At the close of the 2008 Formula One (F1) racing season, the Brawn GP F1 Team faced an existential threat when its sponsor, Honda, withdrew support during the global financial crisis. Team leader Ross Brawn knew he had two options: either close up shop or find a way to survive with a severely depleted budget, an unfinished car, and no engine. By the end of the 2009 season, Brawn GP had turned in a performance for the ages: first place in six of their first seven starts, as well as honors for the top team and driver categories.

How did they pull it off? Through a high-conviction innovation choice, ruthless focus, and the urgency that comes with existential risk—all lessons medtech companies would do well to apply as they work to revitalize their own R&D engines.

Over the last decade, R&D spending among the top 20 medtech companies has risen much faster than topline revenues, but 510k, De Novo, Original PMA, and PMA Supplement clearances have dropped by nearly 50%. Their ratio of total R&D spending to all FDA approvals and clearances catapulted from $4.7 million in 2015 to a staggering $15.5 million by 2024. Simultaneously, medtech M&A has faltered. The industry tallied 150 deals worth nearly $200 billion between 2015 and 2019 versus just 104 deals worth just over $100 billion between 2020 and 2024. (See the slideshow.)

When a historically high-growth, innovation-driven industry like medtech—a sector central to the future of health care technology--no longer delivers on its core premise, it finds itself at the back of the pack. The segment posted an anemic 4.9% TSR in the 2020–2025 time period compared to the S&P average of 10.6%. Among the sectors that outperformed medtech: semi-somnolent regulated utilities, manufacturers of toilet paper and other consumer staples, and purveyors of cement products.

The task of restoring medtech’s vitality is both difficult and urgent. Already facing the constant headwinds of health care budgets strained by aging demographics, firms must now grapple with and respond to new US tariff policies and implement the EU’s far-reaching Medical Device Regulation. Still, the problem is not insurmountable. A systematic teardown of the medtech innovation engine reveals why it misfires and how some leadership teams are building it up. Using a proprietary framework and insights from nearly 100 industry executives, we pinpoint what is going wrong and, more importantly, how to coax peak performance out of a complex system.

Engine Teardown—Fixing the Medtech Innovation Model

To develop a sense of how the medical device development process is sputtering, BCG solicited input from 96 industry leaders representing 49 individual companies across a wide spectrum of medtech segments (see “Methodology”). A telling pattern emerged.

Methodology

Given the relatively small number of respondents, the results are not statistically significant. However, open response commentary in the survey and subsequent management interviews support the conclusion that innovators behave differently from their counterparts in their approach to certain elements of the innovation cycle.

Our survey uncovered key differences between 21 leading business units and 54 average performers across a total of 49 companies. (Business units were classified into four categories: Consumables, Consumable Medical Devices, Equipment, and Surgical. The difference between the total number of companies and BUs in our survey reflects the fact that certain companies reported results for multiple BUs. If a company had at least one innovative business unit, the entire company was recognized as an ‘Innovator’ for calculating R&D expenditure per approval/clearance.) Leaders reported an average of 38 new 510k clearances versus four for the rest of the cohort. The numbers were lower for De Novo and PMA approvals, but innovators outpaced their counterparts by three to one and four to one, respectively. Leaders on PMA Supplements registered 160 products on average versus just three for other players. Not only were leaders more productive, but they were also more efficient: R&D expenditures per approval (including PMA Supplements) for the 2020–2024 period averaged $12 million for leaders and $18 million for the rest of the field. To top it off, leading companies edged the field in top-line results for the time period, reporting average sales of 7.7% versus 6.6% between 2020 and 2024.

To be sure, no single company excelled on every dimension. However, outperformers tended to report high scores on a tight cluster of important subcomponents. The findings suggest that the complex and fickle medtech innovation machine can be tamed with the same formula that worked for Brawn’s 2009 F1 racing team: relentless focus and ruthless execution on the things that matter.

Gearing Up for the Race

When preparing for a race, F1 drivers will often physically walk the track to spot bumps and contours that simulations may miss. In medtech, the equivalent is mapping the product journey end to end—from early ideation through launch and continuous feedback. Each stage presents its own hazards: uncovering real customer needs, navigating regulatory hurdles, proving clinical and economical value, and sustaining disciplined life-cycle management.

