As with any major disruption, change happens slowly—until it doesn’t. We saw this with globalization. We saw this with digitization. And we’re about to see it with climate transition.

Just about everything related to the green transition is accelerating faster than experts predicted. A decade ago, sustainability was championed primarily by those sectors directly exposed to environmental change. Now virtually every business in every industry is developing a climate transition plan. A year ago, only a handful of governments used climate criteria when awarding contracts. Now the entire funding operation of the US government is under an executive order to “buy clean.”

This is how disruption unfurls. Bit by bit at first, then all at once and in all directions. As with prior paradigm shifts, odds are high that some businesses will be caught off guard. Not because changes can’t be anticipated—many can. But because getting ahead of an exponential curve requires a different approach to planning than most companies are accustomed to.

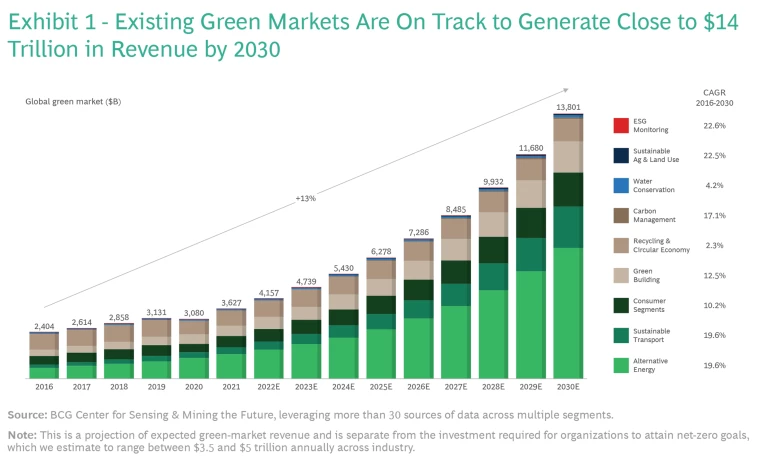

By 2030, BCG analysis suggests that between $13 and $14 trillion in value will be created due to climate transition, with trillions likely to be destroyed from businesses that fail to decarbonize quickly enough and from assets that become stranded. To get on the right side of the transition equation, leaders need to do four things repeatedly and well. They must develop signal intelligence in order to spot transformative shifts early. They must acquire sense-making skills to plot how wealth and influence will shift across their value chains. They must systematize all these capabilities and scale them so their radar and response mechanisms are always on. And, finally, they must move more quickly from consideration of these points to clear and decisive action.

Climate transition will create—and destroy—trillions of dollars in value. Companies must act now to get on the right side of the equation.

Climate Transition Is Heating Up

The green economy isn’t emerging. It’s here. BCG estimates that renewable energy, environmental protection, and other low-carbon goods and services are generating $4.1 trillion in revenues annually in 2022—and growing at 13% annually. (See Exhibit 1.) The first generation of clean energy and clean-tech superstars are rivaling Big Tech leaders in total shareholder returns. And this is just the beginning.

Leaders can plan for disruptive shifts. But making those calculations requires connecting the dots in ways few today are doing well, if at all. To start, take note of three key aspects of disruption.

- The signs are often all around.

Disruption tends to be viewed as a surprise, but it rarely “sneaks up.” It’s obvious in hindsight, for example, that western manufacturers and policymakers were unprepared for how quickly the forces of globalization would rip through their business or how the knock-on effects would impact other sectors. However, while globalization eroded value for some, it opened whole new avenues for others. Sensing the trajectory of change, some planners imagined that outsourcing a company’s operations could be the next logical extension to offshoring manufacturing. Business process outsourcing didn’t exist beyond a handful of entities in 1989. Now it’s predicted to be a half-trillion dollar market by 2027. As trends combine, impacts cascade.

Leaders can be lulled into thinking their business is at a safe remove, and that, mistakenly, today’s baseline performance will extend into the future. But disruption is often industry agnostic, and when powerful trends converge, change can encroach into new areas with ease. For example, it takes only about three steps to get from digitization to the demise of the traditional shopping mall, but few property owners or retail stores made the connection. One trend was the continuous expansion of bandwidth. Another was the meteoric rise in mobile phone adoption. And the third was rapid advances in recommendation engines and personalized online experiences. Each trend was massive. Together, they were an unstoppable force. The maturation and growth in basic e-commerce tools and platforms soon allowed customers to purchase from anywhere.Detailed analysis from a data scientist wasn’t needed to spot these shifts. It only required looking for sources of disruption and following the bread crumbs, imagining how these trends could combine and how the change would impact customers, suppliers, and markets.

