Over the last two years, commercial and defense aerospace leaders have singled out castings and forgings as an acute pain point in the supply chain. This category has late deliveries and longer lead times—resulting in airplanes worth hundreds of millions of dollars stuck in production or grounded waiting for parts. One OEM executive sums it up by calling this category “my No. 1 problem.”

There is a considerable amount of industry lore about where the problem truly lies. To separate fact from fiction, we recently analyzed the casting and forging supply chain, talking to senior executives at OEMs, Tier 1 contractors, and casting and forging suppliers as well as reviewing financial and analyst reports. Through that process, we identified five underlying causes of delays, along with concrete actions that OEMs can take to partner more effectively with these suppliers in both the near and long term.

One key insight underpins our analysis: the fault does not lie with forges and foundries alone. There are issues up and down this complex supply chain—from raw material and alloy production to machining and finishing. OEMs, which ultimately bear the brunt of supply-chain delays, will need to take a new approach to improve performance in this struggling category.

Five Root Causes of Delays

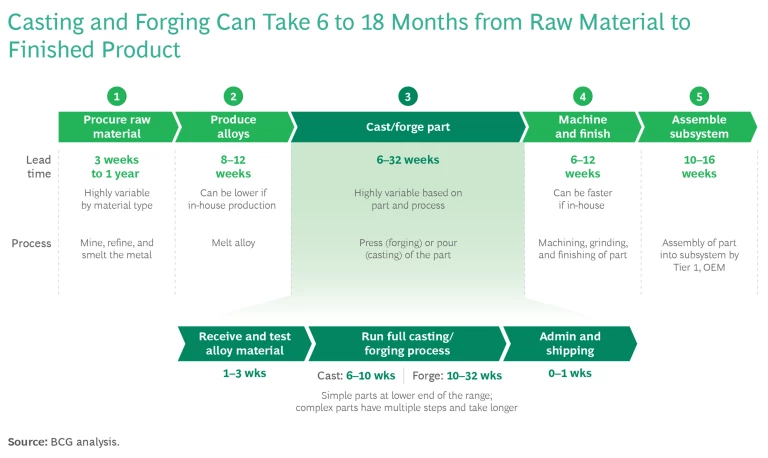

The difficulty of casting or forging parts from raw materials to meet aerospace specifications is often underestimated. (See “The Basics of Casting and Forging.”) The manufacturing process can take 6 to 18-plus months, depending on the part, size, metal, process, and level of vertical integration. (See the exhibit.) When issues arise, such as unexpected demand, late purchase orders, or quality issues, delays can be 12 months or longer. Moreover, foundries and forges serve other industries as well—and OEMs need to factor in the interconnectedness of their suppliers’ overall customer base.

The Basics of Casting and Forging

The Basics of Casting and Forging

Casting happens in a foundry and involves pouring a melted metal into a mold. It is used to produce complex shapes and geometries—often hollow components like airfoils. Cast parts can meet accuracy standards up to .001'', but meeting these specifications often requires extreme precision in temperature, pour rates, and consistency in molds and cores.

Forging entails shaping metal using compressive forces from a press. It maximizes strength-to-weight and durability for parts and is used to make parts that must be highly consistent with each other, such as turbine blades. Forging consists of a complex series of steps repeated three to four times, including pressing, cleaning, grinding, and treatment of the part.

Our analysis points to five root causes for the current supply-chain issues in casting and forging.

Raw material lead times are getting longer.

Demand for aerospace-grade material is increasing around the globe for both commercial and defense purposes, with supplies tightening due to geopolitical tensions. The industry primarily uses aluminum, steel, nickel, and titanium (and alloys of each), many of which are becoming harder to source, more expensive, or both. Lead times for titanium are currently about nine months, and a high-demand steel alloy made by one supplier has a lead time of 70 to 80 weeks.

Longer lead times highlight two issues in the aerospace supply chain:

- OEMs typically don’t have strong visibility beyond their direct suppliers and therefore get surprised by challenges—such as raw material delays—deep in their supply base.

- OEMs may not adjust quickly enough to changes in lead times. An executive at one large forge told us, “We often get thrown under the bus, but my customer may not order soon enough given raw material lead times.”

Considering the current difficult geopolitical environment, issues with raw materials and alloy availability are unlikely to resolve soon.

Production labor is slowly returning to full strength.

Many US foundries and forges had to lay off half or more of their workforce during COVID. Since then, they have struggled to ramp up operations. Hiring, retaining, and training labor is difficult for casting and forging companies, which have a perception as being “dark, dirty, and dangerous” compared with other industries.

The hiring and retention of production labor is stabilizing and expected to improve, but it takes three to six months to complete formal and informal training of new employees. Because forging and casting processes are so precise and sensitive, a small deviation from a new employee could cause quality issues to skyrocket, directly impacting margins and delivery dates.

The industry has lost engineering expertise.

Similarly, the aerospace industry lost many highly experienced engineers due to layoffs and pandemic-related cuts. The current shortage of experienced engineers at OEMs, Tier 1s, and casting and forging companies slows down both the new-part qualification and ongoing production processes. Less-experienced engineers at OEM customers may not be comfortable approving tolerances in parts that might have previously been granted. Newer engineers at forges and foundries may take longer to develop production processes for new parts and troubleshoot production challenges. The engineering shortage will eventually resolve, but it may take five to ten years or longer for newer engineers to develop the requisite experience.

Aftermarket demand is unexpectedly high.