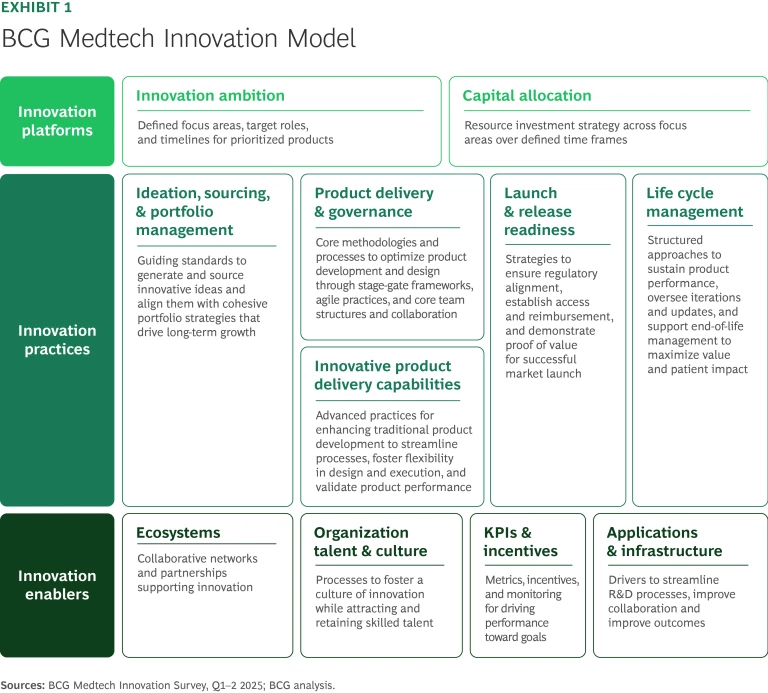

The engine that propels medtech competitors along this course must be geared to manage the twists and turns while delivering maximum power down the stretch. BCG’s medtech innovation model consists of three core elements—platforms, practices, and enablers—supported by distinct capabilities that together drive performance. (See Exhibit 1.) Tuning the innovation engine is fiendishly difficult since the system can go awry at the subcomponent level. Robust performance demands competence across the board.

Innovation Platforms. A medtech innovation engine runs best when a company applies disciplined capital allocation to activities and investments that match its strategic ambition. Setting clear innovation goals sharpens focus, ensuring that R&D efforts target a defined set of products that play a distinct role in the company’s portfolio. In a fast-moving, competitive field, companies must also plan how their portfolios will evolve over a five- to ten-year horizon to stay in the race, so medical device lifecycle management spikes as a crucial capability.

A medtech innovation engine runs best when a company applies disciplined capital allocation to activities and investments that match its strategic ambition.

Often companies struggle to temper their ambition to what they can afford and what they can deliver. Leadership should perform an honest self-assessment of R&D productivity and show the discipline to set aside pipe dreams in favor of products that deliver value for customers at a given point. Failure to set realistic goals leads to an all-too-common doom loop, in which medtech companies raid the budget for longer-term and riskier development projects, generate no new product breakthroughs, and suffer anemic growth and shrinking margins as a consequence.

Innovation Practices. Innovation practices represent the soul of the machine. The portfolio management process balances ambition with budgeting, setting up a cohesive product set that delivers solutions for customers and value for shareholders. Success requires a keen eye on market signals to understand what innovations customers would truly value and a governance and delivery system that pushes product concepts through stage-gate frameworks designed around clinical, medical, and commercial insights. Project managers should have extensive leeway to operate within defined parameters for time, budget, regulatory requirements and a target product profile. When a development project violates those parameters, the broader portfolio becomes unbalanced. A development process with sufficient agility can quickly realign resources to keep the innovation engine in tune.

As innovation-driven businesses, medtech companies must continually assess and adopt new practices to keep pace with market needs, regulatory changes, and technological change. A decade ago, additive manufacturing for rapid prototyping was just emerging. Today, creating and using synthetic data to power large language models is redefining the frontier. Deploying modern technology to streamline processes, increase design flexibility, and validate product performance helps medtech companies stay ahead in delivering customer solutions.

