Life insurers are navigating amid significant change. Demand has grown to unprecedented volumes, with near record-breaking premium levels in both 2021 and 2022. Moreover, demand is expected to remain strong. According to the 2023 Insurance Barometer Study, a report published by LIMRA and Life Happens, more than 100 million adults in the US don’t have enough life insurance.

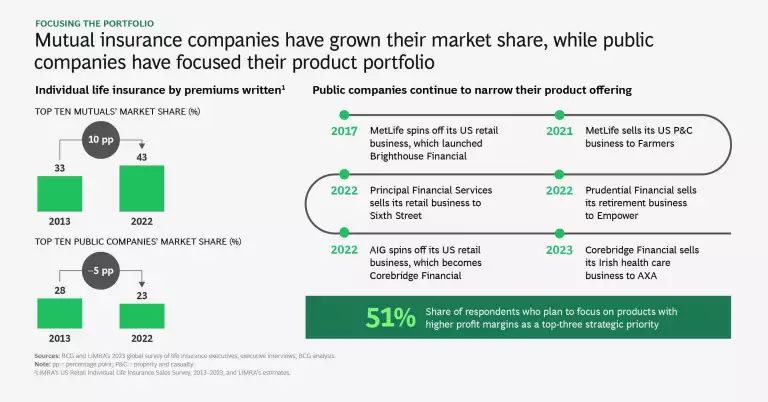

Meanwhile, interest rates and the yields on ten-year US Treasury notes are back at levels not seen since before the global financial crisis, creating an attractive environment for insurers to grow in the US. The top ten mutual insurers are in a particularly good position after expanding their share of the life insurance market by 10 percentage points from 2013 through 2022. They now control about 43% of the market.

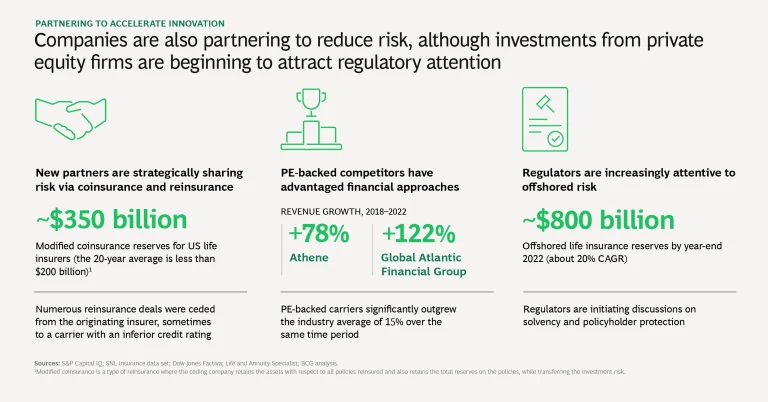

Perhaps one of the most interesting developments is that private equity (PE) firms now own or control 137 insurers, up from 89 in 2019. PE-backed insurers have taken a particular interest in annuities, which saw historically high sales of $312.8 billion in the US in 2022, propelled by higher interest rates and market volatility. Those sales were 18% higher than the previous record of $265 billion set in 2008.

It was in the context of an increasingly complex and vigorous market that BCG and LIMRA conducted the third edition of the biennial survey of life insurance executives. The slideshow presents the results of the 2023 survey, providing insights into the highest priorities and concerns of life insurance leaders.

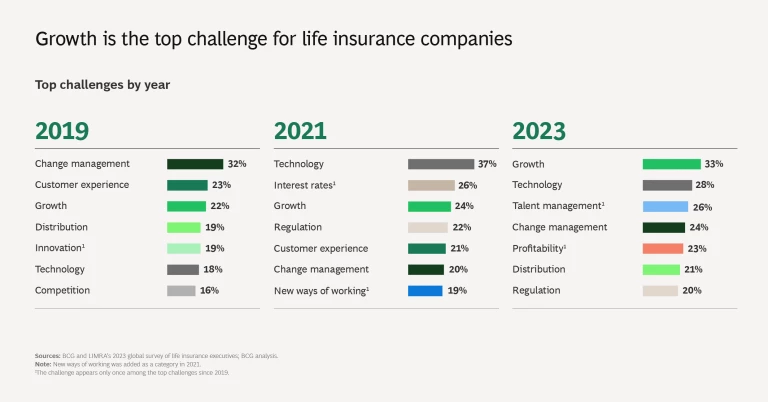

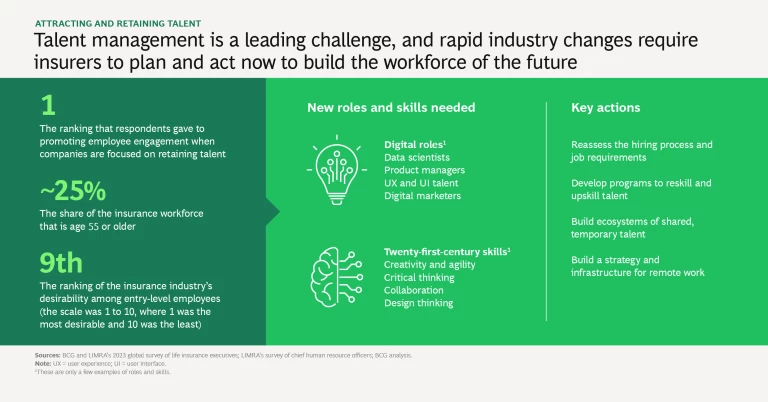

Growth topped the list of challenges, cited by 33% of the respondents. Last year’s top challenge, technology, dropped to second place, cited by 28% of the respondents. In interviews, executives mentioned a broader set of emerging challenges, including macroeconomic uncertainty, the disruptive potential of new tools such as generative AI, and complex talent dynamics that have moved to the forefront of their strategic focus.

