Empowered by the rise of embedded insurance, consumer-facing businesses are weaving coverage into their product and service offerings and taking control of the insurance value chain. This marks a major shift in the way consumers are accessing and experiencing insurance, with companies from outside the industry increasingly owning the customer interface.

BCG analysis shows that embedded insurance could account for more than $70 billion in gross written premiums by 2030, up from around $13 billion today. Meanwhile, conversion rates for traditional insurers that have embraced this model are already higher than for separate insurance for the same products. And these insurers are dynamically defining, monitoring, and adjusting their offerings to adapt to customer needs, opening previously unseen growth opportunities in new customer bases.

Yet, reaching across partner systems and services to become embedded within external digital ecosystems and dynamically configure products to match is a significant challenge. To make the most of these opportunities, insurers will need to collaborate extensively—tailoring their coverage, pricing, and customer experience to each business’s specific products, services, and user base—to become the partner of choice. This level of integration requires extensive and often complex technological adjustments that many traditional insurers are not equipped to manage. Legacy systems, siloed data, and rigid product structures often limit their ability to adapt with the speed and flexibility that embedded insurance demands.

To make the most of their opportunities, insurers will need to support and collaborate extensively with their business partners to become the provider of choice.

To succeed, insurers will need a flexible, dynamic, and customizable tech stack. Instead of one comprehensive travel insurance package distributed through a direct-to-consumer website, for example, an insurer would provide tailored products for each partner, leveraging proprietary data to adjust coverage based on individual customers’ travel profiles and needs. Exact requirements would differ for each insurer based on the lines of business and geographies covered, and technology ownership could vary. (See “Digital Intermediaries.”) However, all would need to introduce a set of key success factors supported by the right tech capabilities to form an effective stack.

Digital Intermediaries

Six Success Factors Underlie Winning Tech Capabilities

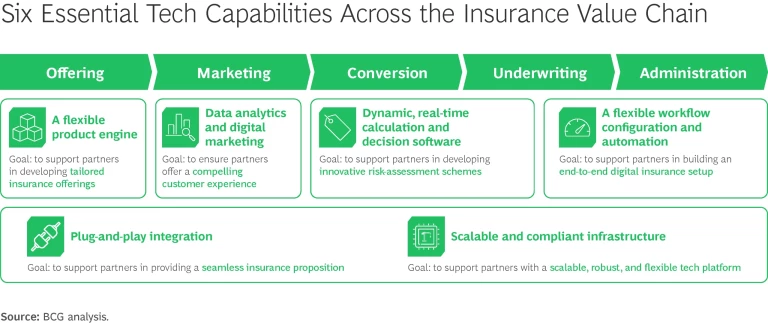

Building the optimal tech stack will naturally require developing a robust IT architecture and choosing the right vendor. Based on our experience, however, insurers must also secure six technology-related success factors across the typical insurance value chain—from developing an offering to marketing, conversion, underwriting, and administration—if they are to meet their embedded insurance goals. (See the exhibit.) Those six are as follows:

A Flexible Product Engine. Embedded insurance raises the bar for product innovation and speed to market. While traditional insurance products can take months or even years to launch, embedded offerings must go live rapidly to stay competitive in today’s fast-moving digital markets. In addition, insurers need the ability to adjust products dynamically after launch, fine-tuning performance, pricing, and risk controls in real time. As a result, they must have a flexible product engine—software and systems that let insurers define various core product types and quickly create new variations and combinations for each business partner. This includes being able to adjust elements such as policy terms and benefits rapidly, without requiring new code.

As embedded insurers scale globally and work with partners across regions, this engine must also support multiple languages, currencies, and regulatory environments.

