Give credit to the consumer. Our latest research shows that people around the world are buying into alternative proteins—and are very happy with what they find. The market share projections that we made in our first Food for Thought report in 2021 are bearing out: current forecast models indicate that alternative proteins will represent 11% of all protein consumption by 2035, and with some help from technology, investors, and regulators, alternative proteins could command 22% of the global market over this time frame.

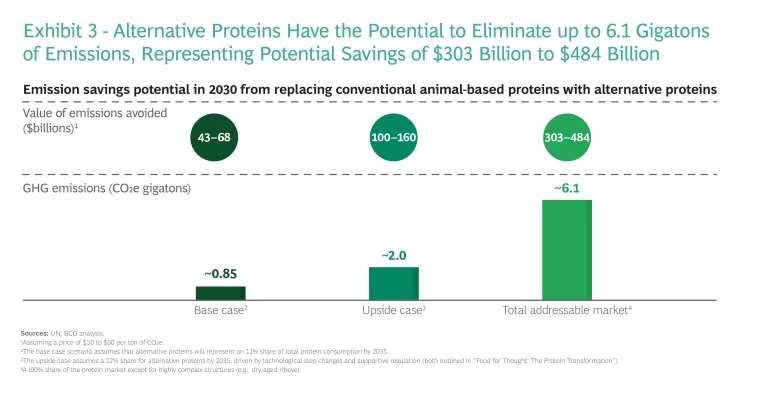

This is good news for everyone involved in the global effort to combat climate change. The food system accounts for 26% of current global greenhouse gas (GHG) emissions. Animal agriculture, the largest GHG emitter within the food system, is responsible for 15% of global emissions, roughly matching the emissions from the transportation sector. If we remain on track for an 11% share for alternative proteins by 2035, we will see a reduction of 0.85 gigaton of CO2 equivalent (CO2e) worldwide by 2030—equal to decarbonizing 95% of the aviation industry. In comparison with other solutions, such as flying less or retrofitting existing housing stock, the economic and individual consumer tradeoffs involved in shifting to alternative proteins are relatively small. Our survey shows that consumers understand this: more than 30% of consumers consider having a major positive impact on climate to be a primary reason to switch to alternative proteins.

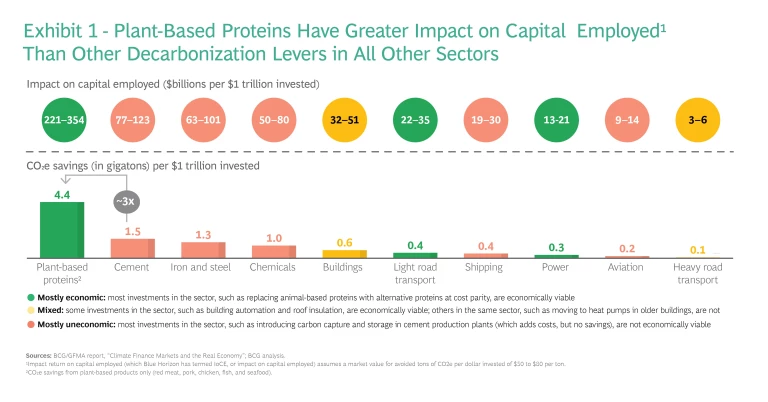

And this is exactly what alternatives proteins do. Investing in the segment has the highest CO2e savings per dollar of invested capital of any sector. The emission savings can be translated into a financial gain when assessed in terms of the market value of avoided CO2e emissions per dollar invested in mitigation efforts. To borrow a concept from finance, we call this impact return on capital employed, which Blue Horizon has coined as IoCE, or impact on capital employed. Given an estimated emissions value of $50 to $80 per ton of CO2e, a total addressable market (TAM) transformation would yield emission savings worth $303 billion to $484 billion. The resulting IoCE of $221 billion to $354 billion per trillion dollars of invested capital is at least three times greater than anything corresponding abatement investments in other high-emitting sectors of the economy, such as transportation or buildings, can achieve. (See Exhibit 1.)

The protein transformation is one part of a broader remodeling of the food system. As value pools form around new technologies and processes that help address such critical issues as taste, health, and cost, the need for some long-standing processes, such as animal slaughtering and meat packing, will decline. Every stakeholder along the value chain is likely to feel the impact of the transformation, and many will find big opportunities in contributing to building a sustainable food system.