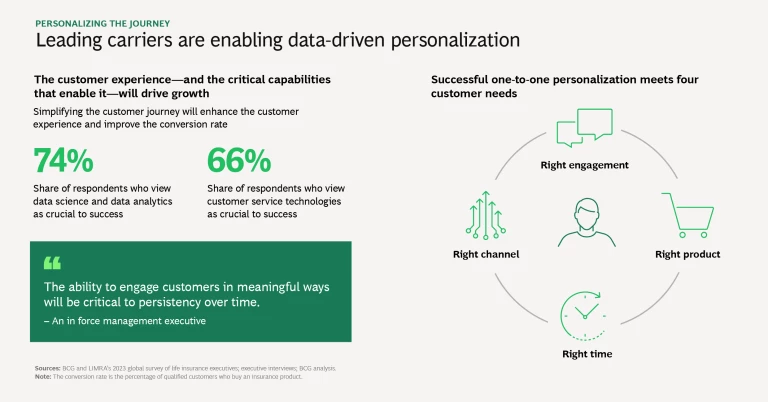

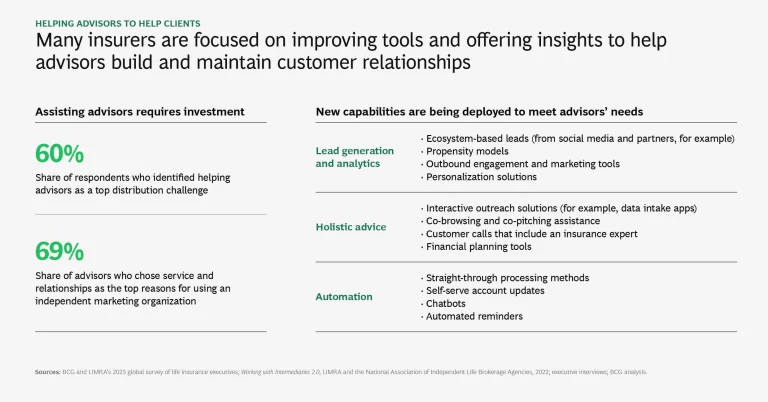

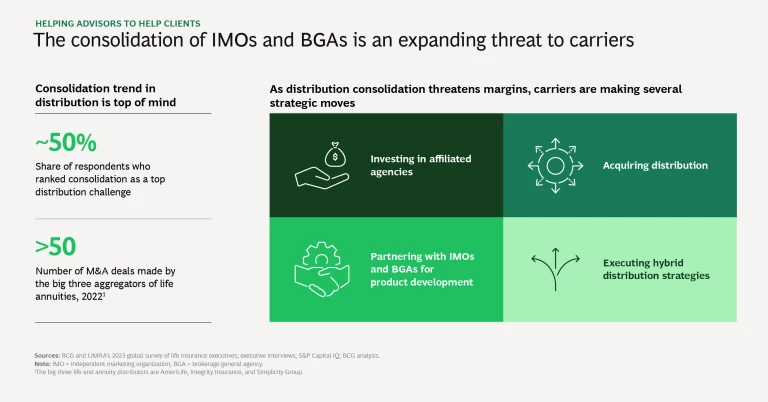

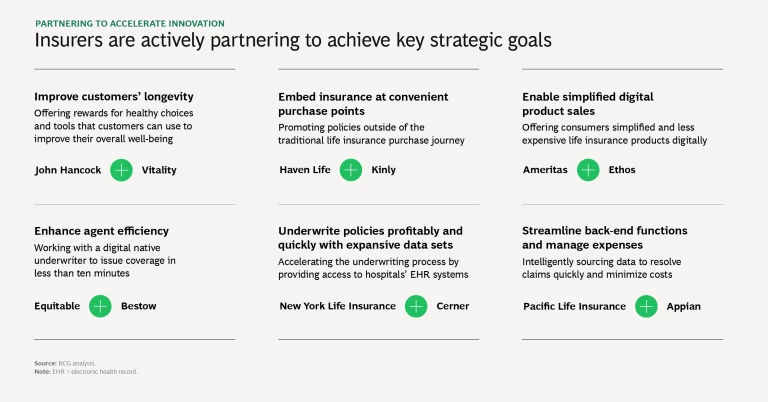

Insurers’ opportunities and challenges are creating a pivotal point for the industry, and leaders are already taking action. We’ve identified six key opportunities that insurers can take: focusing the portfolio, personalizing the journey, helping advisors to help clients, modernizing technology from front to back, partnering to accelerate innovation, and attracting and retaining talent. By being proactive, insurers can make the most of today’s robust consumer demand.