Introduction

Voluntary carbon markets (VCMs) are at a critical juncture. Once a key tool for global sustainability efforts, they were shaken by a 2023 downturn that eroded trust, weakened credit integrity, and drove prices down significantly. Without intervention, these markets and their climate impact are at risk.

Forests offer a path forward. Nature-based solutions (NBS) could provide over a third of the CO₂ mitigation needed by 2030 to stabilize warming at a level below 2°C, and forests are among the most scalable and cost effective of these

Unlocking this potential requires a shift in approach. Supply-side leaders—including landowners, project developers, standard setters, verification bodies, and investors—can take decisive action to strengthen market integrity and ensure that forests deliver robust environmental and financial value. Progress is already underway, led by groups such as the Integrity Council for the Voluntary Carbon Market (IC-VCM)—but much work remains.

This report, a collaboration between Boston Consulting Group (BCG) and the American Forest Foundation (AFF), outlines three actions that are essential to driving this shift:

- View forests as assets, not just as credit banks. With a combined value exceeding $150 trillion, forests are among the world’s most valuable assets. But maximizing their full potential entails managing them as regenerative systems, not merely as carbon-credit generators.

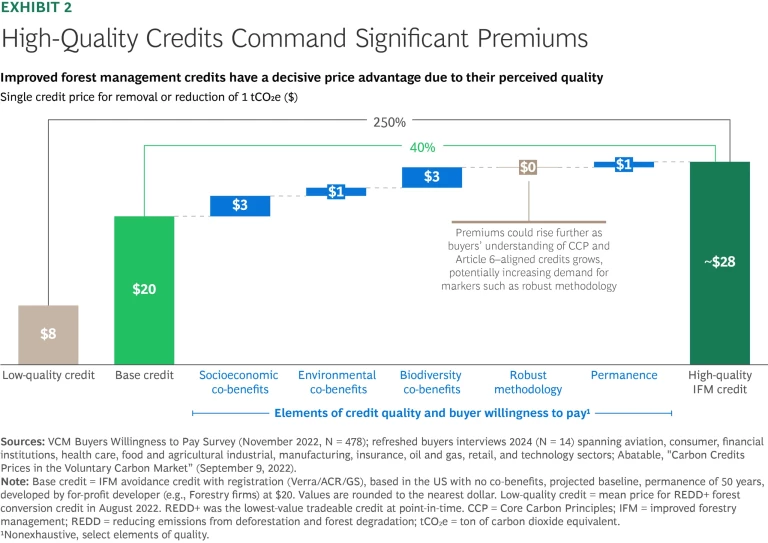

- Invest in quality. Premium credits command prices that are 40% higher than base ones and 250% higher than low-quality ones. But NBS developers need to have confidence that quality is verifiable. Establishing trust in quality requires rigorous frameworks and clear measures such as permanence and additionality that have direct greenhouse gas impact.

- Diversify revenue streams. VCMs alone won’t make forests economically viable for landowners. Success depends on integrating complementary land uses, such as sustainable timber, to strengthen long-term economic viability. Timber harvesting combined with certain forest-based NBS projects can increase a forest’s 30-year net present value (NPV) by up to 50%, according to BCG analysis.

Now is the time to take bold action. With the right strategies, forest-based carbon credits can shift from fragile to foundational—restoring trust in the market, delivering real climate impact, and positioning forests as the cornerstone of a credible, high-value carbon market.

Strengthening Carbon Markets for the Future

VCMs represent a unique and powerful mechanism to combat climate change. (See the sidebar “VCMs Explained.”) But their credibility has diminished over the last several years, with prices for some high-risk credit types falling by as much as 95% from their 2022

VCMs Explained

Voluntary carbon markets (VCMs) turn emissions reductions and CO2 removals into tradable credits, offering a cost-effective mechanism for achieving greenhouse gas reduction goals. They operate in two forms: voluntary markets, where organizations buy credits to meet self-imposed goals, and compliance markets, where they trade credits to satisfy regulatory requirements.

Supply in these markets comes from carbon credits, which represent verified emissions reductions or removals achieved through activities such as renewable energy projects, forest preservation, or engineered solutions like carbon capture. Demand comes from corporations, governments, and other entities seeking to meet regulatory obligations or voluntary climate targets.

