A combination of pressures and technology-driven opportunities are driving US health care payers to take a long-overdue look at productivity. Payers face near-term margin headwinds arising from providers’ inability to cross-subsidize business lines, while customers and employees are increasingly dissatisfied with inefficient legacy processes and technology. At the same time, the emergence of new productivity-enhancing tools, such as generative AI, and the ongoing adoption of back-office digitization are opening new avenues to gain a competitive edge through enhanced productivity.

To solve the productivity puzzle, payers must thoughtfully apply new technologies and capabilities throughout the enterprise—from product development and care management to billing and claims. To implement an effective productivity transformation program, each payer should tailor the application of five levers, considering its current operational maturity and enterprise strategy. We see four payer archetypes based on operational maturity and enterprise strategy that enable the design of a customized approach to drive productivity.

Challenges Impede Productivity Improvements

In past decades, robust top-line growth has often made it easy to overlook operational inefficiencies and avoid hard decisions. When payers have pursued productivity, they have invested in narrow operational areas, such as enhancing auto-adjudication rates by improving claims rules engines and implementing chatbots in customer service.

Today, however, payers are under increasing pressure to do more with less. The pressure is coming from increasing price sensitivity, impending cost-throughs from providers, and the new workforce. (See “Payers Are Under Pressure.”)

Payers Are Under Pressure

Payers Are Under Pressure

Increasing Price Sensitivity. Several factors are making market growth for payers increasingly price sensitive. As the mix of business lines shifts from employer-sponsored to government-funded plans, payers generally experience greater price pressure. The shrinking proportion of employer-sponsored plans makes it harder for providers to use their revenues to cross-subsidize less-profitable government-funded patients, leading them to pursue rate increases across all plans. Within business lines, payers are seeing more intense competition and greater demands for benefits from individuals, employers, and governments. To provide some of the funding for those benefits, payers need to redirect money from administrative functions. At the same time, employers are striving to curb premium increases to relieve their overall cost pressures.

Impending Cost Pass-Throughs from Providers. Today’s US economy features an anomaly: Consumer prices are rising faster than health care costs. As of February 2023, overall consumer prices rose at an annual rate of 6.0%, versus 2.3% for health care

The New Workforce. As companies navigate this landscape, they are also grappling with meeting the expectations of today’s new generation of workers. The ongoing labor shortage presents numerous opportunities for high-performing employees, who are benefiting from the ease of movement enabled by virtual work. As employees place greater emphasis on experience and work-life balance, businesses must adapt their strategies to attract scarce talent and avoid burning out their top performers. Productivity improvements that shift the balance of work toward more meaningful, value-adding responsibilities will enhance the employee value proposition.

As payers seek to respond to these pressures and advance to the next level of operational maturity, they face numerous challenges, including process complexity, an outdated technology stack, and organizational barriers. (See “Challenges to Operational Maturity.”)

Challenges to Operational Maturity

Challenges to Operational Maturity

Process Complexity. Product offerings have become increasingly complex, with hundreds of plans and permutations. For example, to fully service its local markets, a national payer offers more than 200 products, including Medicare Advantage with Part B givebacks and dental and vision coverage options. A regional Blue plan offers enhanced coverage options for mental health, telehealth services, wellness, and ancillary products simply to compete in the marketplace. Offering these customized products leads to process complexity that raises costs and lowers productivity. It also has necessitated a greater reliance on third-party administrators (TPAs). Several regional Blue plans, for example, are asking their TPAs to handle sales and management related to large group clients, as highly customized offerings can no longer be accommodated within their core business.

To address the complexity, many payers have focused on short-term fixes rather than true redesigns. Measures such as staffing reductions, lean initiatives, and the outsourcing or automation of smaller processes have been adopted to meet targets, but these approaches do not fully address the underlying issues.

Outdated Technology Stack. The outdated nature of technology stacks in the industry is exacerbating the fear of disruption and inhibiting investment in transformative change. Technical infrastructure often includes legacy systems more than 20 years old, coded on mainframe computers, and maintained by a dwindling number of skilled individuals. For instance, some claims systems have been in use for two decades.

Implementing transformative change necessitates adjustments to technology, as well as a willingness to tolerate risks. However, many companies fear that even minor changes could disrupt their IT system and lead to substantial regulatory and operational problems. This “what if” mentality, centered around the possibility of irreversible breakdowns, makes organizations hesitant to adopt innovations.

