Executive Summary – Recognizing Strengths, Confronting Challenges, Acting on Opportunities

Norway’s national health care system provides excellent universal health care services to its populace. The development of the life science industry can uplift this existing system in powerful ways, supporting the well-being of Norwegian citizens while also offering a range of economic benefits. With this solid foundation in place, the country is poised to develop its life science industry, which encompasses products and services concerned with human health, including biopharma, medical technology (medtech), and digital health technology—but not including health and care services, such as private hospitals or care homes. Building a stronger health and life science industry is a key political goal in Norway, and may offer significant benefits for the economy, for patients, and for the health system as a whole.

From an economic perspective, development of the health and life science sector can be among the solutions that facilitate the demanding transformation that the Norwegian economy is undergoing. Life sciences is an attractive industry, with high potential for value creation, exports, and enticing, high-paying jobs. It can contribute to diversifying the Norwegian economy. Moreover, it is marked by its resilience—a valuable feature, the importance of which has been underscored by recent global disruptions.

The benefits to patients include access to innovative services and treatments that support good health, longer life expectancy, and fuller participation in the labor force. As for the health system, a well-developed life science industry can improve the quality and efficiency of health care delivery through access to new treatments, additional competencies, and more resources.

The Covid-19 pandemic has demonstrated the importance of close collaboration between the different stakeholders in the health and life science sector. — Ingvild Kjerkol, Minister of Health and Care Services (Labour Party)

However, life sciences is a global and highly competitive industry. Because Norway’s starting point is relatively small, significant efforts will be required to compete. Competition is strong, and several countries are investing heavily to establish a position. The Norwegian footprint is, by comparison, limited in size. Norway does, however, have key strengths it can build on. First, it boasts one of the best health systems in the world, both in terms of health outcomes and access to care. Second, it features high-quality health data sources. Third, there are niches of high-quality research. Finally—and significantly—it has a highly educated population. These strengths can help Norway overcome the numerous challenges that lie before it in terms of developing its domestic life science industry.

First, while Norway has niches of high-quality research supported by high levels of public funding, the return on research in terms of patents and companies is low compared with the other countries in our study. Thus, despite a strong R&D foundation, commercialization has not reached its full potential due to the limited presence of established industry companies with a global presence.

Second, access to risk capital and private funding is limited. Another challenge lies with scaling companies, particularly due to a lack of infrastructure, risk capital, and talent with relevant industry and commercial experience. Again, this is at least partly explained by the limited presence of global technology and pharmaceutical companies that can contribute industrial and commercial capabilities, infrastructure, and funding to the ecosystem.

Finally, a set of cultural barriers—particularly between public and private stakeholders—combine to present other challenges. There is limited understanding among the populace of the need to commercialize health contexts in a manner that will lead to profitability; as such, there is limited dialogue—and, to some degree, mistrust —between public and private parties. This is remarkable considering Norway’s strong public-private collaboration in other sectors.

These conditions combine to set the stage for remarkable opportunity, both for Norway and for life science industry players. As much as the country stands to realize its own benefits from a robust life science industry, Norway could, by putting the right foundation and frameworks in place, create a very fertile ground for international companies as well. By contributing business and industry skills, Norway can in the future drive commercialization of basic research and realize the value proposition of growth in an advanced, highly educated country.

We have identified five key priorities to support the development of the life science industry in Norway:

- Define ambition for Norway’s position in life sciences. The country should set a clear national ambition with regard to how the life science industry can support the health system, and establish a national life science strategy with concrete initiatives and attached funding to prioritize and attract investments to the sector. Likewise, it should facilitate increased ownership of and interest in the life science industry at the political level.

- Prioritize areas where Norway already excels or needs to close gaps. We believe Norway should prioritize therapeutic areas and particular steps in the value chain where the country can excel. Therapeutic areas can be selected based on where Norway has (or could develop) a sustainable advantage; alternatively, they can be chosen based on new fields of research where Norway can invest to kick-start development. Demand from the health system should also be analyzed to guide prioritization. As for the value chain, focus should lie with closing gaps such as the pre-clinical development phase and the scaling of companies. Leaders should steer funding and mandates of public investment arms to compensate for market failures, while expanding the total funding pool for R&D from international and industry sources. Finally, in the academic sector, university curricula should be revised in line with the needs of the life science industry and health system.

- Establish Norway as a global leader for health data access and usage. Norway should clarify its national priorities to improve health data access and use. It should the adjust associated roles and responsibilities of the public institutions involved in developing infrastructure for access to health data, and focus on increasing the involvement of stakeholders such as private companies and health care professionals. It should clarify and provide guidelines for its interpretation of GDPR/data privacy guidelines for the use of health data. Finally, together with academia and industry, it should build and communicate success stories for public-private collaborations on health data.

- Make Norway a friendly environment to attract international capabilities. The country should make efforts to adjust incentives and streamline processes in order to attract international talent and expats. Likewise, it should aim to streamline processes for ethical approval, clinical trial application, etc. Establishing professional networks and cross-industry forums can support companies and talent development alike.

- Break cultural barriers and encourage public-private collaboration. Through dedicated initiatives and incentives, Norway should work to facilitate public-private cross-collaboration. It should revise the public procurement framework to build an attractive home market and collaborations, and establish shared infrastructure to accelerate multidisciplinary research and innovation.