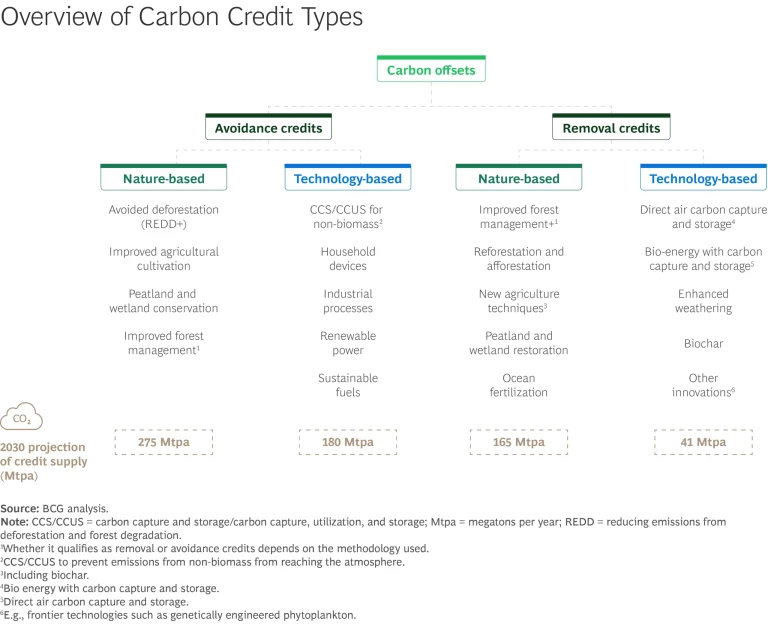

There are two main types of carbon credits: avoidance and removal. (See the exhibit) Avoidance credits prevent emissions by adopting measures such as renewable energy or sustainable land use. Removal credits extract CO₂ from the atmosphere through approaches such as reforestation or direct air capture. The removal credits come from nature-based solutions (NBS), such as forest conservation or wetland restoration, which leverage ecosystems to sequester carbon while delivering co-benefits such as biodiversity protection; or engineered solutions, which use advanced technologies to capture and store carbon.

Forests generate two types of NBS credits. Afforestation, reforestation, and revegetation (ARR) projects establish trees in previously unforested areas and are classified as removal projects since young, fast-growing trees absorb significant amounts of carbon through photosynthesis. Improved forest management (IFM) projects enhance carbon storage in existing forests through biodiversity management, species conservation, and stewardship of mature forests. Depending on the approach, IFM projects may qualify as removal credits or as avoidance credits.

By aligning financial incentives with environmental goals, VCMs create a framework for balancing economic growth with emissions reductions.

The downturn reflects a failure not just of market forces but of trust. Some investigations found that up to 90% of rainforest carbon offsets failed to achieve real emissions

Rapid growth and weak quality assurance methodologies left VCMs especially vulnerable to accusations of greenwashing—the practice of making misleading positive claims about environmental impact. Market critics asserted that companies could claim carbon neutrality without achieving genuine reductions.

These challenges have exposed the fragility of VCMs, but they may also mark a turning point. Like other emerging markets, VCMs are entering a phase of correction and reform that, despite being turbulent, can lay the foundation for a more resilient system.

Stay ahead with BCG insights on climate change and sustainability

In the Near-Term, Volatility Will Remain

Many nascent markets go through cycles of rapid growth, correction, and reform. Such turbulence is normal and can be overcome. Indeed, disruptions often catalyze changes that can lead to stronger, more resilient systems.