Organizational Barriers. The size and complexity of payers’ organizations create barriers to transformational change. Challenges related to information flows, organizational structure, and skill gaps highlight the obstacles.

- Information Flows. Many people in payer organizations struggle to access the right information at the right time to make good decisions. Key operational areas often do not share information and knowledge that is valuable to decisionmakers in other parts of the value chain. Organizations frequently lack robust knowledge management hubs, and essential knowledge is often held closely by long-tenured employees (the average tenure exceeds 25 years at some payers) instead of being codified. Compounding the problem, leaders often lack the right KPIs to evaluate operational efficiency. Although they commonly measure costs, they tend not to track the underlying drivers. Consequently, if costs in areas such as claims are high, leaders may be unaware of the specific factors contributing to increased spending.

- Structure. At many payers, the current operational model entails end-to-end journeys that cross multiple departments and affect various lines of business. This approach gives rise to numerous opinions and shadow functions, with no clear owner of the decision rights for process redesign.

Functional duplication is common, owing to siloed operations and a lack of visibility. For instance, contracting personnel may be staffed in market-based teams or central teams. As another example, call centers handling provider issues may operate in multiple locations for various purposes, such as to support onboarding or to answer questions about claims and credentialing. Because of this fragmentation, the organization lacks a comprehensive view of the customer journey. This organizational approach differs significantly from that used in analogous regulated industries, such as fintech and property and casualty insurance, whereagile deployment is becoming the norm.

Deep organizational structures accumulated over time further impede progress. By throwing more personnel at problems, payors create greater distance between leaders and customers, reducing their understanding of opportunities. Operations organizations often have eight to ten layers with low spans of control. For instance, payors may assign hundreds of nurses to utilization management instead of automating or improving auto-adjudication processes. - Skills Gap. Many payers continue to rely on a few IT personnel with the expertise to run aging technology and platforms, while also seeking to attract new experts to manage digital investments across the product, analytics, and care management functions. The understaffing of automation programs causes long delays in starting initiatives and delivering the intended value. Adding to the challenges, technology teams often do not understand how to best serve business teams, while business teams do not know how to make optimal use of new

technology tools . A significant skills gap heightens stress on workers, diminishes the quality of work, hampers employee productivity, and results in a disengaged workforce. This ultimately makes it harder to retain talented workers and hurts the bottom line. Workforce resilience requires continuous investments indevelopment, upskilling, and reskilling through robust talent development programs focused on building skills that help address the productivity crisis.

Five Main Levers for Elevating Operational Excellence

To design a program to meet these challenges, payers should consider five levers:

Rationalize upstream drivers of complexity. To improve productivity over time, give operations leaders a seat at the table when the company considers expanding product lines or entering new markets. Their participation is essential to identify the full costs of the additional complexity. A significant upstream driver of complexity is the desire to meet nuanced customer needs. For example, a payer may offer many similar Medicare Advantage plans to capture small customer segments or offer niche buy-ups for self-funded plans targeting a small group market within select geography. Before redesigning complex process flows, rationalize your portfolio to minimize such upstream drivers of complexity. In aviation, for example, Southwest Airlines’ decision to deploy only the Boeing 737 means that it cannot serve niche consumers or routes; however, it reaps significant operational benefits, including savings on parts and training and gaining the ability to easily use planes on multiple routes.

Redesign end-to-end processes with clear owners. Designate process owners who are accountable for understanding all the process’s nuances and improving the overall process, even the process is not organized around them. These owners should map out their end-to-end processes from the consumer perspective to identify failure points, bottlenecks, handoffs, and governance models. By analyzing and optimizing each step in the process, you can eliminate redundancies, reduce cycle times, and enhance the overall customer experience. Next, consider the right metrics to manage these processes, which may be quite different from those currently used. In e-commerce call center management, for example, an e-commerce retailer has shifted from the traditional metrics of average handle time or speed to answer. It now focuses on minimizing the number of calls, considering that customers are most likely calling because their needs have not otherwise been met. Adopting a similar metric would help to shift payers’ attention to developing enrollment and provider engagement processes and self-service tools that promote better overall customer satisfaction and lower service costs.

