As the number of air travelers has surged in recent years, so has the amount of shopping that they do in airports. But while the so-called travel retail market has tripled in size since 2002, the rate at which passengers are spending has slowed over the past five years. To reverse this decline, airports, airlines, retailers, and brands will need to work together in innovative ways.

Some of those players are already launching ventures to boost performance, both in the airport and in the air. Among the most recent examples, Kuala Lumpur International Airport is building an integrated big data platform to support operations and provide real-time information to customers and airport operators; it will also facilitate passenger access to retail with features such as click and collect, where passengers buy products online that are subsequently delivered to their gate prior to boarding. In another venture, Singapore Airlines and duty-free operator DFASS have partnered with SATS, a gateway and food services provider, to convert onboard catalogs into an omnichannel e-commerce

experience.

While such efforts are a step in the right direction, companies need to do more than launch standalone initiatives or even individual joint ventures. They must join forces to create a travel retail ecosystem through which they can share data about passengers’ schedules, purchasing behavior, and other related insights, and use that information to offer passengers a compelling shopping experience at every step of their journey.

More Passengers—and More Challenges

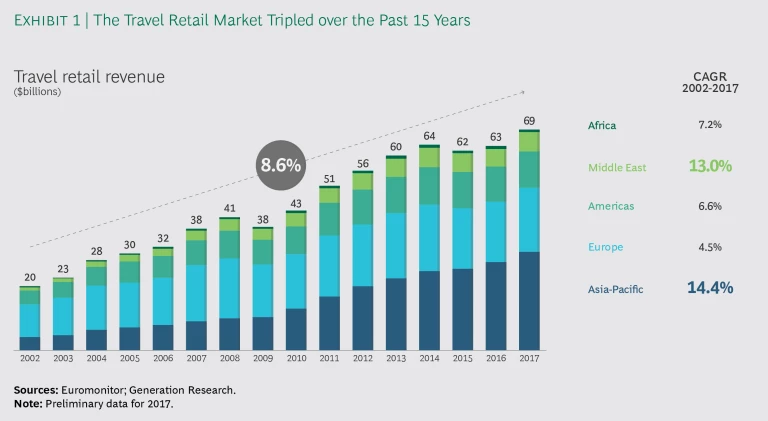

Over the past 15 years, the combined revenue of travel retail markets around the world has grown at a CAGR of 8.6%, at least twice as fast as any other offline retail channel. Today it stands at nearly $70 billion. (See Exhibit 1.)

Asia-Pacific travel retail in particular has exploded, with a CAGR of 14.4%. After surpassing Europe in 2011, the region currently accounts for almost half (45%) of global revenue.

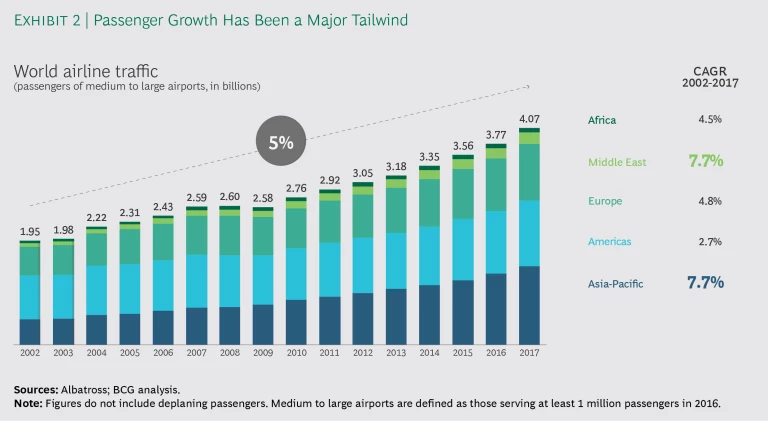

Airline passenger growth has provided a major tailwind for the growth in revenue. During the same 15-year period, the number of global passengers increased by 5% year over year. (See Exhibit 2.) And travel retail is likely to expand even further: according to the International Air Transport Association (IATA), the number of passengers will double between 2016 and 2035.

