Because today’s consumers research and buy products in more places than ever, brands need a presence on everything, everywhere, all at once. Otherwise, they risk being overlooked at crucial points in the customer journey. Fortunately, advances in ad technology and analytics have enabled the evolution of new commerce media networks to help address this need. As a result, we are seeing commerce media offer an upgrade on multiple forms of media: Google Shopping is now offered through commerce media and embedded directly in search; cookie-based targeting has shifted to first-party (1P) data targeting both on and off e-commerce platforms; and broadly targeted linear TV ads are giving way to personalized messaging on the back of a passenger’s airplane seat or in a guest’s hotel room.

In a recent BCG survey of 200 buyers of retail and commerce media, 86% of respondents said that commerce media powered by 1P data drives higher performance than other forms of digital marketing, and more than 80% said that their brands either are already spending on commerce media offerings or plan to do so. Like retail media, commerce media delivers targeted, contextual, and highly relevant messages to customers, but it also extends those capabilities to new customer journey touchpoints. This convergence of rapidly evolving consumer behavior and adtech advances signals that the world of media is at an inflection point.

Retail media works, and it is imperative that organizations think about retail and commerce media. In the third quarter of 2024, Walmart reported that almost a third of its enterprise profit now comes from its commerce media business. Commerce media is the future of media, capable of driving both customer growth and enterprise profitability—but what makes a commerce media business successful?

Stay ahead with BCG insights on marketing and sales

Lessons from Retail Media

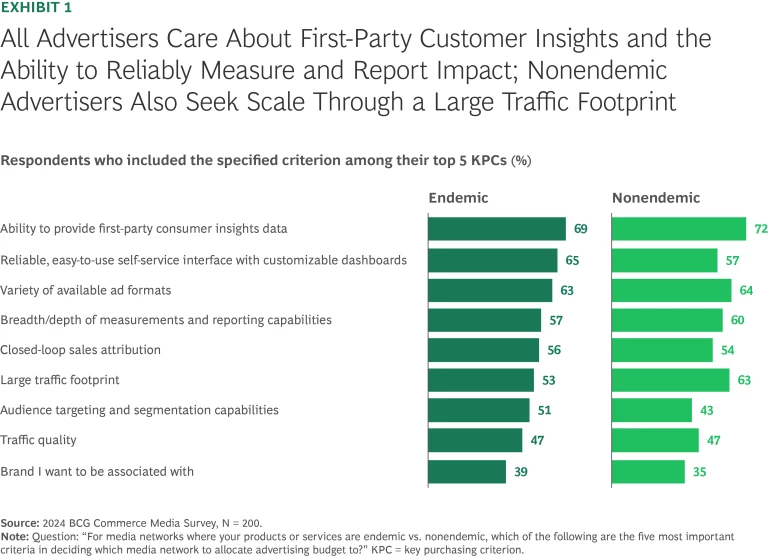

For years, many large retailers and marketplaces have scaled their retail media businesses, offering a blueprint for nonretail companies that are interested in building new commerce media businesses. Our research and survey results suggest that advertisers focus on three key themes when deciding how to invest in commerce media networks: the ability to drive business results for their brands, delivery of results at scale, and proven positive outcomes. (See Exhibit 1.)

The challenge for nonretail companies is to figure out how to build a commerce media network that can satisfy these three fundamental criteria for both endemic brands (those found in their stores) and nonendemic ones (those not available in their stores) and can also attain the size necessary to warrant the investment in the business. As Danilo Tauro, managing partner at Aperiam and former general manager of Uber Eats Ads), said, “One crucial dimension is that you need to understand whether you have a marketplace—because if you do, endemic advertisers must be a key driver for growth.”

The Commerce Media Framework

Companies can’t expect to build a successful commerce media network unless they understand their enterprise’s underlying core business and its relation to both endemic and nonendemic brands. Such knowledge is crucial to helping them devise appropriate strategies to win different pools of advertisers. Analytically, commerce media can be separated into a framework consisting of four quadrants (see Exhibit 2):

- Legacy RMN includes core retail media networks (RMNs) fueled by growth from endemic brands (Amazon, Walmart, Home Depot). The core characteristic of these platforms is to facilitate consumer transactions with endemic brands.