Go beyond standard nearshoring and offshoring. Geographic dispersion has long been a valuable way for payers to control costs, but this only scratches the surface of its potential. By strategically leveraging multiple nearshore and offshore resources, you can promote competition among these parties that fosters productivity-enhancing innovations. For example, a leading national health plan used a dual-sourcing model to achieve labor arbitrage and create competition among the vendors to develop use cases that promote the organization’s innovation agenda. To successfully implement this strategy, evaluate the benefits and risks associated with each location, as well as ensure strong communication and collaboration between teams.

Implement automation and generative AI. Advancing the AI agenda is critical, especially as the traditional advantages gained from robotic process automation become commoditized and no longer provide a competitive edge. We see the potential for major advances in AI applications for enrollment, claims, and customer service over the next three years. For example, a large auto insurer deployed an AI-powered “leakage scanner” to identify the most significant payment levers across the claims cycle, such as retrieving relevant documents. The insurer applied this information to design approaches to incorporate data-driven recommendations into claims adjusters’ workflows, which reduced claims payment variability and ultimately decreased payments for the relevant claims.

For payers, such solutions are possible in the near term, as many are creating innovation centers of excellence with technology partners and experimenting with new applications. For example, a regional Blue plan established an open space innovation center to accelerate partnerships across the health care continuum, while a national payer pioneered the application of generative AI by using synthetic data in different parts of its value chain.

Design the right operating model. Carefully design a productivity operating model that promotes the success of your initiatives and ensures that productivity is a long-term organizational priority. To facilitate this, establish a transformation office and clearly delineate responsibilities between this group and the business units to drive new ways of working. These efforts should be guided by a roadmap that sets out how responsibilities for productivity initiatives will transition from the transformation office to the businesses. Finally, embed productivity within existing forums and goals and consistently review progress. Productivity should not be perceived as a short-term, standalone initiative, but rather as an essential pillar for meeting each organizational goal.

Stay ahead with BCG insights on the health care industry

The Key Enablers

Although the levers may seem straightforward to apply, it is hard to utilize and synchronize them to generate value that exceeds the sum of the parts. A set of enablers serves as the “connective tissue” that allows organizations to address interdependencies and promote rapid implementation.

Lay the foundation. Create a cross-functional agile hub that breaks down organizational silos. The hub provides transparency and exposure to the most likely outcomes of cost-reduction initiatives, the required analytics capabilities, and a forum for governance. Sub-teams with content and functional expertise serve as “spokes” that emanate from the hub into core business areas, such as claims, customer service, technology, and care management. The spokes identify improvement opportunities, set targets, and help design initiatives.

To identify opportunity areas, the hub team should evaluate operational functions based on cost, leading indicators, and quality relative to other functions within the organization and those of competitors. For instance, a function scorecard could include cost, quality, and trajectory over time.

The team should not turn a blind eye to quality. When problems arise, whether customer-reported or not, the team should examine them from an end-to-end process perspective.

Fund the effort. Optimizing the end-to-end payer value chain requires steady investments to confront challenges, mitigate roadblocks, and take calculated risks. To make appropriate allocations to operational efficiency initiatives when forecasting and budgeting, it is essential to gain visibility into specific business areas and communicate with their teams. As enterprise-funded initiatives are implemented in a business area, track cost savings so that funds can be recovered by the enterprise as returns on its investment.

To improve long-term pricing and output, optimize the terms of vendor contracts and rapidly remove barriers (such as funding constraints and legacy contracts) that impede the establishment of new partnerships that enable automation and increase access to expertise. Invest in upstream and downstream visibility by developing tools and processes that bring financial rigor to the operational excellence program.

Roll out systematically. A systematic approach is essential for implementing the changes across an organization. This can be achieved by addressing the following time-tested key components:

- Process. The end-to-end process owners, described above, orchestrate incremental rollouts of cross-functional initiatives while avoiding large-scale changes that are disruptive to the business. Use pilot programs to demonstrate value and a path to scalability.

- People. Empower line managers to oversee pilot programs. This is valuable for two reasons. First, their proximity to the operations allows them to address issues more effectively, avoiding the challenges that arise when leaders are disconnected from the front line. Second, successful line managers can serve as strong advocates for change, fostering a culture of continuous improvement and idea generation that feels more organic rather than top-down.

- Technology. Identify the technology changes, including portfolio rationalization, that will achieve a higher degree of interoperability and automation. Many companies can reduce their technology budgets and upgrade their infrastructure to support end-to-end processes by transitioning to standardized technology available in the market today. Use a robust vendor selection process to find the best technology partner. To limit business disruptions, look for ways to build customized automation on top of legacy systems, so that the old technology stack can be retired incrementally while migrating to new systems.