Beyond product development, medtech innovators need to establish access and reimbursement, and demonstrate proof of value for successful market launch. The regulatory regime in each of the major global markets—US, EU, and Asia—requires a tailored approach, especially in newer areas like software as the use of machine learning and AI in medtech products soars. To complete the set of innovation practices, medtech players should have a structured approach to sustaining product performance, overseeing iterations and updates, and supporting end-of-life decisions for the product line.

Innovation Enablers. A well-calibrated innovation engine relies on a set of enablers that drive peak performance. Not all these elements need to be fully owned. Leading players rely on a broad ecosystem of external parties, minority ownership positions, and capital partners to surface ideas, secure funding, and ensure focus. Internally, success depends on cultivating an innovation culture while attracting and retaining skilled talent. Building and maintaining necessary skills for new areas like AI and robotics can be a challenge for established companies increasingly reliant on cutting edge technology. Given the unpredictable nature of innovation, it is critical to reward controllable inputs such as cross-functional collaboration, process discipline, and improvement as well as other behaviors that lead to successful outcomes.

Given the unpredictable nature of innovation, it is critical to reward controllable inputs such as cross-functional collaboration, process discipline, and improvement.

Racing to Win

While the BCG survey documents the myriad challenges of mastering the complex medtech innovation engine, it also reveals practical, actionable ways to succeed. Exactly how our top performers tuned their engines differed somewhat, depending on whether they excelled in launching 510k, De Novo, or PMA products or simply filing PMA Supplements. That said, there were some clear themes and commonalities in how companies brought products across the finish line in all four categories.

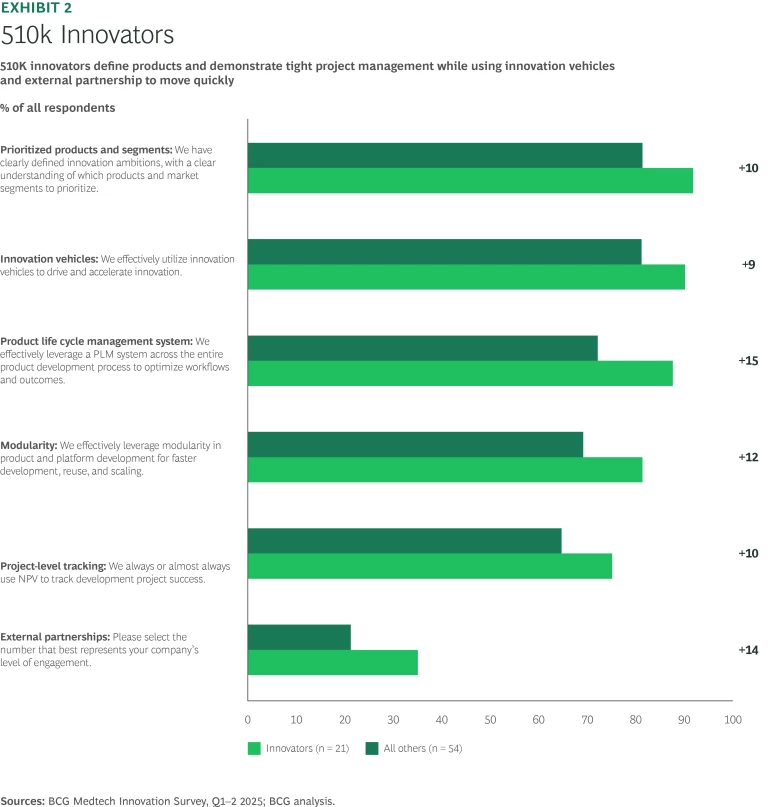

Our survey respondents emphasized many of the same innovation levers, such as defining their innovation goals and prioritizing specific products. However, 510k innovators consistently put more emphasis on a handful of key innovation platforms, practices, and enablers than their peers. (See Exhibit 2.)

One way our 510k innovators leaders separated themselves from the pack was in their use of external partnerships. In the accelerated race to 510k clearance, it is not uncommon to move new products from concept to the market in under a year—and these offerings may have only a year or two on the leaderboard before they are eclipsed by updated and improved alternatives. A reliable external network of partners that can help with prototyping, testing, and compliant manufacturing can be a crucial differentiator. Centers of excellence, particularly for software, are increasingly common given the high reliance on digitally-enabled medical products, software as a medical device (SaMD), and AI/machine learning. Said one company executive, “Many of these projects have a different risk profile and require different capabilities than we have internally; hence we have an incubation engine that allows us to progress at a different speed and avoid the ‘start-stop’ and relentless de-risking dynamic” inherent in a strict internal stage gate process.

