This is the second of two articles that offer advice about the priorities and agenda for incoming CFOs.

New CFOs have a clear priority for the first year of their tenure: deliver value. This may be a surprise to some who still view the CFO’s primary role as supporting other C-level executives in achieving their value-creation objectives. But times have changed. The CFO’s role has expanded beyond bookkeeping to include strategic steering, financial governance, and performance insights.

Whether CFOs rise from within the company or join from another organization, the first year will be a time to set the direction for the finance function under their leadership. Demonstrating results early sends the right message to the investor community and the board of directors, as well as across the company. It facilitates the CFO’s longer-term strategy and transformation efforts, paving the way for growth in future years.

In the first article in this series, we focus on the need for new CFOs to use their first 90 days to develop a vision and an implementation roadmap. In this article, we turn from planning to execution and discuss the key elements of the first year’s agenda.

Six Priorities for Year One

Although the first year’s agenda should be shaped by the CFO’s ambitions and the finance function’s challenges, every agenda should include six high-priority items.

Value Creation, Growth, and Capital Allocation

CFOs are integral members of the strategy development team, helping the company to define its investment plan and financing strategy and to make strategic choices that maximize long-term growth. CFOs should prioritize strategic choices that are related to managing the portfolio and making investment decisions.

“A big part of the CFO’s role is around portfolio analysis and optimal resource allocation—for example, determining which new initiatives should receive funding or whether existing product lines should be shuttered or sold,” noted a CFO from a large technology company. “In a world where funding is limited, helping the company make the right choices about what to fund or to stop funding is critical.”

CFOs should start the prioritization process by reviewing the overall investment portfolio from a strategic perspective, and then pose challenging questions to the CEO: Is the company investing for growth? Is the return on investment high enough to ensure a sustainable competitive advantage? Is the company sufficiently prepared for a variety of business and economic scenarios?

New CFOs need to ensure that they have a seat at the table when investment decisions are made.

New CFOs need to ensure that they have a seat at the table when investment decisions are made. To gain a seat, they need to be very clear on the value that they bring to the discussion. They can create value from day one by building a strong capital allocation framework to ensure that due diligence is conducted before finance makes investment decisions. The framework gives the finance function a basis for challenging and enhancing the investment portfolio. Effective capital allocation requires holding the business units accountable for a return on investment and assessing investment viability through scenario modeling.

CFOs also play an important role in driving growth through innovation. The finance function can support innovation by providing cost-benefit analyses, assisting in business case development, identifying sources of funding, and incorporating flexibility into planning and budgeting. “Organic investment to drive innovation, when done right, can be the most value-accretive weapon in the CFO’s arsenal,” explained a CFO from a midsize consumer packaged goods company. “It is a true virtuous circle, as profitable organic growth creates future cash flow that can be applied to new investment opportunities.”

Business Partnering and Performance Management

In many organizations, CFOs are viewed as facilitators who support the business from the shadows. By contrast, in leading companies, CFOs and the finance function actively partner with the business units in operational planning, business analysis, and decision making.

In the first year, new CFOs should set or refine the framework for operational performance management. A clear and transparent KPI-driven performance framework can align business decisions across the company with the leadership’s strategic priorities.

Such a framework can also enable CFOs to monitor business units’ performance, report insights, and identify and push for efficiencies across the company. New CFOs can bring a fresh perspective when assessing a company’s key activities. They can introduce new ideas and challenge the business units to reduce costs. By implementing systematic internal benchmarking, CFOs can identify localized best practices and disseminate these across the company.

By laying the foundation for effective partnering, CFOs can promote a collaborative relationship with the business units.

By laying the foundation for effective partnering, CFOs can promote a collaborative relationship with the business units and highlight the ways in which the finance function can contribute to decision making. CFOs can then build on this foundation by demonstrating how the finance function can add value through uncertainty planning, investment decision support, and scenario modeling.

Lean Finance Operations

In the first year, CFOs should work toward building a finance function that can quickly respond to complex and changing business requirements. The degree to which the finance function can partner with the business units depends, to some extent, on its level of internal efficiency and flexibility.

