A new regulation makes detailed pricing data widely available for the first time. Providers and insurers need to prepare now for a changed competitive playing field.

Competitive dynamics are about to get much more intense in the US health care sector. Price transparency will soon be pervasive for consumers and employers, enabling both to “shop” much more effectively for health care plans and services. Providers and insurers that want to be prepared have 12 to 18 months to get ready as the new competitive environment takes shape. They need to plan for an uncertain future now.

The cause for action is the Center for Medicare and Medicaid Services’ Transparency in Coverage Rule (CMS-9915-F), which went into effect on July 1, 2022. Among other changes, the rule requires all health insurers to disclose, for every plan and for every provider in their network, the negotiated rate for every procedure. They must publish the data in machine-readable “flat files,” which are simple and easy for others—researchers, regulators, and application developers—to access and use. The files must be updated and republished monthly.

The intent of the new rule, according to CMS, is to “give consumers the tools needed to access pricing information through their health plans.” But the impact will extend to every player in the US health care system, transforming competition and relationships among providers, insurers, consumers, and employers. For providers and insurers—the primary focus of this article—the ability to better manage costs, price services, and communicate value to the consumer is emerging as a key competitive advantage.

Specific predictions are premature, but we can make some broad assumptions about the coming upheaval and what providers and insurers need to do to prepare. One thing is already evident: time is short. Those that delay may find it difficult to respond to the changing market a year or two from now.

Opportunities, Threats, and Uncertainty

To a large extent, CMS-9915-F supersedes the CMS’s 2020 Hospital Outpatient Prospective Payment System rule, which required hospitals to publish their own negotiated rates and with which only a minority of providers have complied. This rule is different. It carries three big changes for insurers: requiring the publication of rates, making out-of-pocket obligation estimates available to consumers in real time, and altering how insurers calculate medical loss ratios (MLRs). (See the sidebar, "How the Transparency in Coverage Rule Changes the Game.")

How the Transparency in Coverage Rule Changes the Game

How the Transparency in Coverage Rule Changes the Game

Publication of Rates. Perhaps the most significant component is the requirement that health insurers publish two sets of rates. The first includes, for each of the insurer's plans and for every provider in its network, every negotiated rate for every procedure. The second covers any out-of-network provider from whom the insurer has received at least 20 claims in the 90-day period beginning 180 days before the file publication date. The flat-file format mandated for publications will permit third parties to aggregate, analyze, and deliver vast amounts of pricing data to consumers relatively quickly and easily for the first time. Insurers are required to update these files monthly.

Real-Time Availability of Consumer Out-of-Pocket Obligation Estimates. Beginning January 1, 2023, health insurers will be required to provide customers with real-time information on their out-of-pocket obligation for elective procedures, at any chosen provider, given their remaining deductible at any given time. For the first year, this requirement involves the 500 most common elective health care services, as listed in the final rule. Starting in January 2024, the requirement expands to all procedures covered by the health insurer.

Change in the Health Insurer MLR Calculation. Health insurers will now be able to provide financial incentives to encourage customers to select more cost-effective options for care delivery and, for the first time, count the cost of these incentives toward their MLR calculations. This is a powerful lever for insurers and employers because it allows them to provide incentives without cutting into their bottom line; when combined with the new ability of consumers to compare provider prices, it could have a significant impact on consumer choice.

Four things are already becoming clear. First, insurers intend to comply. A growing number of companies have published statements on their websites detailing how they plan to address the new requirements. United Healthcare, for example published a 46-page Q&A, "Transparency in Coverage," in September 2022.

Second, the extent of price and data availability is unprecedented in health care. Past efforts to provide greater transparency had only limited success and are of little use in assessing how these changes will reshape the marketplace and consumer behavior. This time, we can expect plenty of opportunities for both providers and insurers—especially those that are prepared to move quickly—to develop new products and offerings.

Third, sectors in which pricing has long been transparent don’t provide great models. Health care is an extraordinarily complex system, and a change of this significance can be counted on, at times, to produce unexpected and unintended consequences. The uncertainties highlight the need for preparation and for fostering the ability to respond to developments with agility and speed.

