The entire $3 trillion, 150-year-old automotive industry is shifting to a connected, electric future. And it is doing so faster than many believed possible. By 2035, electric vehicles (EVs) are expected to constitute 60% of new vehicle sales worldwide.

To meet this challenge, many leading automotive players—both carmakers and suppliers—have announced bold visions for where they are headed. Carmakers are either planning or already implementing the following: a complete shift to EVs, becoming EV-first while maintaining a strong internal combustion engine (ICE) business, or spinning out new EV-only business. Suppliers, too, are forming new EV-oriented partnerships, undertaking M&As to move up into software, consolidating operations, and pivoting their portfolios to emphasize electric and electronic offerings.

As ambitious as these visions and moves are, both automakers and suppliers run the risk of transforming their structures so quickly that their operating models, talent pools, ways of working, and corporate culture simply can’t keep up. In our experience, they are struggling to make the changes needed to benefit from their structural transformations and reach their EV goals.

Automotive players run the risk of transforming their structures so quickly that their operating models, talent pools, and corporate culture simply can’t keep up.

To succeed, automotive players will need to exert more effort to address gaps in the key areas that, if left unaddressed, will lead to a bumpy transition to EV—regardless of how clearly the endgame is defined.

A Complicated Journey

No matter which structures auto players choose to pursue, they face four complicating factors that are making the transition to EV particularly difficult: the degree of change needed, the vastly expanded scope of business activities that must be managed, a scarcity of needed talent, and organizational change fatigue.

Degree of Change

Automakers are well aware that the coming transition isn’t just about making more connected, electric vehicles. It’s about reinventing themselves to look and feel much more like technology companies. This requires rethinking every component of their operating model. In pursuing this goal, however, automakers have fallen into a few traps. Simply overlaying changes on top of their legacy models rather than redesigning the structure for the future only drives complexity. Neglecting key elements of the new model, such as ways of working and talent, leaves major gaps in how the new system operates. And limiting transformation efforts to legacy organizational silos, such as engineering, operations and sales, makes it difficult for functions to interact with each other.

Expand Scope of Activities

On the surface, EVs offer a golden opportunity to simplify operations: less complex interfaces, fewer mechanical parts, and online purchasing of cars, among other factors. Yet automotive players must continue to deliver traditional systems such as seating, chassis, and safety even as they take on new domains of activity like software development, battery cell manufacturing, and advanced driver assistance systems (ADAS). That means rethinking how they manage software and learning to work with partners—especially technology players.

Scarcity of Activity

With the shift to EVs, the expanded scope of vehicle offerings, and changes to insourced versus outsourced capabilities comes a massive need for new and refreshed talent. Over the course of the coming EV transformation, the US auto industry alone is expected to need more than 115,000 people with new skills such as data and analytics, artificial intelligence, systems thinking and sales of services, EV engineering, automation and robotics, and a variety of new blue-collar skills on the shop floor. Yet demand for talent is expected to be six times greater than the supply.

Organization Fatigue

Automakers have faced persistent headwinds and uncertainty over the past three years due to the COVID-19 pandemic, a shortage of chips, and supply chain disruptions, among other factors. In response, they have already undergone multiple transformations and cost-cutting efforts in an attempt to preserve the integrity of their operations and margins. The strain of the coming transformation to connected EVs is only adding to their stress.

Where to Focus

To overcome these obstacles to a successful transition, automakers must address three key areas: refreshing the operating model, reimagining talent, and changing the organization culture and behavior.

