Broad trends in battery supply chains coupled with the US’s Inflation Reduction Act present a tremendous opportunity for Canada and Canadian companies, but we must act now to secure this advantage.

Electric vehicles (EVs) are a lynchpin in the net-zero strategies of countries around the world. Increasingly visible on our roads and highways, pure battery electric vehicles (BEVs) are forecast to become the most popular type of light vehicle sold globally by 2028, surpassing sales of automobiles with traditional internal combustion engine (ICE) drivetrains.

But the critical minerals needed to power these vehicles – namely cobalt, copper and lithium—are in short supply. By 2030, demand for lithium is expected to outpace supply by 4% and that gap could reach 24% by 2035. Passage of the Inflation Reduction Act in the US creates additional supply chain pressures. The Act provides attractive tax credits for BEV manufacturing, but those credits come with strict content requirements for batteries and critical materials. (See drop-down). Without meaningful changes to battery production and localized supply chains, the global transition to EVs could hit a speedbump.

The Inflation Reduction Act has local content requirements for US-manufactured battery electric vehicles (BEVs) to qualify for tax credit

- $3,750 if 40% of battery "applicable critical minerals" are sourced from either the US or a free trade agreement nation starting in 2023, increasing 10% per year (up to 80%)

- $3,750 if 50% of the value of battery components are manufactured or assembled in North America starting in 2023, increasing to 100% by 2029

- No applicable critical minerals are extracted, processed or recycled by a "foreign entity of concern," and no battery components are produced by a "foreign entity of concern"

Canada has a once-in-a-generation opportunity to address these issues. It has significant reserves of critical minerals. It has the industrial base and expertise to expand mining sustainably and build advanced refining, processing and production capabilities. And as a free trade partner with the US, it has the potential to be a key supplier to one of the world’s largest auto markets. Capitalizing on this opportunity, however, will require concerted action across both the public and private sectors to create an integrated value chain.

Extraction Represents a Small Portion of Canada’s BEV Opportunity

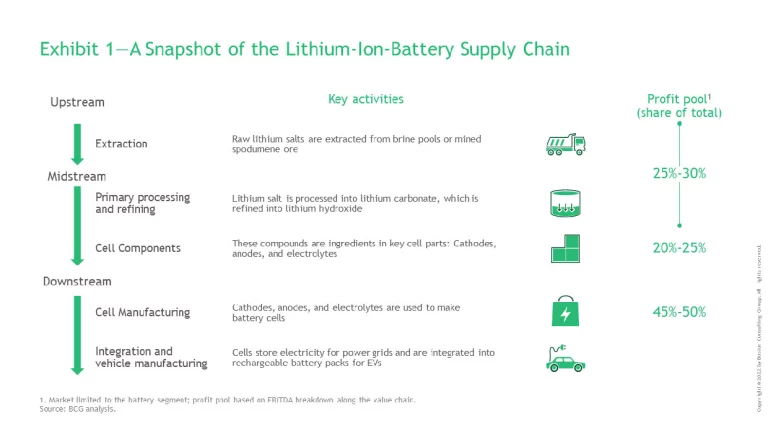

Critical mineral extraction represents just 10% of the total EV battery revenue pool and a similar portion of the profit pool. Capturing a larger share of the BEV opportunity requires considering upstream, midstream and downstream activities. (See Exhibit 1.)

For example, building domestic refining and processing capacity could expand Canada’s current share of the overall profit pool from 10% to 25-30%. Adding cell component capabilities, where refined critical minerals are used to form cathodes, anodes, and electrolytes, could unlock an additional 20%-25% of the EV battery profit pool. And taking these materials and producing the end-stage battery cells that go into EVs could allow Canada to tap into the remaining 45%-50% of the profit pool.

At the moment, however, Canada isn’t playing in many of these midstream and downstream markets. Most refining of critical minerals, cell component manufacturing, and cell assembly is done elsewhere. China accounts for more than half of global lithium hydroxide exports and is the world’s leading producer of battery cells and battery packs.

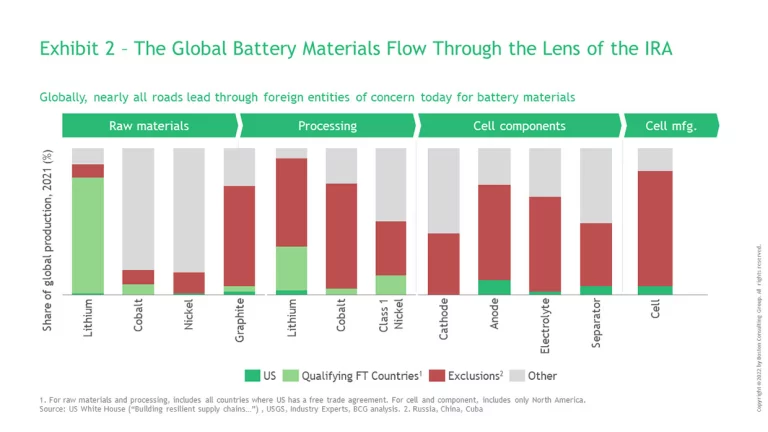

Adding another complication to the global EV battery value chain, under the recently enacted Inflation Reduction Act in the US, battery materials and components that pass through “foreign entities of concern,” including China, disqualify vehicles assembled from these parts from obtaining key tax credits. A vast majority of midstream processing and cathode and cell manufacturing occurs in these “entities of concern” (see Exhibit 2). This requirement would exclude a large majority of current US EVs from this tax credit.