Data Analytics and Digital Marketing. Because embedded insurance is integrated into third-party customer journeys, providers must understand and leverage how different placements, messaging, and channels influence customer decisions. Granular, real-time data analytics are therefore essential, helping insurers monitor performance, test product variations, and optimize offers based on user behavior and channel dynamics. For example, since embedded products are frequently tailored or adjusted, it’s critical to be able to run real-time A/B tests and quickly respond to performance data. Data analytics tools help refine pricing, coverage, and the overall experience to meet both customer and partner expectations.

Digital marketing also plays an important role, particularly during the conversion phase, when customers interact with offers on the business partner’s platform. Good digital marketing ensures that the right message reaches the right user at the right moment, boosting relevance, trust, and, ultimately, conversion rates.

To fully realize the potential of digital marketing in embedded insurance, insurers must also treat it as a standalone opportunity, not just one element of a broader omnichannel approach. This requires a strong digital foundation built on a robust customer data platform, modern marketing technologies, and integrated tools that align activity across digital channels and partner ecosystems.

Dynamic, Real-Time Calculation and Decision Software. Integrating embedded insurance into partner customer journeys requires calculation and decision software that enables real-time transactions, processes relevant data instantly, and automates back-end operations. This software must support tasks ranging from risk assessment and policy issuance to servicing and claims handling, and it must have the flexibility to use manual, automated, or hybrid workflows, depending on the scenario.

To give an example, a smartwatch brand might offer embedded critical-illness coverage to customers who agree to share their health data. The software would use this real-time information to assess risk and calculate an individualized premium. Initially, predefined rating tables might be used, but machine learning models could eventually take over to continuously improve pricing accuracy and risk evaluation.

This type of software is also important for handling real-time parametric claims, which are triggered by specific events rather than based on assessed losses. Common embedded examples include instant payouts for delayed flights or weather-related disruptions.

To maintain the requisite flexibility and speed, the software should allow business users to configure and update products without developer involvement. For more complex products, insurers may need to use additional tools, such as digital surveys, to collect customer declarations for regulatory and underwriting purposes.

A Flexible Workflow Configuration and Automation. In the underwriting and administration stages of the value chain, business partners should build a fully digital setup that can handle multiple transactions in seconds. Insurers, in turn, must rely on flexible workflow configuration and automation whenever possible to ensure scalability and responsiveness.

AI and machine learning can support key decisions throughout the workflow, including eligibility checks, risk assessments, pricing, and claims. And with the rise of agentic AI, or autonomous systems capable of managing multistep tasks, insurers can streamline operations even further. These AI agents can adapt in real time, reduce the need for manual input, and improve both speed and accuracy in embedded settings.

To simplify integration, insurers should maintain flexible, customized configurations that enable their distribution partners to trigger tailored insurance workflows without the need to manage complex rule engines themselves. A no-code or low-code approach will allow partners to tailor and launch embedded products quickly. Customization options might include adding or adjusting workflow steps, integrating specific data fields, or setting rules and triggers based on the partner’s business model.

The workflow system should include real-time monitoring and performance insights. This will help insurers and their partners identify process inefficiencies, resolve bottlenecks, and continuously enhance service delivery.

Stay ahead with BCG insights on the insurance industry

Plug-and-Play Integration. An insurer that wants to be a preferred service provider must allow its partners to integrate insurance into their platforms with minimal effort. That means plug-and-play integration is essential to enabling a seamless embedded experience across the partners’ customer journeys.

This integration must include an operating model built on standardized, well-documented application programming interfaces (APIs) and supported by centralized API management tools. While basic data exchange through end-of-day batch files may still work in limited cases, without real-time, reliable integration, insurers risk losing parts of the value chain to more digitally advanced competitors.

A truly embedded experience goes well beyond distribution. Insurers must also support digital servicing, renewals, and claims workflows, allowing each partner to maintain full control of its user experience while minimizing development work on its side. In cases where partners have limited technical or product resources, out-of-the-box software development kits (SDKs) can help. Even for relatively simple customer journeys, SDKs provide ready-made components and business logic that speed up integration and reduce complexity.

