Finance functions of global companies have not escaped the buzz surrounding the transformative potential of generative AI tools, such as ChatGPT and Google Bard. To see beyond the hype, CFOs need a nuanced understanding of how these tools will reshape work in the finance function of the future.

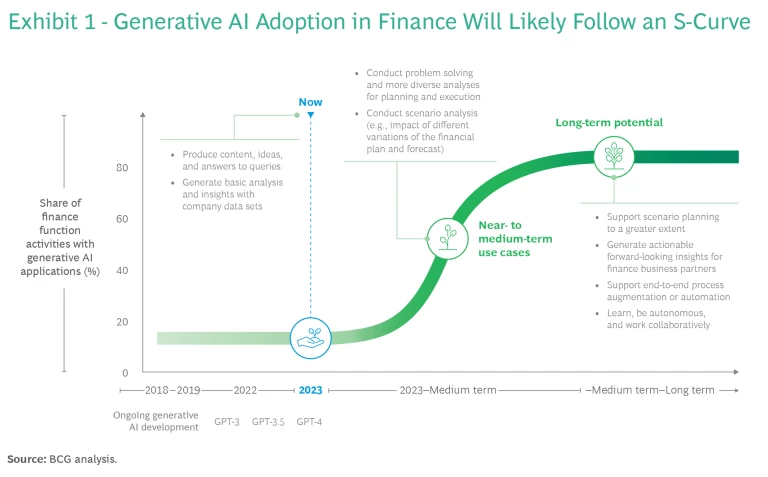

As with other technologies, the adoption of generative AI in finance functions will likely follow an S-curve pattern. (See Exhibit 1.) Currently, finance teams are considering how the technology can augment existing processes by creating text and conducting research. Looking ahead, the integration of generative AI will transform core processes, reinvent business partnering, and mitigate risks. Generative AI will eventually collaborate with traditional AI forecasting tools to create reports, explain variances, and provide recommendations, thereby elevating the finance function’s ability to generate forward-looking insights. The enhancements will empower finance professionals to make more informed strategic decisions, leading to improved operational efficiency and effectiveness.

But, the adoption of generative AI in finance functions entails challenges, including accuracy and data security and privacy. To overcome the obstacles and stay ahead of the adoption curve, now is the time for CFOs to learn about the applications of generative AI in finance functions that will have the most impact and prepare to capitalize on emerging capabilities.

Current and Near-Term Applications Augment Existing Processes

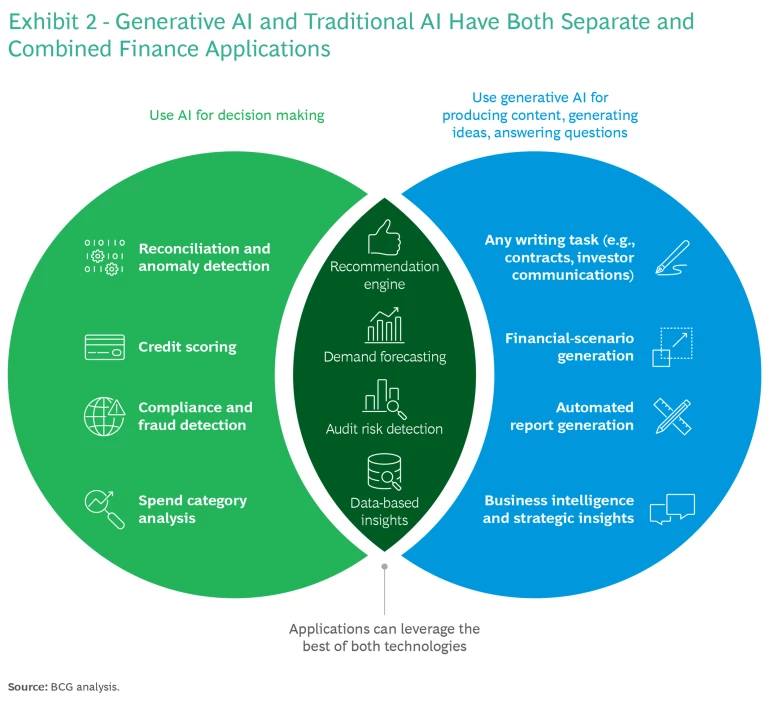

So far, generative AI tools are primarily used to process and generate text and images. Their ability to generate numerical analyses with the accuracy required in finance is still evolving. The tools can perform an initial pass at analyzing limited data sets, but the reliability of outcomes must improve before human intervention is no longer required. In contrast, the traditional applications of AI in finance functions can reliably analyze numerical data for forecasting and risk assessment, among other use cases. Some use cases may therefore be specific to either generative AI or traditional AI techniques, while for others it may be possible to apply the technologies in combination. (See Exhibit 2.)

At present, the integration of generative AI into finance functions focuses on augmenting existing processes through narrative generation and one-off analysis of small data sets. Current and near-term applications across the finance value chain include the following:

- Finance Operations. Creating preliminary drafts for tasks that are text-heavy or require minimal analysis, such as drafting contracts and supplementing credit reviews. (See “Case Study: Supplementing a Credit Review.”)

