Will the rise of the metaverse and extended reality drive the next revolution in e-commerce? Although some “m-world” platforms have clumsy user interfaces and crypto asset markets are in turmoil, real customers are spending time in the metaverse. Already, virtual reality m-worlds capture a significant share of attention from younger consumers. Roblox has about 58 million active daily users—each averaging 2.6 hours per day engaging in immersive experiences on the company’s online platform. Fortnite’s user base is larger than the population of the US. And m-worlds are no longer just about games. Increasingly, they are social spaces. One example: in 2021, users sent 2.5 billion messages per day on Roblox.

While a lot has to fall into place before the metaverse supplants mobile as the primary e-commerce channel and extended reality becomes the new table stakes, it could happen. And change can happen fast. Just 15 years ago, most websites for consumer brands were little more than brochure-ware. But it quickly became essential for companies to provide a seamless e-commerce experience featuring intelligent search, detailed product information, customer reviews, easy payment, and fast delivery.

And soon, that was not enough. Consumers’ move from desktops to handsets drove a mobile-first revolution in e-commerce offering easier navigation, enhanced product visualization, simpler social sharing, and hyper-personalized experiences.

The metaverse has the potential to be at the heart of the next e-commerce revolution.

Faced with potential disruption, taking a wait-and-see approach is rarely the right strategy. The metaverse has the potential to be at the heart of the next e-commerce revolution. To get ready, brands need to focus on four key areas: creating brand awareness and leads, enhancing today’s e-commerce experience with extended reality, exploring new business models for virtual products, and embracing the metaverse as a new end-to-end channel.

A Short Introduction to the Metaverse

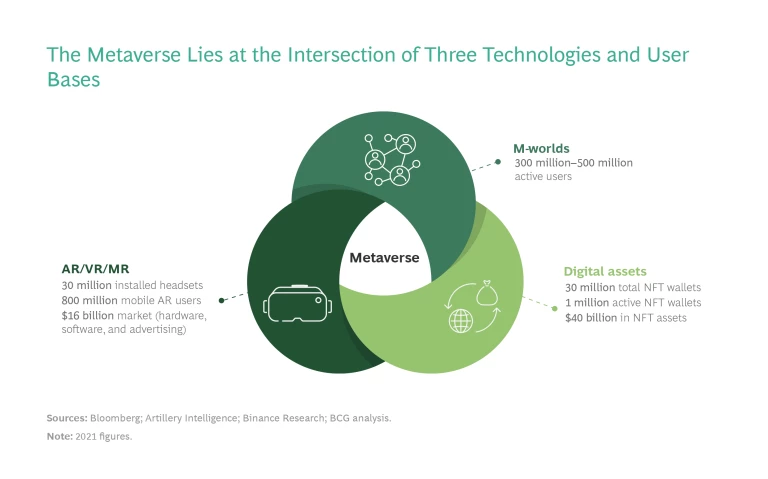

While there’s no official definition of the metaverse, it’s helpful to think of it as emerging from three important technology trends, both individually and via their intersections (see Exhibit 1):

- M-worlds, engaging platforms like Roblox and Fortnite—as well as newer ones such as Meta’s Horizon Worlds and Decentraland—that create community via gaming and playful social interaction.

- Extended reality—a term encompassing augmented reality (AR), virtual reality (VR), and mixed reality (MR)—which annotates, supplements, or reimagines the world.

- Digital assets that support use cases such as product traceability and smart contracts as well as enable virtual assets like nonfungible tokens (NFTs) that are unique, traceable, and transferable.

Given that our objective here is not to explain the evolution of the metaverse itself, we’ll move on to discuss the four ways that leading companies are rethinking e-commerce through the lens of the metaverse.

Creating Brand Awareness and Leads in the Metaverse

For companies targeting younger consumers, m-worlds like Fortnite and Roblox already offer exceptionally efficient customer access. In this context, think of m-worlds as supercharged new social media channels. And as today’s young people age, these platforms are expected to capture a significant share of attention, at the expense of other media—transforming these channels into major entry points to the e-commerce funnel.

To gain experience, companies should explore opportunities in three areas: developing brand presence via m-world partnerships and advertising, boosting brand image through virtual collectibles, and creating excitement around the brand with playful and engaging virtual events. While the rules of the road are not yet standardized in any of these areas, the experience of early adopters is likely to pay dividends in the future—just as companies that embraced other emerging channels such as Instagram and TikTok early and effectively are reaping huge returns today.

On the more traditional end of the spectrum, we see companies building m-world storefronts and exploring advertising opportunities to build brand awareness. Samsung’s 837X showroom in Decentraland, which reproduces its physical retail flagship in New York City, is a prime example. Although m-world advertising is still in its infancy, we expect it to evolve toward a model similar to that in other gaming contexts, such as the branded cars in Grand Theft Auto. That said, we believe that other approaches more tied to the playful, social character of m-worlds—for example, digital collectibles and virtual experiences—are likely to have greater success in the long term.

