In post-merger integration, technology issues have become as critical as the traditionally emphasized financial and people considerations. Technology and data platforms are increasingly vital in facilitating the multiyear integration process, accelerating business synergies, and realizing the transaction’s broader ambitions.

Companies that fail to adequately address technology and data in PMI jeopardize near-term business continuity and impede efforts to achieve the merger’s longer-term objectives, such as promoting competitiveness through efficiency and innovation. They also risk diminishing value for consumers, value chain partners, and investors.

The solution is to move technology to the center of PMI. Although elevating technology's role may seem straightforward, it requires companies to adjust their PMI processes. This begins with establishing joint leadership of integration initiatives across business and technology functions and aligning their strategic priorities. To support integration efforts, companies must institute robust governance and the right operating model and foster a data-driven culture to guide decision making.

By taking these steps, companies have rapidly moved from table stakes, such as maintaining service levels, to value-creating activities, such as transforming products and applying their combined data to boost revenue.

What’s Driving Tech’s Elevated Role?

The imperative to emphasize technology in PMI results from two main factors: its criticality throughout the integration process and its enablement of broader enterprise synergies.

Tech’s Criticality Throughout the Integration Process

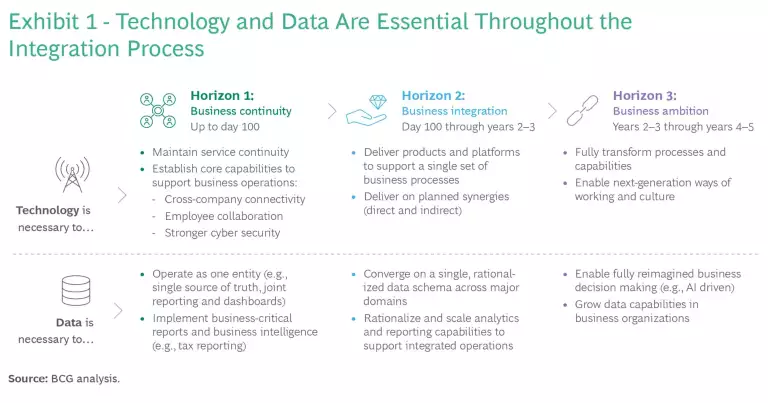

Technology and data play essential roles throughout the three horizons of the integration process. (See Exhibit 1.)

Horizon 1 (Up to Day 100). In the initial phase, the merged company should prioritize business continuity. From the first day of combined operations, business activities should proceed as usual, with technology performing at or above premerger levels. Employees of both organizations should start to have a cohesive experience as one company.

Technology plays a crucial role in enabling this collaboration by establishing integrated operations, such as cross-company network connectivity and common communication and access tools that allow people to work together. Unified cybersecurity measures are also essential—our research shows a significant increase in cyber and phishing attacks immediately following mergers.

In certain mergers, particularly those involving highly digitized businesses, companies should consider opportunities to adopt temporary technological solutions that will help teams rapidly realize high-value business objectives. For example, rapidly migrating data into a common schema, which will later be reintegrated with core transaction systems, can enable cross-company visibility of sales and leads. This allows sales representatives to take orders for products from both companies.

During this period, understanding and governing the data dispersed across both organizations is fundamental to establishing a reliable source of truth that enables critical reporting and promotes business intelligence for the new entity. The merged company should make these capabilities a priority, as they will help to unlock early synergies. Examples include improving the customer experience by means of a unified view of customers and products and optimizing sourcing and supply chain networks.

Throughout horizon 1, teams should consider the objectives of horizons 2 and 3—such as delivering planned synergies and implementing new ways of working—when taking the initial steps to integrate data and technology.

Horizon 2 (Day 100 Through Years 2–3). This stage focuses on integrating business processes and operations. For technology functions, this involves merging platforms and organizations to enable standardized processes, operating efficiently with the combined talent pool, and promoting technology synergies. At the same time, tech teams must engineer future business products that support the merged company’s strategy and lay the groundwork for business synergies now and during horizon 3. For data functions, the goal is to harmonize data schemas and connect them to integrated reporting, analytics, and advanced data-driven use cases (such as AI, automation, and digital applications).

