As a continent, Africa trails other regions of the world in digital penetration, usage, and capabilities, according to BCG’s latest assessment of companies’ digital maturity, the first study of its scale to include the continent. There are many good reasons for the lag—and many exceptions, too, as plenty of African countries and companies are already well advanced. Overall, though, our research shows that increased levels of digital maturity among companies significantly improve competitive advantage, and improving digital capability has big implications for multinational companies (MNCs) in Africa and African companies alike. The improvements occur along multiple performance indicators, such as time to market, cost efficiency, product quality, and customer satisfaction.

BCG has been tracking the impact of technologies in Africa for several years. Previous publications have examined Dueling with Lions: Playing the New Game of Business Success in Africa often beat MNCs at their own game, how online marketplaces overcome the continent’s considerable logistical challenges, how African companies are pioneering the economic integration of Africa, and how challengers from emerging markets, including many African nations, are leapfrogging MNCs by embracing digital technologies. Data and analytics could be a new battleground, particularly between MNCs and African competitors.

Increased levels of digital maturity significantly improve competitive advantage.

All that said, the latest assessment using our Digital Acceleration Index (DAI) shows that both MNCs operating in Africa and African companies need to catch up. (See the sidebar, “BCG’s Digital Acceleration Index.”) If they do not, the former, which have enjoyed something of an advantage thanks to more advanced global digital capabilities, may suffer from inroads made by local competitors that are upping their digital game, leveraging the local relevance advantage. The latter have an opportunity to put their own advantages, such as market presence and customer proximity, to more powerful use as they digitize their operations and customer engagement. For both MNCs and African companies, the key will be their ability to develop and execute digital strategies suited to the dynamics of their industries and markets.