Consumers purchase digital collectibles to accessorize their m-world avatars. These accessories create a sense of belonging and help users project social status. The objective is to inspire an emerging cohort of m-world influencers to endorse your products by embracing them—inspiring other customers to want to burnish their own m-world status by association with your brand. In 2019, Nike and Fortnite announced a gamified collaboration: they invited customers to compete for coins and the ability to unlock nine Air Jordan styles for their avatars’ wardrobes. Recently, Dior introduced an avatar makeup collection on Zepeto, a South Korean m-world that attracts about 20 million teenagers in Asia. Although collectibles are not currently hyperlinked, they have the potential to evolve into gateways to brand websites or, in the future, to metaverse-based e-commerce stores.

Virtual experiences are about creating emotional connection and engagement with a brand, typically in a fun or playful context.

Virtual experiences are about creating emotional connection and engagement with a brand, typically in a fun or playful context. Ferrari generated huge buzz when it announced that a 296 GTB sports car was hidden on Fortnite Island—and that anyone who could find it could drive the car and do time trials. On a more community-building note, during Metaverse Fashion Week, apparel brand Hogan sponsored a major afterparty in Decentraland showcasing its first NFT collection and featuring star DJ Bob Sinclair and the metaverse’s first dance contest.

Enhancing Today’s E-Commerce Experience with Extended Reality

The extended reality pillar of the metaverse is already showing the potential to revolutionize product trials through mixed-reality product visualization on mobile. All iPhones since 2018 and the majority of Android phones running version 7.0 or later already support AR in apps.

Brands are finding that adding AR to their e-commerce strategy is not only an opportunity for differentiation but also shortens sales cycles and enables online channels to make inroads into segments traditionally dominated by physical retail.

Enhanced visualization improves business economics by boosting conversion rates and decreasing the costs related to returns and discounting. In a world where the level of returns for online purchases is two or three times the level of those from brick-and-mortar stores, reducing online returns is a big deal.

Stay ahead with BCG insights on technology, media, and telecommunications

Eyeglass retailer Warby Parker’s mobile app enables customers to see how different frames will look on their faces—and this best-in-class online experience has enabled the company to build a nearly $600 million business in a highly competitive sector traditionally dominated by physical retailers.

Other players in physical-dominant sectors like furniture and clothing are taking note. IKEA’s app lets customers place virtual furniture in their apartments. Pinterest has partnered with multiple home-decor companies including Crate & Barrel, CB2, Target, Walmart, West Elm, and Wayfair to enable customers to visualize rooms with items from multiple companies. And Walmart, through its 2021 acquisition of Zeekit—which in 2020 reported its technology could slash returns by 36%—now allows customers to “be your own model” and try on more than 270,000 items of women’s wear virtually.

As technologies evolve, the metaverse has the potential to reinvent product trial and advice and to compete with the immersive experience of physical retail.

As technologies evolve, the metaverse has the potential to reinvent product trial and advice and to compete with the immersive experience of physical retail. The massive investments flowing into the sector will drive continued progress. New AR, VR, and haptic technologies could yield breakthrough VR headsets and offer the ability to touch and feel items in a virtual environment. Even farther down the road, hyper-realistic hologram-like sales advisors—based on the evolution of technologies such as Google’s Project Starline—could mimic the experience of physical retail.

Exploring New Business Models for Virtual Products

We are already seeing early signs of a shift in the metaverse: from a world primarily based on gaming to a world increasingly focused on commerce. And as people spend more time in digital worlds, it is a good bet that they will also spend more on digital products—both those managed centrally by a single entity and those managed decentrally such as NFTs. To prepare, some brands are actively experimenting with selling virtual and hybrid-reality products that connect the dots between the virtual and physical worlds.

Today, most brands engaged in the metaverse are focusing at the simpler end of the technology spectrum: creating virtual products for m-worlds that help users project their digital identities and social status. For example, Ralph Lauren’s initial foray into metaverse commerce came via a collaboration with the m-world Zepeto. The fashion retailer not only released 50 virtual items, echoing both vintage and current looks, but also introduced two limited-edition skateboards and three distinct virtual spaces, one of which recreated the brand’s flagship store in New York City. And the company recently launched a collaboration with Fortnite that encompasses a mix of capsule collection drops (releases of a small number of related items), virtual events, and other virtual products.

Digital products are also being used to drive sales in the physical world. Nerf, believing that its customers would value a continuous experience across physical and virtual worlds, partnered with Epic Games in 2018 to release physical Nerf-branded guns that mirrored virtual weapons from Fortnite. In 2021, in partnership with Roblox, Nerf added Roblox-themed products, and it is experimenting with hybrid-reality offerings by including a code to unlock an exclusive Roblox virtual item with the purchase of a physical product.

