Is a new era of greener supply chains on the horizon? Significantly tighter restrictions on the sulfur content of marine fuel, set to go into effect on January 1, 2020, could be the catalyst for the transportation and logistics (T&L) industry to make this new era a reality. The new restrictions, known informally as IMO 2020, reduce the allowable percentage of sulfur in fuel from 3.5% to 0.5%. Compliance will result in an additional $25 billion to $30 billion in fuel costs for container liners from 2020 through 2023, according to a BCG analysis. But by selling environmentally friendly services effectively, liners can share these costs with customers as well as promote the ultimate objective of greener supply chains.

The new fuel restrictions could be a catalyst for big changes throughout the transportation and logistics industry.

Shipping liners bear direct responsibility for compliance with IMO 2020 and are rapidly preparing for the technical and operational aspects of compliance. From a commercial perspective, though, many liners need to do more to prepare for sharing the cost of compliance with their customers. The entire ecosystem of value chain participants—including freight forwarders, cargo owners, and consumers—should be willing to bear their fair share of the costs. Indeed, leading companies across industries recognize that investments in sustainability generate returns for their business as well as society.

To enable effective and proportionate cost sharing, liners must provide their commercial teams with skills and tools that help them to communicate about, and enforce, cost sharing. In addition, liners must implement modernized approaches to pricing and develop a less commoditized product portfolio. The liners that are most prepared to share costs—not only with large customers but also with the broad network of smaller customers—will be better equipped to minimize the impact of IMO 2020 on their bottom line. They will also be positioned to create a competitive advantage by helping to promote the transition to greener supply chains.

The Basics of IMO 2020

The new restrictions are mandated by the International Maritime Organization (IMO), the United Nations body responsible for regulating the shipping industry. For the past 15 years, the IMO has pursued a series of regional sulfur reduction efforts by instituting emissions control areas, where the allowable sulfur content of bunker fuel is lower than elsewhere in the world. IMO 2020 elevates these efforts to a global scale. Shipping companies, as well as oil refiners and other stakeholders, must prepare for resulting disruptions to their markets and business practices. As we go to press, all indications suggest that the new restrictions will go into effect as planned on January 1, even though some countries have expressed concerns about the costs.

Although reducing sulfur emissions improves air quality, sulfur is not a greenhouse gas and is not associated with global warming. Beyond 2020, the IMO does aim to reduce shipping-related greenhouse gas emissions, though, targeting a 50% cut by 2050 (relative to 2009); the stretch goal is to eliminate these emissions completely.

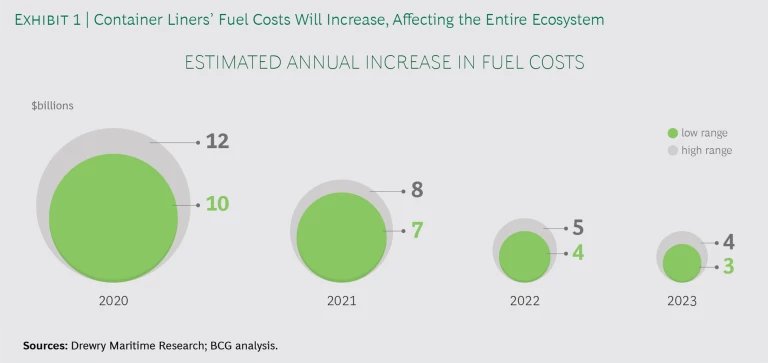

The cost of complying with IMO 2020 will be significant. As noted, BCG’s analysis finds that the cumulative additional fuel costs for container liners could amount to nearly $30 billion through 2023. (See Exhibit 1.) The annual increase will be highest in 2020, when it will reach an estimated $10 billion to $12 billion. Subsequent years will see smaller annual increases owing to a shrinking price differential between high-sulfur fuel oil (HSFO) and the more expensive very low sulfur fuel oil (VLSFO), which has 0.5% sulfur content. Also, some liners will need to make capex investments to install scrubbers (technology that removes sulfur emissions from ship exhaust), and all will incur additional operating expenses (including for inspections).