Fourth, disruptive regulatory changes often attract new players to the value chain. In this case, the new entrants will likely exploit an ability to aggregate and manage pricing data and potentially marry it with other data, such as outcome studies. They, too, can be expected to develop new offerings and services, such as comparisons of provider pricing and treatment outcomes, enabling consumers to shop for health care based on value. These new intermediaries could alter the sector’s competitive dynamics by inserting themselves between consumers and providers, and perhaps between plans and employers. We know from the experience of other sectors that such new players typically move more quickly than incumbents because they are less encumbered by existing relationships.

Where the Big Changes Can Be Expected

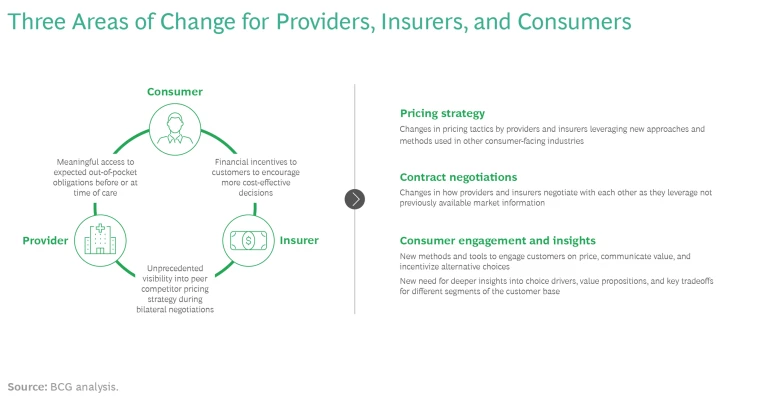

We foresee big changes for insurers and providers in at least three other areas crisscrossing the B2B and B2C sides of the health care sector. (See the exhibit.)

Pricing Strategy

Past studies have shown significant price variation among insurer-negotiated rates with providers, both within and across markets. While current data from insurer machine-readable files is incomplete, BCG’s analysis of data released in July 2022 shows variations consistent with previous study observations. For example, sample data from one market contained differences between low and high prices of more than 200% for lab tests and a nearly 600% variation for knee MRI imaging, both common services that are typically considered “shoppable.”

Cross-provider and cross-insurer price disparities will likely narrow, but the degree of change will almost certainly differ by type of service. Consumers are much less price sensitive when seeking more complex or life-saving services, such as surgery or cancer treatments, than they are with more commodity-like services, such as regular checkups or lab tests.

In response to the expected narrowing of prices, we may see more pricing tactics and incentives similar to those used in other consumer markets, such as retail and travel. For example, higher-priced providers may try to support premium pricing by offering greater benefits or improving the service experience with more convenience, speed, or amenities. They could also unbundle their prices, much as airlines have done, by starting with a lower price for the basic service and then enabling patients to “buy up” for amenities such as private rooms, catered meals, dedicated nursing staff, or valet parking. At the other end of the spectrum, lower-priced providers can be expected to more aggressively market and advertise their price schedules to set benchmarks against which other providers’ options are compared.

As pricing dynamics become more complex and “retail like,” insurers and employers could adopt other approaches used in retail, such as coupons, discounts, and gift cards. Developing and using these new incentives will be more complicated than in other industries, given legal and regulatory requirements in health care.

Contract Negotiations

Negotiations between providers and insurers can be expected to become more fact-based and detailed.

Negotiations between providers and insurers can be expected to become more fact-based and detailed. Both sides will need a good understanding of real costs, procedure by procedure and market by market. Prices are affected by competitive offerings and perceived consumer value. For providers, developing a rich fact base through a combination of the newly released competitive pricing information and a deep understanding of how consumers view the hospital system’s services will become essential to designing sound pricing and contract negotiation strategies.

Providers will need to develop more sophisticated cost-accounting systems with accurate cost pools and cost drivers. Most do not have such capabilities today, and high fixed costs complicate the task. But as pricing becomes more transparent and consumers become more discriminating, the need for accurate cost accounting as a basis for sound pricing decisions will grow.

Insurers will need similar databases, maintained in real time, that track how other insurers are reimbursing the providers in their networks. They must also understand how consumers make tradeoffs among price, convenience, overall experience, and physician loyalty, all in the context of cost sharing. Both providers and insurers should assume that the negotiators on the other side of the table will have much of this information.