Refreshing the Operating Model

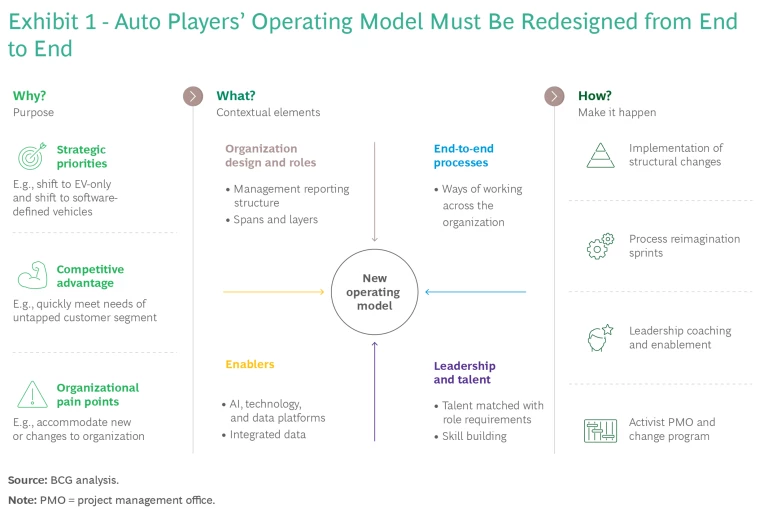

Auto players can use the transition to the electric, connected future as a catalyst to rethink how they’ve always done business. They can break through traditional development roles and increase speed to market, look at new ways to build and maintain direct relationships with customers, and streamline their production operations while gaining more visibility into an increasingly complex supply chain. To do this successfully requires the discipline to completely reimagine the operating model. Exhibit 1 outlines what such an approach could look like.

As auto players start to tackle these fundamental operating model issues, they must keep five key design principles in mind.

Subtract and Simplify. As the scope of activities required of successful automakers has expanded to include software, battery design, and the monetization of services and data, the addition of new groups and processes has increased complexity and interfaces. In the past, for example, sourcing a radio required automakers to interact with just a few suppliers. Today, however, they must manage across hardware engineering, software design, and external hardware providers. This means making decisions on a range of issues: Who has ownership? Who decides on the specifications? Whose timelines should be followed? Indeed, the decision-making process itself should be rethought. One company, for example, used a simple design parameter to test new operating model designs: How many people do you need to talk to in order make a decision?

Shift to “Systems Thinking.” Long accustomed to organizing capabilities within functional silos, automotive players now need to develop a far more overarching, cohesive model. Moving to a “systems” mindset requires end-to-end product ownership and decision rights. For example, product teams must no longer think about cooling the engine, cooling the electronics, and cooling the passenger cabin as separate activities and individual components. Instead, they need to think about the “thermal system” and break down the elements it is made up of to arrive at a more elegant solution that cools the engine, electronics, and cabin while becoming cheaper, lighter, simpler, and updatable with software. To get there, they must empower leaders with end-to-end accountability across the enterprise. They must also reimagine the product lifecycle management process to seamlessly integrate multiple stakeholders and inputs, including the software, hardware, and all partners, and reset the definition of success to break down functional loyalties.

Rethink Governance for Continuous Delivery. The auto industry’s operating model used to be defined by the “model year” approach. Automakers were good at defining and meeting stage gates, and it was clear who was responsible for what. Today, automakers are entering a world of continuous delivery that demands ongoing releases of both software and hardware. When Tesla improves its software, the company doesn’t wait for the next model or mid-cycle refresh, but instead releases it over the air in a regular cadence. This requires more nimble governance mechanisms that allow for continuous synching, including real-time dynamic capital allocation processes, “product boards” to ensure consistency across groups, and real-time dashboards that provide constant updates—especially as some automakers choose to expand the scope of what they develop.

Refresh Performance Management. Traditionally, auto players had straightforward, well-defined KPIs, such as cycle time, equipment efficiency, and on-time delivery, that followed a clear timeline. But in a world with cross-functional product development and continuous delivery, many of the old KPIs are no longer relevant. What matters now are installed base, attach rate of post-sales products and services, second owner activations, and over-the-air software updates, not simply how many cars are sold. To reward the right behavior, automakers need to redefine what success looks like. Different parts of the organization will require different success metrics; makers of EVs may prioritize customer lifetime value while the legacy ICE business continues to focus on operational KPIs. Companies will need to adopt a thoughtful, de-averaged approach to their definition of success, and align their production KPIs with the frameworks they use to assess their people.

