In a period when computing innovation is an unyielding necessity, digital and IT talent are rare commodities.

The advent of cloud computing played a large role in creating this problem. By bringing the latest IT infrastructure and tools within reach for every organization, cloud computing made it possible for companies to increasingly consider developing their own unique programs around digital waves such as Big Data, AI, the Internet of Things, and more recently generative AI (GenAI). This resulted in a frantic search for more digital talent, one that has frequently come up empty as demand has outpaced supply. This imbalance is likely to continue, as the half-life of tech skills is three years and falling and the number of tech workers needed to oversee increasingly complex digital and IT capabilities is rising. Meanwhile, forecasts about expected graduates and career changers indicate that the supply of new software engineers, data scientists, and technical product managers is lagging.

The most effective approach is a strategy that integrates both in-house and outsourced skills models.

As the importance of digitization grows, companies need to find a way around this talent shortage. Broadly speaking, the most effective approach is a strategy that integrates both in-house and outsourced skills models. Ideally, internal talent should focus on the digital capabilities that set the company apart and manage the digital and technology services as well as the vast amounts of data underpinning the organization’s priority and strategic offerings. Strong external partners could handle more routine capabilities, such as the company’s core tech platforms and standard applications. Some outsourcing companies can also provide remote workers who specialize in technology skills that may be scarce in a given region.

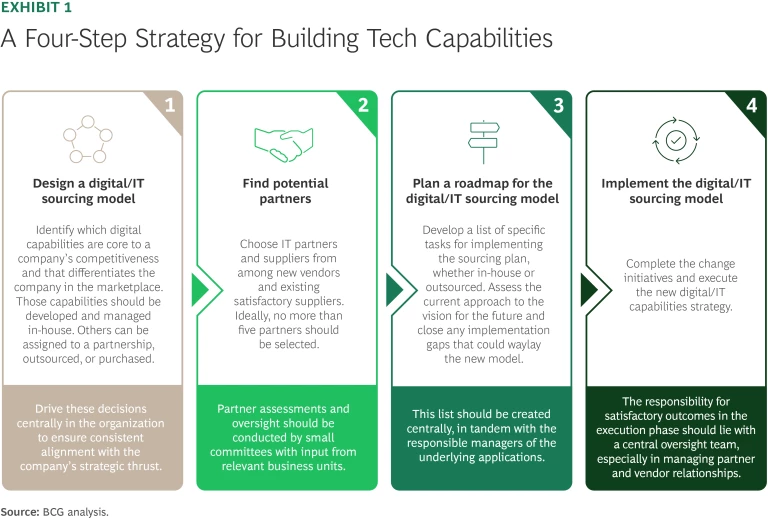

To assist in implementing a strategy for overcoming digital talent shortages, BCG has designed a four-step action plan. (See Exhibit 1.)

1. Design a digital/IT sourcing model.

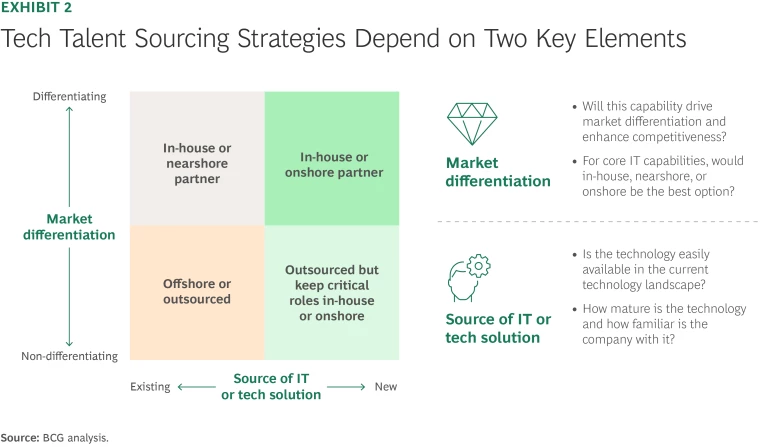

To get started, a company must decide which digital capabilities and IT services should be developed and managed in-house and which can be assigned to a partnership, outsourced, or purchased. While this decision is often described as a series of complicated trade-offs, we find that it boils down to two project categories. (See Exhibit 2.)

