The energy transition will require many trillions of dollars in investment, as companies build more efficient factories, reformulate products, and reengineer supply chains to reach net zero by 2050. The legal, banking, accounting, and engineering firms that will help bring these efforts to life will in turn rely on information services for sustainability-related data and content.

This vast ecosystem translates into an immense opportunity for information services providers. But many have struggled to find the right niche.

We’ve found from our work with clients that three practices are key to success: starting with preexisting customer personas, aligning on a specific type of value creation, and anticipating the impact of new regulations. By following these practices, information services providers can play a vital role in empowering their customers’ success—and create tremendous value in the process.

Major Tailwinds

The past few years have witnessed an enormous wave of sustainability-related regulations as countries worldwide address the net zero challenge. Some regulations, such as the International Financial Reporting Standards, relate to disclosure requirements and affect industries across the board. Other regulations, such as the US and European bans on perfluoroalkyl and polyfluoroalkyl substances (PFAS), also known as the “forever chemicals,” impact only certain industries.

Concurrently, consumer interest in green products is growing, and investors are increasingly putting their money into companies that clearly demonstrate their commitment to sustainability. In 2023, approximately $10 trillion in investments were managed according to some type of sustainability criteria. According to BCG analysis, sustainability investing has grown over 50% in the past five years. And our survey of asset managers found that 80% list sustainability and sustainability-related initiatives among their company’s top priorities.

The sustainability information ecosystem is crowded with data companies, software players, consultants, accounting firms, and others—all vying to establish a foothold.

Businesses are taking steps to address these pressures and boost their sustainability ratings. Functions from R&D to accounting to legal have assumed more sustainability-related responsibilities. But they have encountered all sorts of pain points in the process. For example, multiple functions, such as marketing, investor relations, and accounting, may use the same data to develop reports that reach very different conclusions, creating redundancy and inconsistency. To address such issues, many companies have set up a separate office headed by a chief sustainability officer. But supporting functions across an organization has proved to be an incredibly complex undertaking.

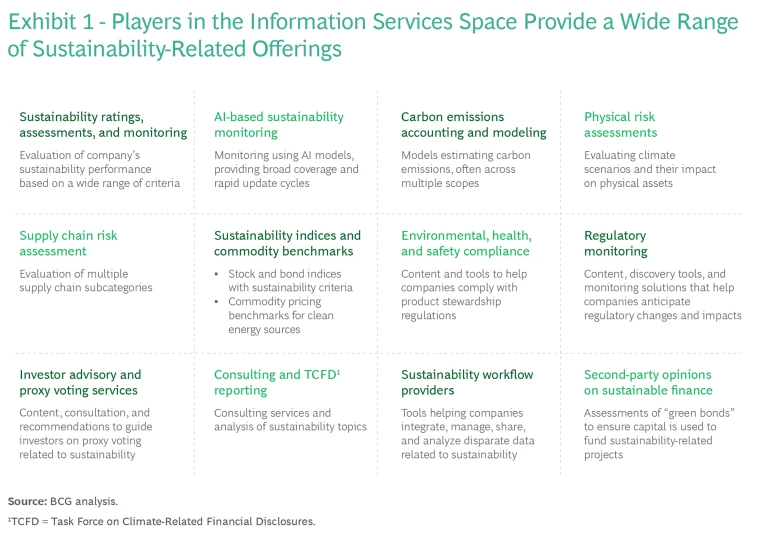

While in certain geographies there has been some negative dialogue around ESG in recent months, the tailwinds created by net zero regulations, global sustainability investments, and business transformations remain strong. Together, these developments have created demand for all different types of information services, from sustainability scoring to supply chain risk assessments to investor guidance, and a diverse set of players have seized the opportunity. (See Exhibit 1.)

As a result, the sustainability information ecosystem today is a crowded landscape, with data companies, software players, consultants, accounting firms, and others all vying to establish a foothold as the market evolves. Little has been clearly defined, leading to confusion and overlap in the offerings that are available.

Key Practices to Follow

Traditional information services companies are aware of the opportunity available: many have been monitoring and experimenting in the sustainability space for several years. Few, however, have built a large sustainability revenue stream. Either they have not been able identify a clear and specific path that they could commit to, or they developed an offering that was not well connected to their core competitive advantage. To avoid these pitfalls, three practices are key.