Today, most brands engaged in the metaverse are focusing at the simpler end of the technology spectrum: creating virtual products for m-worlds that help users project their digital identities and social status.

And finally, brands that master the more technologically complex decentralized assets such as NFTs can explore lucrative new business models. These offer new value to consumers through exclusive, limited-edition merchandise as well as membership in a privileged community that can access invitation-only experiences in both m-worlds and real life.

These new business models enable companies to profit in two ways. First, an NFT’s uniqueness and exclusivity can usually justify a higher price at initial sale. And second, via smart contracts, brands can capture royalties (typically 5% to 10% of the transaction value) when the NFTs are resold. Dolce & Gabbana’s nine-piece Genesi NFT collection has generated more than $5 million so far in primary transactions. Nike has already launched several NFT collections—most notably the CloneX drop led by its RTFKT business. To date, the secondary resale transaction volume for Nike NFTs has reached 370,000 ETH (the cryptocurrency of the Ethereum blockchain and the equivalent of hundreds of millions of dollars at current market prices).

Other companies are embracing these technologies to create both community and exclusivity. Dolce & Gabbana’s DGFamily initiative enables customers to buy into three levels of exclusivity—represented by black, gold, and platinum NFT boxes—that provide access to special merchandise drops and events. And Bud Light’s NFL Fandom campaign allows consumers to buy an NFT that gives them access to both special events and a prediction game that offers prizes, including a year’s worth of beer or tickets to the Super Bowl.

Embracing the Metaverse as a New End-to-End Channel

Broadening the current metaverse e-commerce funnel—brand awareness, trial and advice, and the sale of virtual products—to include the sale of physical products will require much higher levels of metaverse adoption than we see today. In our view, getting there will entail three revolutions:

- A hardware revolution delivering a new generation of VR headsets that become as seamless a part of customers’ everyday lives as their phones are today. Current headsets are cumbersome and expensive but so was the first mobile phone, the 1.8-pound Motorola DynaTac, which cost nearly $4,000 in 1983.

- A customer-experience and “killer apps” revolution that streamlines all stages of the sales funnel from awareness and discovery to consideration and conversion to loyalty—and attracts new demographics of customers beyond gamers.

- A trust revolution that ensures the safety of metaverse transactions and guarantees their authenticity. This could be achieved via the rise of a single, dominant platform—or by taking advantage of blockchain or other decentralized transaction technologies.

If the metaverse overcomes these three hurdles, it could become a new end-to-end channel where people can shop not only for digital products but for physical ones as well. And even before the three revolutions are complete, companies are exploring more immersive go-to-market approaches. Fiat’s Metaverse Store for the new 500 La Prima mimics the showroom experience, allowing customers to meet with an expert, explore, “test drive,” configure, and purchase the vehicle without the need for VR glasses or other specialized hardware. Some brands are already starting to think through end-to-end customer journeys in the metaverse. Domino’s piloted selling real pizzas in Decentraland in 2021—and McDonald’s has filed a trademark for “McCafe” that is described as relating to “a virtual restaurant featuring home delivery.” Other companies have seen customers spending three to four times longer engaging with metaverse e-commerce experiences compared with their traditional websites.

We can imagine a future in which you will put on your VR glasses to buy a car. You could easily try out color combinations, test-drive different models with various options, research the core technologies, and arrange financing, registration, insurance, and delivery—all in the blink of an iris-scanned eye.

Business leaders need to approach the evolution of the metaverse as a potentially disruptive event. For some brands, at least, there may be short-term benefits in terms of increased customer engagement, improved e-commerce economics, as well as new revenue sources both physical and virtual. Fashion and luxury are good candidates for sure, but the metaverse could completely reshape e-commerce in any sector where design or “shelf appeal” is a key decision driver.

Some takeaways:

- Take a test drive. In our experience, too few senior business leaders have actually visited an m-world or even worn a VR headset. Would you enter an unfamiliar and potentially important geographic market without spending some time there?

- Follow your customers. If your existing and target customers are spending significant time in the metaverse, your brand should already be there delighting, challenging, and seeking their endorsement.

- Sprinkle rather than pour. Dedicating just a small slice of your innovation budget to the metaverse keeps you in the game and could even be profitable.

- Experiment and learn. While current revenues from the metaverse are minimal, the learning dividends are huge. By managing a diverse portfolio of experiments, you can build knowledge that enables you to spot and seize opportunities.

- Shape your future. There is no guarantee that the metaverse will evolve into an attractive channel. But brands will never have greater leverage than they do today to negotiate more brand-friendly rules of the metaverse road.

In summary, it’s essential to prepare for the possibility that the future of e-commerce will be out of this world.