- Marketplace/service comprises all nonretail companies that focus on monetizing ad inventory with endemic brands—for example, Expedia promoting hotel brands or car rental companies in search results, or Uber Eats selling ads to restaurant chains. These platforms also facilitate consumer transactions with endemic brands, and they can leverage many of the same tools and strategies that legacy RMNs have successfully used, such as automated sponsored search.

- Extension involves retail companies putting their inventory or 1P data to use to sell ads to nonendemic brands. For instance, makers of pickup trucks might want to target brand messaging to Home Depot’s professional contractors, even though Home Depot doesn’t sell trucks. Winning in this quadrant requires a careful balancing act: maintaining a great customer experience for endemic brands while introducing nonendemic brand messages.

- Lifestyle entails a combination of partnerships, content, and experience in the right balance. Consumers using a car service or taking a flight or staying at a hotel may not be prepared to make other purchases as readily as they might be on an e-commerce site. Nevertheless, these may be opportune moments for brand affinity and product consideration to enter their mind. For example, a restaurant reservation platform might want to remind a hotel guest who is researching a trip to use the platform to make dinner reservations. Or a movie distribution company might want to promote new films available for streaming in the guest’s room. These nonretail players don’t necessarily facilitate transactions, but their customer knowledge is valuable for brands looking to meet customers at new moments with a relevant message.

This framework introduces two key strategic moves for growing commerce media networks:

- Move up the grid and attract nonendemic advertisers.

- Find the sweet spot and build lifestyle partnerships with brands.

Move up the Grid and Attract Nonendemic Advertisers

Both endemic and nonendemic advertisers offer a common guiding message to commerce media networks: drive business results at scale, and prove it. This is more challenging in the case of nonendemic advertisers, however, because retailers don’t facilitate the transaction and, therefore, can’t easily measure results and close the loop. Even so, some tactics that make retail media networks effective for endemic advertisers also work for nonendemic advertisers.

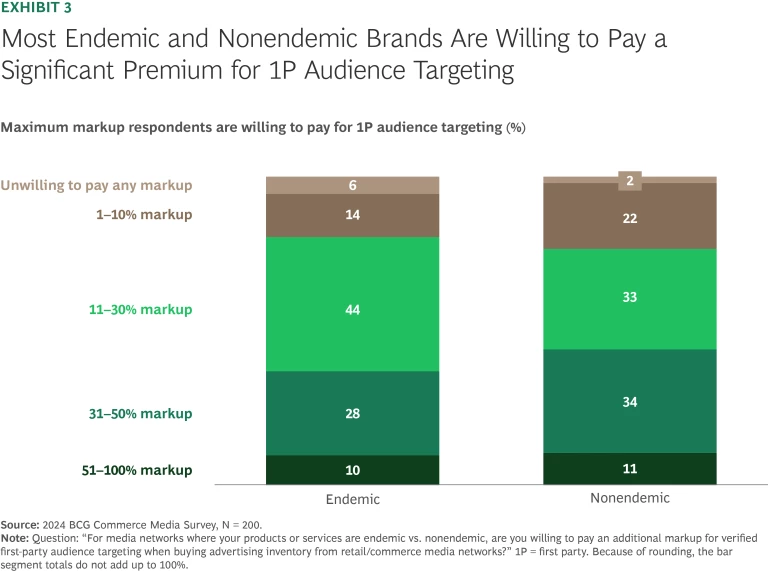

Drive value. Brands are leveraging 1P data from media networks to more precisely target and place their messages across new customer touchpoints that are increasingly close to moments of conversion. Advertisers see the value in this 1P data: as noted earlier, 86% of survey respondents said that targeting through commerce media is more effective than other forms of digital advertising. Nonendemics are especially willing to pay a premium for these capabilities, underscoring the need to invest in data science to build compelling audience targeting. (See Exhibit 3.)