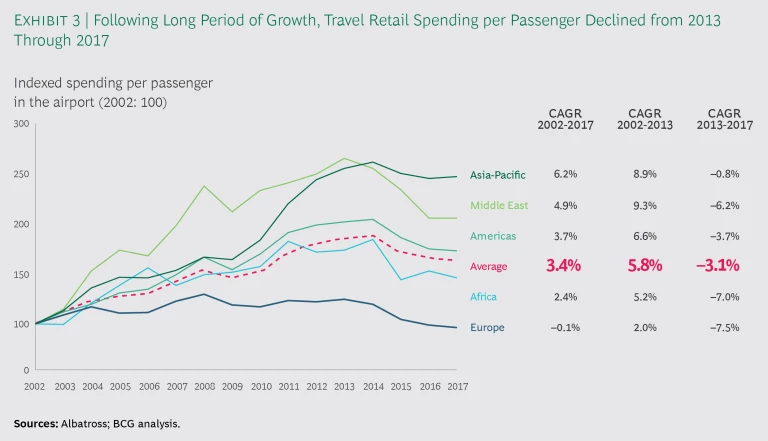

Until recently, revenue growth was also driven by an overall improvement in product assortment and the customer experience. Spending per passenger rose throughout the first decade of the 2000s, peaking globally in 2013, but has declined ever since. (See Exhibit 3.)

Both the growth in the number of passengers and the slowdown in spending per passenger need to be viewed against the backdrop of a transforming aviation industry. The emergence of low-cost carriers (LCCs), shifting demographics, and the growing impact of new regions are changing the face of aviation—and presenting new challenges for travel retail.

Low-cost carriers are on the rise. With their competitive prices, LCCs are enabling new consumers to enter the aviation market; these carriers now claim up to 35% market share in key regions. By expanding into secondary airports, they have also opened up new markets for travel retail. Since the arrival of Ryanair in 2002, for example, the number of passengers at Milan’s Orio al Serio International Airport has grown from 1 million to 11 million a year, a growth rate six times faster than that of other airports in the region. And in keeping with their lean operating model, LCCs take a digital-first approach when it comes to things like booking and checking in for flights.

But while LCCs can help to stimulate further growth in travel retail, other carriers will need to tailor their offerings to the needs and priorities—and the spending patterns—of the new LCC customer base as well. This could involve, for instance, increasing food and beverage offerings rather than retail products or focusing more on mass-market chains instead of luxury retail. LCC-focused airports need to accommodate the airlines’ operational-efficiency requirements while maintaining the service quality expectations of their travel retailcustomers.

Market demographics are shifting. Aviation demographics are also undergoing substantial changes, with new age groups taking center stage. A BCG study on the evolution of travel habits found that, by 2020, millennials (those born between 1980 and 1994) will account for 46% of business trip spending in the US, an 11% rise from 2013. (See Traveling with Millennials, BCG Focus, March 2013.)

To stimulate the buying power of millennials, travel retail will need to leverage digitally driven, omnichannel, and loyalty-based platforms. Meanwhile, baby boomers (those born between 1946 and 1964) and members of Generation X (born between 1965 and 1979) will increasingly retire and spend more time traveling. Travel retail will need to provide those groups with convenient offers that appeal to their respective socioeconomic and demographic profiles in order to stimulate impulse purchases.

In addition to these generational changes, the number of affluent and free independent travelers (those who travel on their own, not in prearranged group tours) will also rise.

New regions are coming into play. More travelers are coming from the Middle East and Asia-Pacific, at a rate almost twice that of visitors from Europe and the Americas over the past ten years. When it comes to Chinese travelers, traffic is expected to increasingly come from outside the four tier 1 cities (Beijing, Shanghai, Guangzhou, and Shenzhen); consumers from tier 2 and 3 cities will drive consumption patterns that reflect the relative immaturity of those local retail markets.

In the meantime, the growth of global GDP has transformed large sections of major countries such as India from low- to middle-income status. And according to the IATA, once people have more disposable income, they tend to spend more on travel.

Travel Retail Remains Fragmented

Between February and April 2018, BCG in partnership with the Tax Free World Association (TFWA) conducted in-depth interviews with more than 20 senior managers at airports, airlines, retailers, and brands in three regions (North America, Europe, and Asia-Pacific). All managers agreed that, by operating in silos, key industry players limit the value they can deliver to customers. Rather than sharing information about passengers and coordinating to provide them with the most compelling offerings in the most appealing environment possible, travel retail players continue to go it alone in a fragmented market.

