This report is a collaboration between BCG and Vestiaire Collective.

Secondhand fashion and luxury has evolved into a resilient and fast-expanding force in the global fashion and luxury industry.

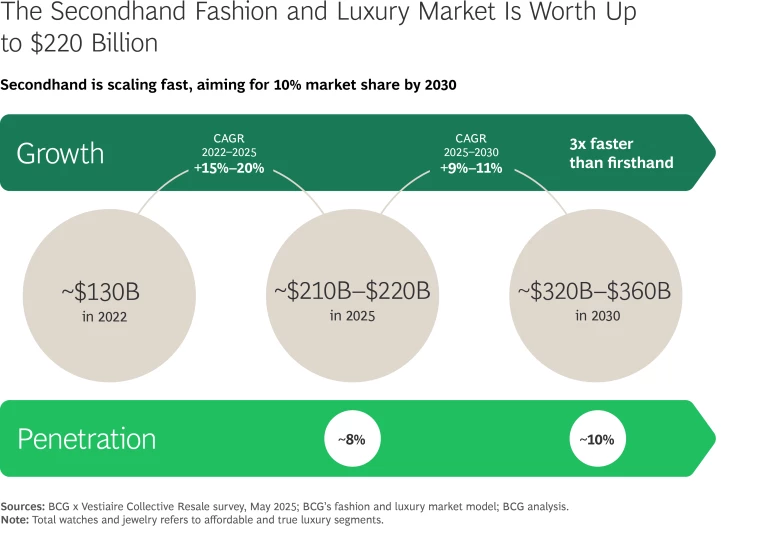

Today’s secondhand market is estimated at $210 billion to $220 billion and expected to reach $320 billion to $360 billion by 2030. With a 10% annual growth rate, the secondhand market is expanding three times faster than the firsthand market. (See sidebar, “The Booming Secondhand Fashion and Luxury Market.”)

The Booming Secondhand Fashion and Luxury Market

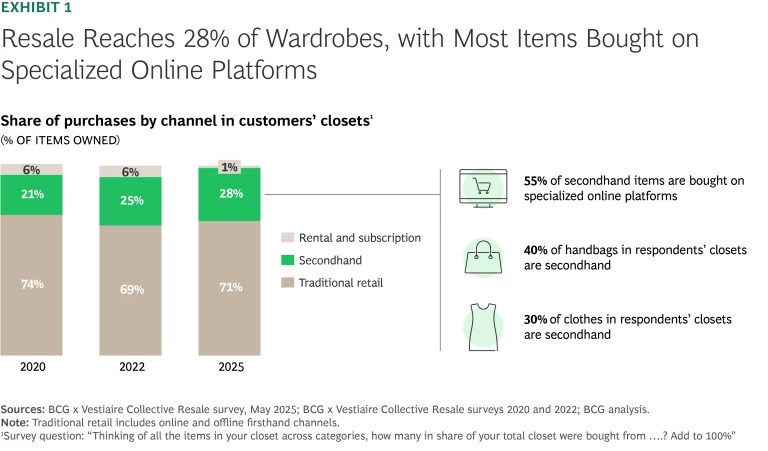

This report, based on a survey of 7,800 consumers from the Vestiaire Collective community, shows that secondhand fashion and luxury is now firmly embedded in how people shop. (See “About Our Survey” at the end of the report.) Nearly 28% of the items in their closets are bought secondhand, a marked increase from previous years. More than half of these purchases (55%) occur through online multibrand resale platforms such as Vestiaire Collective, The RealReal, or Vinted, underscoring the central role of digital channels in scaling secondhand adoption. (See Exhibit 1.)

Once consumers begin participating in resale, they tend to do so at scale—with secondhand items making up a particularly high share of their closets in categories like handbags (40%) and clothing (30%), reinforcing how resale has become a recurring behavior in how people shop and build their wardrobes.