BCG’s Digital Acceleration Index

BCG’s Digital Acceleration Index

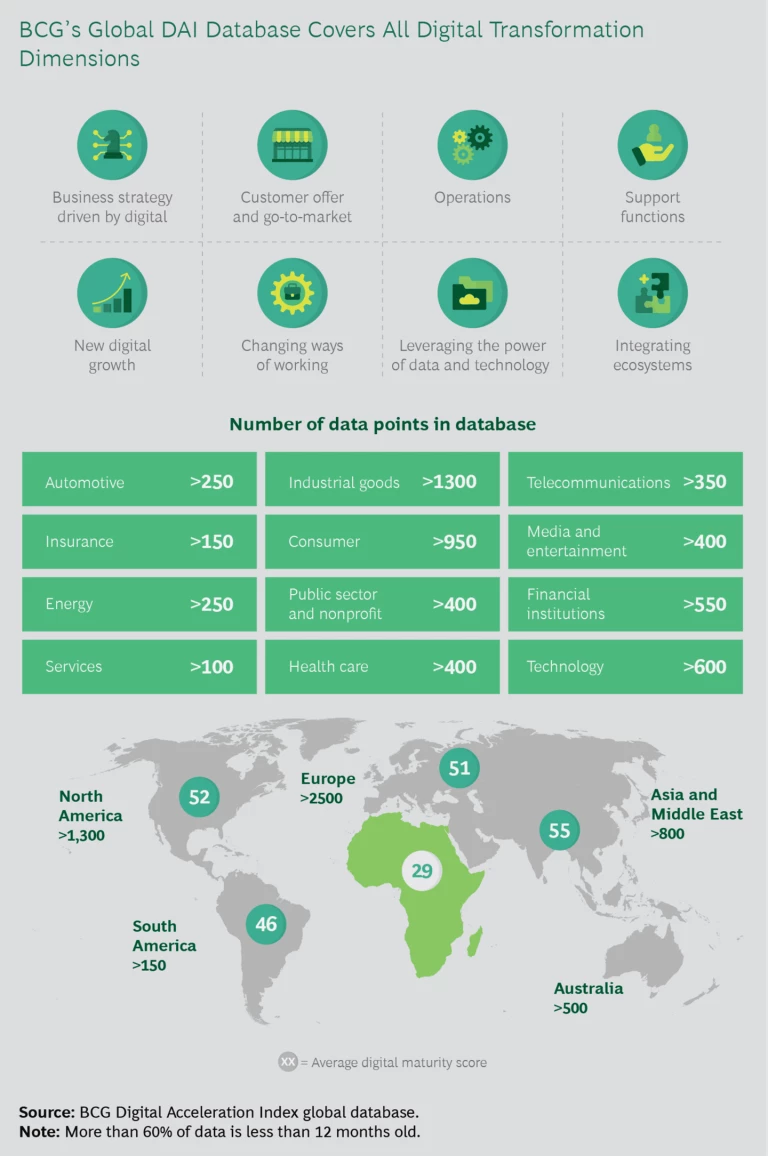

As part of our global DAI survey in 2019, we asked executives at 83 companies in Africa to rate their companies (on a scale of 1 to 4) on 35 points related to digital maturity. (See the exhibit.) We then aggregated raw scores and calculated resulting values to their responses on a scale from 0 (digital starter) to 100 (best-in-class digital leader). We weighted them to determine each company’s overall performance on our Digital Acceleration Index. Our sample was nearly evenly composed of MNCs and African companies—40 and 43, respectively. They included companies from financial services, basic industries, energy, insurance, consumer goods and retail, and telecommunications sectors. All major regions of the continent were represented. We also conducted qualitative interviews in order to better understand companies’ areas of digital investment, the impact they receive from digital, their hiring strategies, and the constraints they work under with respect to talent and digitization generally.

In this article, we explore why Africa is lagging, where the biggest gaps are, and how companies can catch up.

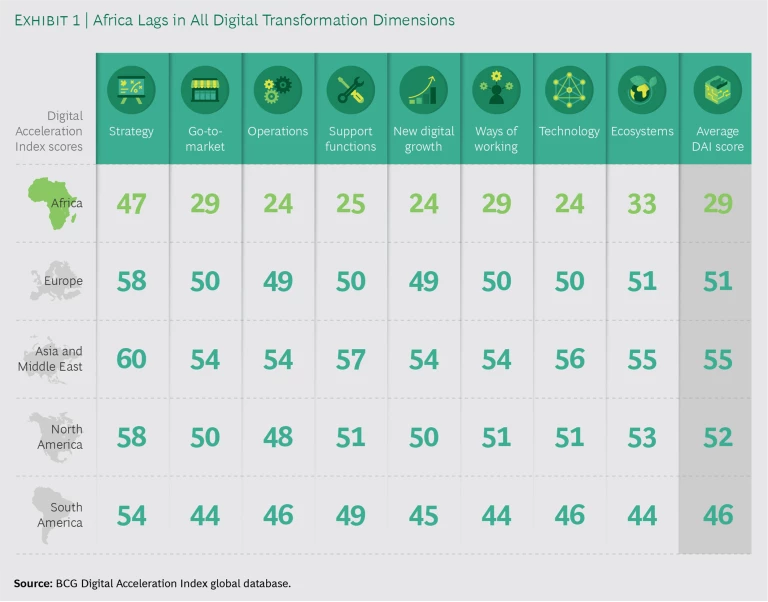

Why Digital Maturity Lags

Africa’s digital infrastructure is still in its early growth stages. As of 2018, only 30% of the continent’s population had internet access. Less than 40% of people in sub-Saharan Africa had smartphones, far fewer than in most other regions of the world. Digital skills lag as well, with Africa scoring 3.6 on the index used by the World Economic Forum, compared with 4.7 for Asia, 4.7 for Europe, and 5.5 for the US. This combination of factors helps explain the average digital maturity score on BCG’s index of 29 (out of a possible 100) for companies on the continent, compared with 55 for Asia, 51 for Europe, and 49 for the Americas combined. African businesses are most mature in crafting digital strategies; their biggest lags come in the executional categories we assess. (See Exhibit 1).

Our analysis shows that the underperformance is caused by three main challenges. The first is strategic: management’s inability to narrow digital priorities (46% of respondents in the BCG DAI survey cited this constraint). Second, employee cultural resistance hinders companies’ ability to scale up change, a constraint cited by 45% of respondents. Third, a lack of technical and human capabilities challenges all companies on the continent—45% pointed to this issue as an important constraint.

It’s important to remember, however, that Africa is not a homogenous mass. For example, internet penetration ranges from 55% in southern Africa to 12% in the central region of the continent. The number of mobile subscriptions is 149% of the population in southern Africa and 102% in northern Africa but only 50% in central Africa.

