Consumer privacy concerns are putting an end to third-party cookies, and with this so-called “cookiepocalypse” first-party data has become the new battleground for digital marketing. Many retailers are sitting on a fortune of data, yet most neither collect first-party customer data in a structured way nor leverage its full potential. The missed opportunities are massive.

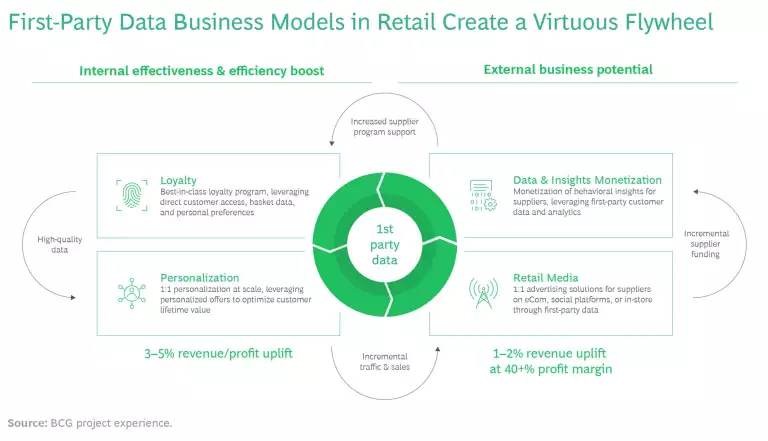

To take better advantage of this asset, retailers should use their first-party data to power four value levers: (1) state-of-the-art loyalty programs that drive engagement and generate high-quality data for (2) personalization of content, communication, and offers. These two levers can open new profit pools with suppliers by offering (3) retail media solutions and (4) by monetizing data and insights. Each lever can drive revenue and profit in isolation, but together they create a flywheel that reinforces each element and turbocharges financial impact. (See exhibit.)

The Power and Potential of First-Party Data

With this flywheel in place, retailers can capitalize on customer relationships like never before. Leveraging their customer data drives revenue and profit in the core business through loyalty, personalization, and commercial decisions around range, space allocation, pricing, and promotions—decisions which will be increasingly AI-driven. In addition, it opens up new opportunities to monetize supplier relationships. For instance, personalization drives the success of a loyalty program and enables advanced audience targeting in retail media, which in turn drives incremental traffic, sales, and supplier spending.

From our experience, a grocery retailer setting up a best-in-class loyalty program to collect first-party data and scaling 1:1 personalization offers typically improves revenue and profit by 3% to 5%. Other types of retailers, such as gas stations or specialty and fashion retailers, might achieve an even higher impact. In addition, this data unlocks new business potential through retail media and data monetization; these usually boost revenue 1% to 2% with a 40+% profit margin (a margin significantly exceeding that of the core business). But to do this, they’ll need to develop new cross-functional capabilities to unlock the full potential.

Designing a Loyalty Program that Engages Customers Across the Journey

Many retailers have longstanding loyalty programs to drive shopping frequency and basket size. Now AI-enabled personalization can make loyalty programs even more effective at lower cost. But leveraging AI for personalization may require creating a new loyalty program or significantly revamping an existing program.

State-of-the-art loyalty programs use various means to engage customers seamlessly across channels (including apps, integrated payment, social media, and Web 3.0) at all points of the customer journey. These programs include offering special subscription models or member prices; generating excitement with gamified challenges or surprise offers; allocating rewards for visit frequency and social engagement; creating immersive experiences beyond monetary benefits (such as member events, metaverse experiences, access to exclusive products or services); and granting tiered or tenure-based rewards for high-value customers.

To kickstart a new loyalty program or to re-evaluate an existing one, retailers should take a series of steps, paying close attention to key decisions for each action.

- Select the customer behaviors the company wants to encourage and incentivize.

- Which changes in customer behaviors would create significant business benefits?

- How can we create win-win situations for customers and the business?

- Decide whether to run a standalone program or tap a partner network.

- How many and which partners will drive the greatest earnings potential and ensure brand fit?

- How do we maintain customer access? Who in the partner network will host customer data?

- Establish a base incentivization mechanism.

- Do we implement a classical “earn-and-burn” mechanism to foster long-term loyalty, or do we reward customers with instant discounts?

- How can we leverage personalization and use both earn-and-burn and instant discounts in ways that appeal to both low-frequency, high-value customers and high-frequency, high-value customers?

- Ensure profitability of the program.

- How can we leverage personalization for more targeted, cost-effective rewards?

- How do we attract supplier funding to cover a significant share of the loyalty program’s costs and co-finance member prices or discounts?

- Carefully consider customer engagement.

- How do we continuously create interest across all touchpoints to encourage customers to interact?

- How should we use personalized coupons, exclusive member prices, frequency incentives, freebies/gifts, raffles, or services such as free delivery?

- How do we ensure a unique customer experience that aligns with our brand positioning?

To power this program, a retailer needs to either build and own the loyalty technology stack or, alternatively, decide which white label solutions to use. Some enterprise solutions offer full loyalty platforms, including loyalty management and offer allocation. There are also service solutions that focus on a loyalty cloud platform and offer services such as hosting. Additionally, niche solutions are available that focus on select loyalty cloud functionalities.

