The world over, the renewable energy industry is racing against time—to scale, to innovate, and to meet the planet’s decarbonization goals. However, when it comes to deploying AI, which could be a game-changer, many renewable energy companies appear to have hit a wall.

Everyone in the energy industry initially believed that AI would help optimize the production of renewable energy, predict equipment failures, and unlock operational efficiency—and that these benefits would be realized quickly. Instead, most renewable energy companies find themselves trapped in a vicious cycle of technological hype, pilots, and unrealized potential.

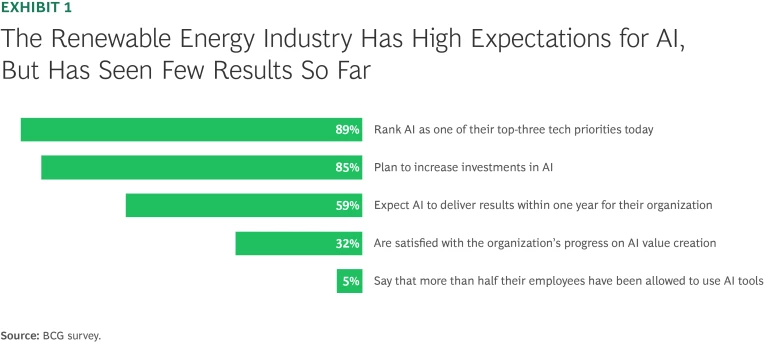

Nearly 60% of energy company leaders expected AI to deliver results within a year, according to a 2024 BCG survey. At the same time, around 70% of them admitted they were dissatisfied with their progress. Like turbines idling on a windless day, AI’s momentum in the renewable energy industry has slowed to a crawl. (See Exhibit 1.) The problem is that while AI’s capabilities continue to expand, the industry’s playbook for making the technology deliver value has not kept pace.

It's time for renewable energy companies to face the hard truth: Without a strategy for scaling AI and managing the organizational changes its use requires, the technology may never generate sufficient value and, in fact, could prove to be a costly distraction. To capitalize on AI, renewable energy companies must move past the experimental stage and start executing at scale.

The current impasse isn’t a pause; it’s an inflection point. Companies that rethink their approach will be able to turn AI into a competitive edge. Those that do not will find themselves left behind in the current global energy transition.

Stay ahead with BCG insights on energy

Renewable Energy Projects Face Challenges

In the renewable energy industry, AI’s adoption has been slow for a variety of factors. Most power equipment lacks the digital subsystems necessary to generate and transmit the high-quality, real-time data that AI demands. The industry ecosystem is fragmented—with misaligned roles across producers, utilities, grid operators, and regulators—leading to disjointed and inconsistent data flows. Moreover, regulations and privacy concerns have made it difficult for companies to access the sensitive data that AI systems need.

Unfulfilled expectations have led to disillusionment. This could prove costly for an industry that must triple its installed capacity by 2030 to help limit global warming to below 2°C (above pre-industrial levels). Achieving that will demand a pace of technological deployment that the renewable energy industry has never seen. In Australia, for instance, wind turbine deployment needs to accelerate by a factor of six to meet climate-related goals.

Renewable energy projects are facing headwinds. Supply chain disruptions, rising capital costs, and complex permitting processes are constraining the industry’s growth. Geopolitical tensions and the imposition of tariffs have added to the uncertainty. In the US, these dynamics have recently driven up the levelized costs of energy (LCOE) by as much as 50%, while in other regions, supply chain realignments are causing delays. Governments are moving from setting targets to catalyzing actions by energy companies, but the lack of clear signals and licensing clarity has complicated progress.

Energy system needs are evolving rapidly. New solutions—such as hybrid plants, energy trading and aggregation platforms, and digital-first business models—are opening the market to new entrants. Meanwhile, rising costs and shrinking financial support are making it difficult for incumbents to sustain their leadership. As a result, competition is intensifying and the pressure to perform is growing, so companies have to rethink their operating models.

Amidst these challenges, the demand for renewable energy continues to grow. Corporate decarbonization targets and consumer pledges to use only renewable energy are driving up long-term demand, so persisting with AI adoption is essential for renewable energy companies. After all, the technology appears to be the key that could unlock resolution of many of the industry’s current challenges. (See “Coping with Creative AI Chaos.”)

