Global inflation and declining real wages have plunged consumers into a cost-of-living crisis. Many consumers in developed markets believe that their own country is already in recession and expect that inflation—which hit 40-year-highs in major economies in 2022—will remain elevated for the next two years.

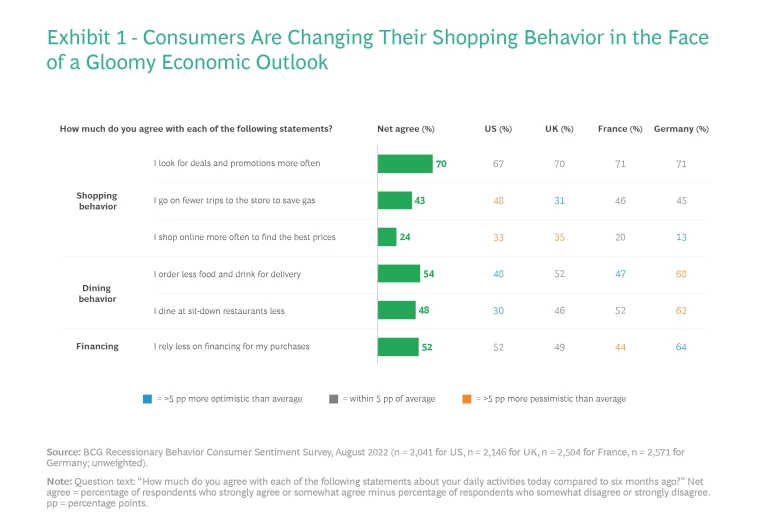

In response, consumers are changing their buying behavior. They are spending more in nondiscretionary categories such as gas, fuel, and utilities, and either spending less or trading down in the discretionary categories such as alcohol, fashion, and cosmetics. (See Exhibit 1.) They are looking for promotions, shopping online to get better prices, making fewer trips to the store, and reducing their leisure expenditures. A decline in real wages in 2022 is reinforcing consumers’ negative sentiments, with the US and the UK reporting real wage declines of 3% and the European Commission forecasting similar declines for the euro area.

Consumer packaged goods (CPG) companies share a lot of this sentiment. More than two-thirds of the companies we surveyed in Q3 2022 expect the same trends to have a negative impact on their volume growth. (See “About the Survey.”) This poses an acute challenge to the way CPG companies generate their revenue growth: how can they find affordable ways to simultaneously serve income-constrained consumers, grow their revenues, and protect their margins?

About the Survey

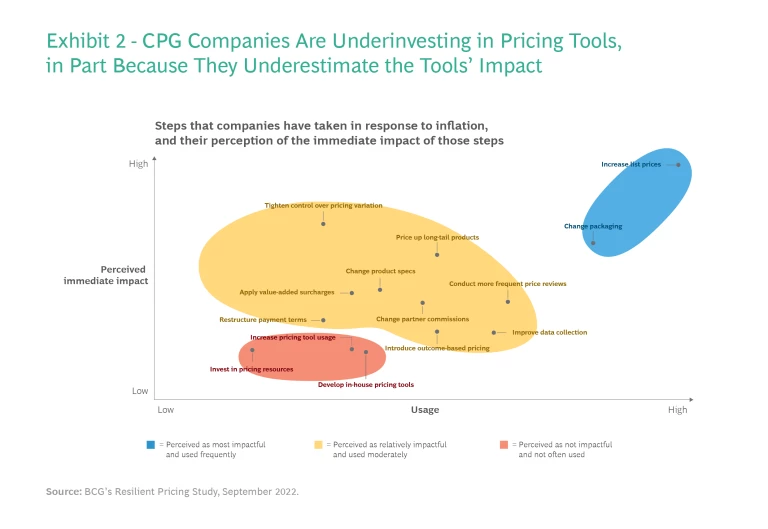

Our survey revealed that most CPG companies continue to address this challenge with the tried-and-true approaches that they feel have the greatest short-term impact: higher list prices and smaller package sizes. (See Exhibit 2.) Approximately 60% of the CPG companies we surveyed have already implemented multiple price increases in the last 18 months. But given the cost-of-living crisis, these measures may be reaching their practical limits, despite the successes of recent campaigns. Downsizing packs, for example, may allow CPG companies to offer affordable price points in the short term, but coming away with less of the same product for the same money is not a satisfactory bargain for most income-constrained consumers.

The limited future potency of these short-term measures helps explain why over 70% of companies in our survey believe that they need to find additional levers to balance growth and profits.

In our experience with socioeconomic and macroeconomic crises during recent decades, we have seen many companies focus too heavily on shoring up immediate results and too little on building medium-term advantage to capture future growth. Yet companies that invest in developing medium-term advantage—in such forms as next-generation digital solutions, advanced analytics, and AI—produce total shareholder returns that are three times as high as those generated by companies that do not.