First, does the digital capability or IT service differentiate your company from others in the sector, giving you a distinct advantage? Or can it be better categorized as table stakes?

Second, are the technical skills required to manage the capability or IT service widely available or new and scarce? Is the underlying technology mature and a well-established competency set among potential technology hires? Or is it a niche skill involving a technology that will likely continue to progress and evolve?

Differentiating digital and IT capabilities are innovative and allow a company to outpace its competitors by offering customers unique products or services derived from proprietary assets or information. Often, these capabilities and the applications that are subsequently developed are the result of a strategic decision that a company-specific solution will lead to significantly better business or social outcomes than a standard purchased solution. In some cases standard solutions are not available.

If the technical skills to develop these differentiating applications are scarce, it is best to build and manage them in-house by ramping up internal digital engineering and IT competencies. This will allow the organization to make rapid progress in launching these applications, retaining control over innovation while leveraging their own talent, assets, and knowledge, which could be useful in developing future technology applications that may not even be on the drawing board yet.

If the skills are widely available, an alternative is to work with a strategic “nearshore” partner—a third-party IT design and development facility that’s close enough to the company’s operations that control and coordination of a technology project is still relatively straightforward. In such cases the venture must be carefully planned to ensure that the project’s proprietary aspects are closely held by the partnership and off limits to the competition.

Non-differentiating digital and IT capabilities can be pieced together from standard solutions that are as good or better than anything that can be developed in-house. Most of an organization’s IT applications tend to be non-differentiating. Generally, these applications can be outsourced—that is, they can be purchased from so-called managed services companies, such as software as a service providers that deliver the software and often its underlying infrastructure and also maintain and update it as necessary. Where specialized configuration is required to link these applications to a company’s internal digital operations, it’s best to use external talent, as there is little need to build internal knowledge and expertise on systems that are market compliant and standardized.

However, an internal product management and technology architecture team should always be assigned to oversee the commercial relationship with the managed services supplier. The primary purpose of this team is to ensure that the outsourced capabilities are operating at peak performance, aligned with the company’s strategic aims and integrated with its IT platforms and architecture.

In addition to differentiating and non-differentiating applications and technology capabilities, there is a third category that could require access to digital talent as well: IT infrastructure. This group includes the supporting platforms, hardware, and software that applications run on, such as storage devices, servers, technology and communications networks, laptops and workstations, and databases, as well as tools for IT developers and security. Like non-differentiating capabilities, infrastructure technology is often best purchased from “as a service” providers that offer, for instance, server and storage capacity, network platforms, or data management systems.

Outsourcing these jobs is financially advantageous because companies only pay for the hardware and services they use and avoid large upfront capital investments to build out the IT infrastructure. Moreover, third-party providers continually update and modernize their offerings with the latest improvements. As a result, companies can piggyback their differentiating programs onto this infrastructure knowing that they will benefit from having cutting-edge platforms to support their applications.

Some sectors, such as defense, energy, and telecom, tend to keep critical parts of the IT infrastructure in-house. For instance, a defense contractor might choose to maintain internal control over its core network as a safeguard against the exposure of proprietary and confidential information.

By identifying which of their digital capabilities are differentiating and which are non-differentiating, companies can strategically limit the number of in-house IT staffers they need—and thus mitigate the consequences of the global talent shortfall. That said, in some cases in-house IT hiring is necessary for non-differentiating applications. For instance, when capabilities for these applications are scarce, keeping at least key operational roles close to home may be required to ensure that the related knowledge base is safeguarded and sustained. In fact, it can be dangerous to rely completely on an outside firm for hard-to-find talent because that could leave the company with a problematic deficit if specialized third-party tech staffers become less available or the outsourcing options are lacking in quality.

