For investors eyeing the automotive industry, this is not the time to shift into reverse. While the next few years will prove challenging, many of the trends that were gathering steam before the pandemic, such as the move toward electric powertrains, autonomous driving, on-demand mobility, and automation will continue. These trends will shake up the industry, but they will also leave it stronger.

Still, the economic uncertainty surrounding the pandemic has made even bullish investors wary. Car sales are down. Valuations are in flux, and the industry’s diverse business model characteristics can create a steep learning curve, even for private equity (PE) firms that already have holdings in some segments.

Fortunately, periods of disruption are when PE leaders do their best work. For those able to build advantage, emerging profit pools present immense potential for growth. The most successful firms over the next few years will use this time to lock in their investment strategy.

Despite Pressure, Automotive Has Untapped Potential

Even before the pandemic, the automotive industry was in the throes of change.

Even before the pandemic, the automotive industry was in the throes of change. Consider the slow but steady shift away from traditional internal combustion engine (ICE) vehicles to electric vehicles (EV); the increasing application of telematics, data, and connectivity; and the growing reach of e-commerce and digital innovation. These changes have altered virtually every corner of the automotive market, leading private investors to deploy more than $300 billion in capital into the automotive space since 2014.

But the impact from COVID-19 on supply and demand leave some investors wondering if the fundamentals in the automotive industry have shifted. While sales across Europe, the US, and China have rebounded exceptionally well from their crisis low points, sales in Europe and the US are not expected to rebound to pre-COVID-19 levels until 2023 at the earliest. Current PE sponsors may be inclined to hold onto their assets until the market stabilizes, as many did following the 2007 to 2009 recession.

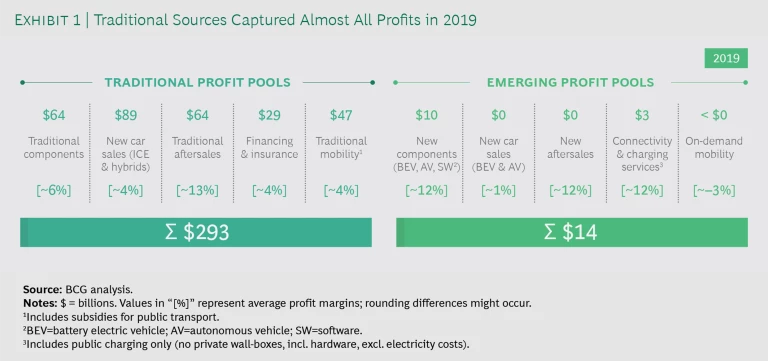

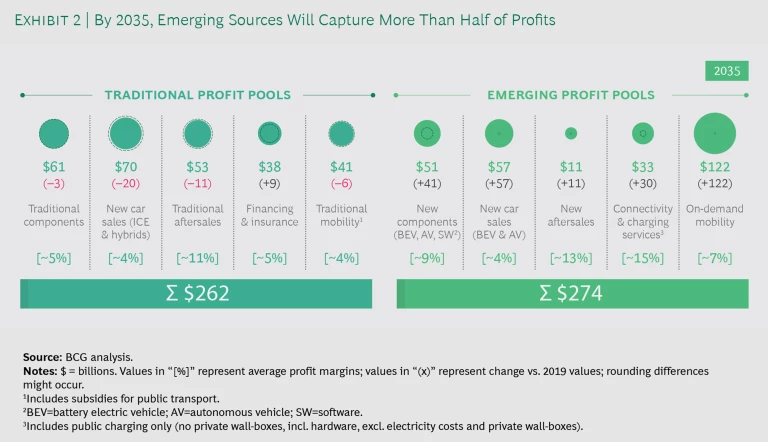

Nevertheless, we believe the automotive sector holds significant promise. Traditional sources accounted for the majority of auto-industry profits in 2019. (See Exhibit 1.) But BCG forecasts suggest that emerging pools, such as connectivity and charging services, will drive nearly 50% of all profits by 2035. (See Exhibit 2.) In addition, volatility in public equity valuations, caused by the temporary drop in new vehicle sales and vehicle miles driven and concerns about the state of the global economy more generally, could motivate some companies to consider private ownership, which could open additional paths to value for PE.

To capitalize on potential dips and imbalances in the market, sponsors must align on their investment strategy now and be ready to implement it. To aid that effort, we examined multiple opportunities across the automotive industry to see which investment hypotheses hold particular promise. What follows are the four that stood out.

EV Migration Will Continue

Electrification is causing seismic shifts in the auto industry landscape. By the end of the decade, battery electric vehicles are expected to account for more than 25% of new vehicle sales, with nearly 60% of vehicles having some form of electrification. Principal investors have three avenues to participate in this growth trend:

- Fund the journey. Automotive original equipment manufacturers (OEMs) and suppliers will need capital to support the transition to EV. Investors should look for players that provide highly-differentiated technologies that can be rapidly commercialized. A material supplier might be able to increase throughput of cell production, for example. An electronics supplier could provide a complete end-to-end system. Even better, some companies may be able to lock in more than one source of competitive advantage—for example, applying connectivity and data analytics to create a moat around their EV offerings.