Case Study: Supplementing a Credit Review

Input. The analyst inputs a process document and prior credit reviews, including supporting customer information, such as company name, website, and other identifiers.

Query. The credit analyst asks the generative AI tool to search for any potential red flags concerning the customer, requesting specific examples of issues such as ongoing legal disputes, business-related concerns, liens, or public disagreements with other vendors.

Output. The generative AI tool does not identify any concerns. Based on this output and an assessment of the information submitted by the customer, the credit analyst determines that the requested line of credit is acceptable and grants approval. If the tool had identified any red flags, the credit analyst would have needed to validate the information before incorporating it into the final credit decision.

- Accounting and Financial Reporting. Offering initial insights for successive iterations of financial statements during month-end closures or assisting with audit trails for reclassification memos.

- Finance Planning and Performance Management. Performing ad-hoc variance analysis of the company’s structured or unstructured data sets (for example, comparing actuals to plans) and creating reports for business partners to explain their unit’s financial performance.

- Investor Relations. Supporting most aspects of the quarterly earnings calls. (See “Case Study: Drafting Responses for Investor Relations Calls.”)

Case Study: Drafting Responses for Investor Relations Calls

Input. The analyst imports data from the current and previous quarters into a spreadsheet formatted to be easily understood. He then copies and pastes the data into a generative AI tool. To give the tool context and help it understand the types of questions to expect, the analyst also incorporates script drafts and transcripts from previous earnings calls. Given current technological capabilities, the analyst needs to input specific context elements and key insights so that the tool can construct more informed commentary.

Query. The analyst asks the generative AI tool to develop a call script (including speaking roles) as well as a preliminary set of likely investor questions and potential responses. He specifically asks the tool to incorporate insights into variances from the previous quarter.

Output. The tool provides the requested content. The analyst formats the content into a Word document and readies it for an initial review by his manager. To help the CFO prepare, he also highlights the questions most likely to be posed by investors.

Tomorrow’s Generative AI Capabilities Will Be Transformative

As generative AI’s ability to accurately analyze large data sets improves and finance professionals become more adept users of the technology, we expect to see a gradual increase in the number of AI-driven “copilots” or “assistants” that operate alongside practitioners. We also envision the seamless integration of traditional AI and generative AI into combined use cases. For example, a traditional AI forecasting tool could produce forecasted financials, while generative AI could explain variances and, more important, offer recommendations on different forecast scenarios and associated business decisions.

As a result, the next generation of finance copilots will empower the finance function of the future in three significant ways:

Transforming Core Processes. An increasing array of generative AI assistants will continually transform core finance processes, such as contract drafting, invoice processing, and general-ledger reviews. (See “Reviewing General-Ledger Entries.”) Initially, focused assistants may improve the efficiency of specific processes by approximately 10% to 20%. However, as tools and capabilities develop, they will augment a larger portion of overall finance operations tasks. Eventually, as use cases expand along the S-curve, generative AI will integrate flawlessly with processes that are currently manual or tedious.

Case Study: Reviewing General-Ledger Entries

During the month-end closure, an accountant reviews general-ledger entries before finalizing the financial statements. She observes that the marketing expense account shows significant activity compared with previous periods. In such instances, the accountant conducts an in-depth review of the general-ledger data to understand the deviation from precedent and to identify any potential errors.

Input. The accountant uploads a record of all marketing expense transactions for the period to a generative AI system. She also submits qualifiers, such as dollar amount ranges and keywords, indicating the types of anomalies to look for in the data that may suggest postings to the wrong account.

Query. The accountant asks the generative AI tool to pinpoint potential entries that might be better classified under different accounts.

Output. The generative AI tool identifies ten questionable entries. Upon review, the accountant discovers that five entries of large amounts should have been posted to other expense accounts. She reclassifies those entries.Reinventing Business Partnering. Generative AI will provide support to the finance function’s business partners. This could encompass insights into financial forecasts, scenario planning throughout the budget cycle, and faster and more comprehensive business intelligence. (See “Case Study: Generating Business Intelligence and Strategic Insights.”) Finance activities that are currently so tedious that they hinder the gleaning of insights can be overhauled to enable rapid and clear insight generation. Pairing generative AI with traditional AI use cases will further enhance capabilities.

Case Study: Generating Business Intelligence and Strategic Insights

A large multinational retailer with hundreds of US outlets develops P&L statements for regional clusters of stores. Internal reporting for each region includes a breakdown of financial data and margins across various business lines. These regional P&Ls are consolidated into a corporate P&L. However, this aggregation process makes it hard for the corporate financial planning and analysis (FP&A) team to construct a coherent narrative of national business performance and deliver actionable insights to executives based on the consolidated data.

Input. To facilitate insight generation, the FP&A team uploads the spreadsheets showing regional P&L statements, general-ledger data, and supplementary data to a secure generative AI tool familiar with similar data sets.

