Much has changed since we conducted our December 2024 CIO Spending Pulse survey. Back then, IT leaders expressed confidence in their plans for growth, driven largely by increased spending on AI and ML—and in particular, on GenAI.

More recently, CIOs have been recalibrating their priorities in the face of newly introduced tariffs and the rising risk of a recession. Understandably, the watchword now is caution. BCG’s latest CIO Spending Pulse survey, conducted in April 2025, shows a sharp shift in sentiment, as almost 60% of IT leaders believe that a recession in 2025 is likely or already underway. In response, companies are tightening budgets, reprioritizing investments, and preparing for a more volatile future.

Still, the survey results contain some bright spots. Many IT companies continue to invest in AI and automation in order to manage long-term cost reductions through productivity improvements. As a result, a two-speed world is emerging in which digital leaders are accelerating investments in AI while less mature companies are staying on their current path.

In short, IT leaders are quickly refining their spending strategies in light of the current uncertainty, tailoring their plans to cut costs in preparation for a tighter budgetary future and to focus on the most promising avenues for growth.

Cost Control Takes Precedence

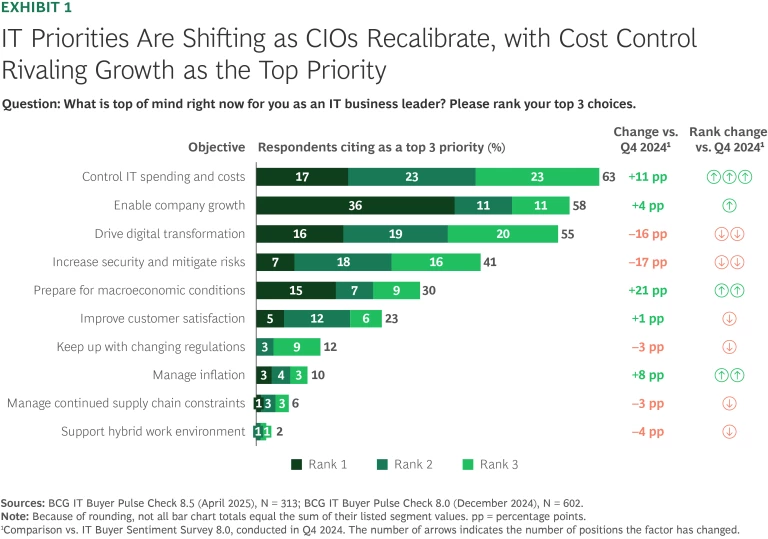

Given IT leaders’ concerns about the likelihood of a recession, it comes as no surprise that in just the past three months, cost management has risen in importance. (See Exhibit 1.)

In our latest survey, 63% of respondents ranked cost management as a top-three priority, putting it on a par with growth for the first time since 2023. At the same time, more than a third of IT leaders ranked “enable company growth” as their number one priority—indicating a perceived degree of importance that no other category came close to matching. (See “Survey Methodology.”)

Survey Methodology

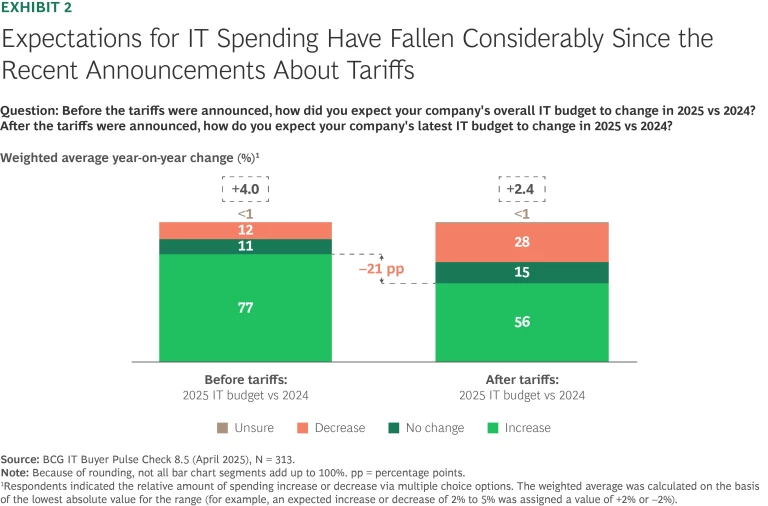

The underlying shift in mindset is evident in respondents’ changing budget outlook for 2025. When asked in our most recent survey about their budget plans for the year, more than three-quarters of IT leaders said that, prior to the tariff announcements, they had been planning to increase their budgets, by an average of 4.0%. In light of the tariffs, however, the percentage planning to increase their budgets declined to just 56%, and their anticipated average increase fell to 2.4%. (See Exhibit 2.)

