Meet the superincumbents: companies with high market share, enviable margins, and big profits. More and more superincumbents sit atop industries that cover a wide swath of the economy—airline, banking, consumer goods, energy, entertainment, pharmaceuticals, and retail, to name but a few. Superincumbents face a double-barreled dilemma. Despite prodigious cash flows, they struggle to reinvest at returns that they find attractive. At the same time, their rich profit pools are the targets of digital insurgents whose new business models superincumbents have a hard time emulating.

The current environment presents an unprecedented paradox: record-high corporate profitability amidst all-time-low interest rates.

We have long argued—as recently as last year—that the principles of value creation are timeless. Yet, the current environment presents an unprecedented paradox: record-high corporate profitability amidst all-time-low interest rates, conditions that have led to record stock valuations but also ensure that abundant capital is available for funding disruptive insurgents. Superincumbents must find new ways to compete. The rules of value creation may be the same, but new competitors are changing how the game is played.

Industry Concentration

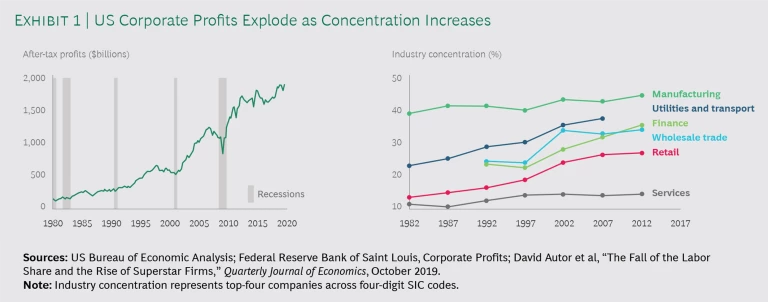

Spurred by a tight focus on maximizing shareholder wealth, successful corporations have rationalized, reengineered, and outsourced their operations; enlarged their market share organically; and bought out their competitors. The result: increasing concentration and an explosion in profits and stock market valuation for the survivors. (See Exhibit 1.)

The problem, for individual companies and for the economy as a whole, is growth. In recent years, corporate-revenue growth has rarely exceeded the low single digits; even some high-tech markets are saturated. Industry concentration renders further gains in market share difficult and the acquisition of related businesses nearly impossible because of antitrust concerns. For big public companies, the acquisition of unrelated businesses is frowned on by investors because they believe that they can manage their own diversification more efficiently.

For many superincumbents, the ROI from the next strategy falls far short of the returns from the existing business. Prisoners of their own success, they face an unattractive tradeoff between stagnant profitability and dilutive growth.

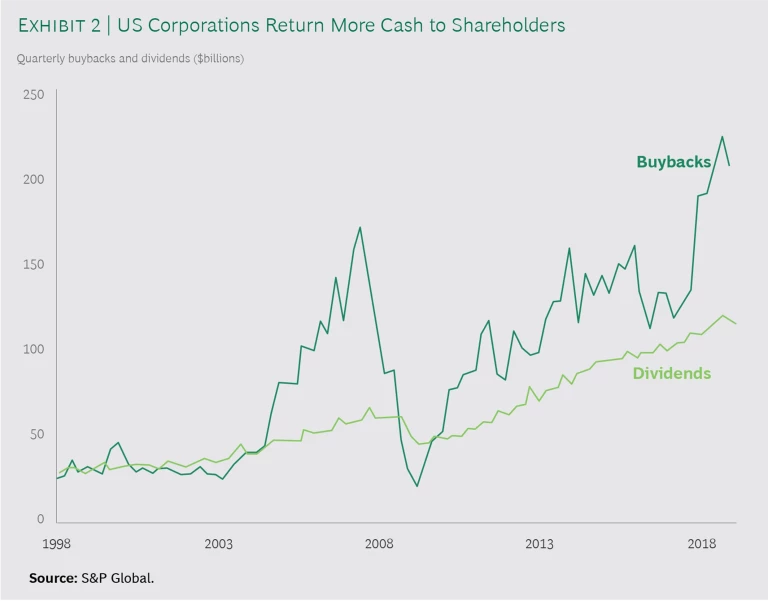

Many choose to distribute their cash to shareholders. (See Exhibit 2.) Even so, they continue to sit on vast amounts. Cash holdings by US nonfinancial corporations now amount to $1.7 trillion—the equivalent of 9% of the US GDP.