Coping with Creative AI Chaos

Many companies have adopted the technology without fully aligning stakeholders, defining the returns carefully, or putting in place all the infrastructure, so AI applications don’t integrate with core operations. Several survey participants told us that they’ve each identified over 100 AI use cases, but when we asked how many they’ve scaled and how much value was created, there were few answers. One European renewable energy company, for instance, identified close to 150 AI use cases, but was able to develop business cases for only 10. It launched all of them, but eventually, none of them was able to scale.

Another challenge is that renewable energy companies rely on talent that possesses domain knowledge, but they lack AI specialists, especially those that understand the energy sector’s unique operational and market realities. Business teams find it difficult to explain to their digital counterparts, or to vendors that tend to operate in isolation, what they and their customers need. As a result, the AI applications don’t turn out to be what’s needed. Without integrating business knowledge with digital technology, and fusing together teams of analog and digital talent, AI projects are likely to stay mired at the proof-of-concept stage.

AI applications are greeted skeptically by field engineers and grid operators, who rely on experience-driven decision making. They distrust AI-generated insights that come from black boxes and, worse, those that require changes to existing workflows. Without employee buy-in, AI tools get added to unused digital dashboards rather than driving data-driven decision making.

Even at the top, senior executives often approve AI projects by invoking the promise of innovation without defining success metrics or understanding the operational constraints. They don’t create structured roadmaps for AI adoption, which leads to poor employee training and ineffective integration with existing workflows. As a result, many AI tools have ended up creating inefficiencies—or simply being ignored.

Central AI Hurdles for Renewable Energy Companies

Every organization has to climb a stairway with four distinct steps before it can generate value from AI, according to a BCG analysis of 350-plus AI projects. We call these steps illusion, theory, showmanship, and money making. Most renewable energy companies have gone beyond the first step, but they are stuck between the second and third, between theory and showmanship. That has resulted in several problems, from rising costs and unreliable forecasts to weaker customer engagement and lower profits, which are putting their current performance and future competitiveness at risk.

Over 100 renewable energy companies are running AI pilots in several functions and departments, according to BCG data, but they have failed to generate value and haven’t drawn up plans to scale the applications. Using AI, especially generative AI, may have increased employee satisfaction, but it hasn’t had much of an impact on revenues or profits, leaving the impression that AI’s financial benefits may be an illusion.

Broadly, renewable energy companies face two core problems that reflect a limited understanding both of how to effectively implement AI at scale and how the organization must change to accommodate the technology.

Most companies are unable to figure out how to scale AI to create value. The shift from pilots to products hasn’t happened because many early experiments with the technology were driven by curiosity and hype, not value creation and business cases.

In addition, companies often underestimate the capabilities they must develop and the extent of change management necessary to succeed with AI. Creating value with AI isn’t just about rolling out a new technology, it requires rethinking business processes from end to end and changing the organization’s existing ways of working. BCG has found that successful AI integration requires balanced investments: 10% of the organization’s efforts should be invested in algorithms, 20% in data and technology, and as much as 70% in people, processes, and cultural transformation.

In the absence of effective change management, only 24% of utility, power, and renewable energy companies had attained a degree of AI maturity by 2024, according to a third BCG study. As a result, most industry leaders remain uncertain about AI’s potential and are unsure whether to treat it as just another upgrade or as a transformative force.

Three Steps to AI Success in Renewable Energy

To deliver concrete results, renewable energy companies must focus on three critical steps when planning AI projects.

Focus on creating and capturing value.

Companies should concentrate from the get-go on the value they can generate from AI pilots, estimating the different types of value that are at stake as well as the quantities. The focus should be on the operational impact, such as equipment downtime, and the financial returns, such as return on investment, of each application—as well as the organizational value measured by, for instance, employee adoption rates and training completion metrics.

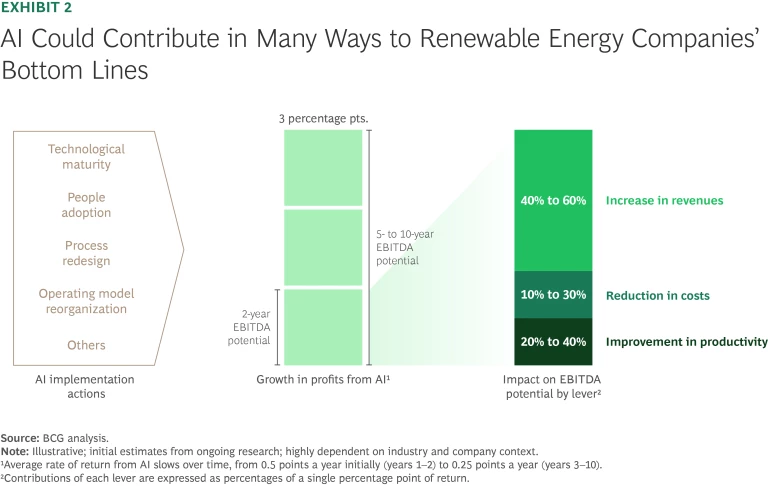

Broadly, AI can help companies create value related to costs, revenue, and productivity—and do so simultaneously.