In the race to bring fresh products to market, 510k leaders are also much more apt to incorporate modular designs that also pay dividends when assembling and launching new offerings. Modularity also enhances the potential for collection and re-use of at least some portion of their products, a key concern given the emphasis on reducing waste and minimizing carbon footprint.

Focusing on these core areas would be fruitless without basic discipline. 510k innovators hew more closely to project management metrics and principles than their counterparts. In addition, leaders take a long view of the role new products are expected to fill in the overall portfolio and lay out plans for how and when to sunset various offerings.

One innovation leader in the device and consumable segment uses a hard target of 2% to 5% product portfolio cuts as part of an annual life cycle management (LCM) review. The rule is applied even to popular legacy products so that sales reps are motivated to transition their customers to successor products. A commercial executive vice president at the company said, “Including cannibalization and revenue loss from discontinuing legacy products during new product development made it easier to make those LCM decisions.”

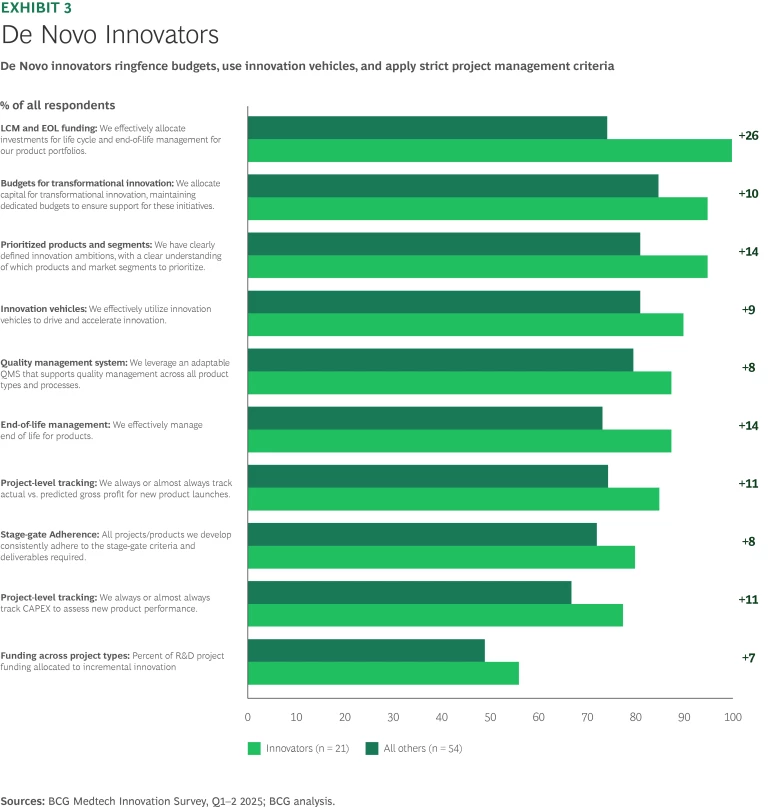

De Novo. De Novo leaders, like outperformers on 510k products, employ best practices across a broad array of innovation levers. They outpace their counterparts on the crucial skill of post-launch rigor and life cycle discipline. Leaders are also more likely to conduct post-mortem reviews than average players, enabling teams to identify whether setbacks stemmed from flawed concepts, process breakdowns, or design shortcomings that left the company vulnerable to competitors. De Novo innovators maintain a clear understanding of where each product sits in its overall life cycle, an advantage that informs both sustaining investments and retirement decisions. (See Exhibit 3).

Financial and operational discipline are both hallmarks of De Novo leaders. Starting with a clear idea of which customer needs and market segments to serve, outperformers provide a pool of capital for more visionary or breakthrough product concepts and draw on innovation vehicles such as incubators, university partnerships, and other accelerators to bring them to life. However, these nascent ideas must survive a gauntlet of financial and operational tests, including gross profit targets, capital intensity, and manufacturability.

