To succeed, telcos will have to navigate a series of shocks and trends that will force them to revisit their traditional strategic approaches.

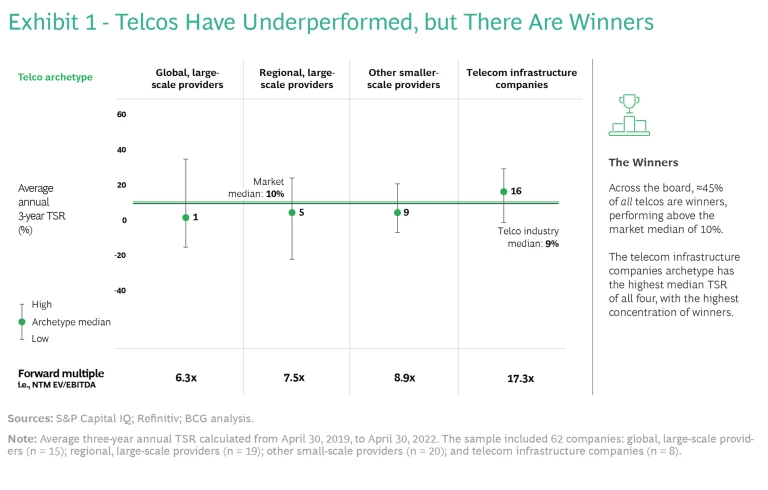

Telecommunications used to be a hot, innovative sector with skyrocketing returns. Those days are mostly gone. In BCG’s analysis of total shareholder return (TSR) from 2019 to 2022, telcos on average turned in a middling performance of 9% annual returns—a point below the overall equities

That is particularly disappointing given the central role that the telecom sector plays in global technology trends. Telecommunications has been the essential thread connecting people, businesses, and whole societies during the COVID-19 pandemic. It is also poised to be the distribution engine for Web3, a world of decentralized cloud-based applications, edge and quantum computing, AI, blockchain, and virtual reality.

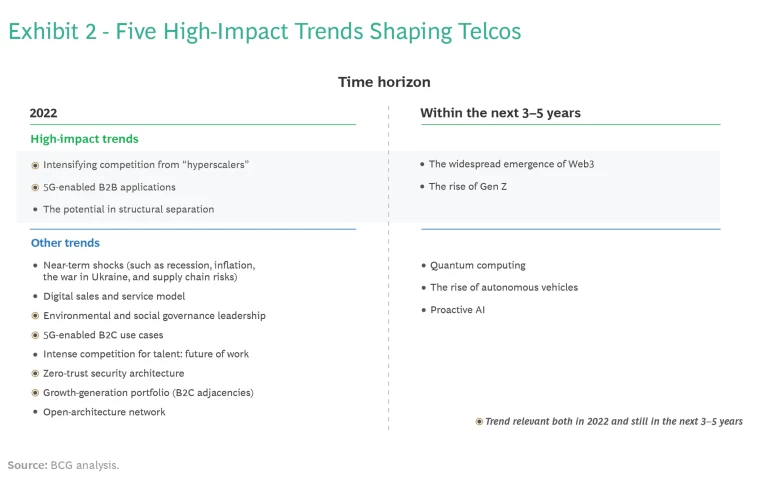

This somewhat disjointed picture of the current telecom market reflects in many ways the challenges that the sector is about to face—a series of short-term shocks and long-term trends that will force companies to revisit their traditional strategic approaches. In particular, the widespread emergence of Web3, the rise of Gen Z, intensifying competition from “hyperscalers,” 5G-enabled B2B applications, and the potential in structural separation are set to transform telecommunications. If navigated correctly, these five trends represent an enormous opportunity that could significantly change the trajectory for telcos, producing years of solid, above-market returns.

The State of Telcos

Even the less-than-impressive TSR of 9% for the telecom sector we mentioned at the beginning is a bit deceptive. These returns are boosted by pure-play telecom infrastructure companies, whose median annual TSR topped the market by 6 percentage points. (See Exhibit 1.) The other three telco archetypes we examined—global, large-scale providers; regional, large-scale providers; and small-scale providers—underperformed the market; however, in each of these archetypes a handful of companies did better than the average.

The telcos that have outpaced their peers have certain elements in common: lean and digitized operations with excess costs rooted out; a coherent portfolio of products and services that could include 5G, B2B, and B2C applications; strong customer support built upon aggressively priced products and services; and network investments in 5G, fixed wireless, fiber optics, and other upgrades. However, these traditional strategies will likely not be sufficient to drive outsized results in the future given five trends that are set to upend business as usual.

High-Impact Trends of the Future

Five trends stand out as having the most potential impact—good or bad—on future revenue and operating income of telcos. (See Exhibit 2.)

The Widespread Emergence of Web3. In the next three to five years, Web3 will transform consumer and business activities well beyond what 5G is offering now. The competition in this metaverse will be fierce, including established technology companies, startups, and businesses in a range of industries from automobiles to health care. Telcos are not automatically entitled to a piece of Web3 and must begin now to anticipate which parts of their markets are threatened by Web3 rivals, the value of these customer segments and how they can invest proactively in new applications that provide innovative and feature rich Web3 uses and enhanced revenue streams.

The Rise of Gen Z. Gen Zers are between ten and 25 years old now, with the oldest among them just beginning their purchasing power ascent. Already this young cohort is increasingly defined by its expectations. For instance, Gen Zers generally prefer digitally enabled experiences and on-demand convenience as well as high-quality authenticity in games, shopping, and content. And they are willing to pay for these types of experiences. That represents a radical opportunity for telcos that target Gen Z preferences while simultaneously a risk that technology startups and innovators will squeeze telcos out before they make inroads with these new customers.