• Reducing costs

AI can analyze complex datasets—such as weather patterns, land use, energy prices, and grid data—to help companies choose the best locations for wind farms, solar plants, and other renewable energy installations. During project development, AI is able to refine engineering designs, streamline paperwork, and coordinate construction timelines. This shortens project cycles, reduces costs, and speeds up the time to revenues.

Renewable energy companies can then use AI to drive cost savings through maintenance, automation, and supply chain optimization. AI-powered predictive maintenance for wind turbines and solar farms enables early detection of potential failures, reducing downtime while extending asset lifespans and reducing maintenance costs.

Similarly, AI-driven supply chain optimization enhances inventory management and logistics, minimizing operational expenses. These efficiencies not only reduce costs but also improve reliability and scalability, allowing companies to grow faster. BCG studies suggest that by using AI, renewable energy companies’ efficiency levels could improve by between 15% and 25%.

• Boosting revenues

Renewable energy companies can increase revenues by using AI to identify better projects, execute them more efficiently, and improve operations. Once a plant is running, AI can optimize output by adjusting operations based on weather forecasts and demand. Smarter performance will result in greater power generation by the same assets, boosting revenues.

Renewable energy companies can also use AI-driven energy trading platforms to boost incomes. Such platforms enhance market forecasts, optimize bidding strategies, and minimize operational risks. They enable energy providers to capitalize on fluctuating prices by using dynamic pricing models and hyper-personalized customer solutions. This allows smaller producers to participate in the complex markets that used to be reserved for utilities and large producers.

Virtual power plants enhanced by AI transform energy management by aggregating decentralized resources, such as solar panels, wind farms, and battery storage, into energy networks. They improve distribution efficiency, reduce waste, and create new monetization opportunities, strengthening renewable energy companies’ profitability and grid stability. Using AI can improve renewable energy availability by two to three percentage points, according to recent BCG studies.

• Improving productivity

Using AI to automate routine tasks helps renewable energy companies improve efficiency and maximize workforce potential. The five functions that are usually most affected by AI—operations, engineering, accounting, administration, and HR—account for over 70% of the potential for improving productivity, according to a recent analysis of the technology’s impact on the workforce in the renewable energy industry.

Operations and engineering report the highest productivity gains because of their sheer scale, while roles in accounting, administration, and HR experience the greatest efficiency improvements at the individual level. By offloading repetitive tasks and optimizing key business functions, renewable energy companies can increase operational agility, reduce overheads, and free employees to drive innovation.

Using AI to drive all three levers—driving down costs, increasing revenues, and boosting productivity—at scale in a renewable energy company results in a significant uptick in profits. And BCG research shows that companies generate a significant return on investment in less than five years. (See Exhibit 2.) Moreover, using AI improves grid stability and sustainability, reinforcing competitive positions.

Measure impact and feasibility to identify high-potential use cases.

Renewable energy companies seeking to harness the potential of AI must focus not just on experimentation, but on prioritization. Effective organizations use a rigorous approach to identify AI use cases that combine impact with feasibility, ensuring that resources are channeled to projects with the greatest value and the lowest execution risks.

Impact must be assessed on multiple fronts. Financial metrics such as revenue uplift and cost savings are necessary, but not sufficient. Strategic relevance—how closely a use case aligns with the company’s long-term goals, such as grid integration, decarbonization targets, and geographic expansion—must also be taken into account.

Equally important are organizational and operational considerations. Use cases that have employee buy-in, manageable change footprints, and faster learning curves will scale faster. The transferability of AI solutions such as chatbots across geographies, facilities, and business units adds value, reducing duplication and accelerating enterprise-wide returns.