Best-in-class finance functions are lean, with processes and responsibilities that are streamlined to eliminate redundant activities and those that don’t add value. Building a lean function requires ensuring clear ownership of tasks, achieving the right level of delegation and accountability, and fostering a culture of continuous process improvement.

CFOs can enhance the flexibility of the finance function by creating task forces to address specific concerns or to drive select initiatives. Cross-functional task forces can expand the finance function’s understanding of the business, which improves collaboration and facilitates further business partnering. They can also quickly launch and run initiatives in the CFO’s transformation roadmap.

CFOs should set a first-year target of optimizing two or three processes or areas that they view as key roadblocks or challenges. Solving these pain points helps to pave the way for a larger-scale lean transformation in future years. BCG’s experience suggests that companies can achieve a cost reduction of 15% to 40% by redesigning their organization and optimizing processes.

Digitization, Data, and Analytics

New CFOs should evaluate and implement appropriate automation, artificial intelligence (AI), and analytics solutions in order to help the finance function and the entire company be smart, efficient, and competitive.

A lean finance function can boost its efficiency by using digital tools to automate processes, enhance controls, and integrate information systems. Additionally, a lean function can increase its effectiveness by using digital tools to improve its data and analytics capabilities.

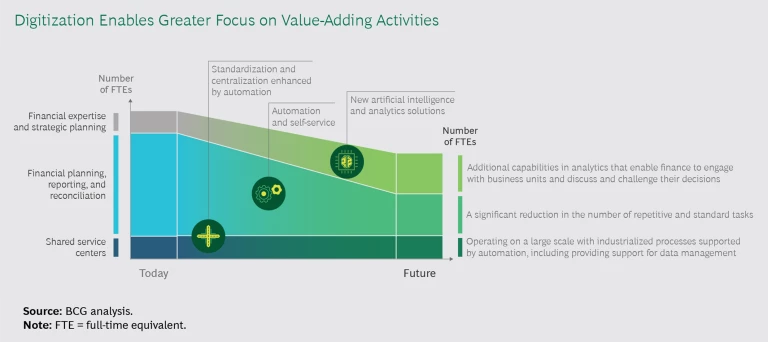

To capture the benefits of digitization, CFOs must help the finance staff adapt to the evolving digital landscape. The new workforce is a mix of humans and bots. By using digital full-time equivalents (FTEs) to automate transactional finance tasks, CFOs can free up people to focus on performing analysis, developing insights, making decisions, and other activities that add value.

Over time, the greater use of AI and analytics allows the finance function to reduce the overall number of FTEs but still expand its capabilities. (See the exhibit.) The share of FTEs that perform repetitive, standard tasks will decrease, but the share of experts and strategic planners will increase. The activity in shared service centers will increase, but the number of FTEs in centers will remain roughly constant because much of the new activity is automated.

Digitization also facilitates transparency and the free flow of information across the company. CFOs can use digital tools to enhance business partnering and to deliver value, such as through market analysis, intelligent forecasting, cash flow modeling, decision-based simulation, and scenario analysis.

Proof-of-concept pilots and minimum viable products can demonstrate the value of digital applications within six months. BCG’s experience indicates that, once refined and scaled up, digital finance tools can reduce costs by approximately 30%.

Risk Management

CFOs are co-owners of the company’s risk and reputation. This is an important aspect of their stewardship responsibilities. “CFOs need the attitude and aptitude to properly balance the tradeoff between risk and reward,” noted a CFO from a large media company. “Risk-taking, and therefore uncertainty, is essential for growth; yet as finance professionals, we live in the domain of data and carry the ultimate responsibility for risk mitigation.”

To be well informed, new CFOs need to get an early start understanding the company’s risk exposure. The first step is to review the current risk-mitigation plans with a critical eye, as well as to establish formalized risk-reporting mechanisms if they do not already exist. Additionally, because the risk landscape is evolving, new CFOs need to keep abreast of potential sources of risk, such as shareholder activism and cybersecurity.

New CFOs need to keep abreast of potential sources of risk, such as shareholder activism and cybersecurity.