When assessing the strategic importance of digital and IT capabilities, a centralized analysis that considers the full breadth of a company’s technology operations, short- and long-term application, platform and infrastructure needs, growth plan, and market landscape is necessary to help leaders make sometimes difficult trade-offs in talent recruiting and outsourcing decisions. We have observed that a decentralized approach, in which each business function might offer its own evaluation of which IT capabilities are differentiating, frequently leads to exaggerated claims about the competitive advantages of the IT capabilities the teams may favor. This can lead to an excessive reliance on and the fragmentation of internal IT staff.

2. Find potential partners.

In this step, organizations will identify IT partners to handle outsourced applications and infrastructure. These entities need not be entirely unfamiliar to the company, and, in fact, good existing suppliers should be considered to continue in their current roles. In any case, the most efficient approach is to consolidate external IT activities to a small number of strategic partners, perhaps three to five. Ideally, this group will accrue scale advantages and cost savings as they become more familiar with the company’s existing technology, needs, and goals. Such a limited group is also easier to manage and ensures that onboarding of new trained staff as turnover occurs is relatively quick and efficient.

However, not all partnerships are the same. Some partners are meant to be engaged collaborators that can provide a high level of expertise for an IT project or ongoing application. This shared outsourcing arrangement often involves continuous interaction about strategic and development targets and performance. Other partners, like value-added resellers and cloud service providers, are essentially vendors that offer a palette of outsourced digital services that are generally not much more than managing the operations and staffing of noncore and relatively generic IT capabilities. Both offer economies of scale and large pools of IT staffers; primarily the depth of the relationship is the difference.

In light of current global trade uncertainties, some companies are giving more consideration to establishing their own offshore or nearshore facilities for certain non-differentiating IT capabilities. Companies may choose this approach to avoid the risks of outsourcing, including geopolitical concerns, vendor dependency, rising costs, and lack of understanding about their own technology platforms, applications, and architecture. But the downsides remains: the need for substantial implementation capital, problems with immediate scalability, depletion of management requirements, and, of course, dealing with the talent shortage.

To ensure that partners and vendors perform at a high level, a primary/challenger model can help. For each outsourced facet of the IT landscape, a main supplier is chosen for a given period, perhaps three to five years. During that time, the supplier provides both ongoing application maintenance and support and the staffers needed for development and management. A second supplier is designated as a “challenger”—an alternative partner who is waiting in the wings to replace a primary supplier if it fails to meet certain key performance metrics, even during the program’s term.

Besides the small number of strategic partners, there are often two other types of suppliers that must be targeted:

- Specialist or niche suppliers that provide expert knowledge on specific types of technology such as AI or transaction processing with huge volumes of data.

- External hiring agencies that can subcontract IT talent for temporary assignments, such as a major architecture refresh or replacing an enterprise resource planning system.

It is advisable to centralize partner analyses and choices in a small group with input from business units that are already closely linked to the relevant applications or parts of the IT landscape. However, this input should not be the deciding factor in the group’s decision making because it is important that these choices are made fresh and not influenced by current supplier arrangements and vendor or partner dependencies.

Stay ahead with BCG insights on digital, technology, and data

3. Plan a roadmap for the digital/IT sourcing model.

The third step involves translating the “target model”—in-house needs versus outsourced partners—into a list of concrete tasks that must be done in order to adopt the new IT sourcing model. To do this, a company must first compare its current approach to its planned vision for each IT capability. This will help it close any gaps that are standing in the way of implementing the new model.