The biggest disruptions often lie under the surface.

As value flows, so does power and influence. Disruption has a way of altering the center of gravity, changing the business and social order. Leaders who focus solely on first-order changes or their immediate effects—such as the growing scarcity of lithium for batteries used in electric vehicles (EVs)—may not notice how value creation and profit pools are shifting.The music industry, for example, was caught flat-footed when iTunes came along. Executives thought they were partnering with Apple on the first viable streaming product, something superior to what competing tech companies were trying to build and far more palatable than illicit downloads from sites like the original Napster. What they did not realize until much too late was that they had enabled the means of their own upending, creating a massive distribution platform and ceding virtually all control of it to one entity—Apple. In the decade following the 2003 launch of iTunes, sales of recorded music cratered as consumers jettisoned high-margin CDs for low-margin 99-cent tracks, and Apple’s market capitalization shot up from $8 billion to roughly $80 billion. Now Spotify is challenging Apple, proving that disruption is not a once-and-done game.

While these examples illustrate the characteristics of past disruptions, the climate disruption will have a far more consequential impact on companies and their shareholders—in every sector and geography.

Climate disruption will have a consequential impact on companies and their shareholders in every sector and geography.

Four Steps Leaders Should Take

Knowing how disruption unfurls can help leaders prepare for it. These are the capabilities that companies need to survive and thrive in the green transition.

Cultivate signal intelligence.

In times like these, businesses need to think differently about the data they gather. Instead of one or two dozen variables, they need to gather as many as 70 or 100. In doing so, leaders need to go broad—amassing data on macro factors from the economy, the weather, and the geopolitical environment to climate policy, new and impinging technologies, and so on. And they must go deep—engaging firsthand with customers, suppliers, investors, innovators, and regulators to determine the pace and intensity of potential market shifts. (See “Signal Intelligence Tools Have Come of Age.”)

Signal Intelligence Tools Have Come of Age

Signal Intelligence Tools Have Come of Age

The first is data. Companies can access far more exhaustive sets on everything from temperature and weather to flooding, drought, storms, and erosion. Many of these datasets are open, fed by multiple organizations, and updated in near real time. This data is helping companies create new customer solutions. John Deere, for example, uses climate data to help farmers figure out what crops to plant in which locations to increase their yields.

Business leaders also have more sophisticated models at their disposal, aided by AI/ML techniques that allow planners to ask a rich set of “what if” questions. BCG’s

Finally, companies have significantly more sources of climate-friendly investment capital available. In 2013, investment in environmental, social, and governance (ESG) funds was a mere $418 million in the US. Now BCG analysis finds the

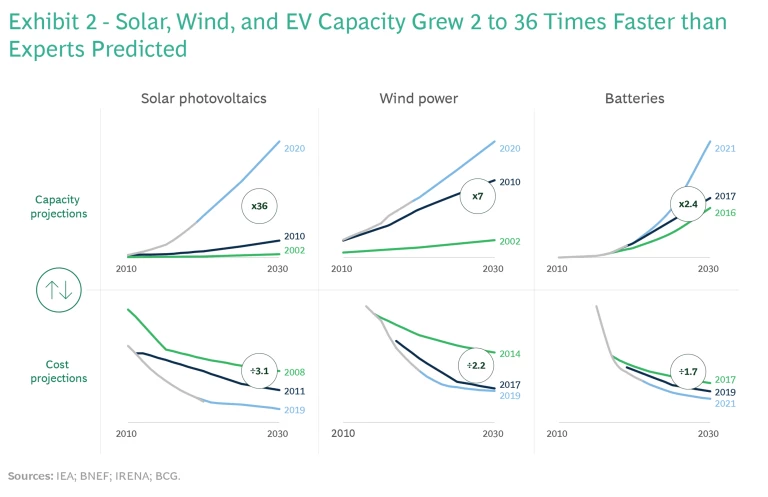

To bake in resilience, companies should also pull in more than one source of data in key topic areas, recognizing that even experts can get things wrong. For example, in June 2022 the International Energy Agency raised its global forecast for renewables growth in what it calls its “largest ever upward revision” for the sector. The agency now forecasts 76% more growth than it did just two years ago. Experts have also consistently underestimated rates of growth in EV batteries, wind turbines, and solar photovoltaics over the past decade. (See Exhibit 2.)