By participating in more of this value chain, Canada can help to power the EV transition globally and spur significant economic growth at home.

The Opportunity for Canada: Integration Is a Value Multiplier

Making good on this opportunity requires that Canada approach the EV battery market in an integrated fashion, connecting upstream extraction sources with midstream refining and downstream battery production. The benefits that accrue to Canada are more than just economic. Deeper value-chain integration will generate more jobs and opportunities for Canadians, more predictability and procurement options for refiners and producers, and more capital investment opportunities to fund sustainable exploration—a win for all.

Canada has the know-how to make this happen. What it needs now is the will to engage collaboratively and provide the support for each part of the value chain to thrive. And it needs to act quickly. The expected shortage of critical minerals is pushing other countries to localize their EV battery supply chains and compelling manufacturers to sign long-term contracts with miners and refiners. Canada has secured some investment commitments from battery players. But to make good on those commitments and expand its share in a finite market, it must expand its capabilities.

The signing of the US IRA, while overall a positive for Canada, also presents challenges. It adds a Production Tax Credit for electrode active materials (including cathodes and anodes), battery cells and battery modules manufactured in the US. This credit can represent one quarter to one third of a battery’s total cost. Companies that have made commitments to cathode and cell manufacturing in Canada may reconsider their site selection in light of these changing economic incentives, and Canada will need to react.

With the correct incentives and support structures in place, participants at each stage of the EV ecosystem will all stand to gain from an integrated Canadian battery ecosystem:

- Miners of critical minerals will have demand certainty, improving the business case for investments into newer and more sustainable mining technologies. These investments would have net benefit for Canadian mining in general, from exploration to exports, making Canadian mining even more carbon competitive and cost competitive compared to its global peers.

- Midstream refiners and processors will achieve shorter lead times due to localization of their critical mineral inputs, greater supply security, and given their input provenance and automaker relationships, assured access to the US EV market.

- Downstream battery makers and automotive OEMs will also benefit from shorter lead times and better supply-demand security. A more efficient supply chain and a reduced emissions footprint could help both midstream and upstream businesses improve traceability and attract more capital from environmental, social and governance (ESG)-minded investors. These shifts could also favourably position Canada to serve markets such as the EU that are introducing tougher sustainability requirements and increased transparency into the battery-manufacturing process.

But Canada Must Act Now—and Every Player Must Engage

Becoming a North American battery EV powerhouse is within Canada’s grasp, but it will require that all players in the ecosystem work closely together, and that each stakeholder commits to tackling tough, but necessary changes.

Governments must come together on strategy. Earlier this year, the federal government released a discussion paper on “Canada’s Critical Minerals Strategy,” a set of proposals that would provide crucial funding for an integrated EV battery value chain. The strategy, due to be finalized by the end of 2022, would expand support for each stage of battery development—including funding and tax credits for exploration and R&D, and funding for advance manufacturing, processing, and recycling applications as well as infrastructure projects. The plan also seeks to advance economic reconciliation in the natural resource sector, with significant funds channeled to support Indigenous participation in the Critical Minerals Strategy.

This is a necessary step – currently there are myriad public and private sector initiatives to emphasize and accelerate Canada’s critical minerals and battery value chain presence, but what doesn’t exist yet is a truly Canadian national strategy. This should be led by a council comprised of federal officials, provinces, unions, and value chain partners. Ad hoc, fragmented cooperation is better than no collaboration, but we will never get a coherent national strategy if we keep acting like we do now.

There are also immediate actions that should be taken by federal and provincial governments, streamlining regulatory processes to get new projects underway more quickly, and ensuring that regulators touching critical mineral projects are adequately resourced to prioritize these projects. This streamlining should include single-touch environmental approval processes and clarifying and aligning the roles and responsibilities of regulators. Regulators and officials should also prioritize communication and hold earlier and more iterative public consultations, especially with First Nations communities. In addition, the government should build on the successful pattern of recent months and encourage direct foreign investment in the form of long-term contracts and memoranda of understanding, with clear economic and tax incentives for investing in Canada.

- Industry players must be willing to take bold moves. Miners must step up investment in exploration and especially in low-carbon, environmentally friendly technologies—such as direct lithium extraction—that can help them remain both cost and carbon competitive. Miners should also support the build-out of domestic refining and processing capabilities with downstream players through partnerships, offtake agreements and investments. The new battery supply chain will see entirely new companies formed, and there is no reason miners cannot be a key player in the formation of these entities.

- Automotive OEMs should lean into sources of advantage. Canada provides a number of key advantages in terms of battery sourcing, including low carbon intensity and proximity for OEMs operating in North America. Automotive leaders should prioritize advances that can enable cost-effective manufacturing methods, with greater funding for emerging technologies and greater support for the startups producing them so critical innovations can scale.

- Investors and financiers can provide critical funding up and down the value chain. The BEV market is one of the most attractive areas of climate-finance for market-returns-seeking investors, given the strong and growing demand for goods produced at each stage of the development process, the measurability of those returns, and the “green premium” associated with this market. With more individual and institutional investors interested in ESG-aligned opportunities, ratcheting up commitment in Canada’s BEV ecosystem can pay dividends for all parties.

Canada has exceptional mineral and natural resource advantages, and it needs to leverage them. But too strong a focus on extraction risks blinding us to critical interdependencies and opportunities across the wider value chain. This is a pivotal building moment for Canada. Focusing on the “whole” and creating an integrated EV battery industry can unlock 10 times more value than from mining alone and unleash a greater and more defendable opportunity for Canada as a whole.