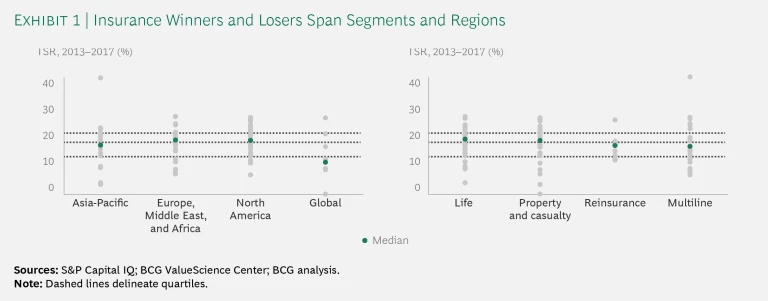

A new boldness appears to be afoot in the insurance industry—and investors are paying attention. This year’s value creators data, which covers the five years from 2013 through 2017, shows that markets rewarded many companies across the industry for a variety of value-creating moves. Insurance as a whole ranked 12 out of the 33 sectors tracked in the BCG value creators database, with a median annual total shareholder return of 18%. It performed more consistently than other sectors, showing a standard deviation of only 7%, the lowest among all industries. But the spread between top- and bottom-quartile insurers was still wide: a median TSR of 24% for top-quartile companies compared with 8% for the bottom quartile. On $100 invested five years ago, that’s the difference between a return of almost $300 and a return of less than $150.

The Sources of Value Creation

The good news—and the challenge—for management teams is that investors are rewarding individual company performance without favoring any particular industry line of business or geographic region. (See Exhibit 1.) Moreover, while a company’s starting point will determine its available options, the market is rewarding much more than just turnaround stories. In last year’s report, we described how the typical top-quartile company was recovering from a low base, reflecting the turnaround situation of many insurers following the global financial crisis, which continued to depress valuations as recently as 2011. This year, top-quartile performers and the rest of the sample all started off from similar positions, but their paths diverged from there.

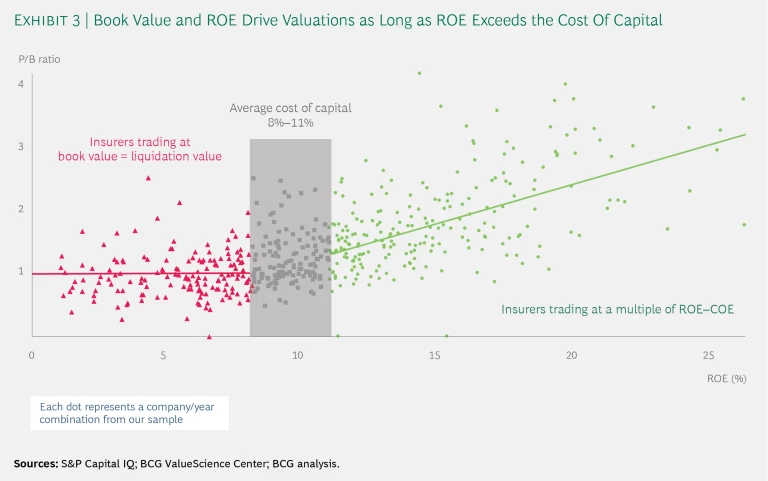

Last year we observed that most insurance companies faced two choices going forward: transform underperforming operations and improve balance sheets (if current return-on-equity performance was poor) or invest in growth (if current performance was good). Only high-performing companies could take full advantage of growth. Others, with ROE below their cost of equity, had no right to grow until they restructured their balance sheets, operating models, and cost base. Many underperformers had not exploited the levers of capital management and tight expense control. These organizations had the opportunity to cast a critical eye over their portfolios and make hard choices about which businesses deserved the capital bases that support their insurance premiums. The combination of portfolio restructuring, balance sheet strengthening, and aggressive performance improvement can substantially move the needle, improving ROEs and increasing the cash available for payout, the two main drivers of expanding price-to-book (P/B) valuation multiples. (See “TSR in Insurance.”)

TSR IN INSURANCE

TSR IN INSURANCE

In the long run, value creation measured by TSR is the true bottom line for any business. From the shareholder’s perspective, TSR is easily measured (the combination of share price gains and dividend yield for a company’s stock over a given period of time) and benchmarked. However, how do operational managers generate TSR? That’s where disaggregation of the primary TSR drivers comes in.

