One segment of advanced diagnostics firms—the next-generation sequencing (NGS) clinical testing labs that run genetic tests—are at an inflection point, based on rapid advances in sequencing technology. In the past, companies could differentiate themselves primarily by reducing costs. Today, genetic sequencing is too fast and cheap for that, shifting the competitive dynamics in the industry. In this new environment, companies also need to expand their offerings to reflect growing preferences for targeted, multi-omic content and whole genome sequencing, among other services.

These are significant shifts, and it’s not yet clear how they will reshape the market for NGS clinical testing labs and life science tools (LST) players. However, it’s already apparent that leadership teams must plan for a wider range of potential scenarios, based on a detailed understanding of how profit pools will evolve. Armed with those insights, companies can make informed decisions to identify the most attractive market segments, innovate to develop new solutions, target M&A opportunities, and differentiate their portfolio of products and services.

Today, genetic sequencing is fast and cheap, so companies need to expand their offerings.

Lower Sequencing Costs and Shifting Genomics Preferences

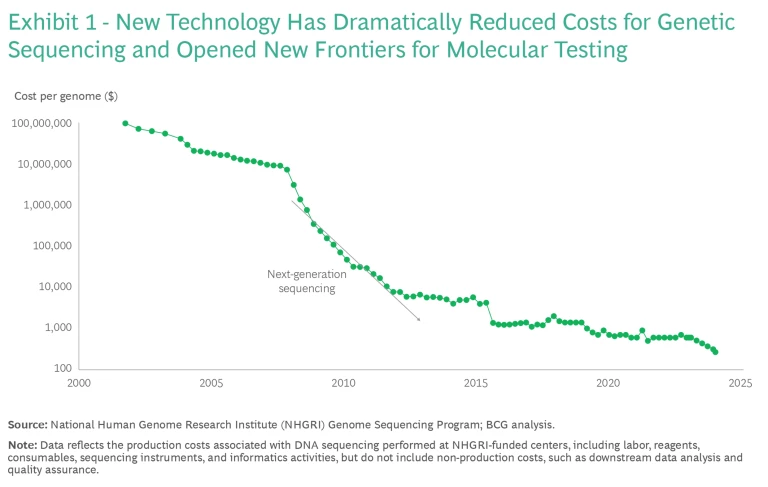

The first human genome took nearly 15 years to sequence; today, that process takes less than 24 hours. Costs have declined just as quickly, thanks to NGS technologies. (See Exhibit 1.) The industry is approaching a milestone: a $100 whole genome sequencing (WGS). At the same time, the applications for genomics are expanding. Comprehensive NGS methods such as whole exome sequencing (WES) and WGS are critical tools in profiling tumors and diagnosing rare diseases.

A $100 WGS will not solve all challenges in the industry. Companies will still face long turnaround times, a continued need for sample batching, and expenses for upstream and downstream processes, including data interpretation and management and complicated laboratory workflows. All of these expenses will be more burdensome for small companies, which lack large cores and economies of scale.

Lower sequencing costs are already shifting overall competitive dynamics for NGS clinical testing labs and LST companies.

Still, lower sequencing costs are already shifting overall competitive dynamics for NGS clinical testing labs and LST companies, in several ways:

- Customers such as researchers and clinicians are capturing better economics in WGS but also in more targeted techniques and expanding into novel areas such as epigenetics.

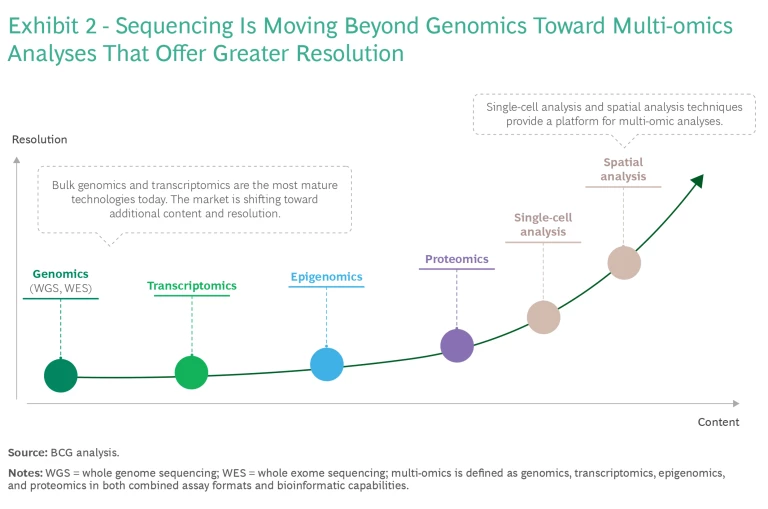

- Customers are also looking toward multi-omic analysis, which integrates data from sources such as the genome, proteome, epigenome, and transcriptome. This analysis can potentially give a more comprehensive understanding of molecular phenotypes and the factors that govern biological processes and influence disease development. As the field matures, we expect multi-omics approaches to play an increasingly important role in diagnosing and treating diseases.