CFOs should also determine whether the company has established adequate financial governance and internal controls, such as the segregation of duties, approval policies, and materiality thresholds. “At the core, strong controls are really just table stakes to ensuring that the company has a strong foundation to build upon,” explained the CFO of a large consumer packaged goods company. “The responsibility for ensuring that the company has a rock-solid control environment is oftentimes what a finance team is most identified with and most valued for.”

Further, CFOs must be mindful of the risk implications of their announcements related to their strategic decisions and actions. All such announcements should be subject to rigorous internal review before they are communicated externally. It is essential to avoid potential fallout or adverse reactions from shareholders, debt holders, financial institutions, regulators, environmental and sustainability groups, and society in general.

The COVID-19 pandemic highlights the importance of CFOs in crisis management once risks materialize. They must help the company through crises by managing liquidity, supporting supply chain planning, and analyzing alternative economic scenarios. Crises also result in increased scrutiny by investors and analysts. CFOs need to proactively communicate about crisis management in order to reassure stakeholders, maintain credit ratings, and avoid stock price fluctuations. At the same time, CFOs should work with the entire leadership team to develop business continuity plans, not only for finance but also for the entire organization.

Talent Management

Building the finance function’s talent and capabilities has a direct impact on the success of a CFO’s vision and roadmap, because these individuals will execute the agenda. The first year is the right time to develop the talent management strategy.

Defining the strategy includes assessing which skills the finance function needs to add or augment to achieve its vision, as well as launching initiatives or programs to accelerate the training and upskilling of talent. Finance functions today require experts possessing skills such as treasury management, tax optimization, investor relations management, process mining, and data analytics. Existing skill gaps may need to be addressed by hiring the right talent to fulfill these expanding responsibilities. “Build the right team early,” advises the CFO of a large insurance company. “This includes people with intellectual curiosity, ownership, drive, the ability to partner, and a willingness to put the company first.”

CFOs’ talent agenda should include grooming their potential successor and the next-generation of finance leaders.

CFOs’ talent agenda should include grooming their potential successor and the next-generation of finance leaders. Throughout their interactions, CFOs should keep an eye out for people with strong potential and build career paths to shape these people into future leaders. “Once the right team is in place, devote time to helping them develop and flourish,” said the CFO of a large technology company. “There is no more important role than to develop the next level of leaders to carry the company into the future.”

The talent strategy cannot be static—it must continuously evolve to adapt to the finance function’s structure and culture. The millennial workforce brings in new ideas and ways of working, while the more-experienced Gen Xers bring expertise in the industry and business trends. Creating a culture where very different groups of people can work together in harmony is essential to prime the finance function for change and evolution. CFOs should also try to have a mix of diverse backgrounds in the finance function to foster a culture of innovation and collaboration within the function and beyond.

“The Buck Now Stops with Me!”

The new CFO is an agent of change, questioning the status quo and bringing in fresh perspectives and innovative solutions. However, to see these ideas materialize into tangible results requires extensive planning and prioritization. In the first year, the CFO may sometimes be the sole champion for the new vision. To broaden support, it is critical to demonstrate and communicate success in a manner that builds credibility and promotes adopting the vision. “By quickly solving some top-of-mind issues, I built credibility and increased my circle of influence as CFO—and that led to a more fun and fulfilling role,” said the CFO of a large commercial bank. “The buck now stops with me!”

Even as they accept ultimate accountability, the best leaders take their team along with them on the journey. New CFOs need to create champions of their vision, both inside and outside the finance function. Entrusting the vision to a dedicated finance function can drive ownership of the results and create allies for change.

Of course, no plans are static, and success depends greatly on how well new CFOs can adapt to changing market scenarios and cultural contexts. The relationships forged in the first year become critical, as they provide a platform for new CFOs to ideate strategic options and seek feedback on their approach and leadership style.

Whether new CFOs inherit a soaring success or an organization in need of urgent change, their first year’s agenda will ultimately determine how the finance function helps the enterprise navigate the journey into the future. That means the first year is a pivotal time for CFOs to make their individual imprint and showcase successes. Although the role comes with many challenges, new CFOs should never lose sight of the overarching goal: to deliver value—for their business partners, for their company and its stakeholders, and for society.