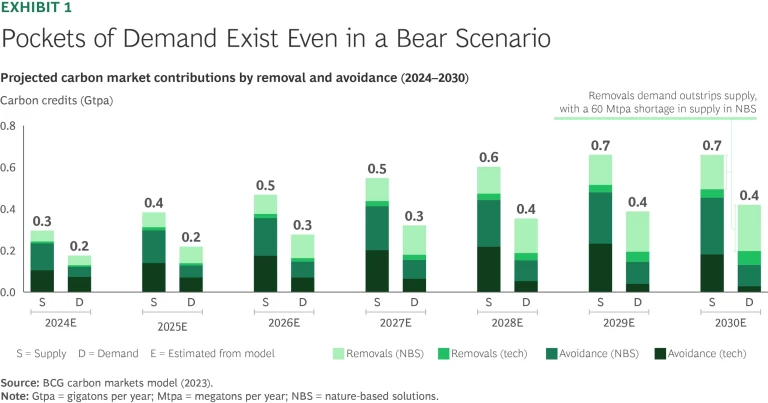

BCG analysis suggests that volatility and supply-demand imbalances will persist through 2030 for VCMs as a whole, resulting in an overall near-term bear market. Nevertheless, certain segments will continue to see strong growth. For example, we project that demand for high-quality nature-based removal credits will outstrip supply by 60 megatons per year by the end of 2030. (See Exhibit 1.)

A confluence of headwinds and tailwinds will shape the overall outlook for VCMs. Headwinds, primarily driven by uncertainty, have taken three major forms:

- Shifting Standards. The Science-Based Target Initiative (SBTi) is undertaking a major revision of its Corporate Net-Zero Standard, creating some uncertainty about the future role of nature-based carbon credits in corporate sustainability efforts.

- Political Uncertainty. A pullback in VCM investment and regulatory support by developed countries could slow innovation and complicate multilateral climate cooperation.

- Market Skepticism. Rebuilding private sector trust will take time. The IC-VCM’s issuance of its Core Carbon Principles (CCP) is a positive step, but restoring confidence in credit quality and integrity will require rigorous implementation and ongoing engagement by all market participants.

But tailwinds also exist—and many are powerful. They include:

Rising Demand for High-Quality Credits. BCG analysis found that demand for NBS removal credits may exceed supply by the end of 2025. Sustained growth in demand at this rate would result in a shortfall of approximately 60 megatons per year by the end of the decade.

Growing Global Momentum on Key Measures. At COP29 in November 2024, countries adopted final technical guidance on Article 6.4 of the Paris Agreement, which enables international carbon market collaboration to meet global climate goals. The integration of reducing emissions from deforestation and forest degradation (REDD+) and afforestation, reforestation, and revegetation (ARR) into the IC-VCM framework adds to this momentum—providing a clearer framework for integrating carbon credits into national and international climate

Compliance Reporting, Providing an Additional Demand Signal. The first compliance year for the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) established that cumulative demand for high-quality carbon credits could increase by 135 to 180 metric tons by

Which headwinds and tailwinds prevail will determine how quickly demand rises. But all market actors have a role to play. Buyers need to signal their willingness to pay for high-quality credits, and project developers should commit to meaningful reforms, as opposed to making superficial changes that maintain the status quo.

Supply-Side Leadership Is Essential

Nascent markets require action from all participants in the value chain to ensure strong, stable growth. The demand side has already begun to respond, with buyers indicating their willingness to pay for credit quality. Premium improved forest management (IFM) credits, for example, command up to 250% higher prices than low-quality credits. (See Exhibit 2.) Premiums could rise further as buyers gain a better understanding of CCP and Article 6–aligned credits, and become more willing to pay for markers of high quality such as robust methodologies.

The supply side has stepped up and can continue to do so. History has shown the power of decisive supply-side leadership. (See the sidebar “How LED Supply-Side Innovation Transformed the Lighting Market.”) A similar path is available to VCMs, and forests lie at the heart of this revival. Buyers and investors play a crucial role in building high-integrity, high-functioning markets, but the most immediate leverage lies with suppliers, including project developers and landowners, and with new actors such as ratings agencies.

How Supply-Side Innovation with LEDs Transformed the Lighting Market

For decades, the lighting industry relied on inefficient incandescent bulbs, which were cheap but short lived and energy intensive. Although fluorescent and halogen alternatives offered marginal improvements, they were relatively expensive, which limited widespread adoption. The breakthrough came with light-emitting diodes (LEDs), a technology that offered superior efficiency but faced early barriers related to cost, availability, and adoption.

LEDs reached a tipping point in the market as a result not of demand but of supply-side innovation. Leading manufacturers anticipated LEDs' potential and acted before mass adoption occurred. They invested early in scaling production, improving efficiency, and lowering costs. These moves triggered an exponential price decline within a few years, making LEDs competitive.