Start with the Customer Personas You Already Know

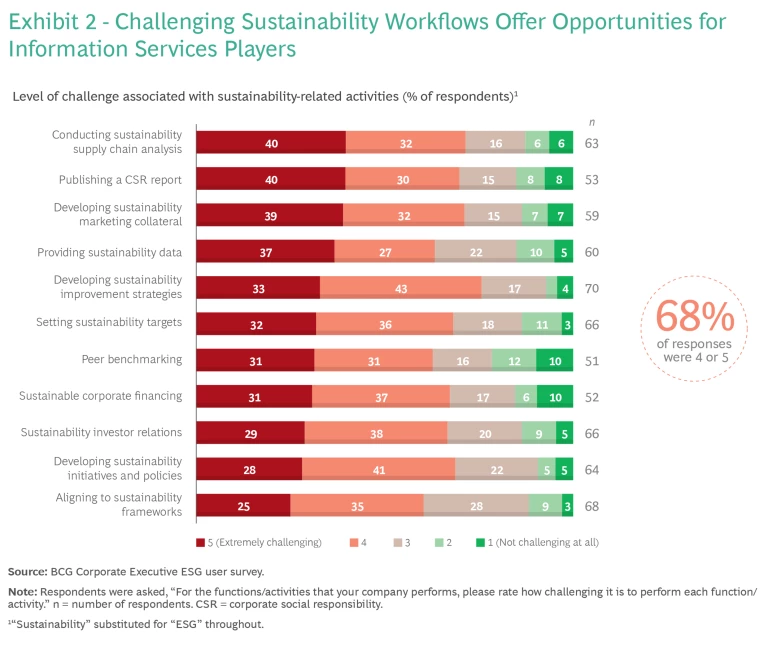

Information services providers should start by addressing the sustainability challenges that their current customers are facing rather than targeting new personas. Our surveys of sustainability professionals found that nearly all workflows were described as “challenging” or “extremely challenging,” which suggests that there are more than enough opportunities to develop sustainability solutions for preexisting customers and users. (See Exhibit 2.)

This strategy has two key advantages. The staffs of information services companies aiming to enter the sustainability space will require upskilling, which is much more feasible if those companies are focused on existing topics, users, and workflows. Moreover, there is also much less of a risk of making bad acquisitions or of developing the wrong products—which in today’s rapidly changing sustainability landscape is all too easy to do.

Align on a Specific Type of Value Creation

Because sustainability is such a broad and complex topic, information services providers often are unable to articulate the value they provide the customer. We’ve seen companies overemphasize a product’s technical attributes or position a product within a framework such as ESG without indicating how the data is valuable. As a result, the product-market fit is lacking, even though demand may be strong.

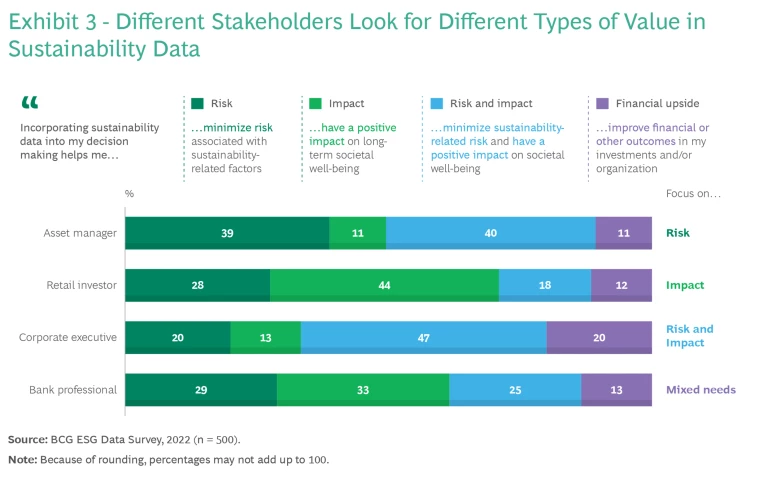

There are three major categories of value propositions for sustainability-related data: risk management, financial upside, and societal impact—with different customers focusing on one over the rest, as we found in a 2022 global survey. (See Exhibit 3.) Asset managers overindex on risk management, retail investors place the most emphasis on societal impact, and other corporate executives focus on both.