Intensifying Competition from “Hyperscalers.” The big tech companies—whether a software giant like Microsoft, a hardware player like Apple, or an e-commerce leader like Amazon—have all stretched well beyond their original markets to increasingly encroach on the territory that telcos historically dominated. Telcos have no choice but to out-create the tech companies and develop applications more attractive to consumers and businesses. This will require a significant investment in innovation or forging partnerships with other companies that have a foothold in these new markets.

5G-Enabled B2B Applications. Although 5G networks are already making limited inroads among consumers, particularly for gaming, video, and early-stage virtual reality devices, they may leave a much bigger imprint in the business environment. Companies are implementing increasingly complex programs and applications to digitally transform their core processes. Many of these new uses are cloud-based and all of them require increasingly higher data transmission speeds. More than likely, they will need to build upon some or all of the differentiating features of 5G.

The Potential in Structural Separation. As the total shareholder return analysis showed, only the pure-play telco infrastructure companies are substantially outperforming the overall market. This performance makes a compelling argument for telcos to consider spinning off their network segments from the service side. Structural separation illuminates the financial condition of both companies with cash flow, debt, revenue, and income clearly assigned to the appropriate business. In turn, that creates a more transparent narrative regarding network vs. service company performance. It allows the network to leave the weight of the legacy service business behind—and that can be attractive to private equity investors seeking telco acquisitions or may lower the cost of capital for infrastructure buildouts. Perhaps most importantly, it gives the new NetCo an opportunity to work with many different service providers, an open access approach that increases utilization of infrastructure assets by as much as 80%.

It is worth noting, though, that although separation could become trendier, it is not a good idea for every telco and must be well planned and carefully assessed before undertaking it. Splits are enormously complex and standalone service companies will often lose a lot of value since they no longer have an exclusive network relationship. Moreover, the added competition in the service environment could lower prices that the NetCo can charge. For these reasons, strong integrated incumbents—with excellent retail and customer service capabilities and the ability to maintain high price points—may do better to keep the company together.

Future Drivers of Value

Taken as a whole, these trends are a lot for telcos to handle and are far more complicated than the issues they dealt with in the past. Many companies will have to rewire their business and operating models to navigate the future. In our view, the simplest way to address these trends is around five strategic vectors:

- Bionic Core Business. There is plenty of value creation still available in the more traditional telecommunications business lines but only if companies push value creation through a strategic mix of digitization, data analytics, and artificial intelligence, among other technological advances. AI and other digital tools should be used to improve operations, personalize customer interactions and other support functions, enhance employee efficiency—all in an attempt to lead the race to becoming a bionic company. By tying big data analytics into these tools, telcos can optimize virtually all of their business activities, including pricing, marketing, and sales.

- “Telco to Techco”—Growth Outside the Core. Start moving from telco to techco by identifying innovative adjacent B2B and B2C digital ecosystems and applications that the company has the potential to play a leadership role in. Pilot projects in these new areas to drive incremental revenue gains that can turn into larger streams as the technology matures and new creative uses are developed. To do this, companies should first improve their own development skills and enhance their information and communication technologies—in other words, upstack—to align them better with value creation imperatives in the new telco landscape.

- 5G Applications as a Network Leader. No matter which markets a telco is planning to play a role in, telco networks will need to be upgraded for a software-defined, cloud-heavy, so-called hyperplexed world. In the immediate future and beyond, this network modernization and expansion will be focused on buildouts of 5G capabilities, which will be required to monetize new applications with huge technological and physical demands. These applications cover a range of company internal and customer-facing critical categories, including virtualization, AI, open access, data analytics, and digitization.

- Next-Gen Operating Model. Each telco has to make the decision of whether they are a service and network company or if it is time to spin off the infrastructure side of the business. The answer is based on each company’s financial, market, and strategic considerations. There are pros and cons to separating and staying together. Splitting into two is complicated and could compromise price premiums for the network segment while worsening competition and harming the service segment. On the other hand, it helps optimize the balance sheet and provide a more transparent picture of network and service performance. Another strong argument in favor of separation is to increase investments in services innovation. Telcos today need so much capex to support their networks that they often can’t invest sufficiently in new digital applications, software development, upstacking, and upselling. By selling stakes in their infrastructure arm via a spin-off IPO or a direct private equity infusion, telcos potentially can free up capital for the services side and realize higher multiples for both businesses than the integrated telco. But for every plus there is a minus to consider; this is a choice that must be made carefully, only after an in-depth analysis of the strengths and weaknesses of the current business model.

- Improve Transformative Enablers. To avoid waste of resources and drive synergy among diverse operations as new products and geographic markets are targeted, telcos need strong and diligent governance procedures, including a large degree of centralized management. Indeed, this is the underlying pillar that enables the other four strategic vectors. To implement these vectors, the corporate culture needs to be more agile than before, adopting rapid product innovation approaches, including fail-fast experimentation and test-and-learn, to encourage creative ideas and continuous product and service improvements. Robust leadership and agile corporate cultures are also essential to ensure being able to recruit creative talent for new initiatives, particularly when there will be unbridled competition from hyperscalers for the most-skilled workers.

For many telecommunications companies, the prospects of achieving double-digit or higher returns may seem slim in the coming years. But when telcos consider the new markets, products, services, partnerships, and customers that are potentially opening up, those prospects are much more promising. Success will depend on speed of innovation, executional excellence, corporate leadership vision, capex availability, and business and operational model creativity.