Collaboration played a role, too. Manufacturers worked with governments to develop standards, incentives, and certifications, ensuring that LEDs met performance expectations at an affordable price. As supply increased, consumer trust and adoption followed. From 2010 to 2020, LED sales jumped from 8% to nearly 70% of the market, according to BCG analysis.

The result? By 2024, the global LED market was valued at $94.5 billion and is projected to grow at a CAGR of 10.4% through

The LED transformation offers a key lesson for emerging technologies in climate and energy markets. When industry leaders drive scale, cost reduction, and quality improvements early, they create self-sustaining demand cycles that can reshape entire industries.

Forests Can Restore Vitality to VCMs

Forests and other nature-based-solutions could deliver over one-third of needed CO₂ mitigation by 2030—but currently they receive less than 3% of global climate funding.

Forests Are a Unique Asset

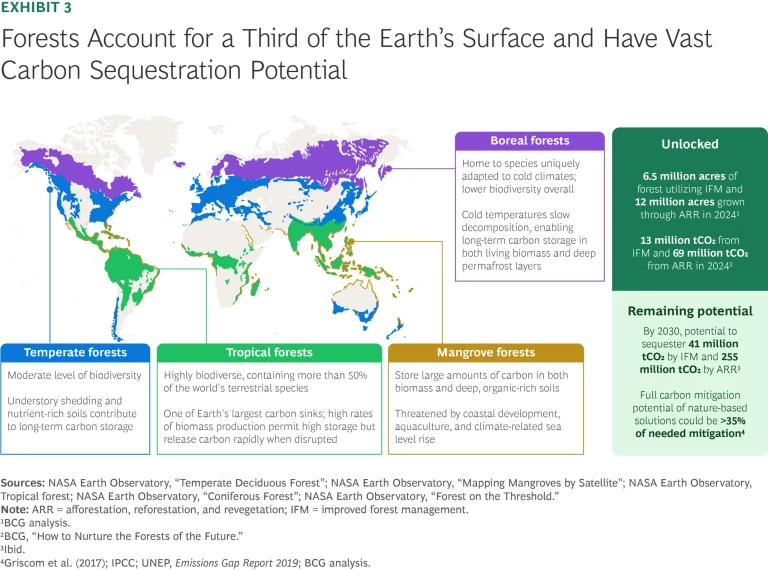

Forests cover one-third of the planet’s land area and offer unparalleled potential in the fight against climate change. (See Exhibit 3.) These vast ecosystems absorb approximately 7.6 billion metric tons of CO₂ annually while providing vital services such as regulating water cycles, preserving biodiversity, and supporting the livelihoods of over 1.6 billion people

Today, much of their value remains untapped. Highly cost-effective climate solutions to protect, restore, and sustainably manage forests receive less than 3% of all global climate

With better support, forests can bolster VCMs and deliver enormous long-term ecological and economic benefits. Here’s why:

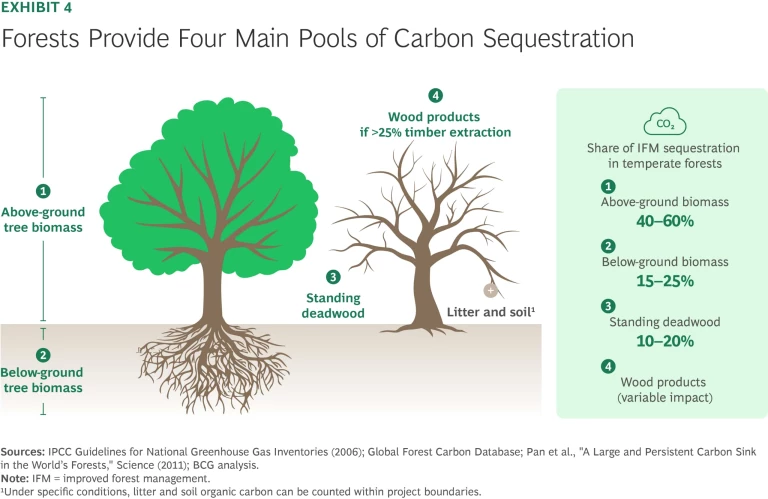

Forests are massive carbon sinks. Forests store carbon above ground, below ground, and even after trees die or are harvested—through long-lived wood products and other mechanisms. (See Exhibit 4.) By 2030, according to our analysis, well-designed forest projects could sequester nearly 300 million additional tons of CO₂e. These initiatives would also deliver broader environmental and economic benefits, including improving water quality, reducing soil erosion, bolstering rural economies, and protecting habitat for endangered species.