Through close analysis of the success of these digital and AI-supported efforts, we have developed five imperatives for CPG companies to act on as the current inflationary and income-constrained environment persists. Meeting these imperatives for net revenue management (NRM) will not only provide short-term relief, but also lay a foundation for ongoing competitive advantage.

Five NRM Imperatives for CPGs to Win Today and Tomorrow

To deal with ongoing inflationary and cost-of-living challenges, CPG companies should adopt NRM solutions that balance future perspectives with lessons from the past, cut across company silos, and link NRM with end-to-end efforts to reduce complexity. The solutions should also take customer and category views into account and not be solely inward looking.

Integrate future-facing consumer perspectives. In the past, the norm for forecasting and planning among CPG companies involved projecting a relatively stable past into a relatively predictable future. But the answers to today’s acute challenges lie outside historic price levels and household budgets—and therefore outside the range of the historical data. To understand how consumers would choose at price points and pack sizes not previously observed in the market, leading CPG companies are using AI methodologies to integrate granular analyses of historical data with future-oriented consumer research.

Combining historical and forward-looking data also enables CPG companies to implement differentiated price increases instead of uniform ones. They can introduce de-averaged price changes across brands and SKUs, depending on brand strength, elasticity curves, competitive positioning, and changes in input costs. We have observed that when companies take this holistic portfolio approach, the profit impact is at least twice as high as that of blanket, cost-driven price increases that have been the industry norm during the past 18 months.

Synchronize assortment, portfolio simplification, and value engineering efforts. Most CPG companies rarely address revenue management and cost/complexity management holistically. But in view of today’s challenges, it makes sense for both sides to work in concert with an end-to-end approach.

If companies persist in focusing narrowly on tried-and-true responses to inflation, income-constrained consumers will increasingly trade down to value brands or private labels, switch to discount channels, or stop buying altogether. At the same time, most CPG companies are trying to improve their margins by reducing costs and simplifying portfolios. The current crisis offers a unique opportunity to serve both objectives by reengineering leading SKUs to increase margins and enhance consumer value. By pursuing this approach, companies can reduce waste in their assortment by 30% or more and generate greater value for themselves and for consumers. The key is to address complexity at the recipe, formulation, and packaging levels for core SKUs, informed by consumers’ perceived value and willingness to pay and by recognition of the true drivers of complexity and cost in manufacturing and the supply chain.

Evaluate NRM levers holistically. CPG companies are taking two divergent directions in their strategic planning for 2023. Some companies are significantly reducing their promotional funding, while others are implementing ambitious price increases that they “deal back” through increased use of promotional price points.

Both strategies have merits. To choose the right one, companies need to understand customer behavior holistically with respect to packs, prices, and promotions, rather than looking at each in isolation. Some shoppers can bear modest price increase at the shelf paired with shallower, less frequent promotions; others can bear higher shelf prices supported by promotions that drive incremental volume.

No single pricing tool, promotion tool, or assortment tool will offer the right answer on its own. CPG companies need to integrate recommendations from their point solutions into a unified plan and then apply their own judgment or use platforms that can make tradeoffs and recommend actions across NRM levers.

Take the retailer’s perspective. Most retailers face just as many issues as their CPG counterparts do. To reset and forge new relationships, CPG companies should start by taking the retailer’s perspective. Most CPG companies underestimate how much incremental insight they can offer even their most advanced retail partners by optimizing outcomes for the mutual value pool instead of exclusively looking to their own self-interest. For example, a company’s promotion strategy will change if it considers how promotions affect overall sales at the category level, including cannibalization of store brands and competing brands and overall impact on retailer traffic, instead of focusing on uplifts for their own products in isolation. Because retailers face many of the same challenges as their CPG suppliers, they may be motivated to share more granular data at the SKU or point-of-sale level in support of these efforts.

Clean up inefficient legacy trade terms. When CPG suppliers and retailers have a shared category perspective, they can work together to identify legacy terms that no longer yield value to either party. Relationships between these parties encompass a web of terms and conditions, some of which lose their relevance in a period of volatility. Legacy terms designed to govern promotional funding or secondary placement in more stable times may have less impact and less relevance in a period of multiple price increases, reduced promotional activity, and major changes to assortments. This creates an opportunity to eliminate inefficient and unproductive terms and conditions.

Stay ahead with BCG insights on the consumer products industry

How AI Can Support These Efforts

Customized AI approaches can accelerate a company’s efforts to follow each of the five imperatives discussed above. They can enhance decision making, improve the quality of forecasting, and enable faster responses to unexpected changes. Three advantages of augmenting NRM initiatives with AI deserve detailed coverage. The speed, sophistication, and scale of AI-based tools can boost EBITDA by over 300 basis points when CPG companies use these tools to improve aspects of pricing that have the greatest leverage within their organization.