Stay ahead with BCG insights on the retail industry

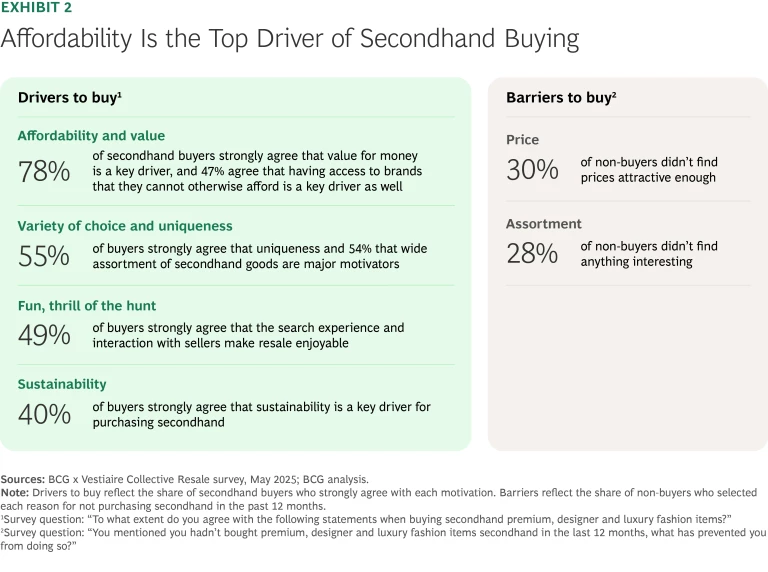

Affordability for Buyers. Affordability is the defining characteristic of secondhand fashion and luxury, cited by nearly 80% of respondents as a key reason to buy. (See Exhibit 2.) For some, secondhand is a smart trade-up strategy, a way to access higher-end or luxury brands that would be out of reach if bought new. Over half of respondents said they prefer buying premium labels secondhand rather than settling for more affordable firsthand alternatives. It’s how they can afford the brands they aspire to own. For others, secondhand is simply a cost-saving tactic—a way to spend less. Nearly half said they buy secondhand specifically to avoid paying full price for items they want. Price remains a barrier for some: among those who didn’t buy secondhand in the past 12 months, the most cited reason was that prices weren’t attractive enough (30%). In addition, consumers are also drawn to uniqueness, variety of choice, and the thrill of discovery, now firmly established as key drivers of secondhand purchasing. All major motivations are seeing higher agreement levels than in previous years, signaling a more mature and deeply embedded secondhand behavior.

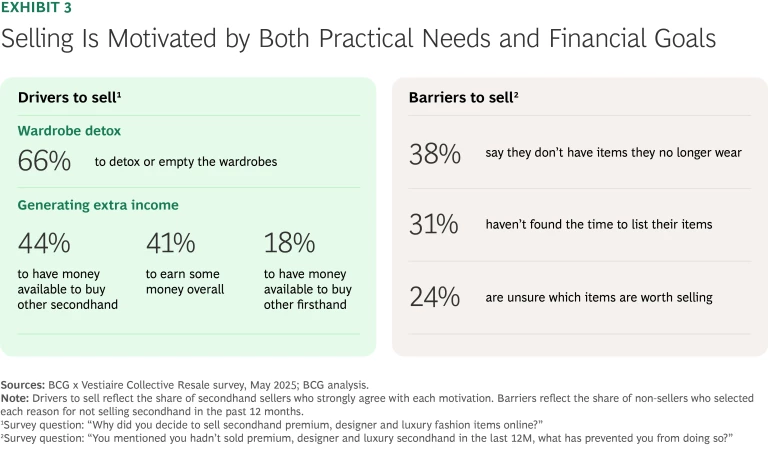

Wardrobe Detox and Extra Income for Sellers. On the selling side, the two main motivations remain wardrobe detox (66%) and generating extra income—41% sell to recover residual value and earn money, 44% to fund future secondhand purchases, and 18% to afford new firsthand items. (See Exhibit 3.) But some barriers to sell remain.

“Our customers want an easy and seamless way to resell their pre-owned luxury items, aligning with the growing interest in sustainability and circularity. They are time-poor, thus they have clear requirements and needs,” says Amber Pepper, chief marketing and customer officer at Mytheresa.

In a time of rising retail prices, secondhand plays a dual role: it opens access for new customers who might not otherwise afford premium or luxury fashion and offers a way back in for past customers who may now be priced out. It’s increasingly complementary to firsthand: for 66% of respondents, resale enabled them to discover or buy a brand for the first time, up from 59% in 2022. Resale thus serves as both a discovery engine and a recruitment channel—connecting consumers with brands and items they might not access through traditional retail. By combining affordability with availability—including access to sold-out or discontinued items—secondhand can extend product life, broaden brand reach, and reinforce long-term brand equity.