Embed Technology. Most automakers are working hard on various elements of technology, such as data platforms and analytics, and greater factory automation. Yet there is an opportunity to dramatically increase even further the use of these technologies, making them core to the operating model. Currently available artificial intelligence and machine learning solutions, for example, are still being deployed piecemeal by automakers. But they should look to deploy AI at scale to assist with transactional activities, such as processing invoices, booking general ledger entries, scanning invoices, and the like.

Reimagining Talent

Automakers must deal with the growing scarcity of the right talent as they reinvent their organizations and scope, but relying on hiring to fill the gap will not be sufficient. OEMs and Tier 1 suppliers must begin to diligently shift their efforts to attract, retain, and train talent with new skillsets. With surveys showing that 98% of industry CEOs reporting that talent and skills are among their top three priorities, companies are fully aware of the growing need.

Yet all auto companies are struggling with how to tackle the problem. What specific skills should they recruit for? Where from? How should they evolve their employee value proposition? And how can they retain and develop the talent they do hire? Answering these questions requires an integrated talent strategy.

New Leadership. Automakers will find that upskilling current leadership or bringing in new leaders from industries such as technology and gaming can jump-start their talent transformation. Consider Ford, which has hired a sizeable portion of its senior leadership team from leading technology players, including Apple, Tesla, Hewlett-Packard, and Amazon. Whether appointed from inside or out, these leaders will need to be equipped for a new style of management, managing far more engineers than technology companies typically employ, across both mechanical and digital realms, and blending them into the institutional knowledge and culture of the automotive sector.

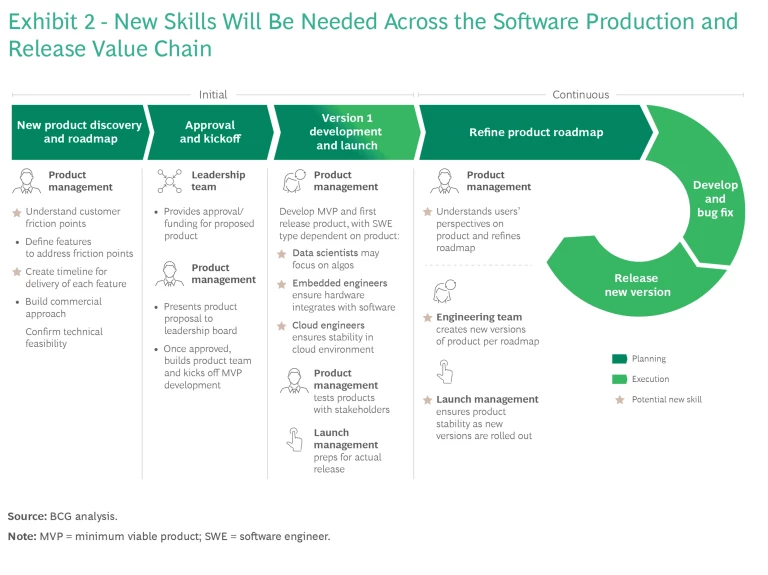

More Multidisciplinary Thinkers. While auto players are catching up on identifying next-generation technical skills, they must also keep up with the paradigm shift from technical expertise to more “T-shaped” skills profiles, with both deep technical expertise and cross-functional skills. For example, engineers will need a strong foundation across physics, data science, programming, machine learning, and AI if they are to innovate across a range of increasingly common integrated components such as ADAS and advanced connectivity systems. Exhibit 2 illustrates many of the new customer-centric, data engineering, and design skills needed throughout the product lifecycle.

A Multipronged Approach to Hiring. The talent gap is too big to overcome simply by hiring more people. Automakers will need orders of magnitude more talent in some areas—and less talent in others—and so must take a de-averaged approach to talent acquisition. In occupations where more talent is needed, such as digitization, teams must deploy a range of levers to expand their talent acquisition processes, and funnels. These include “building” talent internally, “bot-ing” or automating away work (as is already happening in many production facilities), “borrowing” contract workers to fill niche skill gaps, and “bulk buying” through M&A. The right answer to these resourcing strategy decisions will depend on the organization’s current baseline skills and anticipated needs.