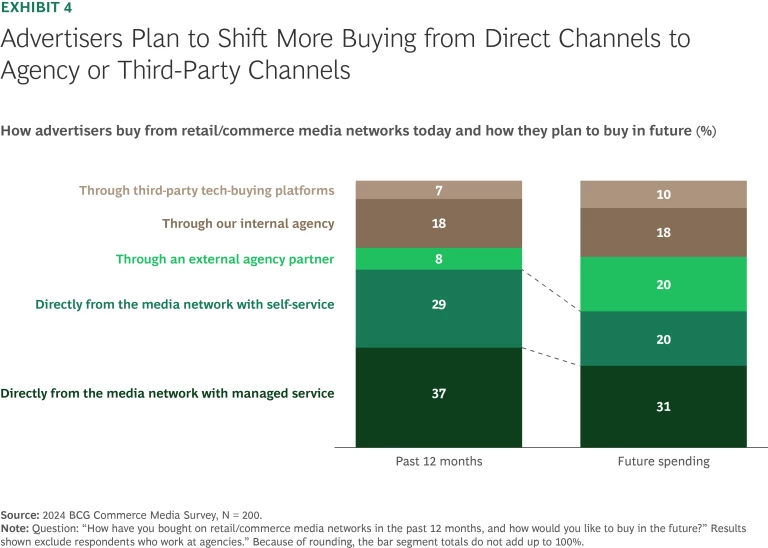

Enable scale. Self-service tools and automation are critical for scaling because they make it easier for advertisers to reach relevant audiences at scale across a wide range of touchpoints. This high level of flexibility and control is especially important for nonendemic brands seeking to maximize targeted reach without incurring a heavy operational lift. (See Exhibit 4.)

To further accelerate growth from nonendemic advertisers, media networks should be open to new programmatic partners. The right partners, coupled with self-service, can help a media network tap into net new pockets of brand funding. For example, Expedia is pushing to build a partner-agnostic tech stack. “As we look to grow with nonendemic partners, we need to ensure that our stack can work with a variety of programmatic partners,” said Rob Torres, senior vice president for Expedia Group Advertising.

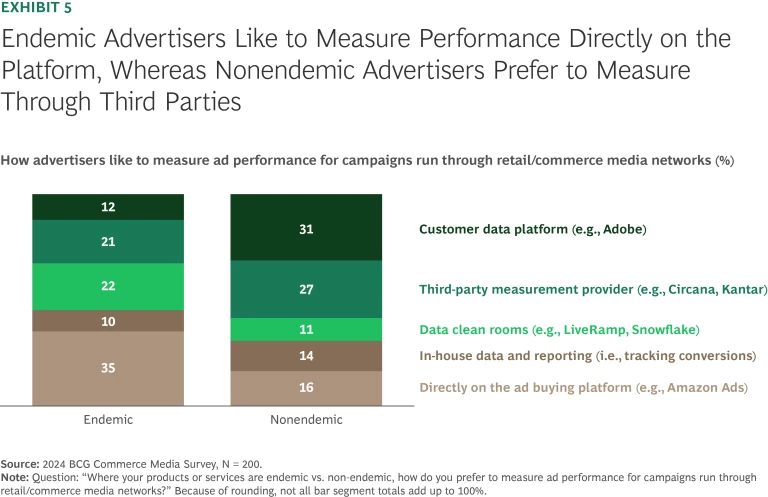

Prove results. Measuring and demonstrating results is critical to renewing advertisers and recruiting new partners. But because media networks don’t facilitate the final sales with nonendemic advertisers, demonstrating traditional sales lift is difficult. Media networks must have the right measurement partners to enhance their existing capabilities and tell a full-funnel story. Nonendemics, in particular, rely on and expect third-party measurement. (See Exhibit 5.)