Gen Z Is Shaping the Future of Resale

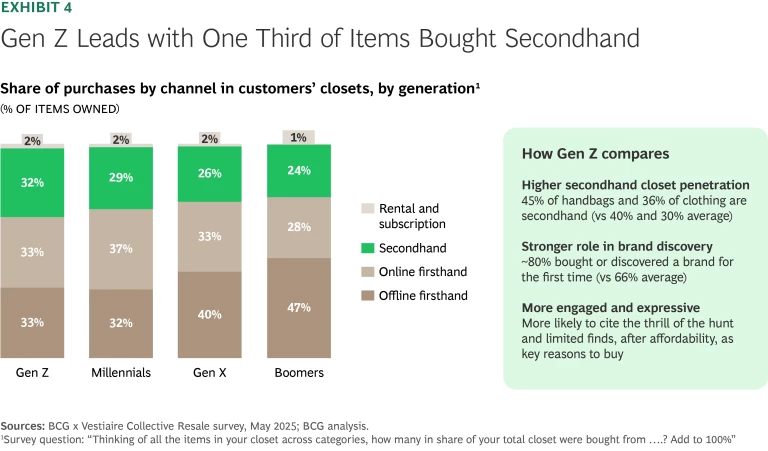

Gen Z is at the forefront of resale, with secondhand items making up to 32% of Gen Zers’ closets—rising to 45% for handbags and 36% for clothing. (See Exhibit 4.) What sets Gen Zers apart is the emotional and creative dimension they bring to resale. For Gen Zers, as with most consumers, affordability is the primary driver (74%), but style, discovery, and experimentation are also important factors. Compared to older generations, Gen Z respondents are more likely to cite the thrill of the hunt and the appeal of finding limited or sold-out items (+7 percentage points vs average), and the joy of enhancing personal style (+5 percentage points vs average). It is also a clear discovery channel: around 80% of Gen Z respondents said they bought or discovered a new brand through secondhand—well above the overall average of 66%.

Resale Motivations Diverge Between the US and Europe

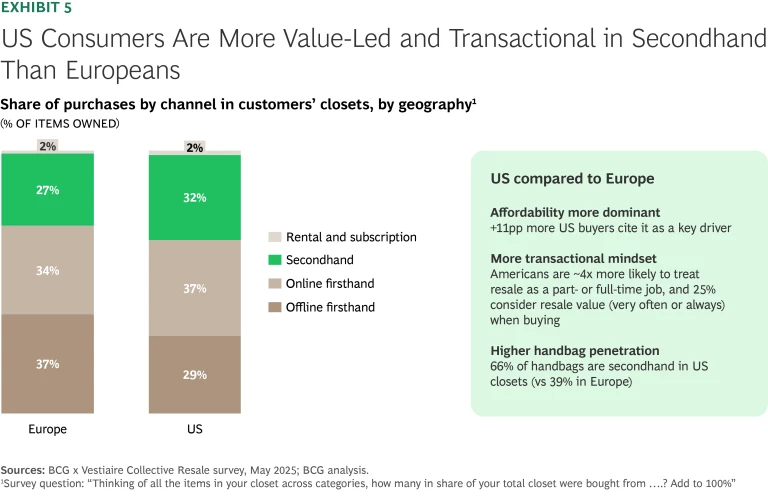

US respondents in our survey are ahead of the curve in resale adoption, with secondhand items making up 32% of their closets—rising to 66% (compared to 39% in Europe) for handbags. (See Exhibit 5.)

In the US, secondhand behavior is markedly more transactional and value-led. While affordability is the number one driver on both sides of the Atlantic, 87% of US respondents cited it as a reason to buy secondhand—11 percentage points higher than in Europe. American respondents are also more likely than Europeans to say secondhand allows them to buy brands they otherwise couldn’t afford and are more likely to prefer secondhand luxury over cheaper firsthand alternatives. This more price- driven mindset also reflects in how US consumers view sustainability: only 28% said they’ve adopted more sustainable fashion behaviors, compared to 33% in Europe, suggesting that in a context of economic pressure, sustainability may take a backseat to more immediate value concerns.

This logic carries through to selling. In the US, nearly four times as many consumers view resale as a part- or full- time job compared to Europe, and 25% of Americans consider resale value (very often or always) when buying new, versus 19% in Europe. While emptying the wardrobe is the top selling motivation in both markets, US respondents are more likely to emphasize earning money (50% vs 40% in Europe).