Some sectors need an additional push, where the state can act as a cheerleader and provide policies that enable public and private stakeholders to act as one team. I would say the life science sector is a highly relevant candidate for such a push. — Jan Christian Vestre, Minister of Trade and Industry (Labour Party)

Norway should be clear-eyed about the reality of this endeavor. Because of the nation’s small existing footprint relative to global peers, realizing the full potential of a robust domestic life science industry will take a long time. It will take years to build the footprint required to achieve benefits commensurate with the necessary investment and efforts. Given that other countries are significantly further ahead, it is unlikely that Norway will be in a position to directly compete for the foreseeable future. However, this does not mean that the country should not act now to strengthen the industry and generate benefits. Indeed, there are numerous reasons why we believe it is in Norway’s interest to make efforts to build a health and life science industry. Opportunities to create tangible short-term benefits, such as accelerated exports, is just one such example. The opportunity to accelerate the industry based on health data is another. Importantly, in addition to strengthen Norway’s international position in life sciences, focus should remain on building an industry that can reinforce and contribute to further develop the outstanding health system the country already has.

As we build the health industry in Norway, we must also build an industry that reinforces the strong health system we already have—with equal access for everyone—and at the same time helps to solve some of the major challenges the system has. How can the life science industry help solve these major tasks? — Erna Solberg, Member of Parliament and former Prime Minister (Conservative Party)

Methodology

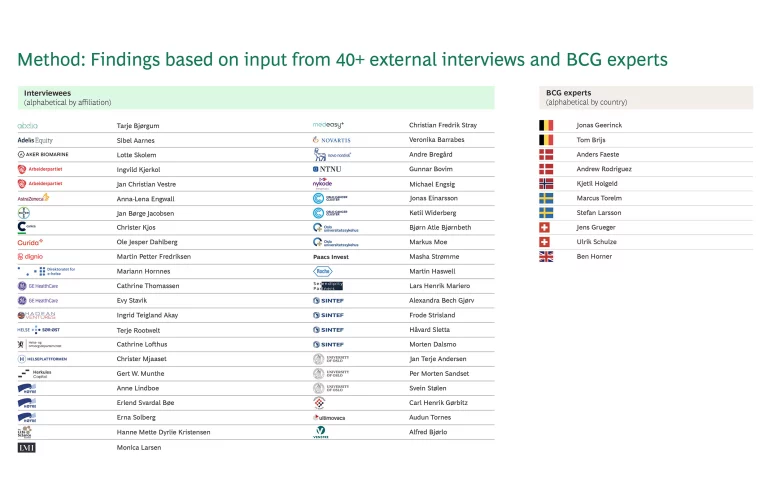

Interviews covered all dimensions required to grow life science companies, summarized in the figure below, which included both biopharma and medtech. Findings were supplemented and backed up with data and analyses from a wide range of sources.

Analysis of Publications, Patents, Startups, and Venture Investments

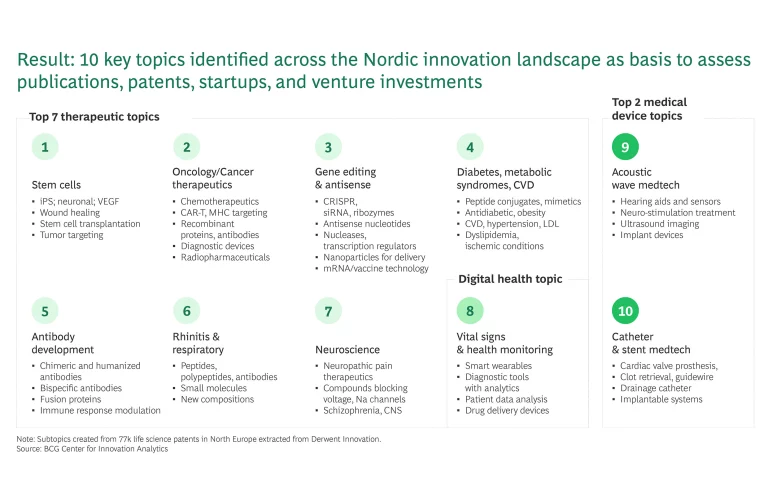

Advanced data analytics capabilities were used to derive insights using multiple innovation lenses such as startup activity/VC investments, patents, and scientific literature. Best-in-class databases and tools were used, including Capital IQ, Crunchbase, PatentSight, and Web of Science. Ten prominent life science areas were initially identified for the study by applying natural language processing (NLP-method) based on the most relevant and prevalent keywords for patents and publications in the Nordics. These 10 areas are summarized in the figure above, and include seven therapeutic topics, two medical device topics, and one digital health topic. We created comprehensive keyword-based search strategies to identify emerging trends in the countries and regions of interest across the ten areas of interest. Each company was mapped to a country using its headquarters, whereas the patents and publications were tagged based on the assignee/author addresses.

Strengths and Weaknesses of This Report

This report was written in anticipation of the Norway Life Science Conference, held in Oslo in February 2023, for which Boston Consulting Group is an industry partner. The views herein represent the authors’ own perspectives and findings, and the report was prepared pro bono.

The report’s strengths are rooted in BCG’s values, high integrity, and breadth of knowledge and insights. BCG was invited based on these qualities, and has had full freedom with regard to analyses and conclusions. Another strength draws from the broad and representative selection of interviewees, including those with deep expertise in health and life sciences, as well as those with perspectives from a range of countries and industries. Finally, the report features a holistic scope, spanning the full value chain and a broad set of enablers.

Potential weaknesses of the report exist insofar as the analyses were based on outside views. Also, several topics could benefit from further investigation, such as the identification of criteria to prioritize areas to build on. The interviews are slightly limited in terms of user perspective, with the main focus placed on decision makers.

Overall, we consider the methodology to be appropriate for the scope and purpose of this report, which was to offer holistic insights into the strengths, challenges, and opportunities that comprise the current life science industry landscape in Norway.