Find the Sweet Spot and Build Lifestyle Partnerships with Brands

As commerce and content intersect across new customer journey touchpoints, media network alliances and other partnerships represent a new growth frontier for commerce media. In our survey, 94% of advertisers expressed interest in media network alliances. We see this sentiment echoed among commerce media leaders such as Richard Nunn, CEO of United MileagePlus, who commented that United is “very bullish on all things partnership—media data, tech, loyalty.” To succeed, these lifestyle partnerships must address the same three fundamental issues that the extension play does.

Drive value. Because content consumption—and therefore brand and product discovery— is happening in new places, commerce media can drive real impact for brands. For example, in the travel and hospitality space, Peggy Roe, executive vice president and chief customer officer at Marriott International, says that “today’s travelers expect personalization, and media can actually enrich, not interrupt, the customer journey, connecting guests with brands in ways that feel natural, relevant, and aligned with their travel experience.” According to our survey, nonendemic advertisers especially want this kind of contextual targeting from commerce media networks, but they largely don’t receive it yet. (See Exhibit 6.) To unlock this growth potential, media networks need to identify key moments in their journey or pockets of customer data that spark native brand building.

Enable scale. New commerce media networks can offer scale in two ways: by reaching a brand’s current customers in new places, and by reaching potential customers that the brand would not have otherwise encountered.

Co-mingling audience data can help deliver scale, whether by enhancing targeting and messaging for shared customers or by enabling more effective acquisition of new ones. Consider, for example, a partnership between an airline, a hospitality brand, and a rideshare company. By integrating their media networks and sharing audience insights, they could reduce drop-off across key moments in the travel journey, increase awareness of advertisers’ products, and promote their own services more effectively.

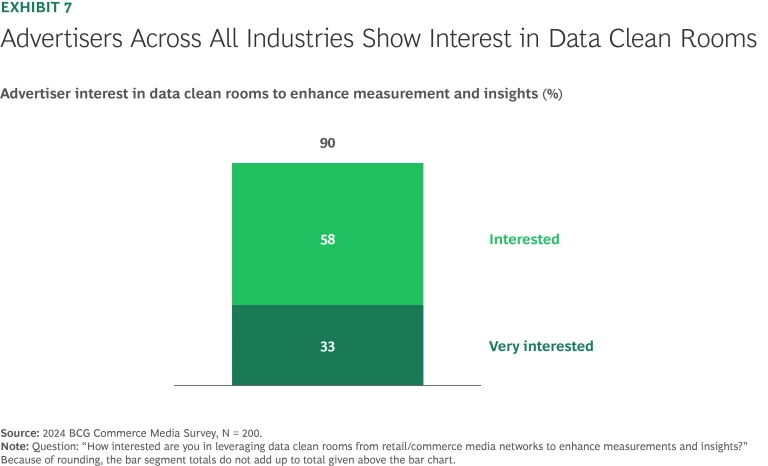

Prove results. About 90% of advertisers across industries are interested in exploring data clean rooms to discover new insights about customers, which could help media networks demonstrate their value even without closing the loop on sales. (See Exhibit 7.) The challenge is to ensure that the networks handle data in a way that complies with all relevant regulations and satisfies all partners, especially as the data privacy regulatory environment continues to evolve.

Next Steps to Build a Commerce Media Network

Because commerce media is the future of media, we expect it to continue to move quickly from the periphery to become an integral element of an enterprise’s growth and margin expansion strategy. Retail companies have had a head start and are well positioned to extend their offerings to nonendemic brands. Many nonretail companies, by comparison, will need to build their commerce media offerings from the ground up. Fortunately, commerce media leaders have a playbook to begin that journey:

- Drive value. Determine what is special about your customer journey and customer data, and figure out how to pair the two to create unique opportunities for brands to connect with your customers in impactful ways.

- Enable scale. Implement the right tech and integrate with the right partners to make it easy for brands to connect with your customers and for you to access new pools of advertiser demand.

- Prove results. Figure out how your customer journey touchpoints perform best for brands (in terms of awareness, consideration, and conversion), and then integrate the right tools for providing actionable reporting and insights to your brand partners.