Ways of Working for Retention. Acquiring talent is hard, but rewiring the operating model to keep them can be just as difficult. Automakers, particularly legacy players transitioning away from the “old school” practices of long-standing OEMs and Tier 1s, will need to change their ways of working and adopt new policies, such as more flexible career paths and more agile teaming models, to avoid “organ rejection” of hard-won talent. Consider, for example, the far more rapid cadence of technical upskilling or the expectations for decision-making speed at companies like Apple and Google compared with legacy OEMs. These are table stakes for the right talent, and automakers need to invest to keep up.

Distinct Operating Models, One Purpose. Many organizations try to find the right balance between separating and integrating “OldCo” and “NewCo” operating models—whether to maintain distinct ways of working, tools, and technology in recognition of different production processes. This approach, however, risks the organization getting stuck in an interim state that can erode the employee value proposition on both sides. Employees focused on ICE production may feel devalued if they have less growth potential or compensation than EV employees, while EV employees may feel hampered by the old ways of working on the ICE side of the business. To avoid this outcome, organizations must ensure that all employees maintain a shared sense of purpose and collective success, and actively cross-pollinate high-caliber talent across business units.

An HR-Business Partnership. To succeed, HR must work side-by-side with business leaders to ensure the talent transformation is deeply integrated with strategic priorities, with ready access to funding and resources. HR leaders can also turn to third-party partners across the human capital management ecosystem to augment their talent-building efforts and free up more time for higher-value-add work.

Changing the Organization Culture and Behavior

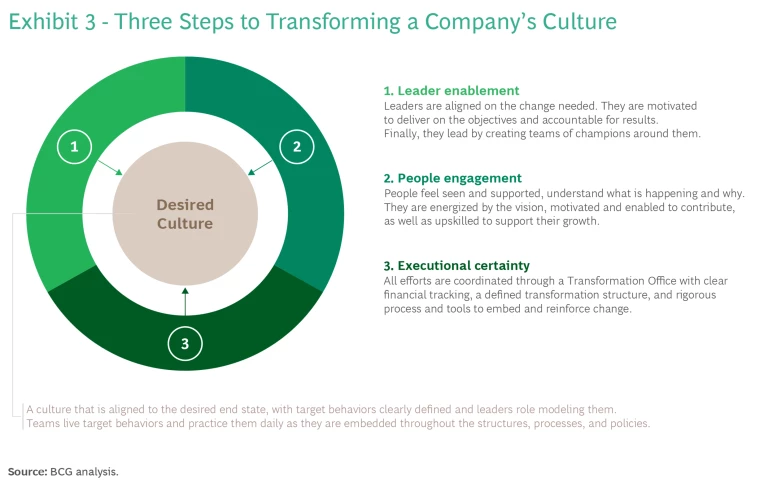

Regardless of the strategy, structure or organization model automakers choose, the EV transformation will require a massive shift in culture, behavior, and people engagement. None of these changes will happen by magic. Given that only one in four transformations succeed over both the short- and long-terms, the odds are stacked against transformation leaders who do not embark on a change journey with a strong plan to deliberately change culture, anticipate and overcome behavioral obstacles, and thoughtfully engage their people. Achieving the desired organization culture requires leader enablement, people engagement, and executional certainty. (See Exhibit 3.)

Desired Culture. Make a purpose-led case for change: take bold steps to reimagine the culture and behavior of the organization around EVs instead of traditional ICE operations. This is especially important for companies that choose to integrate or accelerate EV development versus spinning it off or splitting it out. Through these changes, there are fundamental shifts in human dynamics that need to be managed as workforces begin to identify with the organization’s new purpose.

Organizations that previously lived their culture through a focus on creating the largest and most powerful motor vehicles must now shift to small, smart, technology-driven precision. As they do so, leaders need to ensure that their people see as much of themselves in this future as they did in the past.