Query. The team asks the tool to provide general insights into business performance, focusing on elements within the gross margin that may have contributed to a recent decline in net income at the corporate level. It also asks the tool to furnish insights for investment strategies or operational modifications that could benefit the business lines.

Output. The tool conducts a comprehensive analysis of the data set and identifies key drivers of performance across the business lines. It delivers a summary of insights for each region, highlighting business lines that are more profitable or are experiencing revenue growth or cost reductions. Analysts on the FP&A team check the accuracy of the insights before sharing them with executives.Managing and Mitigating Risk. Finance teams are already using AI in audit and control environments, such as to identify anomalies that might be indicators of fraud or noncompliance. The next wave of generative AI could go further by predicting and explaining anomalies. The timely identification and communication of the associated risks could prevent undesirable audit findings. (See “Case Study: Risk Identification.”)

Case Study: Risk Identification

A company’s recently received audit findings revealed shortcomings in its control environment that posed a threat of financial losses. In response, the company aims to establish a second line of defense to identify risks before an audit and detect gaps in the first line of defense. However, owing to budget constraints, the finance team has insufficient resources to allocate to this second line of defense. As an alternative, they decide to explore leveraging generative AI to aid in identifying potential risks.

Input. Risk analysts import source-to-pay data—including monthly invoice ledger data and master data information—into a generative AI-powered agent.

Query. The analysts ask the generative AI agent to detect potential fraudulent invoices, duplicate payments, and other issues that were recently highlighted by audit findings as potential risks.

Output. The agent furnishes the finance team with a consolidated list of flagged risk areas that warrant further examination before the audit. With this targeted information, the team can judiciously apply its limited resources to focus on the identified areas.

The Challenges to Adoption

Compared with previous technologies, such as robotic process automation and process mining, the barriers to experimenting with generative AI in finance functions are relatively low. However, several critical challenges must be addressed or managed to fully unleash the technology’s potential in the finance function of the future. Among others, these include:

- Data Accuracy. Generative AI tools, especially early versions, can struggle to perform accurate calculations. Ensuring highly accurate calculations requires diligence in designing generative AI tools. Alternatively, teams can use workarounds to generate content based on calculations performed outside of generative AI tools. These challenges are expected to diminish with continued advancements, as demonstrated by rapidly improved capabilities from GPT-3 to GPT-4, which includes a code interpreter plug-in.

- Leaks of Proprietary Data. When training generative AI models in the public cloud, companies transmit proprietary data that could be leaked in a security breach.

- Governance Model. Generative AI tools lack contextual awareness and real-time information. There is currently no implicit or explicit governance model for output validation.

- Hallucinations. Generative AI can sometimes produce incorrect responses in a highly convincing manner.

CFOs Must Prepare

CFOs cannot afford to stand on the sidelines as generative AI reshapes the finance function of the future and its partner functions, such as marketing and HR. Embracing this technology is crucial to maintaining a cutting-edge finance organization. To prepare, CFOs should take several steps.

Finance personnel will likely find that applying the new technology in real use cases is the best way to climb the learning curve.

Create proofs of concept using available use cases. Initiate adoption with use cases whose barriers to entry are low, such as investor relations and contract drafting. Evaluate and continuously refine the approach for optimal results. Finance personnel will likely find that applying the new technology in real use cases is the best way to climb the learning curve. This iterative approach is essential for cutting through the hype surrounding generative AI and developing a nuanced understanding of the technology’s practical applications and concrete value in the finance function.

Identify and train internal talent. Assess existing talent, identify skill gaps, provide training opportunities, and recruit individuals who are equipped to handle future use cases as they emerge. Ensure that finance personnel understand how generative AI can complement their work and unlock their potential by automating routine tasks, accelerating business insights, and improving operational efficiency. At the level of the individual analyst, the value proposition includes fewer repetitive tasks and keyboard strokes and more time for business collaboration.

Develop traditional and generative AI capabilities in-house. Evaluate whether the optimal approach is creating a center of excellence or embedding AI capabilities into technology teams.

Collaborate with IT. Build a strong partnership with IT to drive successful implementation. IT teams will play a pivotal role in prioritizing generative AI investments and addressing data security concerns surrounding the use of AI in finance function applications.

Champion generative AI. Many of the most important current opportunities reside outside of the finance function. CFOs should work with their C-suite peers to encourage creative thinking around potential use cases that promote cost efficiency and effectiveness. CFOs can also collaborate with financial planning and analysis and business partners to allocate investments to generative AI and incorporate generative AI-influenced cost targets into the business plan.

Generative AI has arrived and is evolving at an unprecedented pace. It currently excels in text generation and is swiftly honing its skills in numeric analysis. Finance leaders must closely monitor AI’s evolution, gain hands-on experience, and develop their organization’s capabilities. Given the comparatively low entry barriers, there is no need to wait for further advancements before initiating adoption. CFOs should embrace this technology immediately, remove any obstacles to adoption in their departments, and encourage their teams to take advantage of generative AI across the finance function.

The authors thank Deep Narayan, Francesca Gradara, Udit Mehra, and Kiran Wali for their contributions to this article.