Executive Summary

Switching On the Engine: How Africa Can Accelerate Delivery of Its Infrastructure Pipeline

Africa has no shortage of infrastructure projects. Currently, the continent-wide portfolio consists of ~130 transnational projects and programs across energy, transport, digital, and water. But only 6% of these projects are under construction.

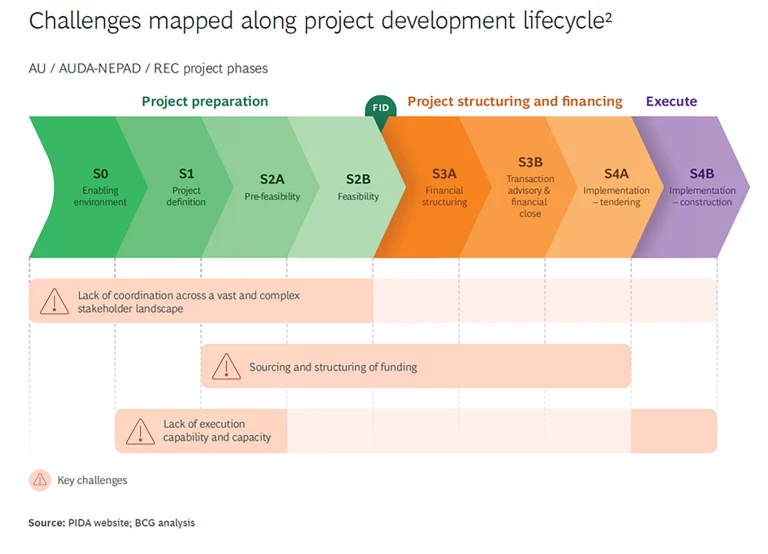

The problem does not lie in planning, but in execution. BCG has identified three main blockages to execution: lack of co-ordination across a vast complex stakeholder landscape; difficulties in sourcing and structuring funding; and lack of execution capability and capacity.

This delivery gap is costing the continent ~$500 billion in GDP, 74 million jobs, and one million lives annually. Without urgent intervention, Africa risks missing its 2040 development targets.

Three Main Hurdles

Africa’s infrastructure execution ecosystem is complex. It is defined by a constellation of stakeholder groups with overlapping mandates but limited alignment. The African Union Commission (AUC), AUDA-NEPAD, Regional Economic Communities (RECs), sovereign ministries, specialized agencies, private sector and development finance institutions each plays a role.

Within the delivery structure, AUDA-NEPAD collaborates closely with institutions like the African Development Bank (AfDB) and other development partners to provide financing and technical support, while private sector engagement typically occurs through RECs and in-country parastatals. Co-ordination and facilitation responsibilities are shared across the AUC, AUDA-NEPAD, and RECs, but actual project execution is largely driven at the national and regional level, with AUDA-NEPAD supporting alignment and monitoring.

Cross-border projects are especially vulnerable, with treaty negotiations, regulatory approvals, and financing structures often stalling for years.

One of the consequences of co-ordination challenges among key stakeholders manifests in the amount of funding committed to African infrastructure projects. The continent faces a persistent and widening infrastructure funding gap—estimated at $60 billion in 2025 alone.

Some of the forces behind this funding gap include concerns about the operational and commercial feasibility of projects post-final investment decision (FID); constraints on borrowing by African governments whose sovereign debt levels are regarded as unsustainable; stagnant foreign investment and cuts in Official Development Assistance budgets; and underutilization of risk-mitigation instruments.

Africa faces an acute skills deficit in core infrastructure roles. It is estimated that the continent requires an additional ~5 million skilled professionals, including engineers, technicians, and artisans, to meet its infrastructure and Sustainable Development Goals (SDGs). Recognizing this need, the AU has established the Skills Initiative for Africa (SIFA), in partnership with AUDA-NEPAD and the German Development Agency (GIZ). But to scale up the impact of such initiatives, there has to be deeper co-ordination with project pipelines, clearer workforce forecasting at regional levels, and stronger enforcement of local content and skills-transfer provisions in major infrastructure contracts.

Africa Unleashed

Three Levers and a Hub Can Accelerate Execution

Lever 1: Mobilize targeted private sector participation

The private sector remains a significantly underutilized force in African infrastructure development, despite its potential to provide capital, as well as critical delivery capabilities, operational know-how, and technological innovation. Activating this potential requires identifying and structuring commercially viable projects, creating credible investment platforms, and deepening public-private collaboration beyond funding by, for example, bringing together sector leaders early in the planning and prioritisation process, inviting technical input on project structuring, and fostering co-investment partnerships throughout the delivery lifecycle.

Lever 2: Harmonize regulations and strengthen cross-border capabilities

Establishing strong cross-border co-ordination mechanisms is essential to accelerate delivery. This includes harmonizing legal and regulatory protocols, aligning tariffs and wheeling agreements, and fast-tracking treaty negotiation and ratification processes. The success of the Lobito Corridor demonstrates what is possible when regulatory frameworks are aligned and governments work collaboratively.

Lever 3: Enhance project bankability by de-risking operational and commercial factors

Investors will not deploy capital into highly uncertain environments, but appropriate risk-mitigation instruments can resolve this hurdle. Africa has access to a growing suite of financial tools that can lower perceived and real risks. These include partial risk and credit guarantees (for example MIGA, ATI), escrow structures, blended finance stacks, and viability gap funding. Structured appropriately, these tools can make projects bankable without distorting fundamentals.

Institutional Enabler: Innovative Coordination Mechanism and Deeper Private Sector Partnership To Enable Execution

What successful infrastructure ecosystems around the world have in common is not just financing or political will, but co-ordination architecture that facilitates fast, informed, and disciplined delivery. With active political leadership unblocking execution barriers, drawing on the lessons of the Presidential Infrastructure Champion Initiative, coupled with effective private sector partnership, the African Union department for Energy and Infrastructure can drive progress across the project lifecycle.

Conclusion: Execution Must Become the Centerpiece of Planning

Africa’s infrastructure deficit is deep but solvable. The economic returns are clear: for every $1 billion invested in African infrastructure, up to $6 billion in GDP value can be unlocked, driven by increased productivity, job creation, improved logistics, and expanded access to essential services.

The focus must now shift to delivery. Execution must become the centerpiece of development planning, and private sector participation must be recognized by all stakeholders – public and private – as the pivotal unlock to accelerate it.