Horizon 3 (Years 2–3 Through Years 4–5). In the final phase, the focus expands to the broader business ambition, aiming to achieve the merger’s strategic benefits on a larger scale. Technology and data teams should work in close partnership with business teams to transform processes and enhance capabilities. Such collaborations should strategically channel investments into:

- Transforming Business Processes. Utilize data and AI to drive decision making and automate operations.

- Revamping Operating Models. Transform the technology and business operating model to boost organizational productivity. This includes establishing a fully integrated delivery model in which business teams are supported by top-tier technical capabilities and are educated on crucial data and analytics topics.

- Enabling Growth. Provide technology that supports both organic and inorganic growth. Examples include application programming interfaces that allow seamless integration with external software-as-a-service providers (such as for controlled data sharing) or scalable tools that enable the rapid incubation of new technologies.

Tech’s Enablement of Broader Enterprise Synergies

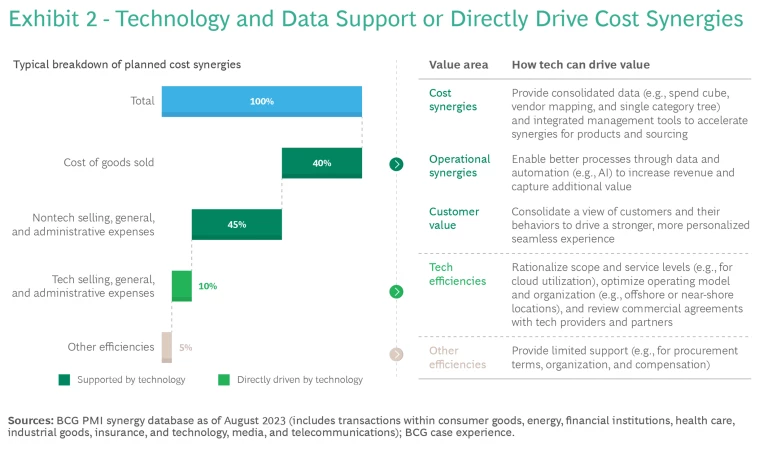

Our analysis found that, in most mergers, technology and data directly drive approximately 10% of synergies while supporting the realization of up to 85% of business synergies across various cost categories. (See Exhibit 2.)

In typical integrations, the technology function must fulfill its own synergy targets. These usually include achieving better economies of scale in tech procurement (for example, licenses, cloud, and support services); rationalizing demand and service levels by combining tech environments, providers, and ongoing delivery portfolios; and consolidating organizational structures and talent.

However, technology’s role in facilitating broader enterprise synergies is even more critical. Technology drives synergies by enabling business units to boost revenue—for example, through transformed processes and better decision making powered by data and AI. It also aids in reducing costs through intelligent automation and agile product-centered ways of working. At the same time, it provides integrated, accessible data—a single source of truth—that all business users can access to improve decision making. For example, the procurement function often achieves synergies in vendor negotiations by leveraging integrated data sets and spend cubes.

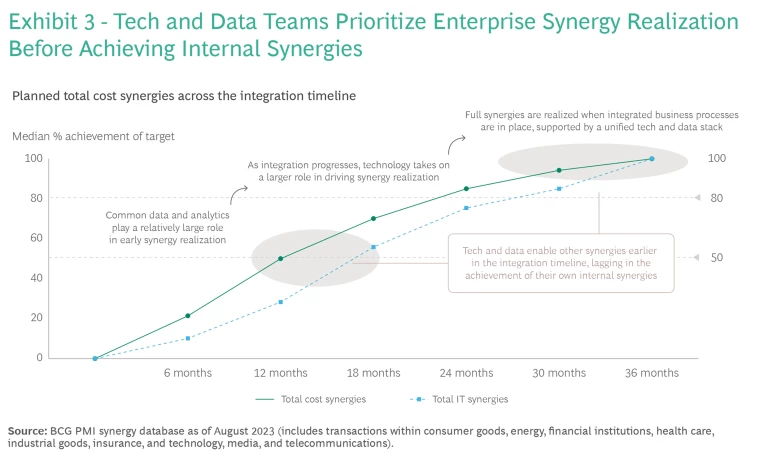

This central role spans the entire PMI timeline, starting with the integration of data sets in horizon 1 and the rationalization of business systems (such as in finance and accounting) in horizon 2. Although technology teams initially trail business teams in delivering their own synergies because of their focus on business needs, they catch up by the end of the integration effort. (See Exhibit 3.)