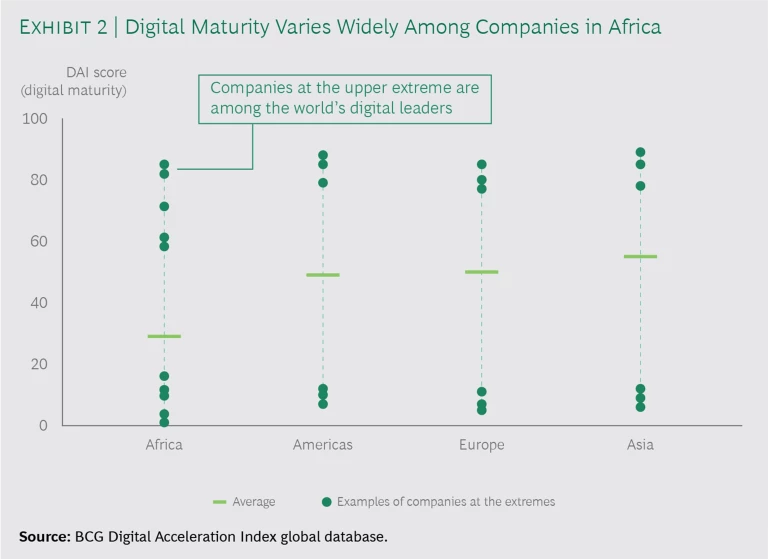

Similarly, digital maturity varies widely among companies. While the average company maturity is lower in Africa, the most mature (and least mature) companies rank evenly with similar companies in other regions. (See Exhibit 2.) Digital maturity matters in part because mature companies invest substantial funds in building world-class technology and IT functions, dedicate a significant percentage of their workforce to digital projects, and push digital efforts to scale. The full extent of the impact of these initiatives will depend in part on how quickly companies move up the maturity curve.

Because there is much room to improve, the dividends of digital efforts are higher in Africa than in other regions, but they require stronger pursuit. While digital skills are essential in building digital maturity, companies should not be apprehensive about a transition to new technologies. The ability to advance in digital maturity lies within reach of every management team.

A Combination of Strategy and Execution

Improving digital maturity requires both the right strategy and solid execution. Strategy involves establishing the digital vision for the company and the ambition for its products, services, and operations; setting priorities and aligning the organization around them (where most African companies believe they come up short); and drawing a roadmap for execution. The execution phase typically entails new undertakings in five areas:

- Digitizing the core—determining how and what to digitize in go-to-market and customer-facing approaches, operations, and support functions

- Exploring new digital growth—creating innovative or adjacent business models outside the core business of the company

- Implementing new ways of working—creating an agile organization and working environment for both current staff and new digital talent

- Leveraging the power of data and technology—determining how to use data and technology tools (such as cloud computing, artificial intelligence, big data, and the Internet of Things) to advance digital transformation

- Connecting to ecosystems—identifying the right ecosystems of partners to accelerate capability building and digital transformation

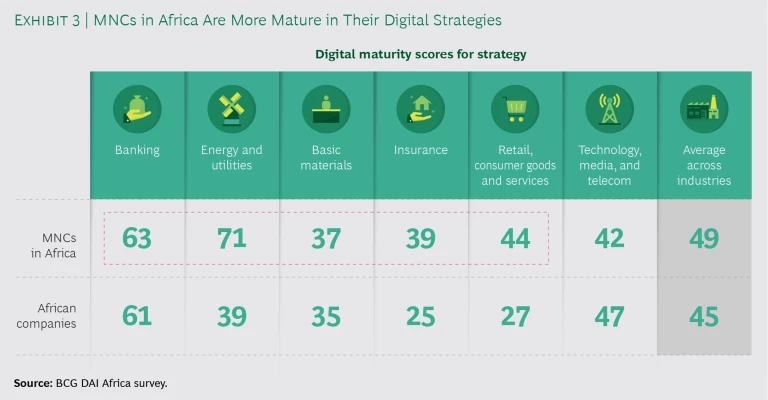

MNCs and African companies perform very differently in many of these areas. Our research shows that, on strategy, MNCs in Africa tend to have an advantage over local competitors. In most industries, they earn higher scores than the locals on BCG’s DAI: 71 versus 39 in energy and utilities, for example; 39 versus 25 in insurance; and 44 versus 27 in retail and consumer goods. (See Exhibit 3.)