Although commercial OEM demand for new aircraft is largely predictable, the demand for aftermarket parts is highly volatile and falls most heavily on the casting and forging supply chain. Several new aerospace engines—including the LEAP engine and the geared turbofan (GTF)—have underperformed in terms of durability and other issues. Numerous engine design updates have strained sparse engineering resources. In addition, the backlog of deferred engine maintenance grew during the pandemic. Both issues are now leading to greater demand for replacement parts and forcing suppliers to adapt.

Even after the challenges of introducing the LEAP and GTF engines are resolved, aftermarket demand will remain high. The elevated temperature for the high-pressure turbine and compressor of the new engines means there will be fewer cycles between overhauls and a greater need for replacement parts.

Suppliers are hesitant to invest.

With the sharp increase in demand, it’s initially surprising that many casting and forging suppliers are not investing in new capacity. The primary reason: a loss of trust in OEMs, following a particularly difficult boom-and-bust cycle during the pandemic and the halt in production of the 737 Max. OEMs issued ambitious production estimates, and suppliers invested to hire talent, add shifts, and build out production facilities—only to have demand disappear virtually overnight.

As a result, although suppliers could expand production, they are choosing instead to only take on larger-volume and more profitable work—a shift that is likely to continue for the foreseeable future. As the leader of one small foundry told us, “Our customers want to play the short game and have us play the long game. Given the last few years, I’m not willing to take on that risk in the absence of information and commitments.”

Recommendations for OEMs

Most of these issues are not going away. OEMs and Tier 1 suppliers need to take steps in both the near and long term to improve performance along the supply chain. Because of the complexities in casting and forging, these measures will be complicated and—to be blunt—expensive, requiring capital and commitment.

Near-Term Solutions: Incentivize Suppliers to Improve Their Performance

In the near term, OEMs and Tier 1 suppliers can take several steps to incentivize suppliers and help improve their performance. Although these are not new, they’re applied inconsistently today.

Take on more risk rather than pushing it down to struggling suppliers.

OEMs can make greater volume commitments earlier within a contract period to get priority and give suppliers the confidence needed to invest and grow. OEMs can also pay for performance, including rush fees, contractual incentives (financial or volume) for on-time delivery, or premium payments for volumes higher than initial orders. Another option is to place advance orders and hold inventory for lower-volume or -value items that a foundry or forge might deprioritize. For example, rather than ordering two units per month, order 24 for the year.

Improve supply chain visibility and reduce surprises.

Providing reliable, low-volatility, long-term demand signals directly throughout the supply chain (including to indirect suppliers) can help suppliers plan more effectively. Other measures can make raw materials more available while also reducing costs—such as making directed buys for key metals or alloys or holding some inventory for exigencies.

Invest to build supplier capabilities.

OEMs can recruit (and even rehire) experienced engineers to work directly with casting and forging suppliers, train new engineers, and provide critical expertise in other ways. Some customers may opt to deploy their own engineers to supplier sites to help resolve issues.

Longer-Term Solutions to Build Resilience and Ensure Sufficient Capacity

Beyond short-term levers, OEMs should consider four longer-term actions to build mutually beneficial relationships with casting and forging suppliers.

Contract for longer periods.

Today, most contracts are for five to seven years and require considerable time to renegotiate. The uncertainty makes it difficult for suppliers to confidently invest in longer-term capacity.

OEMs and Tier 1s should consider longer-term contracts of at least 10 years—and ideally even longer—as they do with providers of other key aerospace systems. These contracts can be structured to be mutually beneficial, ensuring sufficient volume and providing appropriate escalations and incentives (both positive and negative) for both parties.

As one example, suppliers could be paid a premium for aftermarket parts, given the expected fluctuations in demand, to more closely align their incentives with those of their customers. Contracts can also encourage and reward suppliers for investments in automation and encouraging digital technology (such as flow modeling).

Invest to secure long-term capacity.

Beyond traditional contracting, OEMs and Tier 1s have several options to secure additional casting and forging capacity if needed. These include jointly investing with a supplier to expand capacity, paying a supplier to secure dedicated capacity, or investing to develop in-house capacity, either through a greenfield build or by acquiring a critical supplier. Among OEMs, Rolls Royce, Pratt and Whitney, and Safran all have in-house casting and/or forging capacity. Already, OEMs are starting to guarantee volumes earlier, so that their critical suppliers dedicate sufficient capacity to high-priority products. Critically, OEMs should ensure they have sufficient capacity throughout the full supply chain—from raw material and alloy availability through machining and finishing—which are as critical as sufficient casting and forging capacity.

Reduce reliance on cast and forged parts.

Where it’s technically feasible, OEMs should consider designs that incorporate alternative processes. OEMs have shown that advanced machining and additive manufacturing is a viable alternative for some select parts that may have lower strength or less difficult shape requirements. Today, only a small subset of parts could likely be shifted away from castings and forgings, but building that capability will position OEMs favorably as those competitive technologies continue to advance.

Rethink the manufacturability-versus-performance tradeoff.

Last, OEMs can adjust their performance requirements to use parts that are easier to manufacture. For example, with the increasing complexity of hollow-core airfoil structures, engine OEMs may reconsider tradeoffs between small gains in engine performance and manufacturing reliability. Other choices such as selecting an alloy that is widely available—ideally from multiple suppliers—can help to avoid bottlenecks.

Casting and forging processes are having a disproportionate impact on the aerospace industry due to their complexity. OEMs and Tier 1s cannot apply the standard supplier playbook they have used in the past. Instead, they need to develop stronger partnerships and assume some of the financial risk inherent in building out capacity. In doing so, they can reduce lead times and late deliveries and get their products in the air as quickly as possible.