Consumers Are Enticed

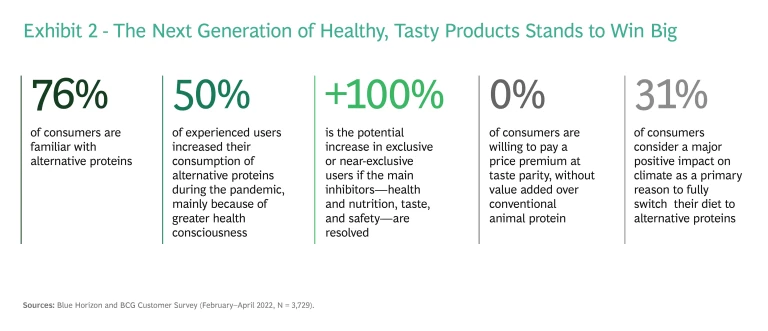

Alternative proteins have made substantial strides with consumers, who are broadly aware of this emerging food category and are favorably impressed when they try available products. (See Exhibit 2.) A 2022 survey by BCG and Blue Horizon, encompassing more than 3,700 respondents in seven countries, reveals that consumers in most markets appreciate the product attributes of taste, nutritional value, and health the most. We also found that improvements in three key areas—health, taste, and price—are key to boosting demand. Approximately 75% of respondents said that having a healthier diet is the primary motivator for them to start consuming alternative proteins. When it comes to making a purchasing decision between several products, though, taste emerges as a key criterion. Price remains a sticking point in all markets. Consumers are not prepared to pay a premium for a product that offers only taste parity with animal-based products.

Since almost a third of consumers say that they would switch their diets to alternative proteins if doing so would have a major positive impact on climate, there is a clear need for more active positioning and consumer education.

Consumers in all markets express a strong willingness to shift their consumption patterns further if their biggest inhibitions regarding the products—health and nutrition, taste, and safety—are addressed. In that case, the share of respondents who consume mostly or only alternative proteins would double (from 13% to 27%), and the number of people who balance consumption between alternative and conventional proteins would increase by almost a third.

Other Stars Align

Multiple factors have been fueling progress. Venture capital invested in alternative proteins rose at an annual rate of 124%, from $1 billion in 2019 to $5 billion in 2021, according to the Good Food Institute. Investment in fermentation-based and animal-cell-based companies, two newer technologies, is soaring. From 2019 to 2021, the former rose more than 137%, from $300 million to $1.7 billion, and the latter rose more than 425%, from $50 million to $1.4 billion.

Many traditional food companies are investing in alternative proteins as well. In 2020, corporations participated in about 60% of funding rounds. Although this figure fell in 2021 because of the rapid growth in investments in cell- and fermentation-based proteins—which attract more venture capital and less corporate funding—corporations are continuing to make valuable non-cash investments. Brewers, for example, not only invest in startups, but also give partners access to their production facilities and skilled employees. The overall growth in alternative protein investments is consistent with a broader focus on sustainable investing globally, which is growing three to five times faster than traditional investing, with a focus on solutions to the climate crisis.

Advances in technology have occurred along the entire alternative protein value chain and are helping bring new products to market. Costs are falling, drawing them closer to parity with conventional animal protein products, and hybrid products are emerging as a way for fermentation- and animal-cell-based ingredients to reach consumers more quickly.

Regulators worldwide are facilitating progress. Since 2015, when Israel announced that its novel framework for regulating food safety would apply to alternative proteins, other regulators have followed suit. New and revised procedures address issues ranging from biotech hubs (Middle East and Singapore) to the evolving needs of startups (US and Israel) to resource scarcity, supply security, and independence (Middle East, Singapore, and China) to protein deficiency (India) to food safety (China) to climate goals (Europe). Approval procedures for plant-based products are generally well established, and procedures for fermentation-based and cell-based products are accelerating.

A Big Climate Impact

All of this progress comes at a critical time. Reducing animal agriculture in the food value chain is an exceptionally high-impact solution to the global climate crisis.