In Europe, consumers are more focused on wardrobe curation. The focus on wardrobe detox is especially strong in markets like Italy and Germany, where over 70% of respondents cited it as a key reason to sell.

How Income Shapes Secondhand Behaviors

We segmented our sample into equal groups based on stated fashion spend, which revealed distinct patterns in how different consumer segments engage with secondhand.

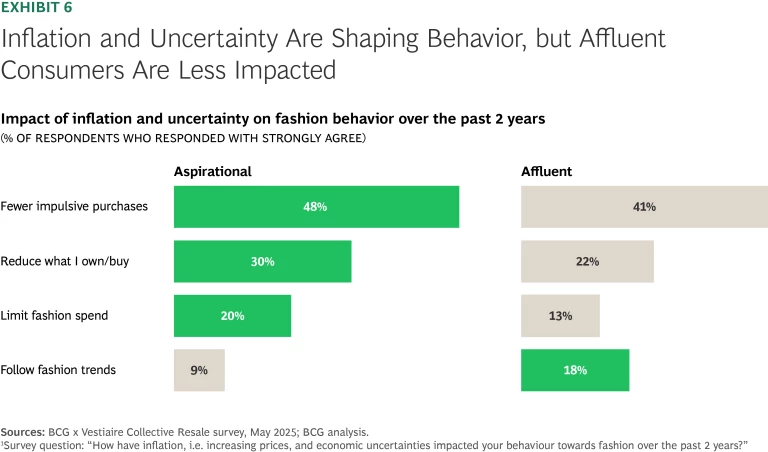

Aspirational Consumers. For aspirational consumers, secondhand is an affordable entry point into premium fashion. This group is more affected by macroeconomic pressure and more likely to say their fashion behavior has changed in the past two years. (See Exhibit 6.) Some 40% said their closet has stayed stable or shrunk, compared to 30% of affluent consumers. They also reported stronger shifts in shopping habits—less impulsive buying (48% vs 41%), reducing what they buy or own overall (30% vs 22%), and a higher likelihood to limit fashion expenses (20% vs 13%).

Aspirational consumers are also more likely to say secondhand lets them buy brands they can’t afford full price—10 percentage points more than affluent consumers. When it comes to selling, aspirational consumers stand out on one motivation in particular: earning money, with 9 percentage points more citing it than their affluent counterparts.

Affluent Consumers. By contrast, affluent consumers are less reactive to downturns and engage with secondhand as a form of wardrobe refinement. They are more likely to say they continue to follow trends (+9 percentage points), actively seek out limited editions (+7 percentage points), and consider resale value when buying full-price items (+5 percentage points). For them, resale is an extension of an already curated fashion experience. They are also more likely to buy from the top of the pyramid in true luxury brands, which often retain price premiums, or even sell above retail, particularly when items are sold-out or limited editions.

Resale Models and Best Practices

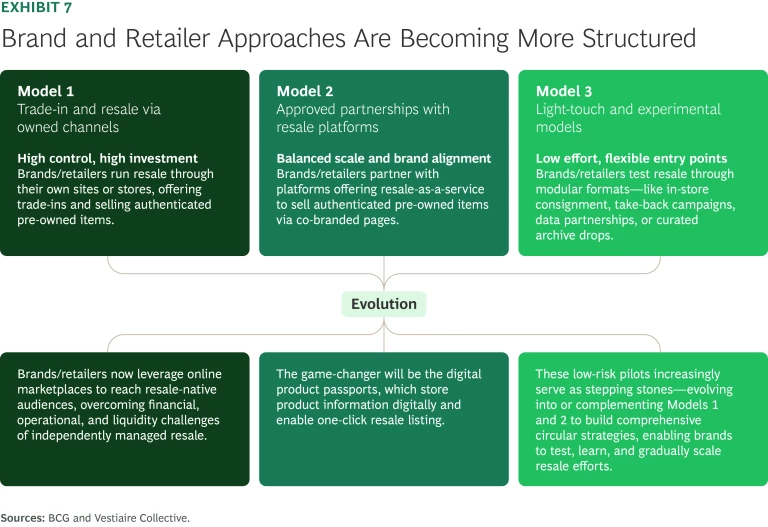

The secondhand fashion and luxury market has evolved from an emerging trend to a strategic imperative. In our 2022 report, What an Accelerating Secondhand Market Means for Fashion Brands and Retailers, we outlined three distinct business models, each offering different levels of reach, capital intensity, and control over sourcing.