In insurance, TSR is broken down into three components: the growth of book value, change in the P/B multiple, and the contribution from cash flow (comprising dividend yield and share buybacks). Over the long run, book value growth and cash flow are the major contributors to TSR. Over the short to medium term, changes in the P/B multiple matter a lot more. (See the exhibit below.) The most important challenge for management is making the right tradeoffs among growing book value, deploying free cash flow, and expanding or protecting valuation multiples. BCG’s TSR methodology helps insurers simulate such tradeoffs and make informed decisions about factors such as portfolio focus, capital allocation, and business units’ financial targets.

Making the right tradeoffs requires accurate estimates of the impact of strategic and operational decisions on not only book value and free cash flow but also the valuation multiple. BCG’s Smart Multiple methodology uses regression analysis to estimate differences in valuation multiples. In insurance, almost 90% of the variance in a company’s P/B multiple relative to its peers can be explained by fundamentals: profitability metrics (ROE and dividend payout), balance sheet health (credit rating, liabilities, and debt), forward growth expectations, and size. When we help an insurer chart a course for superior shareholder value creation, we develop a plan on the basis of the tradeoffs among the fundamental TSR drivers (book value growth and free cash flow, for example) and the expected impact of each factor on the client’s valuation multiple, while also considering the risk and long-term strategic implications.

(See the Appendix for the key performance metrics of the top insurance companies in our sample.)

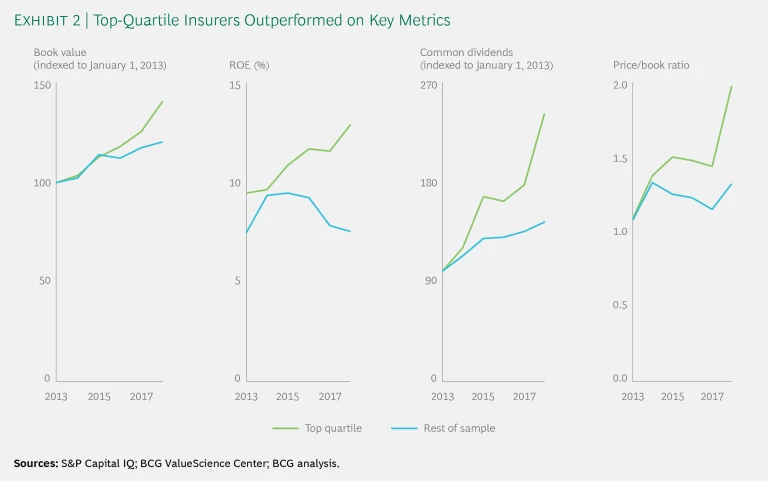

The 2018 data shows that, from 2013 through 2017, top-quartile insurers managed to drive healthy growth in book values (7%), increase ROE (from 9.5% to 12.9%), and grow their dividends (19%) much faster than their book value. As a result, their weighted-average P/B ratio jumped from 1.1 to 2.0, while the rest of the sample’s increased to only 1.3 from the same 1.1 starting point. (See Exhibit 2.)

BCG’s Smart Multiple methodology has shown that these factors, along with leverage, predict insurers’ valuations with more than 90% accuracy. Exhibit 3 demonstrates this empirically: clearly, so long as ROEs are below cost of equity of about 9% to 11%, it doesn’t matter how low they are—the insurer trades close to book value. Other factors (balance sheet strength, for example) are in play as well, but when ROEs exceed the 9% to 11% range, each additional point of return delivers a meaningful increase in the P/B multiple.

We also observed last year that capital management and cost efficiency strategies have limited benefits if they are not part of a more compelling growth strategy. While shareholders have long expected insurance CEOs to grow in moderation, keep costs low, hold sufficient reserves, and pay out a large portion of profits in the form of dividends or buybacks, times are changing. Industry leaders that want to deliver a new era of value creation need to rethink their business models, portfolios, and growth plans. In the long run, profitable growth above the cost of equity is the only recipe for corporate survival.