This year’s budgetary pullback has cut across every sector, but the extent of the retrenchment varies across industries. Industrial goods, retail, and travel and tourism face the largest slowdown in IT budgets, driven by tariff exposure and increased pressure on global supply chains. In contrast, financial services, health care, and tech and media expect smaller declines in growth, as they are less directly affected by tariffs and policy changes.

CIOs Are Taking Swift Action to Soften the Impact

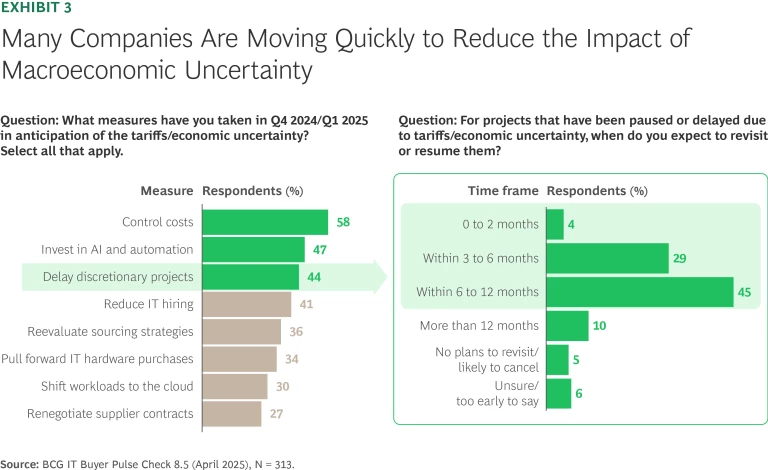

IT leaders were quick to act in response to the introduction of new tariffs. Almost 60% of respondents said that they had already started taking various cost-cutting and optimization measures in late 2024, while almost half reported investing in AI and automation. Importantly, 44% said that they have paused or delayed a variety of discretionary IT projects. (See Exhibit 3.) Nearly a third are hoping to restart these efforts within the next six months, but close to half do not expect to resume them for up to a year.

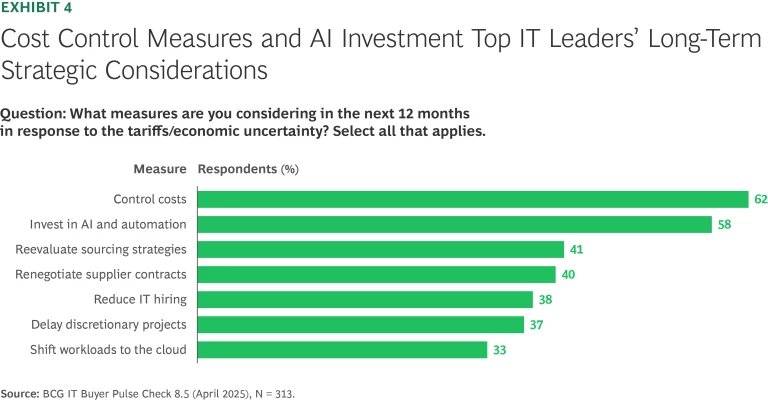

Moreover, almost 60% plan to invest in AI and automation over the next 12 months to mitigate the impact of tariffs. This figure is significantly larger than the percentage of respondents who have near-term AI plans, and an impressive sign of commitment to the technology. (See Exhibit 4.) CIOs are also revising their longer-term sourcing strategies to prepare for potential trade disruptions. In addition to maintaining cost controls and boosting AI investments, around 40% expect to reassess their global sourcing mix and renegotiate supplier contracts over the next 12 months.

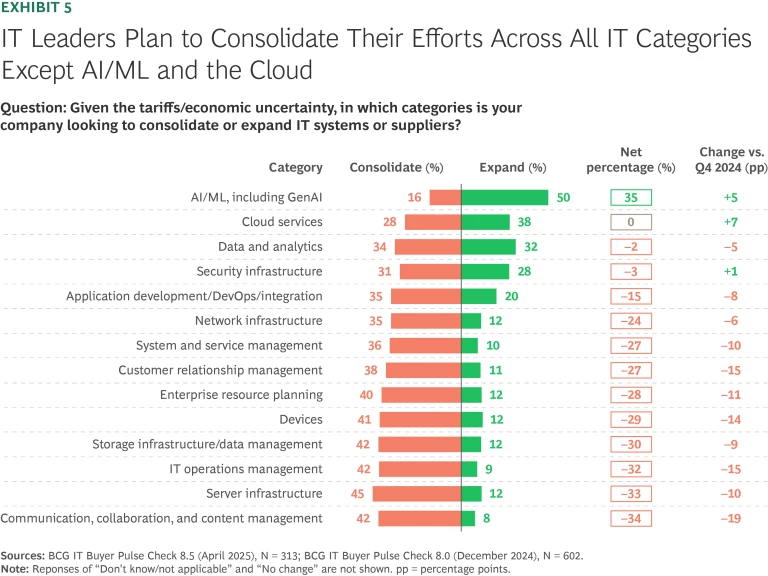

As sourcing strategies come under the spotlight during the next year, a substantial number of survey respondents say that they are consolidating vendors in business-as-usual areas such as server and storage infrastructure, IT operations management, and communications platforms. (See Exhibit 5.)