Feasibility demands just as rigorous a lens, requiring the scrutiny of technical and organizational prerequisites. Companies must evaluate whether high-quality data is available to train and sustain AI models. They must also assess the scalability of solutions beyond pilot projects, particularly across regulatory regimes and infrastructure contexts. The ability to integrate AI systems with the existing information technology and operational technology infrastructure is often a gating factor.

Ultimately, AI use cases that generate financial impacts while advancing strategic agendas—such as accelerating the energy transition, improving grid reliability, or reducing time-to-market for new projects—deserve top priority. Choosing those will allow companies to go beyond fostering ad hoc initiatives and develop enterprise-wide AI capabilities.

Use top-down and bottom-up approaches to manage organizational change.

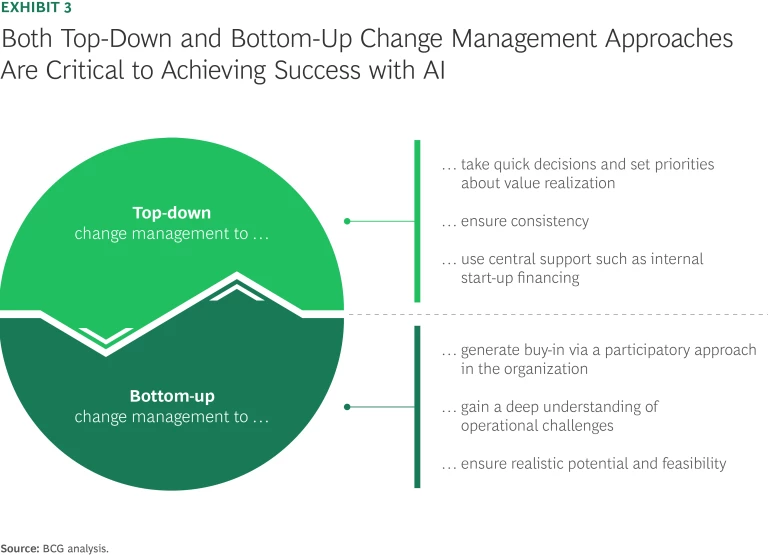

Change management is essential when deploying AI because the technology affects organizations in many ways. Companies should set up an AI change management office to develop and execute a roadmap, proactively manage roadblocks, and track the progress—and the impact—of each project as well as the organization-wide AI program.

Crucially, every AI transformation must be driven from the top. The CEO and the senior management team need to champion the AI agenda, signaling its strategic importance to the company, setting priorities, and aligning resources. Without visible top-level commitment, AI initiatives will risk getting deprioritized and will stall.

Rather than superimposing change, smart teams engage from Day One with employees in business units and functions to co-develop solutions. As future users, these employees can steer the development of applications in the right direction, and doing so will give them the feeling of ownership that catalyzes success. The focus must be on mobilizing teams, ensuring change by taking them along on the proof-of-concept journey. (See Exhibit 3.)

The AI application development process starts with a team understanding a process as is, defining the application and iterating it into an AI solution, and calculating the business case for it. Then, the team interviews the first users of the AI application and identifies possible improvements. Some AI teams shadow employees as they execute their daily routines for a week or more to ensure they understand what the issues and opportunities are.

Adopting a user-centric approach to AI deployment is critical. For instance, a global utility wanted to help its technicians perform maintenance activities better with AI. One week of interviews and shadowing resulted in the capture of 1,500 process-related insights and 150 supporting pictures. User engagement rose sharply following the shadowing exercise, with the AI team gaining access to technicians who would normally spare no time for such things.

After testing concepts with would-be users, the AI team should work with them to develop the application’s key features and test them out. The AI application is thus co-developed by following an agile approach with sprints, and the results are continuously reviewed to improve the technological solution and ensure its fit.

The renewable energy industry, like many others, is struggling to harness AI’s potential because it has tried to roll out the technology with an outdated mindset. To change this, companies must shift from deploying AI tools to building AI-native organizations. That means embedding AI expertise across business units—not just in digital teams—and rethinking how data is collected, shared, and acted upon in real time. Such a shift will demand investment not just in algorithms, but also in business processes, organizational culture, and new kinds of collaboration between domain experts and data scientists.

Ultimately, AI can help renewable energy companies do more than produce clean power efficiently; it can help match supply with demand dynamically, engage customers in new ways, and help energy companies operate flexibly in complex grids. However, that will require forgetting the old assumptions about digital technologies and relearning what it means to lead in an AI-first energy world.