Digital Disruption

A casual perusal of the business press suggests an entirely different picture: an economy-wide explosion of innovation and entrepreneurship driven by revolutionary digital technology. Funded indirectly by the capital that superincumbents have returned to investors and targeting the profit pools that the superincumbents have created, pure-play digital startups seem to have no inhibitions about prioritizing growth over profitability. Time is on their side: a low-interest-rate environment raises the value of the distant future compared with the near term, and it further increases the market capitalization of high-growth companies relative to that of their low-growth rivals. Venture capital, private equity, and, eventually, the stock market seem to reward them—faddishly, sporadically, and, perhaps, irrationally—but well enough to sustain their insurgency.

The principles of “being digital” are indeed different. Change, instability, and surprise are the norms: the past is a weak guide to the future. With high fixed costs and marginal costs near zero, volume drives returns, and share drives advantage. Rapidly increasing returns can be compounded by demand-side network effects, creating a winner-takes-all dynamic. Investments are therefore either disasters or runaway successes. And there’s not much in between. The insurgents’ primary assets are organizational capabilities rather than factories and brands. The traditional balance sheet can be important for funding growth investments, but otherwise, it is competitively irrelevant.

An underlying Borges’ Map: Navigating a World of Digital Disruption is economizing on transaction costs. But insurgents deconstruct traditional value chains with horizontal, interoperative, and “stacked” architectures. Take the transformation of the media industry from vertical silos defined by medium—newspaper, TV, film—to an interoperative stack dominated by horizontal aggregators such as Google, Facebook, and Netflix. Digital attackers often focus on a particular layer of the stack where these rules apply most strongly: they compete horizontally against incumbents that continue to compete vertically.

Sometimes, the contrast between the managerial doctrines of incumbents and insurgents is a classic tale of disruption: the incumbent cannot respond without substantially undermining its own legacy business model. In such cases, a purely financially focused “value creation” perspective is no help: the company faces existential questions of business strategy. But these situations are actually exceptions. Far more often, digital technology can—and should—be incorporated into legacy businesses, creating far more value (for customers and shareholders) when combined with existing assets, advantages, and market positions. A primary challenge for incumbents is to incorporate management methods that permit the full exploitation of revolutionary technologies, despite their alien character.

A primary challenge for incumbents is to incorporate management methods that permit the full exploitation of revolutionary technologies, despite their alien character.

New Value Creation Concepts

To break the tradeoff between future growth and current profitability, managers need a new paradigm that brings aspects of the so-called new-economy mindset into legacy organizations and cultures. They must move faster, experiment more, learn continuously, and adapt to the unexpected. This is absolutely not a rejection of past practice. The fundamental attribute is flexibility—thinking creatively about how to manage each part of the business.

Human Capital. In many areas, talent becomes a company’s most important asset, the huge, hidden item on the corporate balance sheet. This is especially true for such functions as analytics, artificial intelligence (AI), digital marketing, and data engineering. Young, talented people expect to be rewarded for creativity rather than compliance. They value team membership over individual accountability. They relish working in short-cycle projects that show results quickly. And they always have one eye open for their next career opportunity, so they must be recruited not once, but continually. In leading digital companies, the competition for employees is as intense as for customers, and many corporate acquisitions are motivated primarily by the talent in target companies. Indeed, many traditional companies manage digital businesses as separate entities in order to better address such expectations.

Data. This, the second most important asset, is also omitted from the balance sheet. It is the foundation for AI and for almost every service that traditional companies offer to augment or supplement their physical products. Traditional com-panies have been managing data as a “flow”—information that is embedded in, a byproduct of, or confined to vertical silos.

But now data must be considered an asset on which customer relationships and competitive advantage are built. The broader its application, the better. In many cases, therefore, data must be pulled from silos and managed as a centralized resource. It becomes infrastructure. And just as the ROI calculus for investing in roads is different from that for cars, so data as infrastructure must be considered a long-term platform for value creation in ways yet to be imagined. Google once created a zero-revenue, automated 1-800 directory service purely for the purpose of acquiring data. Once it had enough, Google discontinued the service, but the collected data gave the company speech recognition.

“Bets.” To build digital capabilities and offerings, management must embrace uncertainty and prioritize higher risk-reward bets over more predictable plans. Traditional finance tools—such as spreadsheets, cash flow projections, and cost of capital assumptions—are less useful for evaluating these wagers. Managers can better spend their time learning to understand the range of potential outcomes and, more important, the asymmetry of these outcomes. Furthermore, option value, as opposed to traditional ROI, becomes a key consideration, since the “right to play” in the next round of innovation depends on capabilities developed today.

To build digital capabilities and offerings, management must embrace uncertainty and prioritize higher risk-reward bets over more predictable plans.