Taking a system-wide view allows companies to understand how different forces are acting on their value chain and in the innovation ecosystem. Is a trend limited to one or two markets? Or is it gathering pace across their supply chain? For instance, some of the most active hotbeds of environmental innovation in the last few years have been China, Germany, Australia, Singapore, and the Nordics—not markets that every company tracks. To avoid being caught off guard, top-performing businesses gather external data for each essential node of the business—from what it does, to whom it serves, to how it sources. And they back this up with stakeholder conversations to gain deeper context and diverse perspectives.

After mastering basic capabilities, some companies turn signal intelligence into marketable products and services. In real estate, for example, leaders have begun to lock up data partnerships that give them proprietary climate insights, which they use to guide their investments as well as to turn into planning tools and sell to customers.

Game out the implications.

Capturing new vectors of information is essential, but not sufficient on its own. Leaders must also excel at sense-making and tracking how value will flow (and erode) across their business, their customers’ businesses, and the economy at large. Artificial intelligence, machine learning, and dynamic visualization software are bedrock tools to enable this—allowing planners to conduct the multivariable, confidence-weighted modeling they need to track trends over time, evaluate the twists and turns those trends could take, and gauge their projected impact.

Most businesses stop once they glean basic cause-and-effect. For example, a prolonged war in Ukraine will make energy more expensive and increase demand for traditional energy as well as renewables. This much is easy to intuit. But businesses can gain advantage through information asymmetry—by looking where others are not. With solar panel sales soaring, for example, demand for key components such as silicon cells, glass sheets, and aluminum frames will increase as well. Most industry observers are probably already planning for this prospect. But what indirect impacts and geographic dynamics might they be overlooking?

One possibility is growth in solar panel trash. That might seem an odd leap to make given today’s skyrocketing sales. But as the cost and efficiency of home systems continues to improve, new buyers are paying less and pocketing more gains than prior buyers. And that benefit might justify trading up. Researchers at INSEAD and the University of Calgary predict the next four years alone will see millions of tons of solar panel waste produced—a reality that few in the industry are preparing for. Right now, for instance, there is only one solar panel recycling facility in the US (and that facility only recycles the panels it produces). What if more companies thought expansively about the opportunities climate transition can enable, focusing on the second- and third-order shifts that others often miss?

By looking at how profit pools and influence will evolve as a result of green transition, organizations can seize opportunities few may be considering, offset worrisome risks, and lock in better yields, pricing, and costs.

Stay ahead with BCG insights on climate change and sustainability

Invest in enabling analysis and ecosystems.

Having aligned on a set of signals and processes, leaders must begin to systematize them. Top of the list should be formalizing protocols for data collection, analytics, and modeling and standardizing tools that enable reuse, including asset libraries, exposure maps, and automated “trend radars” that scan for early-warning indicators.

This foundation can help companies extend their signal intelligence to more business areas and consider dynamic materialities on a market-by-market basis, factoring sustainability data into strategy.

Creating supporting data and analysis ecosystems is equally important. Strategic partnerships can help leaders expand their “eyes and ears,” keep tabs on more trends, and execute against opportunities more quickly. Walmart and Schneider Electric, for example, have launched Project Gigaton, an initiative involving more than 2,300 suppliers from 50 countries that together aim to cut one gigaton of carbon dioxide from the global value chain by 2030 while increasing access to renewable energy.

Investment portfolios must adapt as well. Companies need to get to know and fund the eco-preneurs whose solutions will become the next high-growth markets. Leading companies are already starting to partner with some of these “born net-zero companies” and sponsor the innovation hubs that support them.

Act now.

The most powerful step companies can take is also the simplest: put aside the second guessing and move forward now. There will always be reasons to delay—from policy changes to geopolitics to economic conditions to social disorder. But there are even better reasons to get going. For each risk that climate uncertainty creates, businesses should ask themselves, “What is the opportunity?” If climate maps suggest exposures, leaders can start hedging against them. Where new regulations may come into play, businesses can start adapting their processes and take advantage of the lead time.

Uncertainty is real, but having implemented the above measures, companies should have the confidence to press ahead with investments that can help them build radical advantage, take promising ideas to scale rapidly, and fine-tune aggressively. Bold action to preserve our planet attracts investors, entices customers, and appeals to the next generation of talent.

Climate transition has the potential to be a profound force for good and an equally profound force for value creation. But the clock is ticking. Many businesses have set some form of net zero target for 2050. But trillions of dollars in value could change hands long before then. Success requires planning from the outside-in and from three steps out— looking beyond first-order changes to consider the downstream second- and third-order shifts. Companies that develop signal intelligence will avoid surprises ... and make net zero a net positive.