Stage gates have been a part of medtech development for decades. However, it is not whether companies have them, but how they use them that makes a difference. Market leaders show strong conviction around stage gate definition, with clear, explainable criteria for advancing concepts to the next phase of the development process. De Novo leaders are more likely than their peers to define stage gates clearly and hold project managers to them as they move toward the finish line.

One innovation leader, a surgical tools and implants company, provides an ample budget for post-launch evidence and sustaining engineering in the original target product profile for development candidates. Post-mortems at the two- to three-year post-launch mark for their top ten programs have helped shift designs from centering on -centric features to attracting broader appeal. The head of R&D reported, “One of the things we uncovered was that we systematically designed for the key opinion leaders and early adopters, but products were often not fit for mass market.”

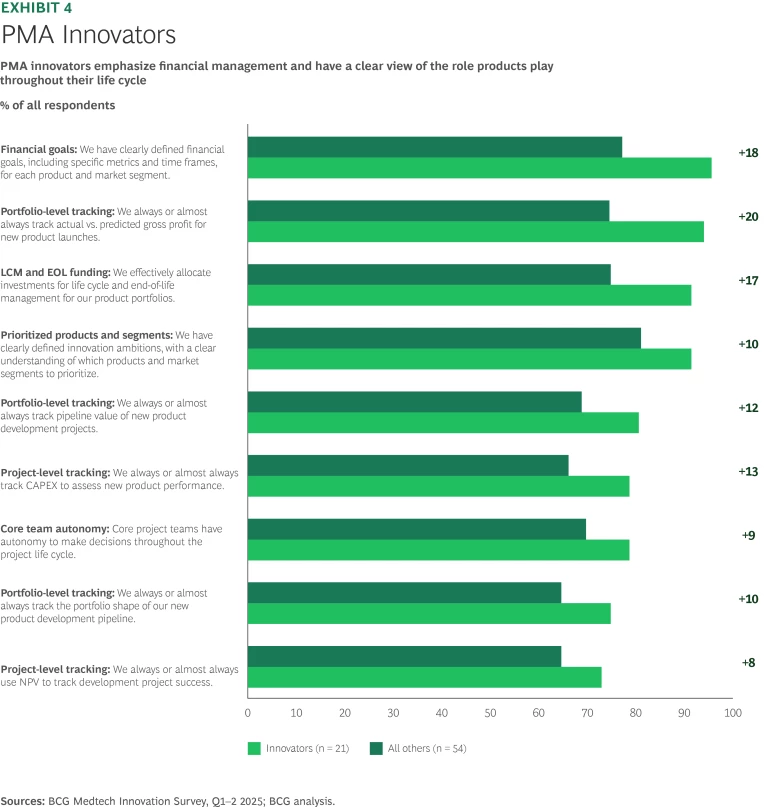

Premarket Approval (PMA). Because the management time and capital requirements for PMAs typically dwarf those of 510k and even De Novo products, PMA innovators face the highest stakes in the innovation race. Leaders perform well across the board, but double down on a tight set of levers that make a difference. Top performers describe a clear and comprehensive vision for the product, what customer need it aspires to address, and how much value is at stake in meeting that need. Innovators examine how a new offering will fit into the overall portfolio and how to keep it competitive over a longer life cycle than a typical 510k. (See Exhibit 4.)

Given the size and importance of PMA candidates, leading companies are more likely to set aside a budget to explore innovative technology and approaches. PMA innovators more frequently dedicate ringfenced and multidisciplinary teams for the full development process, while their peers tend to do so only episodically. Moreover, with a more substantial investment to recoup, PMA leaders often incorporate access and reimbursement strategies as part of the innovation process.

A reliable external network of partners that can help with prototyping, testing, and compliant manufacturing can be a crucial differentiator for 510k innovators.

Even the strongest performers face hurdles and make difficult trade-offs that they would prefer not to make. What sets them apart is their ability to lock in on the issues that matter most, seeking mastery of them as an integral part of their race strategy. When companies are placing big bets on the outcome, they are willing to invest heavily to improve their chance of winning.

One innovation leader focused on implantable cardiac devices devotes significant resources in primary research, including conjoint surveys, as well as secondary research and advanced analytics capabilities to create sophisticated business cases and scenarios. The hypothetical outcomes are simulated using Monte Carlo and real options analyses to understand likely and possible financial performance, especially for their PMAs. “When we expect to invest more than $200 million in R&D over five to ten years, we are happy to invest sometimes millions to get the value potential as right as we can. It is especially important to understand the scenarios and critical inflection points and market signals.”