Planning Cycles. In place of traditional fixed-period budgeting, today’s managers need to think in terms of intent-execution-feedback cycles. These rhythms can vary considerably. Some (typically for top-of-stack experimentation with features, messages, and methods) are very short: a project might be launched, executed, evaluated, and replaced in a matter of weeks. Others (for example, infrastructure for IT systems or data bases) are long: the build might take several years. Companies must learn to manage long and short planning cycles simultaneously.

Strategic Intent. When the success of a company depends on experiments, innovations, and insights conducted and developed by teams distributed across (and sometimes outside) the organization, a traditional corporate-performance framework built around financial goals no longer suffices. Leaders must communicate a compelling strategic intent: a nonfinancial aspiration that connects to the company’s purpose and focuses recruiting and staff incentives on the attributes that make the organization unique in the world.

New Metrics. Traditional accounting metrics do not work so well in digital businesses. In fact, research shows that when intangible assets represent the greater share of investment, the correlation between traditional accounting metrics and company valuations deteriorates significantly.

Competitive Advantage. In principle, favorable financial performance and advantaged strategy should go hand-in-hand. They are simply different lenses for understanding the same phenomenon. But in practice, these are significantly different ways of thinking. Conventional financial metrics, such as cost of capital and discounted cash flows, suffice when the future resembles the past, and future investments will be similar to existing assets. But it becomes very difficult to apply these metrics in times of discontinuity and uncertainty. Business leaders must sometimes be willing to bet on the strategy, even when their view of traditional financial metrics doesn’t show the near-term impact they are used to seeing. Digital startups often prioritize volume over revenues, never mind profits. Building the foundation for its future, Amazon purposefully lost a fortune in its first decade. The key is to focus on creating competitive advantage in markets whose customers are willing and able to pay. Get that right, and ROI will—eventually—look after itself.

The key is to focus on creating competitive advantage in markets whose customers are willing and able to pay. Get that right, and ROI will—eventually—look after itself.

Managing Investors

Business leaders tell us that even when they want to make bets and explore new models and markets, they are constrained by cautious boards and skeptical investors: The stock market will not give us permission to create new value. Dilutive investments will kill the stock price. Our investors expect stable earnings and high dividends.

In closely held companies, the owners select the strategy on the basis of their aspirations for the business and their personal financial goals. In public corporations, the reverse takes place: the strategy selects the owners. Since investors can diversify more efficiently than can individual corporations, capital markets and financial intermediaries enable investors to assemble portfolios that can achieve their goals efficiently and inexpensively with respect to time horizon, cash flow, and risk. Individual companies help investors achieve their goals to the extent—and only to the extent—that they deliver a superior risk-adjusted return over a specific time horizon. If the company successfully shifts its time horizon, cash flow, or risk profile—for example, to exploit new opportunities—investors can simply rebalance their portfolios.

As a result, risk-return and cash-growth tradeoffs are arbitraged by capital markets. If a company is penalized for “going digital” the most likely explanation is not investor portfolio preference but that markets lack faith in the strategy or the company’s ability to execute. The same logic applies to investments that dilute reported returns on capital but earn returns above the weighted average cost of capital. Any investment that does not preclude other investments and earns more than the cost of capital creates shareholder value. This is true even for an investment that does not match historical returns. If markets react adversely, it’s because they do not understand what the company is doing.

These truths underscore the critical importance of communicating effectively with investors and conveying a clear vision, understandable plans and objectives, and realistic expectations and metrics. With sufficient transparency, the question of “investor preferences” evaporates and is replaced by the question that really matters: Is the strategy creating shareholder value? The price of that transparency is, of course, heightened accountability of managers to investors, to which no manager should object.

Resolving the Dilemma

That companies face a tradeoff between stagnant profitability and dilutive growth is a paradox in the context of all the opportunities presented by the digital revolution. Superincumbents can break from this bind only by adopting crucial aspects of the ways that digital natives think and act. Much of this is cultural, but there are specific aspects of financial management and senior-level decision making that need to change. The essential point is to focus on the creation of business value through sustainable competitive advantage. If that requires altered time horizons, a new tolerance for risk, varying management styles, and greater transparency to the investor community, then mangers must adapt. In the long term, investors will not stand in the way of such changes; they are constrained only by managers’ imaginations.

BCG ValueScience® Center (VSC) is Boston Consulting Group’s global think tank and analytics center for corporate finance and strategy topics and initiatives. VSC houses a team of seasoned experts who develop our proprietary analytical methodologies, including the SmartMultiple® valuation technique. VSC works closely with BCG clients to help them make purposeful strategic decisions that accelerate value creation. The team operates from several global hubs, including Bengaluru, Delhi, Munich, San Francisco, and Singapore.