Leveraging Personalization to Stay Relevant to Customers

As noted, retailers need an AI-driven personalization engine to build a strong loyalty program and keep the flywheel humming. For these engines to work, companies must feed the right data into the right analytical models and ensure the correct execution and measurement. They need to continually improve their personalization use cases with a test-and-learn approach and make real-time adjustments with the help of reporting dashboards. Once the proof of concept is established, the company can begin scaling the use case while continuing to monitor and improve it.

But getting personalization right is not just about getting the technology and processes correct. It’s also about changing the mindset behind the offer strategy from a “supply” perspective (What product do I want to sell?) to a “demand” perspective, putting the customer’s interests at the center (What are my customers’ needs and preferences?). This is a cultural shift, which companies can encourage by setting up cross-functional teams with differing perspectives and expertise in marketing, analytics, technology, and category management. These teams should take ownership of the personalization initiatives and take the following steps to get the journey off the ground:

- Set clear goals for the personalization effort and agree on KPIs.

- Start with a specific customer segment within the loyalty program.

- Identify easy-to-implement use cases that engage customers and help achieve the company’s goals.

- Identify loyalty data to power these use cases.

- Set up consecutive “test-and-learn” sprints.

- Measure the impact of the personalization effort on actual customer loyalty.

- Keep refining the use cases and process-based outcomes.

- Once the proof of concept is established, start scaling the use case.

While many retailers have the ability to personalize offers and communicate on a proof-of-concept level, most fail to do so at scale. The key challenge is to build the organizational and technical capabilities to continuously engage with 100% of the addressable customer base in a meaningful way and through a highly automated operating model.

Tapping into New Revenue Pools with Retail Media

Retail media is an advertising business set up by a retailer to sell its own first-party data and advertising space to other companies, such as consumer products suppliers. These ads (designed and targeted using the first-party data) can appear on a retailer’s on-site channels—such as websites, mobile apps, branded emails, in-store digital signage, and social media pages—and also on non-owned, off-site channels—such as Facebook, Google, Pinterest, or programmatic and direct-buy display ads. This is a fast-growing revenue opportunity for retailers. We estimate that global retail media revenue will reach 25% per year to $100 billion over the next five years. Given this growth, we expect that retail media will account for more than 25% of all digital media spending by 2026.

As a source of additional profits, retail media can alleviate some of the growing margin pressure on retailers: we observe on-site margins of 80% to 90% and off-site margins of 20% to 30%. Yet many companies struggle in leveraging this value potential as media is not at the core of the retail business; however, it is easier than many believe. There are various ready-to-use tech solutions available that a retailer can implement within a few months. The key is to get started building a portfolio of media products—with a dedicated team creating and selling the offer—while also ensuring that this team stays closely connected to the rest of the business to avoid conflicts of interest, such as promoting profit-diluting products through retail media.

Success with retail media depends on having substantial offerings across on- and off-site media from the start to improve reach, audience and data quality, cost per mille (CPM), and media spend. In this context, retailers can also offer value-added services, such as creative services, product campaign tests, or a self-service bidding platform. There are a few crucial questions to ask when setting up a retail media offering:

- Define the ambition.

- How big a retail media business do you want to build?

- Which client and products are you targeting for the first retail media use cases?

- Select inventory to reserve for retail media.

- Will most activity be on-site or off-site?

- Which channels and formats, such as sponsored products, have the greatest potential?

- Which value-added analytics and creative services are we capable of offering?

- Define your data strategy.

- What is the breadth of and access to first-party data?

- What additional data needs to be leveraged?

- Determine your tech approach.

- Do you want to build, buy, or partner?

- Be clear and transparent about how to align diverging business interests, especially among retail media, marketing, and commercial teams.

- Set up cross-functional work routines and governance mechanisms.

- Do you have people who can cover sales, media execution, or data and analytics?

- What skills will require retraining existing staff or hiring new staff?

- How will teams work together, especially among retail media and traditional buying / category management teams managing trade marketing budgets?

- Create a roadmap for scaling the technology, organization, and governance necessary to run the retail media business.

Monetizing First-Party Data and Insights

Retailers can monetize data and insights gained from loyalty programs, personalization, and retail media by offering suppliers simple dashboards based on the first-party data being collected, or by offering bespoke customer research that requires the retailer to collect additional first-party data. A few ways to monetize data and insights include:

- Offer a self-service dashboard that builds on the loyalty member base to analyze customer segments, profiles, behavioral insights, and baskets.

- Provide customized, deeper customer insights by surveying specific audiences and loyalty member segments.

- Conduct product tests with small groups of loyalty members.

- Offer product launch tests in-store or online, using loyalty data to identify target audiences, shopping missions, and buyer types.

While data and insights monetization is a viable revenue stream, it is usually not a viable standalone offer. Just “selling the data” does not work. First-party data is most relevant and valuable when it generates insights to drive specific actions.

With customer journeys becoming ever more digital, margin pressures weighing heavily, and competitive terrains shifting quickly, retailers should not delay in leveraging their unique access to first-party customer data. By putting the four-part flywheel in place, retailers can capitalize on their customer relationships like never before.