Scalable and Compliant Infrastructure. Scalability will be a cornerstone of platform excellence for insurers, enabling them to support their partners in delivering and customizing high volumes of reliable embedded insurance offerings. It requires secure, fault-tolerant, and metered APIs along with decoupled core systems, which are designed to operate independently. With these elements in place, insurers can promise service availability, support accurate service-level agreements, and build a foundation for long-term growth.

Scalability becomes even more critical as insurers shift from long-term policies to short-term and micro policies, which could lead to thousands of transactions per second, making strong system availability a non-negotiable requirement. Cloud technology plays a key role in enabling this kind of scalability, offering dynamic horizontal and vertical scaling that helps insurers handle fluctuating volumes, particularly during peak periods such as Black Friday or Cyber Monday, when performance under pressure is crucial.

Insurers must also embed compliance into their infrastructure design. Given the complexity of the regulatory landscape, they need to prioritize data privacy and protection—especially when processing customer data on behalf of partners through cloud platforms. Consent management is vital as well, particularly for advanced use cases such as personalized recommendations, where customer data needs to be used responsibly and transparently.

Implementation Can Be Greenfield or Brownfield

Insurers typically follow one of two strategies to implement the tech capabilities required for embedded insurance: greenfield or brownfield.

Greenfield. Building new capabilities in a separate environment, independent of legacy systems, means that internal integration will be limited to essential adjacent systems, such as financial platforms or payment processors. This greenfield approach offers maximum flexibility and is ideal for launching digital-first ventures.

One leading European insurer adopted a greenfield strategy to scale embedded insurance across the region. The initiative operated as a standalone business with its own tech stack, free from legacy constraints. Working with a software partner, the insurer used off-the-shelf features and extended digital capabilities, including self-service tools. Its product portfolio included travel, gadget, and device insurance embedded into fintech, mobility, and travel platforms across Europe. This approach allowed the insurer to launch new embedded propositions rapidly, experiment with digital distribution models, and establish a strong foothold in high-growth digital ecosystems.

Brownfield. By contrast, a brownfield approach builds on existing systems and infrastructure. While established capabilities and compliance frameworks are beneficial here, this strategy also brings its own challenges, such as more complexity, greater maintenance costs, and potential performance limitations.

A major global insurer took a brownfield approach to expand its embedded partnerships across the Asia-Pacific region. It leveraged its existing tech stack, licenses, and operations as a foundation and extended them with new capabilities for digital distribution, real-time data management, and API integration through a software partner. The focus was on device, gadget, accident, and travel insurance distributed through digital channels, including a strategic partnership with a leading social media platform. This approach allowed the insurer to maintain and leverage its core systems while closing gaps, accelerating its market entry, and building scalable, embedded offerings.

While both strategies can succeed, greenfield approaches often provide greater speed, flexibility, and cost efficiency—key advantages for insurers aiming to lead in the embedded insurance market. That said, as core technologies evolve, some of the traditional limitations of a brownfield approach are starting to fade. Modern core insurance platforms are increasingly designed with open APIs, modular product logic, and real-time processing capabilities. This shift enables seamless integration, faster response times, and a more adaptive, data-driven value chain. Embedded insurance is therefore no longer just an add-on; it is becoming a native function of next-generation insurance technology platforms.

Embedded insurance is no longer just an add-on; it is becoming a native function of next-generation insurance technology platforms.

Move Now to Play a Central Role

To stay ahead in this evolving landscape, insurers must take a proactive and strategic approach to embedded insurance. They must evaluate the full potential of embedded models and rethink their tech foundations accordingly. And they must build or extend the right capabilities across the value chain, whether through greenfield initiatives or brownfield enhancements to existing systems.

Insurers that move quickly and decisively will be well positioned to secure a leading role in tomorrow’s embedded ecosystems, forging deep relationships with partners and unlocking new sources of growth across industries and geographies.