Use Four Archetypes of Operational Maturity to Tailor the Program

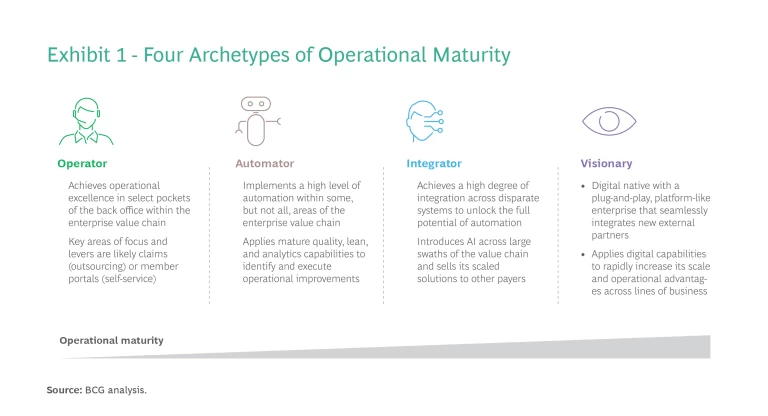

To devise a tailored program for applying the levers and establishing the enablers, each payer must understand its current level of operational maturity and identify its aspirations for improvement. Our research identified four archetypes of payers with respect to their operational maturity. (See Exhibit 1.) They are:

- Operator—excels in select pockets of the back-office operations.

- Automator—comprehensively digitizes specific areas of the enterprise.

- Integrator—connects disparate systems to fully automate operations.

- Visionary—digitally adept from the outset, with a flexible, platform-like structure.

To determine which archetype to pursue, a payer must define its enterprise strategy and what it needs from operations to support the objectives. For example, a regional payer seeking to maximize cash flow for investment may select the operator archetype to reduce costs while bypassing a broader transformation. In contrast, a large national payer that aspires to holistically own its value chain, including numerous providers, will likely strive to be an integrator across a wide array of assets, processes, and go-to-market channels.

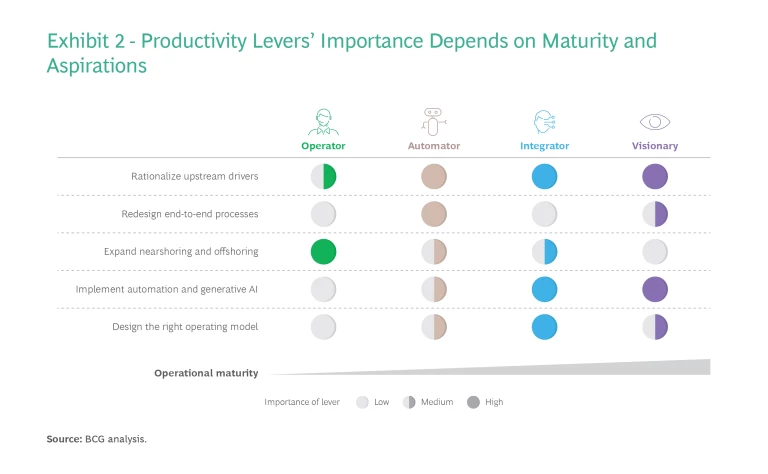

Selecting the archetype allows a payer to prioritize productivity-improvement levers and determine the intensity with which to apply each one and the optimal sequencing. (See Exhibit 2.) This provides the basis for designing a fit-for-purpose, customized program to boost productivity.

For example, a payer achieved a highly ambitious cost-reduction target of more than $1 billion by designing its transformation journey from automator to integrator. In addition to integrating automation across the ecosystem, the company emphasized redesigning end-to-end processes and rethinking nearshoring and offshoring to rapidly accelerate its operational maturity. Internal technology teams worked hand in hand with business unit teams to modernize technology and launch pilots that accelerated the integrated adoption of automation.

A confluence of challenges and opportunities has made it imperative for payers to improve productivity. To elevate their operational excellence, payers need to harness the power of technology and digital assets and adopt a productivity-centered mindset. The improvements will boost profitability, enhance the customer experience, and heighten employee engagement. To succeed, each payer must identify its operational maturity archetype and execute a tailored productivity transformation that fosters efficiency, growth, and sustained improvement. Payers that master the challenges will promote their competitiveness in today’s price-sensitive market and, ultimately, unlock long-term enterprise value.