One reason for the disparity is that most MNCs benefit from well-established global strategic planning functions and processes. As the COO of an MNC’s African operation said, “We benefit from the support of the central machinery at the group level. There is a strategic framework we can cascade, and there are use cases whose impacts were already evaluated in other countries. Of course we need to rethink things in our context, but it makes it easier in many respects to know what worked and what didn’t.”

Their lack of exposure to the wider experimentation and established platforms of related entities contributes to African companies’ struggle with prioritizing digital initiatives, as well as with other issues. More than half of the African companies in our survey, crossing all sectors, cited prioritization as a top-three constraint.

All companies struggle with infrastructure-related challenges when physical goods are at the core of the business.

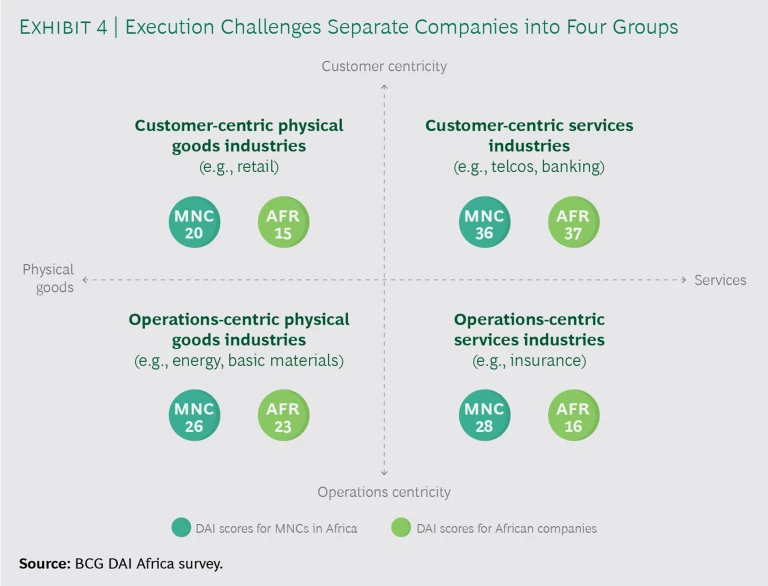

When it comes to execution, Africa presents a unique set of challenges to both MNCs and local companies, which fall into four categories according to whether they are product or service oriented and whether their processes are customer or operations centric. (See Exhibit 4.) In operations-centric businesses (such as energy and basic materials), MNCs tend to have an upper hand because they can leverage their global platforms, expertise, and best practices. In businesses where customer centricity is key (such as banking and telecom), African players compete more effectively. All companies struggle equally with infrastructure-related challenges when physical goods are at the core of the business (in e-commerce, for example).

Each of these factors plays out in its own way in different industries. For example, multinational banks and telcos rank slightly below local companies on the DAI, and they reach their totals on the basis of different strengths. African companies score higher on go-to-market approaches and new digital growth. One large African bank, looking for an innovative way to handle interactions with its customer base of more than 10 million people in its home market, developed an artificial intelligence-powered chatbot that provides customers with financial assistance for high-use services (such as opening a bank account, checking credit, paying bills, transferring money, and accessing financial news updates) rather than requiring customers to navigate the bank’s website on their own. Customers now prefer the chatbot over the website.

In insurance, by contrast, many companies of both types score poorly, held back by a combination of factors, such as a highly regulated and risk-averse industry environment, relatively few customer interactions, and low digital adoption and trust among customers. With a few notable exceptions, African insurers tend to lag, often exhibiting a “digital follower” mindset, while MNCs benefit from their experience in more mature markets and optimism over the expected outcomes of digitalization.

Energy presents a similar picture. One African subsidiary of a global energy group was able to digitally transform its support functions quickly and at low cost and launch its Industry 4.0 transformation by leveraging key processes and solutions from other subsidiaries around the world, particularly with respect to digital use cases (such as predictive maintenance).

Retail and consumer goods companies of all kinds tend to be held back by the logistical difficulties of doing business in Africa. Geopolitical, economic, and infrastructure fragmentation frequently poses barriers to trade and frustrates companies’ efforts to digitize. For instance, while other world regions have already succeeded in building e-commerce champions, widespread retail e-commerce is five to ten years away for Africa. E-commerce penetration could move from about 2% today to 4% to 6% in about five years, but scale effect is needed to sustain this growth and make it economically viable.