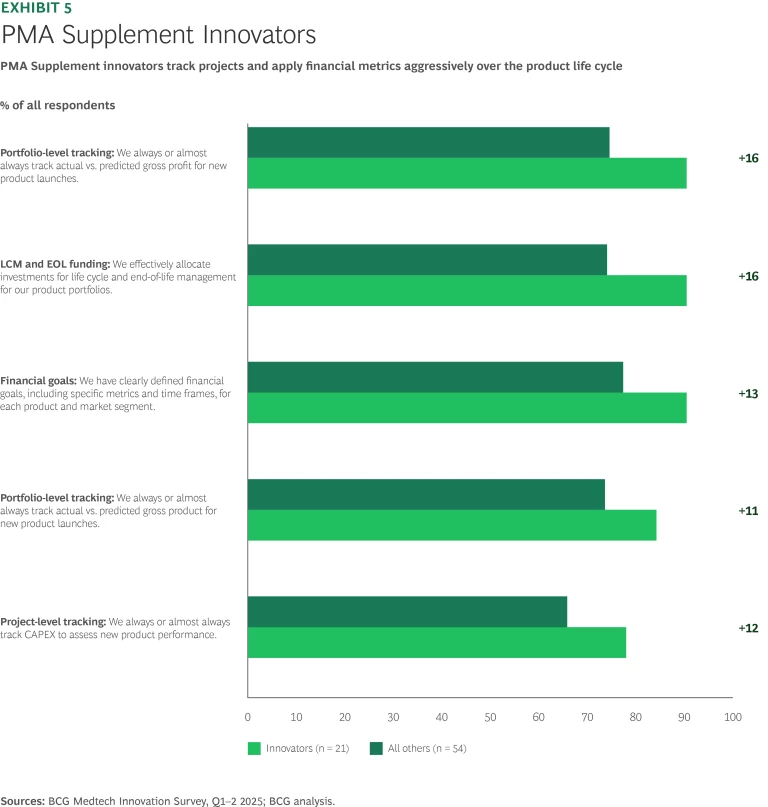

PMA Supplements. While many PMA Supplements cover humdrum items such as notification of new suppliers or packaging, these filings address the crucial challenge of maintaining and extending product life cycles for the existing portfolio of PMAs. Quite often, success comes down to discipline and preparation; for instance, setting detailed stage-gate definitions and success criteria by function. With a detailed scorecard locked and loaded, it pays to be ruthless. PMA Supplement leaders outperform on financial management, setting specific goals and managing gross profit aggressively. Innovators showed a greater propensity to manage products over the entire life cycle and incorporate capital employed as a key management metric. (See Exhibit 5.)

One PMA Supplement leader, a consumer medical device manufacturer, says 90% of project terminations occur in the pre-development and feasibility stages, so they suffer only a handful of painful and expensive late-stage failures. A company representative said, “Our cross-functional stage-gate reviews are not rosy presentations of pretty slides, but a forum to air out market and technical benefits, risks, and mitigations and to make informed decisions.”

Always Another Lap

Unlike in F1 racing, there is no checkered flag. There is always another lap in the medtech industry. The immediate disruptions of COVID-19 and the pullback on elective surgeries are now in the rearview mirror, but new headwinds loom large: from the EU’s Medical Device Regulation to ongoing tariff policies. At the same time, aging populations and stressed health care budgets will continue to put pressure on performance. These dynamics help explain why medtech’s TSR has been lapped so often in recent years.

To get back into the race, medtech players need to fix their complex and sputtering innovation engines. As difficult a feat as this may be, our survey highlights how market leaders are driving performance. Some leverage global reach to reduce costs and boost R&D productivity, others invest heavily in digital tools and capabilities, while still others apply a disciplined “quick kill” philosophy in early development stage gates Their stories suggest that mastering every aspect of the complicated innovation machinery should not be the goal. Rather, medtech players should strive for competence across the board while, like the Brawn F1 team, focusing with ruthless efficiency on the things that matter most. The urgency is real—because keeping medtech’s innovation firing on all cylinders is what will power the future of health care technology.