- Sequencing and service providers are being pushed to offer not just comprehensive DNA sequencing but also cutting-edge technology and analytical tools for diverse clinical and research needs. For example, the ability to measure multiple features (DNA, RNA, proteins, post-translational modifications, and cell morphology) simultaneously on one instrument will unlock a new era of comprehensive biological insights beyond traditional genomics.

Growth in Research Use Only Content

In the evolving landscape of genomics, novel research use only (RUO) content is emerging as a key driver of market growth and value creation. RUO content is not approved for any clinical use and thus has a lower regulatory barrier than content designed for patients. However, it can serve as a starting point for companies to validate and innovate for translational and clinical applications. For that reason, recent developments in sequencing require labs to invest in initial RUO content in order to create value downstream.

Adopting incremental and stepwise strategies to introduce new layers of RUO innovation is key to unlocking technologies that provide comprehensive insights and expanded clinical opportunities. A notable example is epigenomics, which plays a significant role in identifying disease mechanisms in complex and rare conditions. This insight is now being applied in the diagnostic field, with commercial tests evaluating abnormal methylation patterns that indicate diseases such as colorectal cancer.

As RUO innovation advances, we can expect to see technologies emerge that are even more transformative, further revolutionizing clinical practice. For example, as noted, the future of NGS content will focus on increasingly multi-omic methodologies with techniques that offer higher resolution, such as spatial analyses. (See Exhibit 2.) However, extended lead times for regulatory approval and reimbursement are likely to temper the immediate impact. For that reason, multi-omics approaches are generating significant interest initially as RUO technologies.

Two Potential Scenarios for How the Market Will Evolve

Considering the near-term progress of sequencing innovation—including reduced cost, the shifting dynamics of clinical reimbursement, and evolving regulation—two scenarios emerge:

- Scenario 1: cost erosion leads to a contraction of the NGS clinical testing lab market. In the first scenario, continued cost reductions and stricter than expected regulatory policies lead to slowdowns in content innovation. As the cost of sequencing becomes increasingly affordable, the market will become commoditized, making it difficult for NGS clinical testing labs to differentiate their products and generate profits. The market will consolidate to a smaller number of competitors and shrink in overall size, due to increased innovation cycle times and a slower path to multi-omics.

- Scenario 2: content differentiation leads the NGS clinical testing lab market to expand. In the second scenario, moderate regulation and differentiated sequencing players will speed up the overall pace of content innovation. As companies develop more innovative sequencing solutions to differentiate, the path to multi-omics becomes more realistic. The NGS clinical testing lab market will expand while players scale and consolidate.

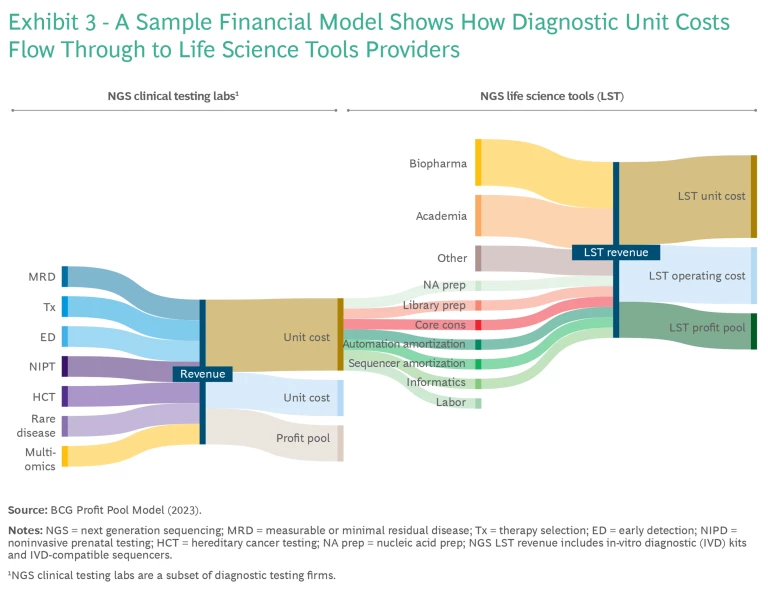

To better understand these potential market evolutions, we developed a profit pool market analysis based on more than 30 data sources and more than 900 input factors. (See Exhibit 3.) This analysis forecasts US spending in NGS clinical testing and LST from 2023 to 2032, indicating that the future of sequencing profit pools will probably fall between these scenarios.