Forests are an economic engine. Forests have a combined global worth of up to $150 trillion—more than the world’s stock markets. Better carbon markets can increase that value. In 2022, high-quality forest-based carbon credits traded at $8 to $15 per metric ton of CO2e in 2022, compared to $2 to $6 for energy efficiency credits. Recent trends suggest that forest-based credit prices will rise further, even in the short term. Beyond its value for carbon removal, strategic forest management can unlock new revenue streams across multiple markets, from medicinal plants and resins to nutritional products.

Forests enhance societal well-being. Time spent in nature correlates with improved health

VCMs Can Increase the Value of Forests

Without market incentives, forest land often falls short of its full environmental and social potential or is converted to other purposes. Forest-based solutions such as IFM and ARR can address this challenge by enhancing forest health, increasing land value, and generating carbon credits that are monetizable in VCMs.

Frontiers in Forests and Global Change reports that IFM has the potential to boost global carbon stocks by up to 2 billion metric tons annually—the equivalent of 30 billion barrels of oil. IFM generates removal credits by accelerating forest growth, optimizing carbon sequestration, and improving land productivity. These practices also create avoidance credits by preventing premature harvesting and extending carbon storage. Analysts measure their impact against a business-as-usual baseline.

ARR initiatives expand forest carbon potential by restoring degraded land, sequestering carbon through biomass growth, and enhancing soil. Research published by Nature Communications estimates that ARR could remove up to 2.6 billion metric tons of CO₂e annually by

Similarly, rigorously implemented REDD+ frameworks incentivize conservation and support the issuance of high-quality carbon credits. These projects help standing forests remain effective carbon sinks, delivering large-scale impact quickly. The IC-VCM also awarded a CCP high-integrity label to REDD+ methodologies, further reinforcing their credibility.

Together, project interventions such as IFM, ARR, and REDD+ demonstrate the immense potential of nature-based solutions to reduce atmospheric carbon, protect biodiversity, and create long-term economic value.

Markets alone cannot fix the credibility crisis. Fortunately, however, the supply side is in a position to lead innovation on credit integrity.

Driving Change from the Roots Up

Supply-side developers and landowners will determine whether VCMs deliver real climate impact and a product that meets buyers’ needs and expectations. By seeing forests as assets, investing in quality, and diversifying revenue streams, they can ensure that forest-based solutions deliver lasting environmental and economic value that grows VCMs.

View Forests as Assets, Not Just Credit Banks

Forests are not just carbon-credit factories. They are real assets with profound ecological, social, and economic value. But the only way for developers and landowners to support high-functioning VCMs is to move beyond a transactional view of forests and to manage them as part of a broader system. Forest solutions require strategic management of specific, contiguous landscapes—unlike engineered approaches such as direct air capture, which operators can deploy in any location that meets logistical and energy needs.

For example, mangrove forests replanted in areas where historically they have thrived can store up to 60% more carbon than comparable numbers of mangroves planted in nonnative

Treating forests as holistic assets can also reveal hidden opportunities for value creation, and forest plantations and rural family landowners can help unlock this potential. Despite covering 3% of global forested land, plantations generate 12% of the world’s commercial forest value. In the US, although rural private families manage 39% of the nation’s forests, much of the surrounding land remains underused—a missed opportunity. Analysis from AFF suggests that afforestation or reforestation of these peripheral areas, combined with improved management of existing forests, could deliver at least 1 billion tons of positive climate impact by 2050.

Adopting an asset-first mindset puts biodiversity, water regulation, and soil health into clearer economic, social, and ecological context. These factors are vital inputs for protecting portfolio value and resilience. Weighing them alongside actions that might otherwise appear to be “higher and best use,” such as real estate development, shifts forest management from a narrow carbon focus to a multidimensional economic strategy that benefits the rural landowners who steward them. This perspective ensures the evaluation of forests are valued not just on the basis of their carbon-removing power, but as long-term assets that drive environmental and economic growth.