Bold Moves Pay Off

What a difference a year makes. In an industry traditionally seen as slow and complacent, companies have moved quickly and boldly. Strategic partnership agreements, technology investments, and M&A deals have been announced almost every week in the last year or so. We’re seeing a lot of activity in an industry that was thought to be driven in large part by macroeconomic factors such as interest rates. Investors are responding. Our analysis of industry shareholdings shows a higher percentage of growth-oriented institutional investors (43%) than in any year since 2008.

Many of the bold moves seem to have paid off, although the jury is still out on some of the longer-term initiatives. One area worth noting is M&A. Value creation via M&A has always had a spotty track record, and this continues to be the case. The ten most acquisitive insurance companies in the last five years delivered only 14% median TSR, four points less than the median for the total sample, but individual case-by-case analyses are needed to assess the strategic value of each M&A transaction. Acquisitive growth delivered only one additional point of book value growth, while costing four points through lower dividend yield and new-share issuance. That said, the insurance industry, especially in the US, is still very fragmented compared with other mature industries, and a new wave of consolidation could help lower its overall expense ratio.

In other respects, plenty of companies outperformed. There are 23 individual stories among the companies making up the top quartile, and what characterizes many of them are a clear strategy, rooted in the reality of each company’s particular circumstances, and a willingness to take decisive, sometimes bold action to achieve superior returns.

Given the risk today of market shifts—rooted in changing economic circumstances and consumer demand—and disruption, especially from technologically sophisticated players, winners understand that complacency is not an option. Incumbents need to take their fate into their own hands, recognizing that instituting or reinstituting growth can take time, particularly in an environment of mature markets, intense competition, and technology that is changing the world around them. They need to fund the journey by reshaping business portfolios and improving productivity. It’s important to notch some quick wins that demonstrate progress and build momentum while bigger initiatives for the medium term (typically a three- to five-year horizon) are at an early stage. They also need to align their leadership, culture, and organization with the businesses they want to create.

Digital technologies will almost certainly be important, as will a more agile approach—one that is based on testing, learning, and failing fast and cheap in various functions, including IT, product development, marketing, and distribution. But acting boldly is not just about embracing new technologies. Plenty of companies also need to consider realigning their portfolio in order to improve ROE or address capital-intensive back books that restrain higher returns.

Life insurance companies, in particular, face the challenge of accelerating profitable growth, especially in Europe where the new Solvency II regime has altered the capital requirements for long-term products with financial guarantees. While asset management-type products (such as unit-linked insurance plans in Europe) offer a less capital-intensive avenue for growth, focusing on savings raises tough issues of how to compete with banks and asset managers that have competitive strengths in asset gathering and wealth management. Many life insurers need to make better use of their strong brands and advantaged distribution, but doing so requires a stronger customer focus and enhanced digital capabilities that enable companies to guide customer journeys. It also requires that they navigate heightened regulatory concerns in the savings and asset management businesses, in particular the demands of regulators for strong walls or complete separation between these two lines of business.

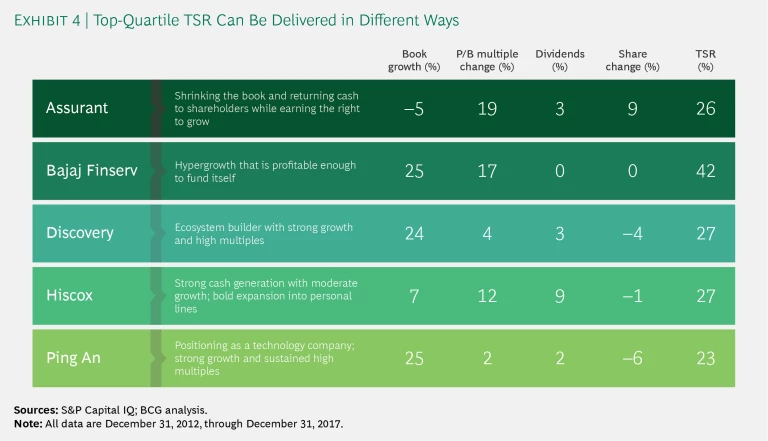

In the remainder of this report, we highlight five examples of how top-TSR companies in very different regions and lines of business have acted aggressively and generated market- and competition-beating TSR. (See Exhibit 4.)