Since then, we’ve seen these models evolve: what began as experimentation has matured into more structured, scalable strategies. Below, we focus specifically on the evolution of the two more advanced models—Model 1 and Model 2. (See Exhibit 7.)

In the first model, brands/retailers ran resale through their own sites or stores, offering trade-ins and selling authenticated pre-owned items. However, independently managing resale has proven challenging for some brands, due to factors such as liquidity, operational complexity, inventory management, and access to resale-focused customers. It has since evolved, with brands/retailers now extending their reach through online marketplaces— accessing resale-first audiences while preserving brand narrative and minimizing cannibalization.

Concrete examples include:

- Rolex’s Certified Pre-Owned program offers factory- authenticated timepieces with warranties via authorized dealers.

- Patagonia’s Worn Wear platform allows customers to trade in used gear for credit, with refurbished items resold on the brand’s own site.

- Rimowa’s RECRAFTED program allows clients to resell their pre-owned suitcases, which are refurbished and resold on their website.

- Flagship department stores such as Galeries Lafayette have embedded secondhand as permanent in-store fixtures.

In the second model, brands/retailers partnered with resale platforms through resale-as-a-service programs, enabling the sale of authenticated pre-owned items via co-branded pages. It has since evolved with the rise of digital product passports (DPPs), which store product information digitally and enable one-click resale—streamlining the process and increasing customer participation.

Digital product passports store product information digitally and enable one-click resale.

Concrete examples include:

- Chloé x Vestiaire Collective partnership featuring digital product passports offers flexible reward options (brand credit, platform credit, or donation) and reduced resale time by over 60%. “By leveraging digital ID, we aim to support future secondhand resale and contribute to the broader evolution toward circularity,” says Christophe Bouquet, sustainability and responsible sourcing director at Chloé.

- Poshmark x Coach x EON partnership leverages EON’s digital product passport technology to enable seamless one-click resale functionality. Customers can initiate resale directly from Coach’s digital ecosystem and be redirected to Poshmark’s marketplace.

Secondhand is no longer a circular side bet—it’s a foundational lever for growth, brand relevance, and long- term customer engagement.

Unlocking Value and Bolstering Trust Through Digital Product Passports

The strategic resale models outlined earlier have established the foundation for fashion and luxury’s circular future, but they all share a common constraint: the lack of structured, interoperable data beyond the point of sale. This data gap is critical because brands lose visibility of essential information: product authenticity, condition, and post-sale lifecycle data—repairs, ownership changes, and usage patterns—that could unlock significant value. Without this information, it is more complex to authenticate products, optimize operations, or capture revenue from their products’ second lives.

Aligning Compliance and Capturing Value. The data gap is now being targeted by a broader wave of regulation, led by the EU’s Ecodesign for Sustainable Products Regulation, which will introduce digital product passport requirements through a series of sector-specific Delegated Acts—starting with textiles. The main goal of the DPP is to promote transparency and circularity by providing standardized, accessible information on a product’s sustainability, composition, and environmental impact throughout its lifecycle. While many brands are currently focused on meeting minimum compliance, it is also important to look ahead. By enabling structured and interoperable data across the entire product journey, DPPs can help address today’s critical information gaps—such as authenticity, condition, repairs, and ownership changes—and unlock significant value in the resale market. DPPs represent an opportunity to build the digital backbone for scalable, data-driven circular models.

While consumer awareness remains limited—65% of respondents in our survey reported having never heard of DPPs, and an additional 15% were familiar with the term but unaware of its meaning—this gap in understanding presents a clear first-mover advantage. Brands that act early can shape both the technological standards and consumer expectations, turning compliance into competitive edge.

Reducing Friction and Building Consumer Trust in Secondhand. The data points made visible through DPPs—such as product specifications, material composition, certifications, and authentication information—can help address several key friction points for fashion and luxury resale.