Invest in Quality

Project developers should consider quality in every aspect of land management, confirming that their initiatives have the support of robust measurement, reporting, and verification (MRV) methodologies and demonstrate permanence and additionality. A recent BCG survey showed that buyers view these quality markers as among the most important criteria when purchasing credits.

Adhering to comprehensive frameworks such as the IC-VCM’s CCP is an important step. These principles emphasize governance, the additionality of emissions impact, and the benefits of sustainable development, ensuring that projects meet rigorous standards across all key dimensions. By applying them, developers can align projects with best practices and signal high credit quality to buyers.

Additionality and permanence present project developers with unique opportunities for differentiation, particularly in IFM projects. For example, the scientific complexity of establishing additionality creates room for innovation—giving a competitive edge to developers that adopt advanced methodologies and verifiable metrics such as independent replicability and after-the-fact validation of claims.

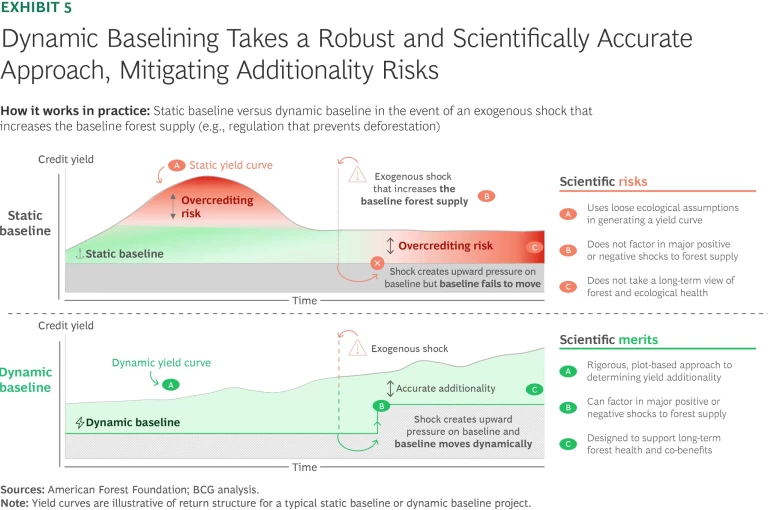

AFF’s dynamic baseline methodology, VM0045, exemplifies innovation in carbon credit quality. Unlike static or modeled baselines, dynamic baselines use real-time data to deliver greater scientific accuracy and adaptability, reducing the risk of developer subjectivity and overcrediting. This rigor appeals to premium buyers who prioritize quality and transparency. (See Exhibit 5.) Dynamic baselines generate credits only when a project demonstrably achieves additionality, unlike traditional baselines that assume additionality upfront on the basis of predictive models.

Building variability into credit issuance may introduce financial risk for developers, underscoring the need for demand-side recognition of the enhanced quality that dynamic baselines provide. Buyer alignment will be critical to supporting high-integrity projects and ensuring their long-term viability. In addition, recent research suggests that IFM would benefit from improved mechanisms to mitigate and account for leakage and from stronger approaches to managing non-permanence

Diversify Revenue Streams

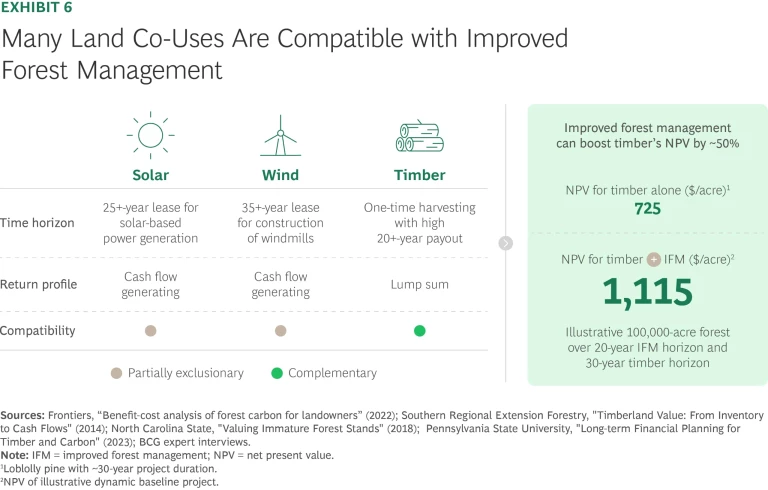

Forest-related NBS may not yield the same immediate returns as other land uses, but they don’t need to. IFM projects can complement existing activities, such as timber harvesting, by creating an additional, NPV-positive revenue stream over time.

