focus on the benefits and the progress achieved. On the basis of our experience working with clients and conducting more than 50 discussions and interviews with senior leaders at B2B companies, we offer some lessons learned and best practices.

Vision. Companies need to start with a shared vision of what the demand center is and is not. They must identify which products, regions, channels, and segments to serve over time and how to serve them; and they must decide which model to employ (global, regional, or business-unit-specific, for example). Often, the extent to which a company serves common customers across these dimensions—as well as the need for customization and the existence of minimum scale requirements—will shape this decision.

Ultimately, it’s essential to align marketing (including central, operations, field, and product), sales (including inside, field, and partners), and customer success in support of common goals for the demand center to achieve. Defining the roles that each function will play in achieving these goals is also critical.

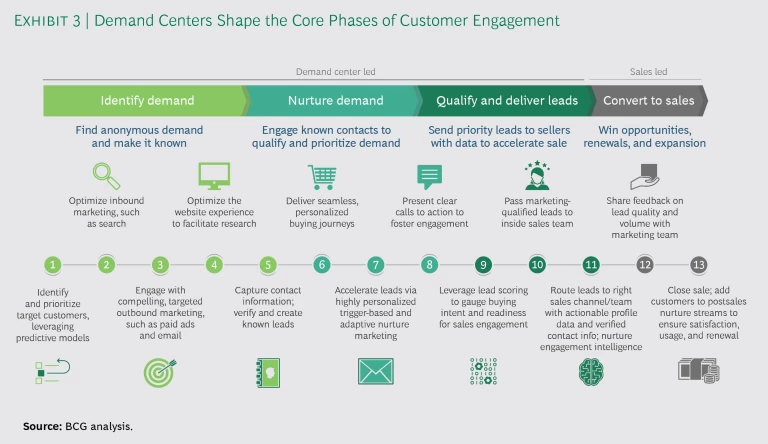

Customer Journeys. The primary tasks of the demand center should be to orchestrate and execute improved customer buying journeys that are differentiated from the competition and use data to identify pain points and anticipate customer needs. Companies have plenty of opportunities at all stages of the journey to assist buyers, guide their direction, and deliver the right content at the right time to facilitate decisions. (See Exhibit 3.) Companies will need to experiment with inbound and outbound marketing engagement, the web experience, and the use of personalization across these interactions. The demand center can play an important role in helping to manage the complexity driven by personalization, balancing inherent tradeoffs between customization and cost, and in helping to build the capability to enable it.

Planning and Alignment. Most companies find that they need to change current planning processes across marketing and sales to ensure that both functions interlock on goals, strategy, and programs. An approach of constant testing, measurement, and learning is essential, using regular forums to review performance between annual planning exercises and to make appropriate adjustments. Companies need to develop clear metrics on revenue impact and the underlying drivers, operational performance, and delivery of service-level commitments (such as the time the sales function takes to act on marketing-qualified leads). They must also invest in marketing and sales communication; many do not do this well today. During the first year or so, companies often derive large benefits from instituting a program management office approach to drive initiatives, measure success, escalate issues, oversee communication and governance, and report on progress to executive management.

Operating Model Design. In our experience, it is wise to take the time upfront to design the operating model in detail. Companies need to be very clear about what they need to centralize and why. Some activities, such as customer engagement strategy, certain types of content development, local customer events, and offline customer engagement, may need to be executed locally by the business units; but centralizing the core marketing operations capabilities—tech, data and analytics, campaign processes, and measurement—often yields savings related to standardization and scale. The right balance of centralization versus decentralization varies across industries and companies, as well as within companies by region, business unit, and product. Getting the demand center model and its details right can be challenging, but it is one of the keys to success.

Location is another important consideration: collocation of staff helps with cross training and skill development, although companies can also realize efficiencies with low-cost centers for certain activities.

Journey Funding. Building a demand center is a long-term play. Companies should look for opportunities to drive shorter-term wins that generate real value (such as new revenue or lower costs) to help fund development. Outsourcing more to B2B-specialist agencies early on to drive faster execution and help build skills can accelerate benefits. Many companies also redirect current marketing spending—especially spending not focused on customer journey optimization—to support the demand center. A global tech company found that it could fund over 50% of its multimillion-dollar investment by reallocating underperforming marketing spending.

Technology. The tech stack can be a big challenge. Many companies struggle with complexity here, especially given the swiftly expanding universe of marketing and sales platforms. For the technology platforms themselves, a key first step is to assess the current state of marketing technology and identify gaps in it, starting with the CRM and marketing automation platforms. Content management operations and the supporting CMS are also critical. Attribution is important to understanding performance, but most CRM and marketing automation platforms have limited attribution capabilities, so companies may need to develop them separately—either in-house or with vendor-provided tools.

Much of the value comes from integrating the technology pieces, which is not always easy. Failure to handle integration well can lead to a significant underleveraging of the tools while also creating a disjointed customer experience. Upfront planning, with the demand center working closely with IT, helps. Companies must decide between using integrated product suites and adopting a best-of-breed approach, which requires the integration of individual product solutions. The latter approach requires greater support but can result in a stack that better meets a company’s particular needs.

Whichever route it takes, management needs to define new business processes and recruit or develop new skills. Companies won’t get the optimal return on their tech investment unless they also put in place well-defined, well-executed processes managed by people with the right technical and analytical skills.

Data. All participants in the demand center need to work from a clean, common customer data source. Best-practice companies today are working toward a “single source of truth,” but few have this structure fully in place. Most continue to struggle with fragmented data that is siloed in different platforms. Best-practice companies look for ways to connect data across silos to enable specific use cases, leveraging data warehouses or lakes, data management platforms, and customer data platforms. Possessing integrated data is critical to generating insights and enabling more advanced modeling efforts to better anticipate customer needs and behaviors and to measure performance.

Pilots. It’s neither necessary nor advisable to go all in from the get-go. Companies should start with a few pilots that focus on a particular product, geography, or customer segment, learning as they go and ramping up over time. It is crucial to set specific goals for the pilot. Companies don’t need to fill all the gaps in current capabilities in order to execute a limited pilot: over time, they can build capabilities requiring investment in technology, data, and people.

Change Management. Finally, companies should take care not to underinvest in change management and the skills they’ll need to make the demand center work. Building a demand center can be complex, touching all elements of the go-to-market model. Going down this path will require transformational change, including new ways of working that will push cultural norms and barriers. One important step is for the company to audit its current capabilities and understand where it is on the digital marketing maturity curve compared with where it wants to be at key milestones. It is also critical to invest in talent and to build marketing operations capabilities, including technology and data and analytics. Most important, companies must work hard to bridge the marketing and sales divide; often, this is the biggest risk factor affecting success.

Building a demand center involves undertaking major technological, organizational, and cultural changes. That’s a tough trifecta for any company to manage. But without greater technology-enabled automation and a more centrally driven approach, many B2B companies will find the complexity of managing wide-ranging customer relationships and attracting new customers an overwhelming challenge in an increasingly digital world.

Customers have come to expect sophisticated online and mobile engagement, and they will migrate toward companies that provide a seamless experience, anticipate their buying needs, and deliver relevant, compelling, timely content and support. Management should not underestimate the challenge of the transformation required to build a better demand center, but neither should it delay the process. Instead, it should plan in detail and execute carefully as it moves forward. Today, digital strategies are already shaping the future, and the benefits of demand centers are too great to ignore. Most large companies should consider a demand center approach to take their digital capabilities to the next level.