For capabilities that will be insourced—that is, those that are core to the company’s strategic direction and operations—building out the in-house IT talent team often involves executing several activities that must be implemented in a disciplined fashion. These may include the following:

- Writing job descriptions with enough specificity that candidates will be well suited to the new jobs, skill sets, and technical expertise required to develop and maintain critical apps or programs

- Redesigning the recruiting program to draw the appropriate candidates, who may include undergrads and graduates

- Reskilling or retraining current staff that have shown the ability to handle the new IT model

- Amping up the intern program to identify and maintain contact with young workers that have shown the most aptitude for the types of capabilities that the company expects to focus on

- Reviewing the operating model to ensure that IT talent is working closely with business teams to help develop differentiating digital and IT applications and programs

- Adopting a compensation and career growth structure that is designed to attract and retain top talent, especially in regions that also house large tech companies that may attempt to lure the brightest candidates with high salaries and desirable perks

- Setting aside the appropriate office space for the new workers to foster a team effort, individual development efforts, communication between IT and the business side, and oversight

- Creating a vendor management program to oversee which contracts with external firms need to be ramped down as the jobs are brought in-house.

When establishing a substantial number of new capabilities and recruiting and training a large in-house IT team, it can be beneficial to partner with providers who specialize in build, operate, transfer models. These organizations provide a support staff to build new capabilities together with the internal team and then transfer those capabilities and the staff to the company.

For capabilities that will be outsourced—those that are not core to strategic direction and operations—the actions needed for implementation are a bit less cumbersome but nonetheless must not be given short shrift. Since they involve day-to-day and table stakes activities, many of which may be customer facing and ultimately reflect on the overall efficiency of a company’s operations, these applications must be managed with care and discipline. That means consolidating and renegotiating contracts with suppliers identified in the second step and establishing the ground rules and expectations for oversight, deliverables, and performance KPIs. It is advisable to draw up a long list of potential initiatives. This list should be created by a centralized strategic team in the organization, in tandem with the responsible managers of the underlying applications. This will ensure that any current constraints—such as a shortage of IT talent or skills that will hopefully be remedied in short order—are woven into the planning of the initiatives, making them executable and setting realistic expectations for completion. Subsequently, these change initiatives can be encapsulated in a realistic implementation plan. This will involve making decisions about the timing of the initiatives, considering the available capacity for change, limitations arising from existing agreements, and ongoing IT projects.

4. Implement the digital/IT sourcing model.

After the details of the change initiatives are finalized, the digital talent procurement and recruitment strategy can be fully implemented. Most organizations aim to implement the key parts of the strategy within 12 to 24 months, and with sufficient organizational attention, that is largely achievable.

However, it is worth noting that the responsibility for satisfactory outcomes in the implementation phase should lie with a central oversight team, especially in managing partner and vendor relationships. In other words, implementation in this case is a top-down and not a bottom-up activity. Large outsourcing initiatives and negotiations require extensive knowledge of both the IT landscape and the digital talent pool and significant vendor management capabilities within the organization. A team equipped with this expertise is essential to objectively monitor partner and vendor key performance benchmarks, timelines, and budgets. At the same time, this team must be capable of overseeing internal recruitment and staff development.

A central team should also be expected to be dispassionate in its assessments, calling attention to shortfalls before they become catastrophic and threaten to derail the project. By contrast, when an IT capability or application is overseen by a business unit with a vested interest in keeping the project alive even if it is failing to meet crucial goals, the result is often subjective, overly rosy, or unrealistic updates that are not backed by actual project realities.

Companies Must Make Difficult Choices Now

Many organizations are facing technological crises today. Formulating the capabilities they need and recruiting or training the talent to engineer and manage digital and IT development projects involves difficult decisions that could determine the future success of the organization. There is no doubt that new technologies—in particular GenAI, machine learning, cloud-based networks, and advanced data management—will have a huge impact on companies’ growth strategies in the coming years. And, in turn, demand for people with sufficient digital skills and expertise to drive the development of these technologies will skyrocket.

Businesses must plan now for both sides of that coin. That means choosing which capabilities can distinguish them from the competition while ensuring that they have access to sufficient digital talent—in-house or outsourced—for successful implementation of both differentiating and non-differentiating IT capabilities.