Contrary to common assumptions, NBS don’t necessarily carry high opportunity costs. IFM initiatives can coexist with certain timber operations, leveraging science-based guidelines to promote sustainable forest management. Although these projects require incremental investment and administration, they enable long-term, stable cash flows through mechanisms such as advanced market commitments, where buyers commit to purchasing a fixed volume of credits. This dual approach balances economic returns with ecological sustainability.

BCG analysis shows that IFM projects can generate an NPV of $250 to $500 per acre over 20 years, reaching a breakeven point in just two years. When combined with sustainable timber harvesting, IFM can increase a forest’s 30-year NPV by up to 50%, making it a valuable addition to a diversified land portfolio. (See Exhibit 6.)

Developers and landowners also need to account for long-term risks. Forest-based NBS face persistent threats on fronts ranging from wildfires to economic encroachment. To ensure lasting climate impact, project developers should design them with durability in mind. All players in the value chain—developers, rating agencies, buyers, and others—can elevate credit quality by prioritizing projects that support carbon permanence. (See the sidebar “Why Permanence Matters in Forest Carbon Projects.”)

Why Permanence Matters in Forest Carbon Projects

In the carbon market, permanence refers to the durability of a carbon benefit, typically defined as 100 years or more, although time frames can vary by standard. Some protocols require like-for-like matching, where fossil-based emissions—which release carbon from past geologic cycles—must be offset by similarly long-lasting removals. Biogenic emissions, released from shorter organic cycles, may be matched with less-durable removals.

Permanence is a critical attribute of a meaningful carbon benefit because it determines whether removals or reductions truly lower cumulative atmospheric CO2e. One way to support permanence is through the creation of pooled reserves such as AFF’s permanence fund. This fund sets aside a portion of carbon credit revenue to ensure long-term sustainable forest management. It mitigates risks such as wildfires and carbon reversals by supporting remote monitoring, technical assistance, and recovery efforts. Even after a project’s contract ends, the fund provides resources and expertise to help landowners maintain sustainable practices, reinforcing the environmental and economic stability of forests.

Turning Fragility into Strength

Forest-based carbon projects stand at a pivotal moment. Their potential to drive positive climate impact and economic value is clear, yet their long-term viability depends on decisive action. Stakeholders can take three actions to stabilize and scale these markets:

- Put the land and its stewards first. Forest health is not endogenous to VCMs. Although these markets are a tool to incentivize emissions reductions, the foundation of high-quality NBS lies in the land itself and those that steward it. Manage the land first, and credits will follow. An asset-first mindset ensures that all stakeholders prioritize ecosystems, biodiversity, and long-term economic value, unlocking forests’ full conservation and economic potential while naturally generating high-integrity credits.

- Raise the bar on quality. Suppliers can continue to advance rigorous quality standards, starting with frameworks such as the IC-VCM’s CCP. Delivering high-integrity credits entails investing in advanced MRV systems that ensure transparency and credibility for buyers. At the same time, strategic partnerships with governments and private stakeholders can secure financial incentives and regulatory support, both of which are essential for scaling high-quality projects.

- Collaborate for impact. Markets thrive on clear incentives and efficient information flows. Suppliers can actively engage buyers to define and elevate high-quality benchmarks, share insights, and align incentives. Open dialogue fosters the collaboration necessary to scale market confidence and ensure that supply meets the demand for integrity-driven credits.

Forests offer a rare convergence of climate impact and economic opportunity. But realizing their full value requires carefully planned action. Those who commit to quality, integrity, and long-term investment won’t just stabilize VCMs—they’ll define the next era of sustainable growth.

The authors gratefully acknowledge Jamal Nimer, associate, and Emmie Oliver, manager, in BCG’s New York office for their contributions to the report, and Marie Glenn for her editorial support.