Assurant: Shrinking to Grow

Some companies have to shrink to earn the right to grow. When Alan Colberg stepped in as CEO of Assurant in 2014, he inherited a multiline insurer with operations in lender-enforced homeowners insurance, extended-warranty and credit card coverages, health insurance, and employee benefits. He realized that the company needed to exit health insurance and employee benefits, refocus on its core property and casualty lines (where it could grow), and redeploy capital to more value-creating uses. These were bold decisions, given that the health and employee benefits businesses represented about a third of Assurant’s book.

Assurant announced the moves in 2015 and completed the restructuring two years later. Once it struck a deal for the sale of the employee benefits insurance business, it expanded its share buyback program, and then did so again in 2017. It also raised its dividend, reflecting increasing cash flow from its remaining property and casualty operations.

Last year, the company announced the acquisition of the Warranty Group, which complements Assurant’s extended-warranty and credit card coverage business, for $2.5 billion, including debt. The deal closed in 2018 and has brought better balance and less cyclicality to the company’s simplified business mix. Lenders require more borrowers to purchase home protection coverages in times of economic difficulty, and consumers buy more extended warranties for appliances and devices during economic expansions.

This combination of moves helped propel Assurant’s ROE from about 9% in 2012 to 13% in 2017, and the company delivered 26% annual TSR between 2013 and 2017 despite shrinking.

Bajaj Finserv: Aggressive Growth in an Underserved Market

Topping the 2018 TSR table for the insurance industry is India’s Bajaj Finserv, with annual shareholder return of more than 42%. Bajaj also led the 2017 insurance rankings, with five-year annual TSR of 47%. Bajaj’s TSR is rooted in growth: the company has grown at a rate of 25% annually and, perhaps uniquely among high-growth companies in insurance, its growth is self-funded through a remarkable ROE, which was 26% in 2013. Moreover, despite a massive expansion of the equity denominator, Bajaj’s ROE still stood at 14% at the end 2017—far above the company’s cost of capital. This is driven by strong focus on profitability. Bajaj has registered a combined ratio of less than 100 in its property and casualty business for nine of the last ten years, a rare achievement in the Indian marketplace. Indeed, Bajaj is the only major P&C business in India with a combined ratio consistently below 100.

To be sure, Bajaj has been riding a wave of middle-class expansion in India, where more than a billion consumers are still hugely underserved by financial services companies. The company has built a strong brand, focusing beyond major metropolitan areas on tier 2 and tier 3 cities, which represent a big share of the overall market. Bajaj has also proved successful, where many others fail, in the cross-selling of insurance, loans, and savings products under one brand umbrella. The company’s operating model is defined by low customer acquisition costs and high profits. It has also boldly invested in advanced technologies such as robotic process automation and virtual branches, which enable it to operate without staff in remote locations. (Rural areas are home to two-thirds of India’s population, or some 870 million people, and BCG’s Center for Customer Insight projects that The Rising Connected Consumer in Rural India.) Given Bajaj’s acquisition cost advantage, continued investment, and continuing high growth prospects, its P/B ratio is now 4.1, among the highest in the global sector.

Discovery: Pioneering Shared-Value Health Insurance

As our colleagues explored recently in their report on how emerging-market companies are leading the digital revolution in business, South Africa’s Discovery is a pioneer in the shared-value health insurance model, which encourages healthy living through health-promoting behavior. Discovery is South Africa’s largest health care funder, managing 19 schemes. From 2012 through 2017, it grew at a rate of 18% a year, compared with an industry rate of 6%. It grew book value by 24% and delivered TSR of 27% a year from 2013 through 2017.

With more than 8 million members, Vitality, created by Discovery, is the world’s largest incentive-based wellness solution company. It is active in South Africa, North America, Europe, and Asia-Pacific. The Vitality program encourages healthy behavior by providing such benefits as discounts on gym memberships and healthy food, reward points for preventive care and checkups, and incentives to maintain personal health records and track diet and exercise through an online platform. The program is also used in life and health insurance, as well as in investments, motor insurance, and banking.