Compliance costs will not be uniform across trade routes and liner companies. The additional cost per shipping container will depend on a vessel’s size, utilization, and speed as well as the type of technology deployed. Moreover, the price differential between HSFO and VLSFO will vary across bunkering ports, depending on the availability of fuels and infrastructure and the cost of transporting fuel to the port, among other factors.

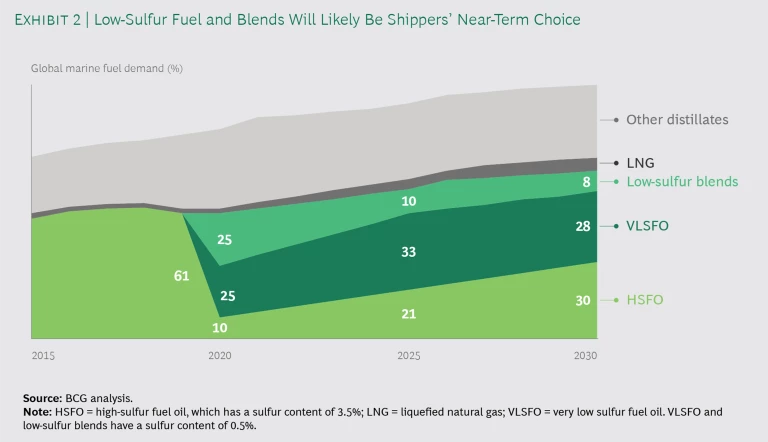

To comply with IMO 2020, liners must adopt one of three possible solutions: installing scrubbers, using liquefied natural gas (LNG), or switching to VLSFO. Retrofitting a vessel with a scrubber requires an investment of $3 million to $5 million. To use LNG, operators need to install new engines or convert existing ones—we estimate that the additional capex would reach $25 million to $30 million for a large container ship. In contrast, substituting VLSFO for HSFO requires only minimal capex investments. As a result, in the near term, fleet operators will likely choose VLSFO. Our analysis finds that VLSFO and other low-sulfur marine gasoil blends will account for approximately 50% of global bunker demand in 2020, after IMO 2020 goes into effect. But their market share will decrease to approximately 36% by 2030, following a ramp-up of scrubber installations and LNG-powered vessels. (See Exhibit 2.)

The additional costs arise at a challenging time for shipping companies. Although the major shipping liners have seen strong volume growth in the past several years, most have experienced declining profitability. Indeed, none of the major liners has had annual EBIT margins of more than 7.5% in the past three years, and liners generally struggle to return the cost of capital. In this context, liners and other industry players need to explore how to most effectively share the costs of IMO 2020 compliance throughout the ecosystem.

The Commercial Impact Across the Ecosystem

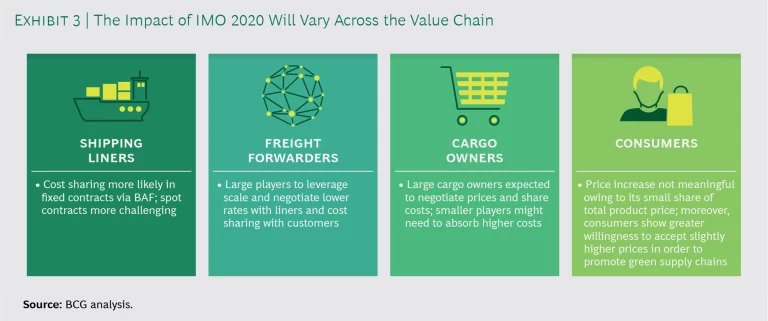

IMO 2020 will affect pricing for players across the value chain in different ways. (See Exhibit 3.) The following insights are based not only on our experience supporting T&L companies in achieving commercial excellence but also on in-depth discussions with T&L executives.

SHIPPING LINERS

To sustain their economics, liners need to find effective ways to share higher costs for bunker and overall environmental compliance with other players in the ecosystem. But, to do so, they must overcome significant challenges. They operate in an increasingly commoditized market with excess capacity on vessels and little perceived differentiation among offerings. Customers can easily move their business from one liner to another and know that they can pressure liner companies to reduce prices.

