Women in the US are in search of a better health care experience, one that meets their unique needs during the different stages of their lives. And as the rapidly growing number of startups indicates, companies are racing to address this demand. Leveraging advancements in telemedicine and artificial intelligence, these players are developing innovative suites of services to provide women with comprehensive, personalized care from puberty through the postmenopausal stage.

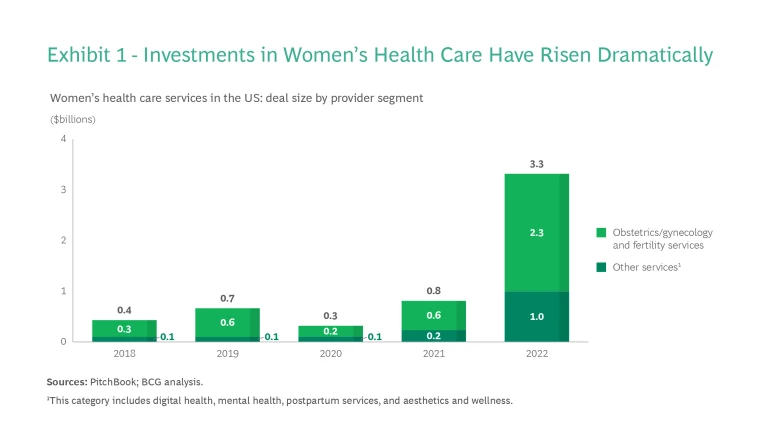

This promising opportunity has not gone unnoticed by private equity firms either. Investment in women’s health care companies in the US surged to an all-time high of $3.3 billion in

We believe that this is just the beginning of what is likely to be a major buildout of women’s health care services. For private equity firms that already own a business in women’s health or are contemplating an investment in this sector, three critical care episodes should be front and center: fertility, pregnancy, and menopause.

The Current State of the Women’s Health Care Ecosystem

For many women in the US, the health care experience is less than optimal. Compared with even a generation ago, women today have many more life paths to choose from—and therefore a wider and more varied array of needs—but the delivery of health care has not kept up. Because the traditional medical system is focused on solving specific problems, it can be a frustrating system to navigate for providers and patients who favor a more comprehensive approach. In addition, a holistic solution is not easy to provide because many doctors lack the time, training, and access to the required infrastructure and resources.

As a result, women looking for more-integrated care are forced to cobble together services from many providers. This challenge holds true regardless of whether the care in question is for a general medical condition such as heart disease or for a more female-specific condition. To take just one example: during pregnancy, women must frequently identify a number of providers to obtain the birth, lactation, postpartum, and mental health services they need. Already burdened with responsibilities at home and at work, many women do not have the bandwidth to navigate this maze on their own.

Over the past few years, women’s health care providers have slowly begun expanding their offerings to provide the suites of services their patients are seeking.

Over the past few years, women’s health care providers have slowly begun expanding their offerings to provide the suites of services their patients are seeking. So far, much of the investment activity behind these provider companies has focused on two segments, obstetrics/gynecology (OB/GYN) platforms and fertility services.

OB/GYN Platforms

Rising demand for a one-stop ecosystem of care—combined with a highly fragmented OB/GYN market—has set the stage for the development of digitally enabled OB/GYN platforms that disrupt the status quo and provide primary care and OB/GYN services under one umbrella.

Investors have put significant money into OB/GYN platforms and multispecialty services, with more than 190 deals in just five years. Recipients include:

- Companies such Unified Women’s Healthcare (UWH), one of the largest national physician practice management organizations dedicated to women’s health

- Tech-enabled firms like Tia, whose comprehensive primary care platform provides women with online and in-person gynecological, mental health, and wellness services

- Maven Clinic, an employer benefits provider and holistic virtual women’s and family health platform

These players are growing quickly, acquiring companies in areas that include maternity analytics, parenting, pediatric care, and menopause services to advance their aim of providing a more holistic experience.