Integration is limited along the customer journey. Every point along the customer journey provides a buying opportunity. And airports and airlines have an unparalleled amount of real-time information about passengers as they make those journeys, from their age and nationality to their present and future locations. By not giving retailers and brands access to that data, they lose the ability to target customers with personalized offers.

Conversely, many retailers and brands don’t have the infrastructure to collect such data. Those that do gather information tend to focus on customer demographics, preferences, and buying patterns. But competition for concession contracts is fierce, and retailers and brands view their customer data as a source of competitive advantage. Rather than sharing the information, they keep it to themselves.

Players’ priorities conflict. On the basis of experience with an airport in Asia-Pacific, BCG has found that the amount of money passengers spend can increase by up to 2.5% for every extra minute they’re in the retail area. But security processes and airlines’ gate allocation, preboarding, and boarding requirements limit the amount of time passengers can spend browsing. (And free Wi-Fi means that many passengers stay away from the retail section altogether, choosing instead to sit in leisure areas and use their phones or laptops.) Another notable source of friction is related to the cabin allowance. A TFWA survey of nonshoppers indicated that 8% are uncertain about what they’re allowed to bring onboard (whether related to regulations or airline-imposed restrictions), which is one reason they don’t make a purchase in the retail area.

Quality is compromised, and assortments are limited. Contracts between airports and retailers tend to be short in duration, have razor-thin margins, and place the lion’s share of risk—such as fluctuating airport traffic levels and the inconsistent revenue stream that can result—onto the retailer. The result is that retailers must compromise on product quality and customer service. But TFWA found that the lack of value and selection were among the main reasons travelers didn’t make purchases.

Low margins and tight contract durations also force retailers to minimize their investments in new products and formats. Brands are subsequently unable to deliver their full array of assortments and pricing options to customers.

Standalone Improvements Generate Only Incremental Value

Airports, airlines, retailers, and brands are making notable changes to accommodate the shifts in passenger demographics and priorities. But individual improvements will take them only so far. They need to consider—and support—passengers’ entire travel experience.

Airports need to win market share by focusing on quality. Airports are increasingly looking for ways to generate revenue from nonaviation sources such as travel retail. Indeed, travel retail is a vital element when it comes to delivering a competitive experience, particularly for airports competing on premium routes. Improving terminal offerings helps attract new carriers and, with them, more passengers. But BCG research shows that more than 20% of passengers are still unhappy with the airport commercial area. Passenger complaints vary across airports, with the most common being poor Wi-Fi connections, dissatisfaction with the food and beverages available, and difficulty finding their way around.

Airlines need to offer more, and better, selection. In the face of strong pressure on profits from LCCs and other competitors, all carriers have been developing lean operating models—often to the detriment of travel retail, both onboard and in the airport. For example, in an effort to improve operational effectiveness, such as by reducing turnaround times and imposing one-bag carry-on limits and other constraints, airlines have also cut back on both the quality and the variety of products available to buy while in the air, causing growth in onboard retail to stagnate. Instead, they should be looking to partner with retailers to offer items that can be purchased during the flight and picked up upon landing.

Retailers need to focus on customer convenience and new formats. While leading travel retailers have consolidated to strengthen their financial performance, they could do more for the customer, such as making the shopping experience more convenient by offering click-and-collect systems or by enhancing loyalty schemes through vertical integration with airports and brands. Retailers could also improve their in-terminal formats, investing in innovative layouts and further distinguishing their product offerings from those of traditional retail channels.

Brands need to differentiate their offerings and formats. Brands are also refining their approach to travel retail—for example, by considering it as a separate channel and dedicating departments to it. Pricing strategies and customer service could be further improved, however, as could format innovation, even in a constrained environment such as the airport. One example is the new Louis Vuitton store in Singapore’s Changi Airport; opened in late 2017, it is the first LV airport store in Southeast Asia and features, among other things, a glass and copper-diamond mesh surface and a digital LED display at the entrance.

Building a Travel Retail Ecosystem

Travel retail’s ability to provide the customer with a compelling shopping experience while meeting the strategic challenges of new markets, changing demographics, and competition from online retail will hinge on how quickly and effectively airports, airlines, retailers, and brands can work together. By moving past their current silo mentality, they can create a travel retail ecosystem that makes personalization and integration core features of the passenger experience.