How to Move Tech to the Center of PMI

To move technology to the center of integration planning and management, companies should take action in several areas.

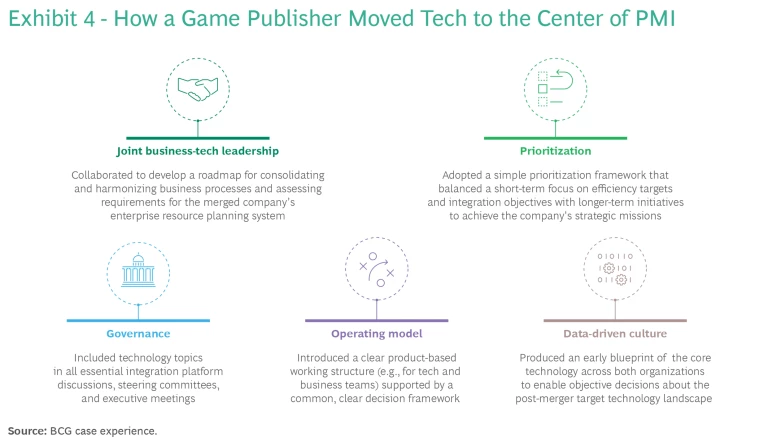

Joint Business-Tech Leadership. Establish collaboration between business and technology leaders to jointly develop the integration agenda and make decisions from the outset throughout the three horizons. Successful integrations hinge on strong, two-way working relationships between business and technology teams. Shared principles, joint goals, and collaboration patterns are essential for effective decision making and prioritization.

Prioritization. Define clear decision-making principles and prioritization guidelines, adopting an iterative approach that sets out success criteria during each part of the integration. Focus pragmatically on what you need to achieve during each horizon rather than aiming for perfection.

Governance. Bring technology and data under formal governance and steering mechanisms by establishing a dedicated team within the integration management office. This team identifies and coordinates all tech-related dependencies in conjunction with business stakeholders, ensuring that the available technology supports the combined entity’s business vision.

Operating Model. Create an integrated operating model with multidisciplinary product teams jointly staffed by highly skilled business and technology personnel. With assistance from the integration management office, these teams follow the agreed-upon principles to conceive and implement an integrated set of business processes, supported by the required technical environment. This model promotes clear accountability within teams, with business personnel defining the direction and tech personnel responsible for determining how to achieve the goals.

Data-Driven Culture. Foster data-driven decision making by encouraging and celebrating fact-based choices across the three horizons. In the emotionally charged post-merger context, decision makers may cling to the legacy structures and processes of their former organizations. So it is essential to ensure that facts, not personal biases, guide their decisions. Enable a data-driven mindset by baselining your starting position for the integration. For example, understand existing strengths and gaps in processes, tech, and data. This provides a solid foundation for analyses and decisions about which assets to maintain, improve, or replace going forward.

A large, diversified game publisher used this approach to rapidly modernize and rationalize technology systems and optimize contracts following a merger. (See Exhibit 4.) Technology delivered more than 25% of the merger’s synergies and became a strategic enabler for several of the company’s long-term goals.

Technology is increasingly becoming embedded within business operations as a driving force of value creation. This is particularly true in PMI, where problems with technology integration can diminish value, inflate costs, and result in subpar solutions that may persist for years. By moving technology to the center of PMI, companies can avoid complexities and delays that hinder business integration and the realization of synergies. The necessary actions are neither complex nor expensive, but they require early implementation to prevent costly repercussions in the future. Ultimately, adopting the right technology strategy at the outset of an integration is critical for ensuring that the merger's goals are fully achieved.