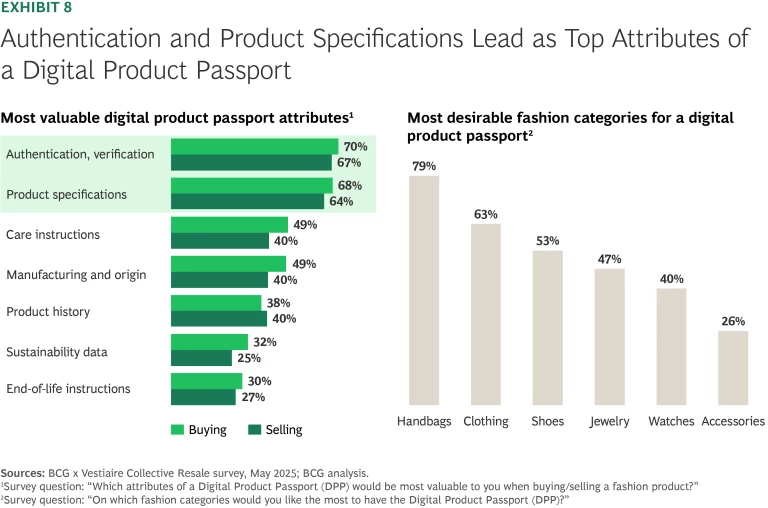

According to our survey, authentication and verification are considered the most valuable DPP features by consumers (70% when buying, 67% when selling), followed closely by product specifications (68% when buying, 64% when selling). (See Exhibit 8.) This perceived value is especially strong in the handbag category, which 79% of consumers identified as the fashion segment where they would like to see DPPs implemented. At the same time, handbags often represent considered purchases, where consumers increasingly seek more information about how and where a product was made, its material composition, and environmental footprint. In this context, DPPs can empower more informed, responsible buying decisions—not only enhancing trust in resale, but also advancing broader goals around product transparency and sustainability.

Key customer benefits include:

- Instant authentication: verifies product originality and reduces counterfeit risk—restoring trust in secondhand transactions.

- One-click resale: pre-filled product data enables faster, easier resale, eliminating friction in listing and relisting.

- Trusted product information: verified details on specifications, provenance, condition, and ownership, supporting smarter buying and selling decisions.

- Better product use and care: built-in guidance on maintenance, storage, and end-of-life options, promoting longer-lasting ownership.

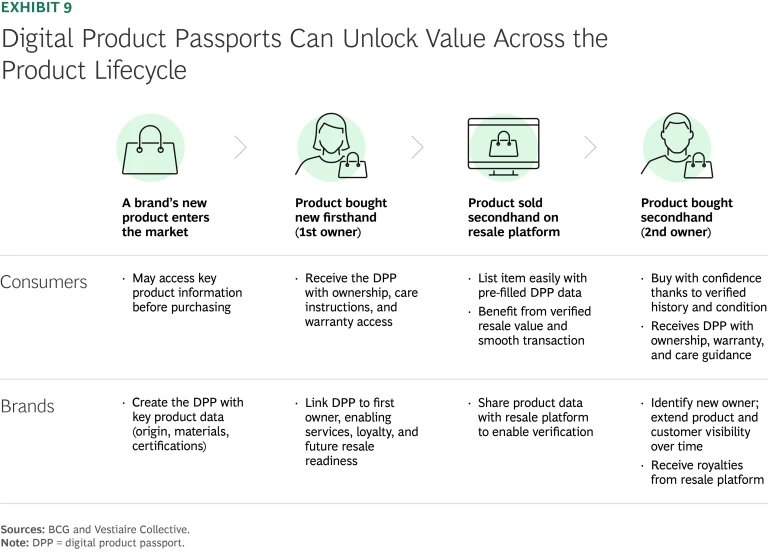

Building Lifetime Value Beyond First Sale. Digital product passports offer brands a way to stay connected with products and consumers long after the initial transaction, unlocking richer CRM, deeper product insight, and greater downstream control. (See Exhibit 9.)

Key brand benefits include:

- Creating new customer touchpoints: enables additional engagement when customers resell or rebuy secondhand, extending brand presence across the lifecycle.

- Reaching previously untapped audiences: captures resale buyers who may never have purchased firsthand, opening new acquisition and loyalty opportunities.

- Enriching product and usage data: collects real- world insights from repair, ownership, and resale, helping brands improve product performance and inform future development.

- Strengthening authentication and brand trust: verifies originality and ownership, reducing fraud risk and preserving resale value.

- Enabling smarter take-back and resale operations: provides real-time product condition and history, supporting better reverse logistics.

Additionally, when resale is integrated through platform partnerships, DPPs could also generate incremental revenue—turning each verified secondhand transaction into a royalty opportunity for the brand.