The one bright spot in IT leaders’ plans is their ongoing commitment to AI. Despite the current uncertainty, fully half say that they plan to expand their supplier base for this key technology in the near term.

Stay ahead with BCG insights on technology, media, and telecommunications

AI Investments in a Two-Speed World

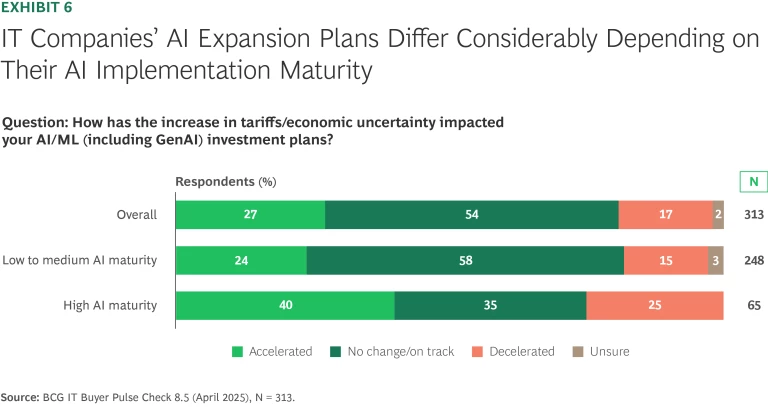

Clearly, despite concerns about spending in just about every other IT category, the current climate of macroeconomic uncertainly has not discouraged most IT leaders from pursuing plans to expand their push into AI/ML and GenAI. Overall, 81% of respondents say that they intend either to maintain or to increase their investments in AI/ML to boost productivity and cut long-term operating costs. Nevertheless, there is a clear distinction between companies that are leading the way in implementing AI and those whose AI efforts are less mature, with 40% of the former saying that they plan to accelerate their AI investments, and just 24% of the latter doing so. (See Exhibit 6.)

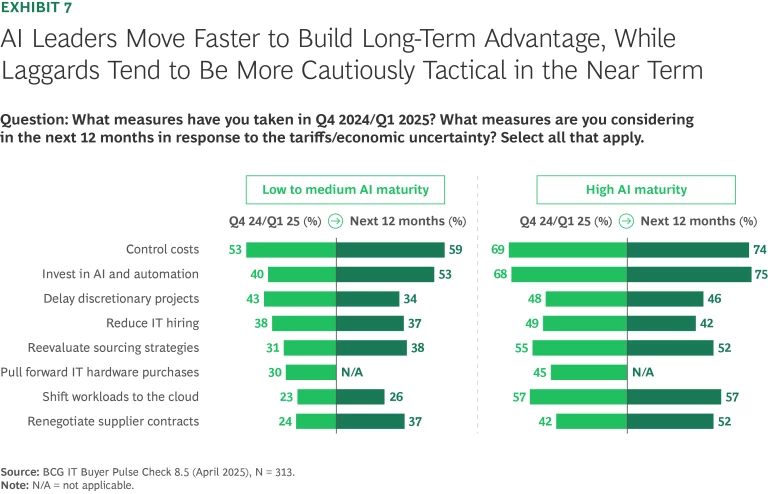

The distinction in degree of AI maturity cuts across other IT spending categories as well. (See Exhibit 7.) In addition to boosting their spending on AI and automation, companies with high AI maturity are generally acting more broadly and holistically than lower-maturity firms both in the near term and over the next year. They are reprioritizing projects, reworking vendor agreements, and moving faster on strategic decisions—such as reevaluating supply chains—that have the potential to build long-term advantage.

In contrast to AI leaders’ activist approach, laggards tend to be more cautious and tactical in their mitigation measures. In fact, the surge in attention to cost discipline is occurring most markedly among firms with low to medium AI maturity. They are far more likely to focus on a few immediate cost-cutting actions and adopt a wait-and-see stance toward any larger structural changes that might deliver strategic advantage in the longer term.

Conclusion

IT leaders are shifting to a more cautious and cost-conscious mindset in 2025, driven by fears of recession and concerns about the effects of new tariffs. Although expectations regarding overall IT budget growth have declined, especially in sectors most exposed to global trade, investments in AI and automation remain a strong focus.

At the same time, a clear divide is emerging. Companies with higher AI maturity are aggressively pushing ahead with their AI initiatives and broader strategic adjustments, while less mature firms are taking a more conservative, tactical approach. Despite the prevailing economic uncertainty, companies’ commitment to AI investment remains strong, highlighting their belief in its long-term potential to drive productivity and resilience.