Consumer Engagement and Insights

Consumers are likely to be more directly involved in decisions involving their care, especially when there are price discrepancies, such as two or more in-network providers in the same region charging substantially different rates for the same procedure. The rule's change in the MLR calculation introduces an opportunity for insurers to influence consumers’ selection of providers for more commodity-like services, even when cost-sharing arrangements mean that consumers do not directly experience the price difference. This should stimulate innovation in consumer engagement, segmentation, and insights. With price dispersions exceeding 100% in many cases, the impact of guiding patients to lower-cost sites of care could eventually have a material impact on premium levels. Insurers will need to avoid distributing incentives and rewards to those who can be counted on to use low-cost providers, and they will also need to guard against rewards persisting longer than necessary to ensure that consumers remain with their lower-cost providers.

Consumers are likely to be more directly involved in decisions involving their care, especially when there are price discrepancies.

Recent focus groups conducted by CMS revealed that the best venue in which to influence patients’ choice of ancillary providers is the physician’s office itself. Because many doctors express concern over how much their patients will be obligated to pay for certain services, arming physicians in the insurer’s network with the information needed to guide patients to the most cost-effective option may be a potentially powerful tool for modifying patient behavior. Likewise, communicating total costs-of-care differences to employers (and to consumers in the individual market) could be important for customer retention as competition intensifies over time. Preemptively engaging and educating brokers, who will surely encounter tough questions about price and reimbursement differences, will be vital.

Digital engagement with consumers can be expected to grow in importance. The likely bevy of new entrants threatens providers with yet another intermediary seeking to own a piece of the patient relationship while extracting a fee. Providers have some intrinsic advantages that they can deploy to preempt these new entrants, including upgrading their own digital front doors, building on physician-patient trust, becoming an efficient electronic repository for patient medical records, and perhaps even creating their own “rewards” programs.

For providers in particular, segmenting consumers and deriving insights about each segment will become another important capability. Providers will need to be able to answer such questions as:

- What are the discrete and strategic segments of the patient base today?

- Which patients are more price versus service sensitive?

- What are patients’ “breakpoints” when making tradeoffs (for example, how far will a consumer travel to save how much money)?

Time to Act Now

The preparation clock is ticking. Some data is available now, and much more will be available in the coming months. Early-stage and more mature companies are already racing to occupy lead positions as the go-to purveyors of information and insights. Aggregating, organizing, and analyzing the data will take some time, so insurers and providers likely have 12 to 18 months before the pricing information becomes widely available to, and usable by, consumers and other value chain participants. This is the window in which to evaluate and prepare for the potential disruptions, threats, and opportunities. Those that move slowly may find themselves outmaneuvered by much better-informed and decisive competitors, partners, and new entrants.

Insurers

Here are some specific steps insurers should take:

- Initiate a member market segmentation process as soon as possible to understand which customer segments are more or less price sensitive, for which types of procedures they are most price sensitive, and what customers’ “breakpoints,” or tradeoffs, may be.

- Identify a set of targeted clinical services and member segments within which to deploy newly available MLR incentive levers. Use price dispersion data from current negotiated rates with existing network participants. Employ an agile, test-and-learn approach to put minimum viable products (such as app updates and other tools that help members comparison shop more effectively) in the market and evaluate the impact.

- Start to assess how to best build transparency, MLR incentives, and out-of-pocket obligations into your digital consumer engagement approach.

- Evaluate the opportunities to design innovative products for different segments, including fully insured, administrative services only, and Affordable Care Act customers.

Providers

Providers also need to move quickly along the following lines:

- Develop an accurate, detailed cost accounting of all contestable services (such as labs, imaging, ambulatory surgeries, endoscopic procedures, and cardiac catheterizations).

- Segment patients to derive a better understanding of the strength of their loyalty, price sensitivity, and breakpoints associated with switching.

- Determine where you want to be positioned on the price-to-value spectrum, from low-cost solid service at one end to premium high-end care with lots of extras available at the other. (Larger markets will likely accommodate multiple value propositions.) The determination will have follow-on implications for the organization’s cost base, talent, culture, asset base, and supporting business management processes.

Providers and insurers should both assume that the Transparency in Coverage Rule will disrupt the markets for health insurance and health care services. The more urgent questions are how much and how quickly. Capturing the opportunities and preparing for the threats will largely be a function of recognizing that the time to plan and act is now. There’s a lot that can be done before pricing data is fully available, and incumbents will need the full 12 to 18 months to prepare.

The authors thank Etugo Nwokah, Jean-Manuel Izaret, Matt Beckett, Jon Kaplan, and Sarah Guezmir for their assistance in developing this article.