To sustain their economics, liners need to find effective ways of sharing IMO 2020 compliance costs with customers.

Traditionally, liners have offered all-in pricing to large cargo owners and freight forwarders. An all-in price specifies a single rate that does not isolate bunker costs. This pricing approach is attractive to customers because it facilitates shopping for, and locking in, competitive rates.

Liners recognize that all-in pricing will make it very difficult for them to recoup the costs of complying with IMO 2020. As the chief commercial officer (CCO) of a top-five shipping liner explained: “All-in prices are over. That model is unsustainable in light of how much it will cost to respond to IMO 2020 and how quickly the costs will hit.”

With this in mind, major liners have announced plans to use the common practice of separating bunker costs from their base rate and applying a fuel surcharge—referred to as a bunker adjustment factor (BAF). Typically, a BAF is calculated by multiplying the fuel price per ton by variables specific to the trade route (such as average fuel consumption per round trip). These formulas give liners and their customers more transparency into fuel costs. The announced formulas vary by liner, however, creating opportunities for customers to exploit the differences. Moreover, some large cargo owners have announced plans to impose their own BAF formulas in shipping contracts.

Liners will be more likely to enforce BAFs in fixed contracts than spot contracts. Because fixed contracts typically cover 6 to 12 months, they customarily include mechanisms to adjust rates on the basis of changing conditions. But liners must ensure that their formulas are specific enough (that is, de-averaged) to capture IMO 2020’s differentiated impact with respect to individual markets, trade lanes, and products.

By contrast, in spot contracts (which typically cover up to three months), a liner runs the risk that its commercial team will progressively offer discounts on BAFs in order to ensure that vessels are fully utilized. Because such reductions will reduce operating margins, a liner should make sure that its commercial team holds the line on BAFs as much as possible. And, at the same time, it must ensure that the team does not offer discounts on freight rates instead. A liner that enjoys a high percentage of online booking will be at an advantage because this channel traditionally uses non-negotiable list rates.

FREIGHT FORWARDERS

Some forwarders have already notified their clients that rising fuel costs stemming from IMO 2020 will result in higher prices. They have directly reached out to key accounts and are using newsletters and social media to create broad awareness about the impending rate hikes. Many forwarders expect to formally notify customers of rate increases two to three months before IMO 2020 goes into effect. They are also seeking updates from liners on the timing and size of surcharges by route.

To reduce their exposure to fee volatility, forwarders are ensuring that all client contracts incorporate protective clauses that explicitly enable them to adjust rates on the basis of IMO 2020 surcharges. They are also updating internal processes and systems so that they can accurately pass through the surcharges, such as by adding appropriate line items to invoices. “Freight forwarders are more efficient in pushing surcharges than we are,” said the CCO of a top-five liner.

CARGO OWNERS

Cargo owners should expect to absorb at least part of the higher costs arising from IMO 2020. But because the cost increase is small per shipping container and negligible per product, cargo owners can readily share the cost with customers. In some product categories, cargo owners can emphasize to consumers that the small additional cost helps fund efforts to create a greener supply chain.

A cargo owner’s negotiating power will determine its share of the compliance costs. Large cargo owners are in the best position to negotiate all-in rates (without explicit fuel surcharges) or favorable BAFs because liners cannot afford to lose their business. Small or midsize cargo owners generally lack bargaining power to negotiate the best rates from liners. To secure space on vessels at reasonable rates, many are likely to choose to do business with forwarders rather than enter into contracts with liners.

CONSUMERS

If increased costs relating to IMO 2020 are ultimately reflected in the price of consumer goods, the impact is likely to be small for individual products. For example, according to an analysis by Flexport, the cost of shipping 40-inch TV sets from Shanghai to Los Angeles will increase by $0.5 per unit. For a $300 TV set, the price hike to offset the additional cost would be less than 0.2%. Moreover, consumers are increasingly buying sustainable products, and many are willing to pay a premium for them, although purchasing behaviors differ across product categories.