Industry players can take a number of steps toward creating such an ecosystem. These actions are grounded in two guiding principles: a renewed focus on the customer and the establishment of a value-based platform for cooperation and collaboration.

Use data to provide the customer an integrated experience. Convenience—in both price and delivery—as well as immediacy are two of the primary reasons online retail is so successful, and together, they give it a competitive advantage over today’s travel retail offerings. One way the travel retail industry can fight market erosion from online competition is to match the convenience and immediacy that online provides. Travel retail should enable purchasing at every stage of the customer journey, from booking and other pretravel activities, to time spent in the airport, to in-air travel—all the way through to after deplaning. A strong partnership among industry players, which a third-party technology provider could help to anchor, is critical. But the success of any technology platform will depend on its ability to integrate data from all players regarding products and services that can be offered along the traveler’s journey. (See the sidebar.)

Integrated Data Platforms in Travel Retail

Integrated Data Platforms in Travel Retail

Several travel retail players have already developed integrated data platforms. For example:

- AOE has developed an omni-channel and multimerchant marketplace for Frankfurt Airport, which hosts one of the largest shopping areas in Germany. Users can download the Frankfurt Airport app to browse products offered by selected retailers and receive related promotions, reserve products for purchase that they can collect at the gate once they’ve landed, and check their flight status in real time.

- Skybuys is a prototype app that integrates the offerings of more than 100 duty-free points of sale globally (in-airport, onboard, and downtown) for the frequent traveler. Users can browse offerings across multiple duty-free retailers, compare items by location, save items to wish lists, and reserve and collect purchases in the airport.

- Flio integrates more than 300 individual airport apps into one. For each airport, it provides a vast array of operational information, from airport maps to flight time- tables to lists of shops and services; a one-click connection to airport Wi-Fi; the ability to make in-app purchases for further travel; as well as lounge access and selected promotions from featured retailers.

Airlines (and their data) are a critical component of the ecosystem. They can play a role in increasing the value of the travel retail market in three ways, starting with passenger data. Unlike airports, retailers, or brands, airlines are the main point of contact with passengers. As such, they have an unparalleled amount of knowledge about their customers, which they’ve used to develop competitive pricing policies and precision-marketing strategies. And they could take this even further—for example, by offering customer information such as ticket fare class to retailers for use when marketing travel retail products. This data could be shared in exchange for transparent transaction fees.

Another way of increasing travel retail revenue is for airlines and retailers to form joint ventures to create digital platforms that complement onboard service. For example, Singapore Airlines and travel retail operator DFASS signed a joint venture agreement with gateway and food services provider SATS to move the catalogs they provide to passengers in the air onto an omnichannel e-commerce platform. With such agreements, retailers can expand their ability to reach customers, and airlines can shore up any limitations in their product offerings while still maintaining operational efficiency.

In addition, airlines could allow a wider variety of goods to be promoted during check-in and at the booking stage. And they could provide complementary onboard travel retail services. For example, the online brand REWE is trialing an onboard grocery-shopping offering with Lufthansa that allows passengers on selected long-haul flights to shop for products that can be delivered once they arrive home.

Enhance the customer experience, from terminal planning to in-store execution. The travel retail industry should focus on building differentiated offerings that deliver a surprise effect. For example, in early 2018, Tiffany used its iconic blue packaging to draw passengers to its pop-up store in John F. Kennedy International Airport’s Terminal 4.

Excellence in customer experience starts with retailers and airports sharing a common understanding of the core principles that govern terminal design and passenger acquisition strategies. For example, when planning a terminal expansion, operators of one European airport engaged heavily with their commercial partners to establish criteria for space allocation and passenger flows. Engagement with large retailers started four years before the terminal opened; with select luxury brands, engagement began two years before it opened.

When it comes to operations, travel retail needs to be flexible enough to respond to changes in the number of passengers in different locations and at various times of the day in order to maintain profitability. One example is the integrated big data platform that Kuala Lumpur International Airport is deploying for its KLIA2 terminal. The platform will pull in data about passengers’ real-time locations throughout the airport so that services and supports can be adjusted to seamlessly accommodate fluctuations in passenger flow. Airports can also use big data and analytics to better manage resourcing, parking congestion, and in-terminal retail assortments.