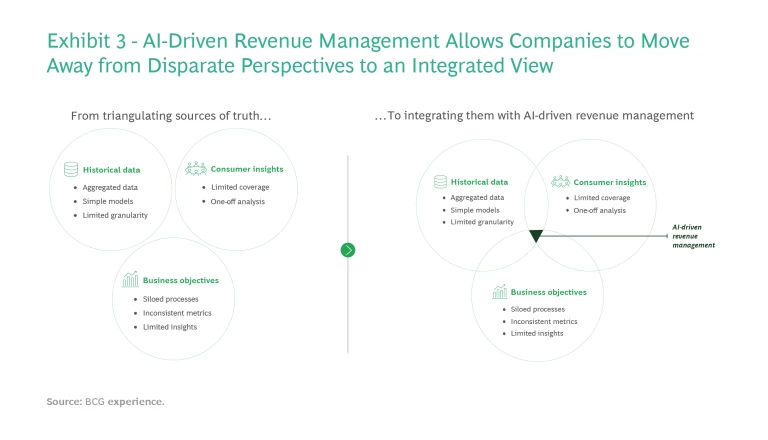

Integrate rather than triangulate. Decisions on pack price or promotional strategy often require triangulation to resolve conflicting results from different inputs. For a particular product, analyzing historical data may yield one optimal answer and assessing consumer research may lead to another, with neither outcome fully satisfying the company’s original set of objectives. (See Exhibit 3.)

AI supports more holistic decision making by integrating perspectives that CPG companies typically treat separately. It helps companies gain a more precise read of consumer behavior by combining future-facing elasticities from market research (for example, from conjoint measurement) with traditional elasticities derived from historical data. It also enables companies to understand tradeoffs better by simulating complex scenarios involving simultaneous changes to multiple parameters, such as pack prices, promotions, and pack sizes.

Optimize rather than diagnose. It is not uncommon for CPG companies to spend 80% of their analytical time on efforts to understand the past—their true baseline, their elasticities, and the like—and then to translate these analytical results into incremental changes to future plans. AI solutions allow these companies to think in the future tense, not just the past tense. By generating forward-looking recommendations instead of ex post facto analyses, AI can flip a company’s commitment of analytical effort to 20% past and 80% future. The overall internal focus shifts from performing diagnoses to defining future recommendations and actions.

Act at the pace of change. The frequency of price, pack, and promotion adjustments has tripled in the past year, and we do not expect this pace to slow in the short or medium term. By using AI, CPG companies can act at the pace of change, introducing a step change in the speed and precision of their NRM decisions.

Debunking Myths About AI-Driven NRM Solutions

In the past, several misconceptions have made companies hesitant to invest significantly in AI-led NRM solutions, despite the advantages we have described. Three misconceptions are especially counterproductive:

- We must have great-quality data before we start.

- We must walk before we run. That is, we must take a sequential approach to building NRM tools, starting with the basics. We can’t leapfrog to more advanced effective solutions.

- AI may quickly become commoditized, thus leveling the playing field and eroding first-mover advantages.

Our experience shows the opposite effects. We have observed that companies can generate value from relatively basic data, which is more valuable than many CPG companies think. And when companies do start generating value from their data, they create incentives for business teams to improve its quality over time. Leapfrogging to state-of-the-art solutions also makes sense, because they generally have the same data requirements as simpler systems but generate more value.

There is definitely merit to implementing basic solutions and gaining quick wins from them. Nevertheless, although the data foundations of basic versus next-generation solutions are largely the same, next-gen delivers a value differential two to three times as high as the basics do. With that in mind, we recommend leapfrogging to next-gen in top markets, or at least building the two in parallel.

Many off-the-shelf AI tools can offer solid results for a given NRM lever, but companies that rely on these standard approaches will miss the opportunity to build fundamental competitive advantage across its NRM efforts. Furthermore, implementing AI is both a sprint and a marathon. Initial sprints to create value build organizational buy-in, increase confidence, and generate funds for additional investments. This effect over time will widen the gap between early adopters and laggards.

Even while debunking myths about AI-led NRM solutions, companies should not underestimate the capabilities, process reengineering, and overall change management required to make advanced AI solutions an integral part of the organization. Investments in upgrading algorithms and enhancing data architecture can be significant, but the biggest challenge lies in convincing the organization to operate in different ways with the support of AI tools.

Ongoing inflation and rising interest rates mean that the acute challenges that CPG companies face—finding affordable ways to serve consumers, grow revenues, and protect margins—are not going away anytime soon. At the same time, the effectiveness of such tried-and-true short-term measures as price increases, promotion reductions, and pack downsizing will decrease as the cost-of-living crisis takes hold.

Our survey indicates that most companies have focused too heavily on the short term over the past 18 months and have underinvested in future capabilities. To correct this imbalance and prepare for a future rebound, companies need NRM solutions that integrate historical and future-facing perspectives, simultaneously evaluate the benefits for consumers, customers, and the company, and encourage their teams to devote more of their time on developing robust recommendations and less of it on diagnostics.