The insurance industry has long relied on human expertise and manual processes to handle claims. But the advent of advanced technologies, particularly generative AI, has opened up new possibilities to transform and streamline the insurance claims process.

GenAI—coupled with machine learning, natural language processing, and other cutting-edge technologies—promises to enhance accuracy, efficiency, and customer satisfaction. While it is too early to assess the full potential of GenAI to reduce costs in the claims arena, we are observing substantial interest among nearly all large insurers to experiment.

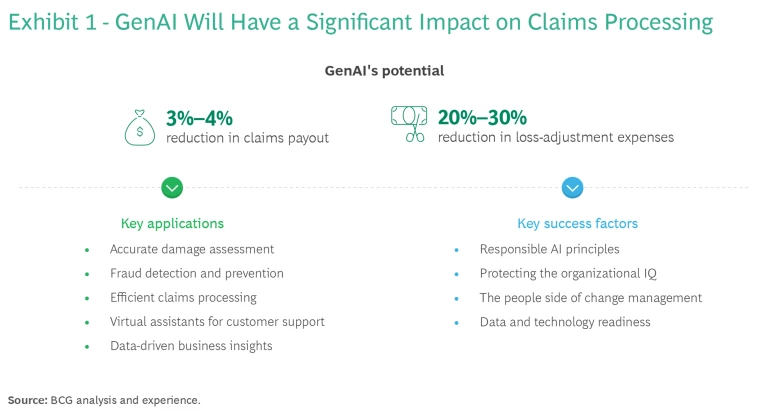

The chief claims officer of a leading insurer in Asia-Pacific recently told us that GenAI will be a strong feature in the company’s plans and capability improvements over the next 12 months. That captures the sentiment of the whole industry. A major group in North America has seen early signs of real improvements in cycle time. Another large insurance company in Europe is anticipating that it could improve productivity by 20% to 30% through large-scale adoption of GenAI for administrative tasks related to claims. (See Exhibit 1.)

Large-scale adoption of GenAI does present some risks, as well as a number of technical implications for organizations to consider—among them the ability to keep personal customer data secure. How governments might regulate AI and GenAI also remains uncertain. But if deployed strategically and responsibly—as a tool to augment and support human decisions, not replace them—GenAI has the potential to revolutionize insurance claims in areas such as damage assessment, fraud detection and prevention, claims processing, and customer support while also providing valuable data-driven insights.

The Potential Improvements from Large-Scale Adoption of GenAI

Current experiments with GenAI promise significant benefits for insurers and their customers. The technology shows particular benefits in these five areas:

Accurate Damage Assessment. In our experience working with large insurance companies, we often observe striking differences in individual performance among their claim handlers—in terms of their ability to determine the extent of damage correctly, for example, or to estimate repair costs. Cumulative experience, employee tenure and engagement, and concurrent workload can influence claim handlers’ effectiveness, as well as the attitude they have if the value of the claim is disputed.

Some of these companies have started to develop AI tools to support claims handlers, not replace them. They have achieved better data visualization, better access to and use of historical references, more timely alerts, and more confident data-driven recommendations. Together with image recognition and computer-vision technologies, GenAI can assess damages with unprecedented precision. Claims handlers can also use GenAI to scan external data sources, such as past court rulings, to gather evidence to support a possible negotiation.

GenAI can also dive into mundane details faster and more efficiently than people. It can scroll through the complex terms and conditions typically present in commercial policies and quickly assess the validity of the claims coverage.

Fraud Detection and Prevention. GenAI gives insurers the ability to analyze vast amounts of data from multiple sources, including customer profiles, historical claims data, and external databases. This allows them to assess risk factors accurately and make more informed decisions regarding claim eligibility. The advanced algorithms of GenAI can quickly evaluate the likelihood of fraud and flag suspicious claims for further investigation, enabling insurers to allocate resources more effectively and reduce losses.

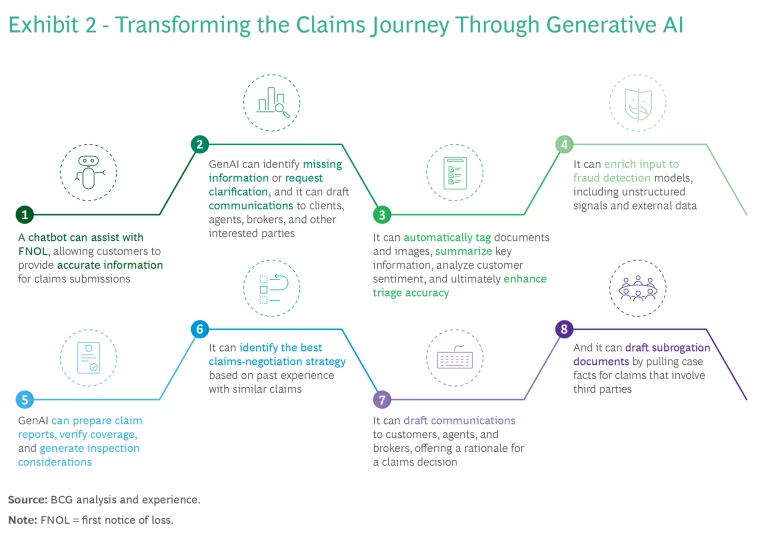

Efficient Claims Processing. Claims processing has traditionally been a time-consuming and labor-intensive task. GenAI can automate several stages of the claims journey, significantly reducing the time and effort required. (See Exhibit 2.) Typical use cases would include the preparation of standard mailings to claimants and the preparation of engagement letters to external service providers. This can enrich the role of adjusters by freeing them to focus on higher-value activities.

