Executive Summary

Unleashing Africa’s critical minerals could transform the continent’s future

Africa owns a disproportionate share of the world’s critical minerals, which are the foundation of the 21st century industrial transition. These minerals are not only essential to clean energy, electrification, and digital infrastructure, they are also becoming increasingly valuable due to intensifying global competition, supply bottlenecks, and rising geopolitical pressure.

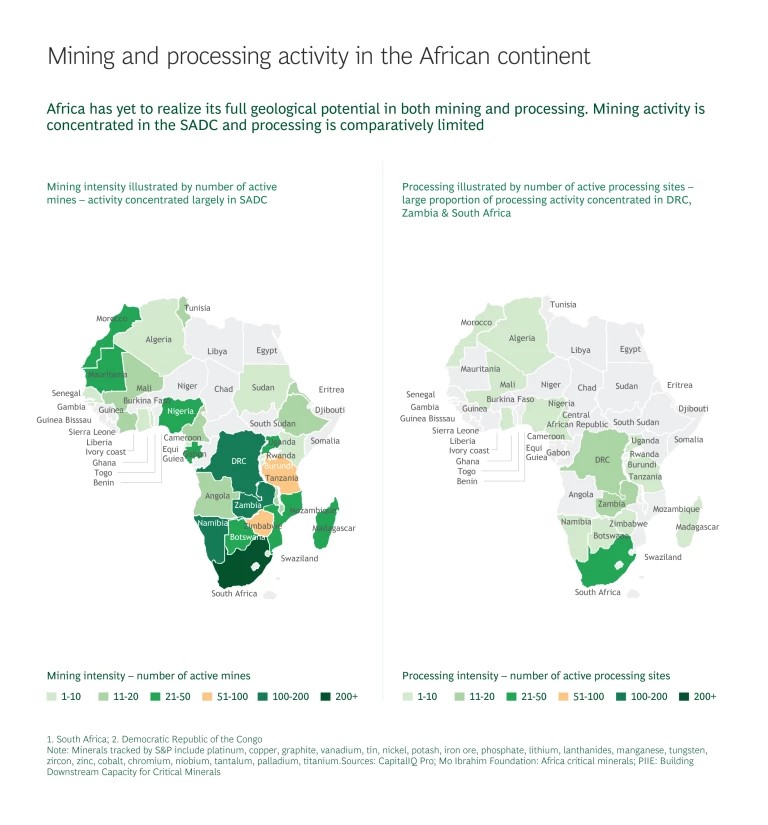

Unfortunately, most African countries remain heavily reliant on (stagnating) upstream extraction of legacy materials, while failing to advance the development of future-facing reserves or move down the value chain. This results from a number of interlocking structural barriers, including lack of infrastructure (water, reliable power, access to roads and ports), regulatory fragmentation and uncertainty, scarcity of capital, shortage of specialized skills, and ESG concerns, including those related to artisanal and small-scale mining. As a result, finished goods, high-quality jobs, and technological capabilities are imported, and opportunity is exported.

Growing demand for critical minerals creates leverage, opening opportunities for Africa to attract long-term capital through offtake-backed investments and concessional finance; negotiate stronger terms on infrastructure, technology transfer, and local content; and partner globally to build capabilities, advance traceability, and share in downstream value.

The continent must move quickly to convert this moment of strategic relevance into durable economic and industrial gains. Unleashing the potential of the critical minerals endowment would trigger GDP growth, job creation, infrastructure investment, generate revenues for governments, develop skills, diversify economies, and generate inclusive growth and global relevance.

Some governments are taking action already. For example, some are formalizing artisanal mining to improve social outcomes and supply chain credibility. Others are investing in logistical corridors, grid upgrades and energy access. Several have signed long-term agreements with global buyers, setting conditions relating to local beneficiation, skills transfer and infrastructure development. Regional initiatives are taking shape, for example the African Continental Free Trade Area Agreement and the Lobito Corridor.

For Africa to fully unlock its mineral opportunity, it must move beyond fragmented efforts and advance a shared agenda across the entire mining value chain, from exploration and extraction to infrastructure, processing and higher-value exports. As a continent, it should act deliberately and collectively to advance regional co-ordination, build value chains that reflect mutual benefit and industrial depth, and create institutions that enable investment, develop talent and embed ESG excellence.

Africa Unleashed

In this report, we examine three critical levers that could unlock Africa’s full value chain.

The continent can attract investment through providing clear regulations, streamlining approvals and embedding ESG standards. Governments can forge global alliances with offtakers to bring concessional finance, technical know-how and long-term buyers. Regional value chains can be built through co-operation between African countries, each specializing in extraction, processing or manufacturing to maximize shared value.

The global race for critical minerals is already well under way. Africa is not a bystander—it is a focal point. The choices made in this decade will determine whether the continent remains a supplier of raw inputs or becomes a strategic actor in a new industrial order.