How Companies Accelerate

For African companies and MNCs, digital maturation is not necessarily about making massive investments in new systems (although investments will be required). More important are three initiatives that are well within reach of most companies:

- Narrowing priorities down to a few locally relevant and industry-specific initiatives

- Attracting digital talent through a differentiated employee value proposition

- Concentrating digital capabilities in digital centers for scale effects

Priorities. Companies should be quite hard-nosed in demanding value from digital. As noted above, they should focus on a couple of priorities that can be piloted and moved to scale quickly. The emphasis should be on demonstrating real business value from digital—with tangible improvements in the core business of establishing new channels or with entirely new revenue streams.

How companies approach prioritization, of course, will depend on the industry and current circumstances. For example, the top performers in banking and telecommunications, both data-intensive industries, are investing heavily in data, particularly data-driven marketing and operations. One African bank has shifted from a product-centric, mass-marketing approach to one in which data is used to gain a 360° view of its customers and machine learning is applied to identify potential churners and cross-selling opportunities. It has developed models to personalize offers for customers and updated its relationship management capabilities to support the personalization drive. As a result, the bank reduced customer churn by 14% in the first year, increased cross-selling revenue by 24%, and boosted annual profits by $30 million.

In contrast, energy and basic materials companies create most of their value by prioritizing operations and support functions, while retail and consumer goods companies focus on go-to-market and operations efforts to circumvent the lack of infrastructure. One online retailer built its own platform to optimize delivery routing. To manage inventory and control delivery, it designed a proprietary logistics tool that includes an optimization module for routing delivery, especially last-mile delivery, which requires customers’ exact or approximate addresses as well as traffic patterns for those locations. The company has reduced its logistics costs by 30% to 50% compared with those of its competitors.

One step that will help almost any company mature more quickly is moving beyond the pilot stage to scale up digital initiatives.

One step that will help just about any company mature more quickly is moving beyond the pilot or proof-of-concept stage to scale up digital initiatives, thus changing how the company makes decisions, operates internally, and interacts with its customers. In our experience, far too many African companies launch multiple digital pilots without fully executing any of them. Pilots help build momentum, but they should not be confused with actual progress. Companies that want to mature are better off launching a couple of use cases and executing and industrializing them fully than pursuing eight or ten initiatives that will never reach scale.

Talent. Talent is a tough nut to crack everywhere but perhaps nowhere more so than in Africa. Both African companies and MNCs use a wide variety of strategies to secure the digital talent they need, including upskilling, school recruitment, retention programs, recruiting abroad, outsourcing, and acquisitions. These levers are all important, but we have found that successful companies also build a digital EVP—employee value proposition—around the qualities that digital talent values and integrate this proposition into their recruitment strategies. While compensation is important, the top priorities for digital talent are learning and skills training, career development, relationships with colleagues, and job security. A global BCG study on digital talent found that 70% of African digital experts are willing to move abroad (primarily to the US and Europe) in search of better skills development, career opportunities, and corporate cultures. African policymakers should encourage talent development on the continent and expose Africans to global ecosystems.

Digital Centers. The top digital performers in Africa are building scale by using centralized digital centers. Approximately 40% of the companies we surveyed, both African and MNCs, have either a regional or an international digital center. The proportion rises to 60% among top performers, compared with 32% of bottom-quartile companies.

In our experience, concentrating capabilities in a digital center can help companies in Africa overcome many of their challenges. Digital centers can help in two ways:

- Making it easier to attract and retain people with digital skills. Talent attracts talent; skilled people want to work in an environment with equally or better skilled peers.

- Taking advantage of scale and cost benefits while decreasing the time to market. This includes centralizing digital governance and capability management (thereby helping address prioritization and capabilities challenges) and standardizing methodologies, platforms, tools, and the tech stack. It also helps sidestep any resistance to change and new ways of working from the existing organization.

We have seen digital centers bring significant value. For example, an international automobile manufacturer succeeded in recruiting 300 digital experts and accelerated project delivery by a factor of four.

Africa got off to a slow digital start, but its adoption of digital technologies and capabilities is gathering speed. The history of other markets shows that as consumers and businesses gain experience with digital technology, they make the transition to using it quickly, and they find new ways to weave it into their lives and operations, usually much faster than companies can build digital offerings from scratch. Companies that have not begun their own digital transformation need to start now.