Making this vision a reality will require close collaboration between brands and resale platforms—aligning on the capabilities needed to make circular models scalable. This includes data feedback loops (such as resale and repair data fed back into DPPs), while ensuring strong data protection and compliance with regulations such as GDPR. Secure access management will also be key—defining what data is public versus permissioned—and must be designed with privacy and user consent in mind. In addition, systems integration (linking DPPs with operational tools like POS or PIM) and fair revenue-sharing models (such as royalties that reward both brand and platform investment) will be essential to enable a robust and collaborative circular ecosystem.

From Data Discipline to Consumer Adoption. While the potential of digital product passports is clear, turning that potential into scalable impact presents a number of challenges—many of which go beyond cost. A key challenge lies in the complexity and discipline required from all stakeholders across the value chain to input and manage data accurately and consistently. This process may differ from brand to brand and will demand significant internal coordination, alignment of responsibilities, and systems for data verification. As of now, many details remain uncertain, as the final decisions and specific requirements under the EU’s Ecodesign for Sustainable Products Regulation are still pending.

Consumers will also play a critical role in the data ecosystem. After the point of sale, it is ultimately up to the firsthand and secondhand owners to use the DPP and contribute relevant information. A DPP only delivers value if it is actually accessed and used—and current consumer motivation to do so remains low. One idea is to integrate DPPs into popular digital wallet apps, enabling consumers to easily receive and store product information at the point of purchase and access it later without friction. Making DPPs lightweight, visible, and more seamlessly embedded in the customer journey is one other way to encourage adoption and unlock full value across resale, repair, and sustainability use cases.

Above all, DPPs must be owned strategically—not treated as a compliance check box, but as a foundation for long- term value creation.

Strategic Considerations for Fashion and Luxury Brands Pursuing Successful Resale Strategies

Build a resale strategy rooted in brand and business fundamentals.

- Align your resale model with your brand positioning and strategic objectives. There is no universal playbook for resale success. Your approach should reflect strategic intent—aligned with brand positioning, audience, and the intended role of resale in creating long-term value. Each resale model offers a different level of control, investment, and risk—and should be chosen accordingly.

- Reduce friction and thoughtfully integrate resale into the customer journey. Resale should feel as seamless and intuitive as traditional retail. While integration varies based on the chosen model, addressing common barriers—like trust gaps, pricing uncertainty, and listing complexity—can enhance customer experiences and adoption.

- Strike the right price balance between firsthand and secondhand in brand-owned channels. Affordability is a key driver of secondhand demand, especially for aspirational consumers. In resale models where pricing is controlled, brands should manage price positioning with intention—maintaining accessibility on some items, while preserving strong resale value on hero products to reinforce brand desirability and protect equity.

Tailor resale to the right audiences with targeted value propositions.

- Leverage resale as a potential recruitment and brand-building channel for Gen Z and aspirational consumers. For many of them, resale can represent an initial interaction with a brand. Brands opting into resale should intentionally manage their secondhand presence—curating presentation, storytelling, and authenticity to build trust and long-term brand affinity.

- Reinforce trust and exclusivity in the resale experience for affluent consumers. Affluent shoppers often turn to secondhand for rare or sold-out pieces that often carry high resale price points. Brands should strengthen confidence through authentication and quality guarantees, while ensuring a curated assortment is available—whether via direct resale platforms, targeted buy-backs, or incentives to resell specific items.

Consider strategic investment in enablers of a scalable and circular resale future.

- Explore shaping circular commerce infrastructure through digital innovation. Digital product passports and related technologies can streamline authentication, automation, and downstream insights, but standards remain under development. As regulation approaches, brands with an active resale interest might benefit from engaging early to influence circular fashion standards, positioning themselves strategically for potential regulatory shifts and opportunities to reduce friction and capture additional value.

About Our Survey

About Vestiaire Collective

Driven by the philosophy “Think First, Buy Second,” Vestiaire Collective offers a trusted space for its community to prolong the life of its most-loved fashion pieces. The platform's innovative features simplify the selling and buying process, as well as giving its members access to one-of-a-kind wardrobes from around the world. The company boasts a curation of 5 million desirable items.

Co-founded in 2009 by two female entrepreneurs in Paris, Vestiaire Collective is a Certified B Corporation® and is active in 70 countries worldwide. To learn more, download the app, visit vestiairecollective.com and follow @vestiaireco on Instagram.