Fertility Services

With many women delaying motherhood, the rising number of gay marriages, and the development of technology and legislation related to egg freezing, the demand for fertility services has increased dramatically in recent years. Numerous companies are striving to meet this demand.

The pace of investment has followed suit. Investment in the fertility services segment is the fastest-growing by deal size. The US fertility services market, which reached $3.6 billion in 2022, will rise at a CAGR of more than 9% through 2026. Core fertility services such as egg freezing, intrauterine insemination (IUI), and in vitro fertilization (IVF) will drive revenue, while ancillary services such as long-term egg donation and storage, genetic testing, and surrogacy will unlock additional revenue.

Innovative companies are already focusing on creating an accessible continuum of care. For example, Progyny provides comprehensive fertility and family-building benefits coverage. Broadening the mindset around fertility as more than a singular event in a woman’s journey will be important to set the stage for Women’s Health 2.0.

Women’s Health 2.0: What’s Next?

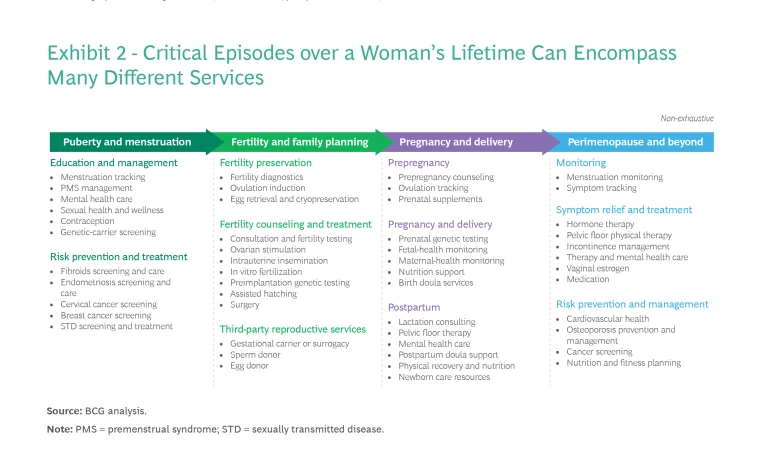

We are at an inflection point where women are ready and asking for more-integrated and holistic solutions for care. BCG predicts that over the next 25 years, the winners in women’s health care will offer patient journeys that are increasingly coordinated, digitally enabled, and personalized. These experiences will be based on two premises: first, every woman has unique health care needs determined by factors such as lifestyle choices, age, and medical history; and second, these needs will change over the course of her life.

To make this level of health care a reality, winning players need to start by building out their services in one or more of three critical life episodes: pregnancy, which offers the greatest investment opportunities, followed by fertility and menopause. (See Exhibit 2.)

Pregnancy Services 2.0

Many women who choose to have biological children find the pregnancy journey difficult and frustrating to navigate. And the burden of vetting and coordinating services more often than not falls on the woman.

The winners in the pregnancy care space will offer a more streamlined experience, one that the patient and the provider codesign.

The winners in the pregnancy care space will offer a more streamlined experience, one that the patient and the provider codesign. After a woman decides to try to conceive, she will go to her OB/GYN platform for guidance on the prenatal journey. Once she is pregnant, the platform will facilitate regular checkups as well as nutritional guidance, mental health care, community support, and prebirth classes. In addition, the platform will provide referrals and continued care for maternal-fetal medicine, genetics, and more. During and after the birthing process, the platform will direct the woman to doulas, midwives, postpartum physical therapy, lactation services, and more.

Companies can realize this vision by creating an integrated set of offerings and developing a more digital and user-friendly patient interface by improving one focused service option at a time. SimpliFed, for example, offers virtual one-to-one breastfeeding consulting, while Origin provides virtual and in-clinic postpartum pelvic floor therapy. Mae connects Black expectant mothers to doulas, birth-planning tools, and other resources. And Partum Health’s platform features a seamless pregnancy experience with virtual and in-person fertility, pregnancy, and postpartum services.