With its natural language processing capabilities, GenAI can analyze claim documentation and extract relevant information, such as policy details, incident descriptions, and supporting documents. This automation leads to faster claims processing, allowing insurers to provide quicker resolutions to policyholders.

Customer Support. The customer journey is gradually becoming a more omnichannel experience, with a significant portion of remote interaction directly with the insurance company. This starts with the first notice of loss and increases in the subsequent phases of the claim. GenAI virtual assistants have the potential to revolutionize such customer interactions, though the speed of the transition varies widely by market and company. They can enhance customer satisfaction, reduce wait times, and provide round-the-clock support, ultimately improving the overall customer experience.

Intelligent chatbots or voice-bots powered by GenAI provide policyholders with instant access to information and assistance. Customers can interact with a virtual assistant through websites, mobile apps, and messaging platforms; the assistant can offer personalized support by understanding customer queries, providing relevant information about claims status, and providing coverage details. It can also guide customers through the claims process, offering step-by-step instructions and collecting necessary information for a seamless experience.

Data-Driven Business Insights. GenAI can transform the vast amount of data generated during the claims process into valuable insights. Insurers can identify trends, optimize processes, and make better, data-driven decisions when they bring unstructured data into an actionable form that integrates with their core platforms and subsystems. And by analyzing customer data with GenAI, insurers can identify patterns and preferences, allowing them to provide customers with tailored communications and a convenient, hyperpersonalized experience throughout the claims process.

GenAI's ability to recognize patterns and correlations in claims documentation, such as loss appraisers’ reports, can also help insurers identify areas of risk concentration and improve the feedback loop to underwriting and product design. A European insurer used GenAI to review thousands of past loss appraisals from weather events and natural disasters in order to better identify risk correlations and cost drivers—information that will help the company build more effective claim-resolution paths and more precise underwriting terms for its policies.

Risks and Implications from Large-Scale Adoption

Like any other technology, generative AI is not a panacea—it comes with risks, both external and internal, and it requires a well-thought-out, holistic approach to implementation that combines the power of GenAI with machine-learning tools that many insurers already have in place. Companies should prioritize the following:

Monitoring Heightened Fraud Risk. While GenAI can help insurers detect and prevent fraud, it can also enable it. Fraudulent claims can now be enhanced and embellished in new and convincing ways with GenAI, including the generation of fake imagery and the creation of personas that act human. This requires insurance companies to acknowledge the risk of such sophisticated fake claims and to strengthen their defenses with a combination of robust data analysis, behavioral analytics, collaborative data sharing, human expertise, and customer education. Insurers could also incorporate additional layers of verification in the claims process, such as the use of biometrics, geolocation data, and image recognition to validate the authenticity of claims.

Protecting Customer Data. GenAI requires responsible adoption. Insurers need to be mindful of regulatory and reputational risks associated with the potential disclosure of their customers' sensitive personal data. Companies adopting GenAI solutions need to establish a closed environment to protect that data. They also need to avoid model outcomes that could reinforce biases against certain groups of customers—biases based on race, gender, country of origin, religion, or age, for example.

Preserving Organizational Intelligence. Over the medium and long term, insurers should not use generative AI as a substitute for organizational IQ. The right GenAI architecture should instead ensure the constant development of employees’ professional skills. GenAI should accelerate claim handlers’ acquisition and absorption of experience, not impede it or replace it.

Enhancing Human-Machine Interaction. Large-scale adoption of AI solutions, including GenAI, always requires an integration of talent and technology. Companies should introduce the technology as a means to an end; they should carefully explain GenAI’s role to employees and provide them with adequate support and incentives for its use. The key levers of change management—such as solution codesign, cascaded training, and the systematic tracking of adoption progress—play an important part in this.

On the technology side, success starts with data quality. GenAI is not immune to the old adage of “garbage in, garbage out.” In our experience, the other critical success factors are the proper selection of the most appropriate large language model (considering performance, operating costs, and maturity with respect to the local language), a robust and secure IT architecture for data management, and the internal ability to integrate GenAI with AI models the company is already using.

The integration of GenAI into the insurance claims process marks a significant advancement in the industry’s digital transformation journey. From streamlining claims processing and enhancing accuracy of assessments to delivering personalized customer experiences and detecting fraud, GenAI offers immense potential for insurers to improve efficiency, reduce costs, and enhance customer satisfaction. As GenAI continues to evolve, the competitive advantages of the insurance companies that embrace this technology will evolve as well.