The first steps toward this transformation have already been taken. Brands and retailers are developing new formats by using technologies such as video and augmented reality. They’re also embarking on enhanced partnership agreements with airports to create new formats, such as pop-up shops, that can occupy unused terminal space while providing novelty to travelers.

Refocus on the customer with tailored products, pricing, and promotions. Retailers and brands must further integrate around products to deliver differentiated offerings, starting with a shared understanding of customer demographics and purchase patterns.

According to Swiss travel retail research firm m1nd-set, the top two reasons Chinese consumers say they buy duty-free items are that they offer good value for money and a clear price advantage. With that in mind, the travel retail industry should exploit the price advantage offered by tax exemptions on core categories. That will allow them to compete with prices found elsewhere, whether online, downtown, or at the passenger’s destination, especially given that those other prices can be discovered with a simple web search. One solution—already widespread among e-commerce retailers—could entail the introduction of dynamic-pricing policies to match those of the competition.

The industry can also take advantage of airports’ intrinsic data richness, pooling customer information with real-time data to further tailor promotions and marketing campaigns. An example is the data-driven advertisement initiative jointly developed by Dubai International Airport, Dubai Duty Free, and JCDecaux. Together, they created a marketing ecosystem that integrates all their data to optimize ad scheduling, boosting the efficiency of campaigns. Retailers can change their artwork every 15 seconds using different languages and promotions according to the time of day and the expected passenger flows in the airport.

Three Ways to Start Working Together

To help airports, airlines, retailers, and brands craft their next steps, we offer three business model archetypes for partnerships that could provide the foundation of a travel retail ecosystem.

A Data-Driven Marketing and E-Commerce Platform

The industry could partner with a third-party technology provider to create an integrated, data-driven global-insights platform that could increase the number of marketing opportunities by focusing on customer outreach before travel starts and on convenience both during and after the journey.

All industry players would share data about their customers—from their age and nationality to their brand loyalty status—in a way that complies with privacy regulations. The platform would systematize and orchestrate the exchange of that data in return for a fee. For increased impact, the ecosystem could be extended to include, for example, hotels, parking operators, and online travel agencies.

The platform would then feed into a second, commercial platform that enables comarketing activities among airlines, airports, brands, and retailers. Given their natural connection with the customer, airlines and brands would serve as the touchpoint channels, while retailers and airports would provide the right assortment, resources, and areas for the comarketing activities.

The platform could be used to push targeted airport retailer promotions when the customer is engaged with the airline, either at check-in online (such as discounts on family meals or parking promotions) or while onboard (for example, a click-and-collect system at the gate during a stopover). Brands could also leverage the platform to increase the span of services they offer customers, such as the ability to collect or return items purchased online during a forthcoming airport visit.

Similar platforms are already being developed in adjacent markets. One example is Journera, a back-end data platform that collects passenger information from participating travel partners to provide a single, real-time snapshot of passengers that participants can use to offer a customized experience. For example, a hotel operator could see that one of its guests landed ahead of schedule and offer an early check-in time.