The Impact on NGS Clinical Testing Labs

Today’s NGS clinical testing labs are grappling with profitability challenges, losing around $0.50 per dollar in revenue. Clinical testing labs are struggling with high competition, sub-scale economics, and high costs. In particular, they must invest significantly in R&D and clinical trials. In the future, innovation may come through predicate devices—previously approved or cleared sequencing-based clinical diagnostic tests. Predicate devices can serve as benchmarks for establishing the safety and efficacy of novel diagnostic tools and will spur further innovation by allowing new products to be compared to established technologies. However, these devices are currently limited.

In the cost-pressure scenario, NGS clinical testing labs remains unprofitable. To succeed, companies will need to capitalize on market consolidation among weaker players, along with stable pricing and efficient operations. They will also need strong regulatory expertise to inform investment decisions so they can avoid wasting resources on developing diagnostic products that are not likely to receive approval. Many NGS clinical testing labs will become risk averse, and some could choose to develop tests using sequencers with the largest market share, meaning less competition and slowing price decreases.

However, in the content differentiation scenario, NGS clinical testing labs could reach profit margins of 20% or more, driven by clinical somatic sector volumes. Multi-omics is anticipated to see the highest growth in minimal residual disease and early cancer detection, though growth will vary across tests. Notably, NGS clinical testing lab R&D costs are forecast to decline from 40% to less than 15% of revenue, with selling, general, and administrative costs dropping from 72% to less than 35% of revenue, assuming an increase in scale and business unit synergies.

The Impact on LST Firms

In contrast to NGS clinical testing labs, LST players are highly profitable and benefit from being paid first as suppliers to labs. LST clinical revenue includes payments for nucleic acid prep, library prep, core consumables, automation amortization, sequencing amortization, and informatics. LST players gain around $0.05 for every dollar in clinical testing lab revenue.

In our analysis, the LST market is expected to remain consistently profitable in both scenarios, benefiting from overall market growth. Tools providers are suppliers in the value chain, with less overall risk exposure to factors such as reimbursement. However, the LST market’s upside is limited compared with the potential for NGS clinical testing labs. Clinical volume is the primary lever impacting LST revenue.

LST companies still need to be thoughtful in how they can best enable NGS clinical testing labs across the two scenarios. In the content differentiation scenario—for example, technological advances, primarily in multi-omics and somatic testing—LST’s revenue distribution is expected to shift toward library preparation, automation, and bioinformatics in the next few years, with above-market compound annual growth rates of greater than 20%. A focus on content differentiation is likely to lead to bioinformatics becoming a more significant revenue driver.

In the cost pressure scenario, LST companies will need to understand their role in supporting NGS clinical testing labs with the regulatory requirements for new sequencing-based tests, potentially through increased investment in regulated instruments and assays to help offset the profitability concerns of NGS clinical testing labs.

The Importance of Scenario Planning

For NGS clinical testing lab and LST players, advances in genetic sequencing are changing competitive dynamics and creating a wider range of potential scenarios. Overall, the market will continue to be shaped by efficiency gains, the state of reimbursement, and the regulatory landscape. But these factors will have a huge impact on profitability—and the profitability of the industry as a whole. Companies need to be prepared regardless of how the future unfolds. Several factors can help:

- Build up internal capabilities. First, given the wide scope of potential outcomes in diagnostics, the ability to identify and assess potential scenarios will become essential. Companies need to build up these organizational muscles as a core capability.

- Adopt a regular cadence. Rather than being a one-off analysis, scenario planning should become a cornerstone of the annual strategic planning process, along with upstream product development analyses.

- Look at profit flows. The ability to track financial flows can make various scenarios tangible for leadership teams by quantifying the bottom-line impact of decisions, along with any potential tradeoffs among competing options.

The genomics industry is approaching a new frontier in genetic sequencing. Companies need strategic foresight to successfully adopt new sequencing technologies and develop more advanced genetic diagnostics. Scenario planning can ensure they are prepared for this new environment and can compete successfully, regardless of what the future holds.

The authors wish to thank Otto Liska, Kristen Cook, Sandra Andersen, Johannes Thoms, Bob Lavoie, Matt Prisby, Alec Ludin, Joe Bernardo, Max Schmid, and Kerri McWeeney for their contributions.