The UN has projected that GHG emissions will reach 55 gigatons by 2030, absent any change in current government policies. In our 2021 Food for Thought report, we estimated that the shift to alternative beef, pork, chicken, and egg alternatives will save more than 1 gigaton (Gt) of CO2e by 2035—or about 0.85 Gt CO2e in 2030. This is equal to decarbonizing most of the aviation or shipping industries or about 22% of the building industry. In our upside scenario (which envisages alternative proteins capturing 22% market share), we see decarbonization of 2.2 Gt CO2e, or 4% of emissions under the UN’s current policies scenario, by 2030. If alternative proteins were to replace the total addressable market of animal proteins with like-for-like alternatives, building on current technology, global emissions would fall by 6.1 Gt CO2e —11% of projected current emissions in 2030. (See Exhibit 3.)

There’s also a climate bonus. Any significant overall change in diets toward more alternative proteins will have an immediate cooling effect on the planet, since GHG emissions from animal farming include a substantial portion of methane—as much as 50%. Methane has a much higher global warming potential than CO2 and a much shorter atmospheric lifetime. Consequently, reducing methane levels in the atmosphere doesn’t just prevent further warming; it comes with a cooling effect.

Stay ahead with BCG insights on climate change and sustainability

A Sustainable Food System Means Big Changes

Given the opportunity, the key question becomes, how can each player make the most of doing well by doing good? The shift to alternative proteins means big changes—and big opportunities—for all food industry players. New processes and approaches will transform multiple long-standing paradigms, and certain steps along the value chain will change radically. Players in all segments—farmers, suppliers, manufacturers, and investors—must assess how quickly the transformation will roll out and what the risks and opportunities are for them.

The biggest shifts will involve value pools migrating upstream toward the production and processing of new protein sources. In each case, the speed and extent of impact will depend on the type of protein (meat, fish, dairy, or eggs) and the type of alternative (plant-, fermentation-, or animal-cell-based) at issue. Value pools will remain dynamic, however. For instance, the value of improved extraction methods for plant-based proteins will likely increase over time. In fermentation-based and animal-cell-based proteins, further value shifts toward improved strains and cell lines are likely if new techniques can materially reduce the need for costly culture media inputs or enable the shift to cheaper carbon sources. Upstream enablers of new protein sources and products, as well as technologies that remove key bottlenecks, will realize superior returns and act as multipliers enabling higher impact. Protein sources, ingredients, and processes that contribute to taste and texture parity or to nutritional value will continue to sustain high value shares regardless of where they fall in the chain.

With regard to the stakeholders who will be affected by the changes, the least amount of attention so far has been devoted to the group that will feel the biggest impact. Farmers are key enablers in the move toward a more sustainable food system, but they face some of the greatest risks. Aside from large agribusiness companies, they also have the fewest resources. Other stakeholders must be involved in developing incentives for farmers to make the necessary switch.

Accelerating Progress

Everyone has a stake in accelerating the protein transformation and in the broader transition to a sustainable food system. We see the need for concerted attention and action in five areas, which we explore in more depth in our full report:

- Supporting farmers

- Ensuring a level policy and regulatory playing field between conventional and alternative proteins

- Directing capital toward transformative ventures

- Optimizing resources and waste recovery

- Continuing to build consumer acceptance

Our consumer research suggests that the conditions are right for another surge in adoption of alternative proteins once the next generation of healthy, tasty products hits the shelves. Our impact analysis shows that the protein transformation is one of the best tools available to combat the climate crisis. It all points to an untapped opportunity that everyone can embrace.

Disclaimer

In particular, neither BCG nor BHC provides any legal advice, medical advice, nutritional advice, tax advice, or accounting advice. Further, evaluations, market and financial information, and any kind of conclusions contained in the Opinion are not definitive and are not guaranteed by BCG nor BHC. The recipient is responsible for obtaining independent advice concerning these matters. Further, third parties may not, and it is unreasonable for any third party to, rely on these contents for any purpose whatsoever. Any reproduction, distribution, editing, and exploitation of the BCG content, in full or in part, published in the Opinion requires the prior consent of BCG. Neither BCG nor BHC is obliged to update the contents or to make any corrections.

The Author Team

Malte Clausen

Nico Dehnert

Markus Hepp