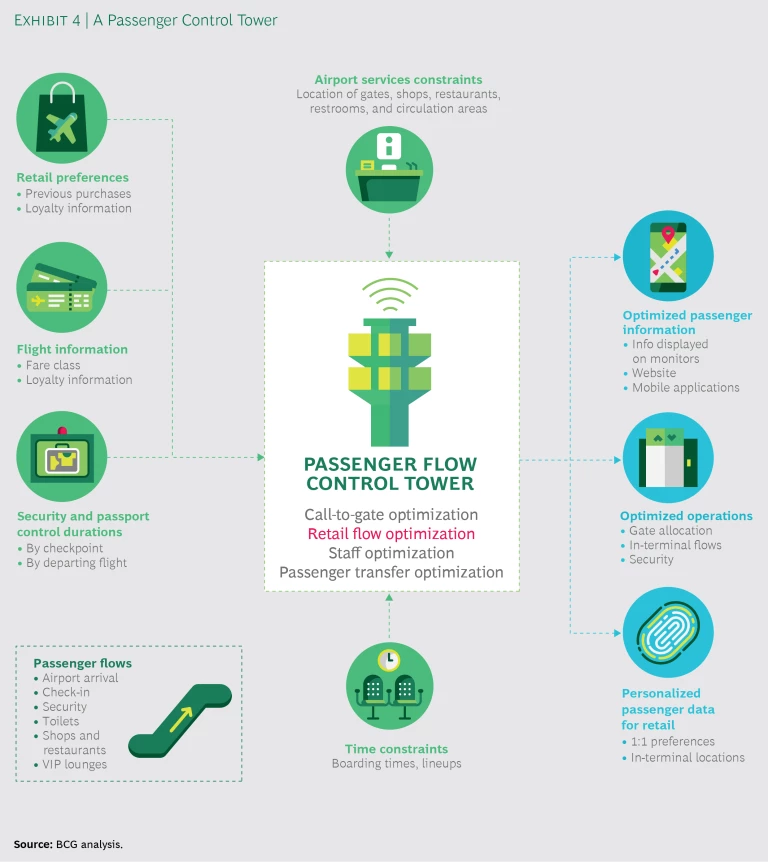

A Passenger Control Tower

Today, passenger flows are static and operations-driven. Airports allocate gates on the basis of customs officer availability, aircraft turnaround times, and ground handling requirements, for example. To give passengers a better experience while maximizing the amount of money they spend, airports could work with airlines, retailers, and brands to develop a digital passenger control tower. (See Exhibit 4.)

This tool would take data from multiple sources (retailers, airlines, airports, and data streams produced through passengers’ digital devices via airport Wi-Fi) and pertaining to multiple fields—from passenger purchasing preferences to flight departure times. Using this data, the system would then provide real-time passenger information to retailers, such as point of origin or destination, and would optimize a series of airport-critical operations that would help to direct passenger flow. For example, the system would dynamically redesign gate allocation in order to maximize passenger exposure to the retail areas most appealing to them.

Airports would need to lead the development of this tool, setting criteria and providing the operating resources. Robust data platforms and innovative partnership agreements would be especially important because success would depend on airlines sharing their passenger information, brands and retailers defining their potential interest, and airports dynamically allocating suitable gates while ensuring that minimum levels of operational service are fulfilled.

Small-scale mockups undertaken for specific airports have already shown that such tools can deliver significant increases in spending per passenger.

A Personalized Pricing and Assortment Tool

Today’s customer wants personalization and special treatment on the basis of loyalty. Moreover, travel retail customers are rational in their purchase decisions and often compare prices online even while in airports. Retailers can take the lead in improving customer personalization by devising a real-time, personalized pricing and assortment tool.

The system would leverage the intraday difference in passenger mix as well as the inherently data-rich environment of the airport to optimize and dynamically offer pricing, promotions, and assortments. The ultimate objective of this type of system would be to reorient the product mix, increase spending per ticket, and generate more impulse purchases. Such a tool would be especially helpful during an economic downturn, when spending per passenger needs to compensate for any shortfall in the number of travelers.

For input, the system would require airport information, such as flight schedules and the position of passengers in the retail area using beacons and Wi-Fi, consumer brand preferences, and third-party information such as downtown benchmark prices or the weather in a destination city. For example, the system could optimize duty-free prices and special offers at an airport in Antalya, Turkey, prior to the departure of an evening flight to Russia in order to align with prices in downtown Moscow and the categories preferred by Russian consumers.

Online retailers already make plenty of daily adjustments to prices as well as to promotions, and similar experiments are also taking place in many brick-and-mortar retail stores. To achieve comparable results in the airport environment, retailers would need to coordinate their efforts and—most important—they would have to invest in adapting their systems to dynamic pricing, all of which would require that they revise the compensation terms of their concession contracts.

The travel retail industry has experienced exceptional growth over the past 15 years. But while an increase in the number of passengers has been a major tailwind, airports, airlines, retailers, and brands have contributed to the development of the sector as well. In the past five years, however, signs suggest that the market is reaching a turning point, with travel retail spending per passenger dropping in all regions around the globe.

To reverse that decline, airports, airlines, retailers, and brands need to abandon their current silo approach and instead create a travel retail ecosystem. Only by sharing information, aligning operational priorities, and integrating along the entire customer journey can the travel retail industry reverse the current falloff in passenger spending and stave off any further declines.