Big data and advanced analytics are critical to Discovery’s business model, allowing it to build a picture of clients’ lifestyle choices and behaviors as they relate to health and disease. Multiple types of information, including unstructured data from such sources as websites and smart devices, are used purely for the benefit of clients in order to tailor incentives for behavioral change. In South Africa, Discovery recently partnered with PHEMI Systems, an analytics company specializing in large, unstructured data sets, to further analyze how behavior affects an individual’s risk profile. It is using the resulting insights to fine-tune the incentives system. Discovery is also working with Fitbit, Nike, and Garmin on novel tracking possibilities and is expanding its incentive and tracking system to other insurance products, such as car insurance, where it uses telematics to track vehicle usage and driving behavior.

In 2017, Discovery launched an app that allows members to engage with doctors in South Africa and internationally. Patients identify their condition or ailment and then get information about treatment options and urgency. “Answers are tailor-made to suit client and patient needs,” Discovery Health CEO Jonathan Broomberg told the South African website Moneyweb. The company is now introducing a service that uses artificial intelligence to predict medical risks, providing new decision-making capabilities for physicians and allowing for the proactive treatment of diseases and other medical conditions.

Hiscox: Underwriting Expertise, Growth, and Value

With more than a century of underwriting experience, Bermuda-based Hiscox creates value the old-fashioned way—by outperforming in a few well-chosen lines of business in which it has built strong advantages. Hiscox started as a specialty property and casualty insurer in London in 1901 and has stuck to its specialty roots, recognizing that in specialty lines such as professional indemnity and cyberrisk, competition is less intense because underwriting expertise is essential and products and services are less prone to commoditization. The company regularly registers combined loss and expense ratios that others can only dream about: combined ratios in the mid- to upper-80s are common. As a result, it also maintains a high ROE.

Hiscox has applied a similar strategy to its bold and successful expansion into personal lines by focusing on high-net-worth individuals who have specialty insurance needs (multiple homes, jewelry, and fine art, for example) and are often also business owners or senior executives and therefore purchasers of commercial coverages as well. In the last five years, Hiscox has doubled down on the strategy of growing its retail business, increasing premiums 90%. The retail line has surpassed the company’s traditional larger-premium, global business in size and now makes up 55% of total premiums, with its core offering—insurance for small businesses—accounting for more than a third of all premiums written. Hiscox’s retail business continues to drive healthy growth of around 10% a year. The company generated annual TSR of almost 27% from 2013 through 2017, ranking fifth among all insurers in our value creation database.

Ping An: Innovation Through Advanced Technology

In only 30 years, Ping An Insurance has grown into the world’s most valuable insurance company, with a market cap of more than $200 billion. While other listed Chinese insurers remain in the bottom quartile of our ranking, Ping An has outperformed the market, with an impressive 23% TSR from 2013 through 2017.

Ping An creates value using technology in three ways: improving the productivity of its core businesses, developing new opportunities in its core businesses, and investing in fintech ecosystems and solutions. For example, using Ping An’s technology platform, the company’s life insurance agents outperform industry averages by about 50%, even as its agent base more than doubled in size to 1.5 million from 2014 through 2017.

Ping An focuses on five key technologies: cloud computing, artificial intelligence, blockchain, biometrics, and big data, which have enabled it to develop multiple innovations. For example, cloud-based technologies support virtually all of the company’s functions and activities. Face and voice recognition systems using AI technology facilitate customer interactions. Machine learning and image recognition are integrated in automatic claims assessment. Big data platforms enable advanced models that can predict disease and monitor epidemics. The company uses blockchain technology in a dozen different scenarios in finance and health care.

In addition, these technologies allow Ping An to act as an incubator for internal fintech startups, sometimes pitting competing teams against each other to work on the same problem. These startups are responsible for more than 15% of Ping An’s value. They have helped the company build new ecosystems as bases for expansion in four areas: financial services, health care, auto services, and real estate.

As we pointed out last year, TSR has no memory. The value creation strategies that these five firms have employed may or may not work for others, and they may not work in the same way in the next five years as they did in the last five. But there is a value-maximizing strategy for every company and current circumstance. Insurers need to take the future into their own hands, with an honest assessment of whether they are taking the right actions to outperform and whether their actions are bold enough in an increasingly alpha-oriented market environment. The companies that lead the insurance value creation rankings of the future will be those that act now.