- Create scale. Powertrain and vehicle development are among the most capital intensive areas of automotive. With OEMs forced to develop multiple powertrains in parallel—be they battery electric, hybrid, gas, or diesel—economies of scale will become a crucial differentiator between the best and the rest. Players that have struck codevelopment or cross-sharing partnerships for electric powertrain development could be especially attractive to investors. So, too, those that provide contract manufacturing or that license EV platforms to multiple OEMs.

- Tap into the network. The rise of electric vehicles will expand the market for charging networks. But EV users won’t want to deal with multiple apps or payment systems to use charge points outside their home or offices. Over time, a few dominant charge point operators will emerge in each region of the United States. Those with strong reach and customer demographics could present an attractive investment opportunity.

By the end of the decade, battery electric vehicles are expected to account for more than 25% of new vehicle sales, with nearly 60% of vehicles having some form of electrification.

ICE Still an Attractive Opportunity

While the move to EV will accelerate in the years ahead, ICE powertrains will continue to account for most vehicles in operation well into the next decade. This, in turn, creates attractive opportunities for PE, since many ICE-related businesses are undervalued relative to the profit potential they provide. In the public markets, for instance, many investors have placed a zero terminal value on revenues derived from ICEs.

While EVs continue to attract a great deal of attention, acquiring well-run ICE suppliers at attractive valuations is another way for PE to participate in the electrification trend.

That means while EVs continue to attract a great deal of attention, acquiring well-run ICE suppliers at attractive valuations is another way for PE to participate in the electrification trend. Firms can take these businesses private and consolidate them with other ICE-exposed suppliers that are facing similarly depressed valuations. Free from the growth pressure of the public markets, these companies can pivot their business models from chasing growth to aggressively managing for cash. That will allow them to impose a more disciplined approach to capital, ruthlessly taking out cost and realigning pricing to the value created. The skills needed to execute this “last man standing” scenario fall within the wheelhouse of most PE-owned companies. When combined with the acquisition and integration expertise that top PE firms bring, first movers will create a recipe for success that others are likely to replicate.

A Strong Aftermarket Means Good Investment Opportunities

The average consumer spent roughly $1K per vehicle on aftermarket parts and services in 2019. That figure has been growing by about 4% annually, and we expect that trend to continue as consumers opt to hang onto their cars for longer periods. An extended shelf life for automobiles means a longer repair window for aftermarket players. And with roughly 270 million vehicles in the US, the result is strong growth potential, making the aftermarket ripe ground for PE investment.

The top ten players in the auto parts space account for about 80% of sales. But the remaining 20% could present investors with consolidation opportunities. Because the ecosystem is complex, however, the where and how of investment decisions requires close evaluation. We recommend focusing on players whose value propositions are strongly differentiated. This could include B2B businesses with market-leading efficiencies or B2C companies with superior e-commerce capabilities and service innovations, such as mobile pickup and repair.

Retail Distribution Presents Attractive Roll-Up Opportunities

Owning and operating car dealerships used to be a path to wealth. But that business has become far more challenging in the digital age. The ease and availability of digital tools and channels has ushered in new and nontraditional competitors, increased price transparency, and made it easier for customers to bypass showrooms. These factors have challenged once-lucrative revenue streams. In financing, for instance, a plethora of online, third-party options means customers are no longer as reliant on captive financing.

As the number of niche players specializing in different stages of the buying process has grown, automotive retailers and OEMs have to work harder to gain customer attention.

As the number of niche players specializing in different stages of the buying process has grown, automotive retailers and OEMs have to work harder to gain customer attention. They also have to defend many more parts of the value chain—which has taken a toll. Between 2015 and 2020, many large players saw margins decline by as much as 80 basis points.

These margin pressures are propelling a wave of consolidation: large dealers are getting larger and smaller ones are exiting. Since 2013, for example, the number of new car dealerships has grown by less than 1% annually, while those with the largest footprints have expanded their holdings by 6% per year. We expect the consolidation trend to continue, aided by the fact that retail owners skew older as a segment and may be especially open to attractive opportunities to sell their businesses as they near retirement age.

For PE sponsors, these shifts could create an opportune moment to enter the space. Beyond providing retail businesses with managerial discipline and best-practice sharing, sponsors could advise them on how to use their scale and channel savings into strategic digital initiatives. These initiatives could improve customer outcomes and business growth and help retail outlets adapt more quickly to the changing needs of consumers.

What to Do Now

Timing is everything in investing, but never more so than during periods of disruption. The trends we’ve just described will create value and emerging profit pools, but only for firms that develop a robust investment strategy. To get started, leaders might consider the following questions and actions:

- How will your firm’s investment appetite and aperture need to change to accommodate the wide range of automotive opportunities currently in play?

- What emerging opportunities are most relevant to your existing investments—for example, adjacent plays, expansions?

- What capabilities will you need to support your portfolio companies in the face of material technological innovation in the automotive space?

Investors that do the upfront work today will be ready to capitalize on key moments as they emerge in the automotive industry and capture strong returns for their stakeholders.