Fertility Services 2.0

Typically, people don’t start thinking about fertility until after they have begun trying to conceive, so their family-planning choices often are limited. Fertility services can be challenging, especially IVF treatments, because they are not only mentally and physically taxing but also expensive given the typical lack of insurance coverage and number of cycles it takes to get pregnant. Compounding these difficulties, when individuals need to use third-party reproduction support solutions like sperm banks, egg donor programs, and surrogacy-matching agencies, they frequently must navigate the archaic and cumbersome process on their own.

The winners in fertility services will address these challenges head-on. Acting as both educators and providers of fertility diagnostic services, companies will proactively inform patients about the fertility services available to them and provide the necessary diagnostic tests so that individuals can learn about their fertility status long before they start planning to conceive. Moreover, insurers will offer coverage of such services to make them more affordable and accessible. Larger, established platforms as well as newer IVF clinics will use AI technology to increase efficiency and pick the most viable and healthy embryo, in turn reducing the number of attempts needed for a woman to get pregnant.

Many fertility services providers are beginning to build Fertility Services 2.0. Some companies, like Ro’s Modern Fertility unit, supply at-home testing kits for measuring hormones and tracking fertility. Others, such as Univfy and Life Whisperer, are exploring the potential of AI to increase the fertility success rate. The company Just a Baby has developed an app that matches intended parents with potential donors, while Nodal’s platform provides donors and intended parents with guidance throughout the surrogacy journey.

Menopause Care 1.0

Traditionally, menopause care has been neglected. Treatment has been limited to hormonal therapy for hot flashes and other acute symptoms—for the relatively few women who were aware that such solutions existed. Today, there is growing awareness of the connection between menopause and everyday symptoms such as insomnia, fatigue, brain fog, and weight gain. Left untreated, these symptoms can lead to metabolic changes that make menopausal women more susceptible to conditions like osteoporosis, diabetes, and heart disease, which can have a costly impact on the health care system. Yet these symptoms are not getting the attention they deserve. Given that the average woman spends more than a third of her life in the peri- to postmenopausal stage, the gap in care is appalling.

The winners in this space will offer treatment for the hormonal and nonhormonal symptoms of menopause, to prevent the negative health effects before they occur. Companies will take an integrated approach, addressing symptoms with proactive customized dietary and lifestyle changes in combination with hormone therapy and regular screening for metabolic health issues. Menopausal women will also have digital access to a community of women and professionals for education and support. Menopause impacts many women who have or are about to assume senior leadership positions while raising children and caring for aging parents. So it is imperative for providers to develop solutions that tackle the problem head-on.

A growing number of companies are already addressing the need for targeted menopausal care. Gennev, a virtual clinic recently acquired by UWH, provides integrated menopause management, with access to OB/GYNs, dieticians, and more. Elektra Health, a digital platform, offers education, telemedicine, one-on-one support, and access to a community of other menopausal women. And apps such as MenoLabs’s MenoLife and Chorus Health’s Caria help women manage menopausal symptoms.

Seizing the Women’s Health Care Opportunity

Clearly, the women’s health care industry is undergoing a massive shift. Personalized, one-stop shopping, digital-forward platforms for specific health episodes will emerge as the winning model.

Making the most of these opportunities calls for a change of mindset, one that puts the voice of the customer front and center. The focus, therefore, should be on developing holistic platforms that provide an array of choices that are tailored to a particular episode and are easy and intuitive to navigate.

Services are just one piece of this opportunity. The rest of the women’s health care value chain also has tremendous potential—from advancements in pharmaceuticals, to significant development of early-diagnostic tools and devices, to new delivery models through Medicaid.

With all these exciting developments, the future of women’s health care is full of promise. And

Note: The companies that appear in this article are just a sampling of the many players developing innovative services in the women’s health care space.

We thank our colleagues Alex Friedman, Natasha Taylor, Derek Matus, Andrea Linares, Hanna Bendjador, and Erica Dalla for their contributions to this article. Special acknowledgment goes to Anula Jayasuriya, MD.