How to Win in the New Environment

To minimize the impact of IMO 2020 on the cost base and meet higher standards of sustainability, a shipping liner can deploy a variety of operational measures. Short-term measures include slow steaming, route optimization, vessel upgrades, and reducing the number of empty-container moves. For example, with respect to slow steaming, a 12% reduction in average speed at sea leads to an average decrease of 27% in daily fuel consumption. The fuel cost savings would more than offset the costs arising from the slower shipment of goods. Slow steaming will be feasible only if liners can ensure strong adherence to the schedule, in particular by managing congestion in ports or improving the turnaround time in terminals.

From a commercial perspective, a liner must focus its efforts on both the product portfolio and its commercial teams.

THE PRODUCT PORTFOLIO

IMO 2020 comes at a time when more and more cargo owners are pursuing environmentally friendly ways of doing business, including greener supply chains. These customers are likely to be willing to participate, including financially, in the effort to reduce environmental impact. T&L companies have an opportunity to deepen their customer relationships by collaborating more closely with cargo owners to support them in achieving their environmental goals.

Liners, in particular, can offer differentiated and higher-value services focused on reducing the environmental impact of supply chains. To get started, liners should identify customers that are already implementing greener supply chains. They should collaborate with these customers to identify opportunities to design new products and services that promote greener supply chains and create value for both parties.

COMMERCIAL TEAMS

Liners must ensure that the entire commercial team—including trade managers and pricing specialists, key account managers, and the sales force in the field—is prepared for IMO 2020.

Trade Managers and Pricing Specialists. Liners should train trade managers and pricing specialists on how to account for the cost of IMO 2020 in their pricing decisions, for both fixed and spot contracts. Although they are already experienced in applying BAFs, trade managers and pricing specialists need to understand the de-averaged monetary effect of IMO 2020 on the trade routes they manage. As noted, the impact will differ for each trade route depending on factors such as the type of vessels deployed and the speed at which the vessels operate.

It is more critical than ever for liners to establish mechanisms and KPIs to track price realization and measure price leakage linked to BAFs. The pricing performance should be used to evaluate and improve the performance of trade managers and pricing specialists.

To ensure that trade managers and pricing specialists have the necessary support to achieve their goals, liners also need to strengthen their capabilities, tools, and processes related to pricing. This includes establishing companywide pricing formulas and ensuring trade managers and pricing specialists apply them. Today, many liners have different formulas for each trade route, and some pricing specialists apply their own formulas. Additionally, pricing at many liners is supported by unsophisticated tools, such as simple spreadsheets. Given the higher costs arising from IMO 2020, the risk of price leakage from such practices is unacceptable. To gain an advantage, liners should put in place more advanced pricing tools that support fast, fact-based pricing decisions. Liners can turn this into a significant competitive advantage by integrating an advanced analytics engine into these tools and thereby enabling dynamic and more customer-centric pricing.

Key Account Managers. Liners need to train key account managers on green shipping solutions so that they can initiate discussions with customers on collaborating to create greener supply chains. Product specialists can then work with customers to develop concrete solutions.

Sales Force. Liners should educate members of the sales force on the reasons for IMO 2020 as well as its benefits and impact so that they can help customers understand the new rates and the rationale of the IMO-related surcharges. The sales force should be prepared to articulate a positive message to customers about the benefits of protecting the environment and sharing the costs of doing so.

Management should give the sales force a playbook that helps members answer customers’ questions about IMO 2020, including providing guidance on how customers can share costs with their clients. Smaller cargo owners and freight forwarders will require the most guidance. Ideally, the playbook should be in a digital format accessible on a smartphone or tablet. A digital format allows for regular updates and live discussions with an expert support team via interactive chats.

The sales force also needs training on how to sell environmentally friendly services and support customers that want greener supply chains. Liners should consider designating a green shipping specialist in each region, for example, who can provide support to other members of the sales force and clients.

Given the higher costs that come with IMO 2020, the risk of price leakage from unsophisticated pricing tools is unacceptable.

All participants in the shipping industry—including liners, freight forwarders, cargo owners, and consumers—have joint responsibility to ensure that supply chains become environmentally friendly. And each participant must be willing to contribute to offsetting the additional costs incurred. Given that end customers increasingly prefer environmentally friendly products, industry participants have a clear opportunity to realize the vision of greener supply chains.