This makes it critical for information services providers to identify the specific value proposition for each target segment. It is not enough to provide data related to a specific theme, say “carbon-emissions modeling.” Companies need to position that thematic offering in terms of one of the three types of value creation—for example, providing the “carbon-emissions modeling necessary for supporting green product claims that resonate with customers.” This type of positioning connects the theme of carbon emissions to value creation—in this case, the financial upside of customers’ willingness to pay green premiums.

Anticipate the Impact of New Regulations

Many recently enacted regulations, and others in various stages of adoption, are likely to create yet more pain points for information services customers and increase the demand for sustainability solutions. Consider, for example, the EU Sustainable Finance Disclosure Regulation, which requires investment management firms to classify their investment products as “light green” or “dark green” and back up these classifications with detailed disclosures. These requirements have raised the standard that investors use for evaluating a fund’s sustainability and, consequently, their need for support from information services providers.

Another important example is the EU Carbon Border Adjustment Mechanism, which requires European companies that import products manufactured with carbon-intensive processes to calculate and report the embedded emissions. Providers of supply chain and tax and accounting information services can help these companies comply with this regulation.

To anticipate the impact of regulations, we recommend that information services companies implement two best practices.

Build a robust monitoring capability. To be really prepared for such opportunities, information services providers need to develop the capacity to conduct horizon scanning of new regulations, guidance, and updates and incorporate the findings into their solutions. Increasingly, we are finding that our best-in-class clients have regulatory experts on staff who are responsible for monitoring the regulation pipeline, interpreting the potential impact, and working directly with product and sales teams to adjust roadmaps and talking points as the regulatory landscape changes.

Optimize internal operations and controls. Given the growing demand for transparency, providers will be expected to disclose their methodology—the calculations, data inputs, and processes—for calculating their customers’ sustainability scores. Having the right controls in place will be crucial.

Borrowing from the credit ratings sector and other highly regulated industries, top players are implementing proven protocols and controls to combat conflicts of interest and allegations of greenwashing. They are separating the analytical teams that create methodologies from the commercial teams that sell the data, and they are making methodologies publicly available and aligning to voluntary frameworks developed by international independent standards organizations, such as the Global Reporting Initiative and the United Nations Global Compact. In addition, information services providers need to be prepared to accommodate more regulatory disclosures of their own, especially those relating to analytics methodologies on sustainability data.

Information services companies will also need to improve their data-collection capabilities to keep pace with the pending explosion of sustainability data that will be driven by greater company disclosure requirements. Leaders are simplifying their data scraping and aggregation processes to enable smoother interactions with companies. Some companies are using AI to expand data sets in areas that previously were extremely difficult to cover, whether that means using natural language processing to extract data from the web or using AI to translate non-English disclosures so that they are accessible for data mining.

Looking Ahead

Despite the recent flurry of activity, we believe the market is still in the early stages of the sustainability journey. Information services players, however, must move quickly to meet simpler use cases in the short term and expand their capabilities to support additional value creation over the medium and long term.

Short Term (2024–2025). In the short term, many information services customers are focusing on the basics to cater to investor and customer demand. They are sizing their footprint and measuring their performance; setting, refining, and communicating their sustainability targets; and developing internal sustainability capabilities. In our experience, most current demand for information services content is related to these basic-measurement use cases.

Medium Term (2025–2028). We anticipate that as information services customers increasingly conquer the basics, there will be a wave of more sophisticated use cases. These include establishing new reporting and compliance regimes; identifying levers for making progress toward set targets; expanding areas of focus in line with customer, investor, and regulatory demands; and developing, refining, and piloting new products and services based on their sustainability impact.

Longer Term (2028–2030 and beyond). Over the long term, sustainability materiality will go mainstream, and information services customers will need help scaling nascent capabilities into robust systems, showing real progress toward net zero, and adding the ability to keep up with regulatory scrutiny in nearly every geographic region.

Clearly, information services providers that have not yet developed sustainability-related offerings haven’t missed the market. Companies that act now can help their customers, build sustainable growth, and accelerate the journey to net zero in the years ahead.

We would like to thank Lauren Hawkins for her contributions to this article.