Companies should seize this opportunity to use EV transformations as a catalyst to implement a high-performance culture, one willing to accelerate and centralize product development, adopt agile ways of working, automate manufacturing, and introduce new enhancements to software and electrical architecture development. Ultimately, using the shift to EVs to fuel performance improvements for the business will go a long way to positively changing traditional ways of working.

Stay ahead with BCG insights on the automotive industry

Leader Enablement. Organizations need leaders who can shift their mindset to focus on the future needs of the company and be honest and clear about where ICE fits in future operations—another key factor in transformation success. To disrupt traditional ways of working, leaders need to take bold steps to live desired behavior shifts and reinforce the new culture. For instance, for companies which will remain reliant on ICE for key offerings in the near term, leaders need to maintain a unified front for how they speak about the future of ICE operations and how EVs will scale within the business. Visible demonstrations of collaboration and support, such as town halls, common meetings, and parity on the organizational chart, will help minimize feelings of alienation and highlight that while there may be very different capabilities, speeds, and products in each business, they are ultimately working to build the same vision.

People Engagement. In embarking on transformation journeys, automakers are working with a double-edged sword. They have strong, distinctive cultures, in many cases developed and nurtured over many decades. These cultures provide a strong foundation on which to build a shared agenda. Being a part of a strong culture is often a reason why employees join these companies in the first place. On the other hand, these cultures are notoriously difficult to change.

Successful execution of automotive players’ EV strategies hinges on equally bold transformations to their operating models, talent strategy, and culture.

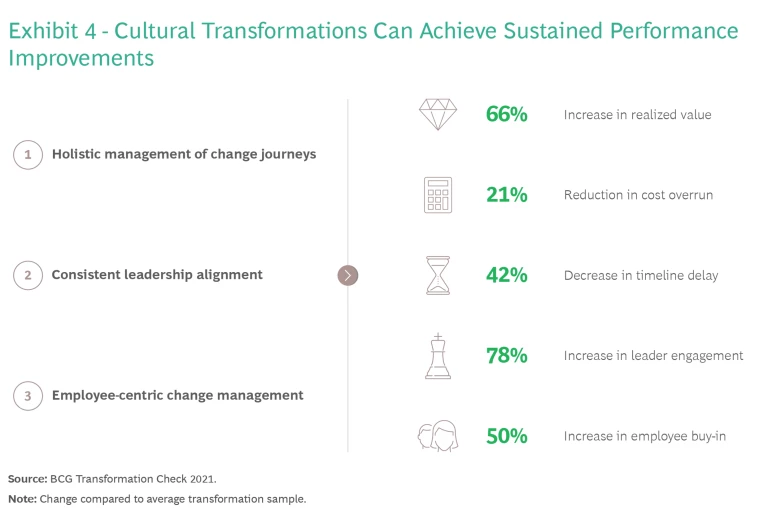

Attention to the human element is a key factor leading to transformation success. As Exhibit 4 shows, employee-centric change management can help improve realized value by 66%, and employee buy-in by 50%, compared to average transformation efforts. (See Exhibit 4.)

Executional Certainty. To drive accountability and achieve the expected impact of EV goals, organizations should empower a Transformation Office responsible for developing and driving the end-to-end implementation roadmap for the shift to EVs. Having a dedicated team will drive the pace of transformation, prioritize and sequence initiatives, and reduce the risk of siloed operations that can negatively impact production and coordination between business units.

The tactical activities to support a move to an electric, connected future are not easy, but they are necessary for OEMs and Tier 1s to ensure their continued existence. From the pressures of environmental concerns to the increased competition between startups and legacy OEMs, a successful transition to electrification is becoming increasingly vital.

Many automotive companies have taken the necessary steps to declare targets and develop the strategies needed to complete the shift to EVs and software development excellence. No matter which strategy they turn to, successful execution ultimately hinges on equally bold transformations to their operating models, talent strategy, and culture.