Climate adaptation and resilience (Climate A&R) is rapidly emerging as the next trillion-dollar investment opportunity for private equity. Yet, despite these powerful tailwinds, private equity investors have largely struggled to capitalize on this market until now, hampered by difficulties in understanding, navigating, and analyzing the space. However, once the market is better structured and analyzed, a clear and compelling landscape of actionable opportunities becomes apparent.

In this report, we introduce BCG’s Climate Adaptation and Resilience Investment Opportunity Map, designed to systematically guide investors through the Climate A&R space, by identifying and structuring the universe of opportunity areas. The report further provides six sectoral deep dives, uncovering market dynamics sought after by private equity investors and spotlighting concrete investable opportunities for investors with strategies ranging from venture to growth to buyout. Our findings challenge the perception that the Climate A&R market is a market of the future. Instead, it is a market of today, ready for investors to move.

The need for Climate A&R solutions is evident. Over the past decade, each year has broken the previous year’s record for being the hottest in recorded history. As a result, the negative impact of extended climate events, such as droughts and rising sea levels, has worsened, and the frequency and intensity of extreme weather events—such as wildfires, heat waves, cold waves, and floods—have increased significantly.

In Europe, Spain faced its worst floods in decades in October 2024, which claimed over 200 lives and caused around $11.7 billion in damages. In Asia, temperatures touched record highs in May 2024, forcing schools and businesses in several countries, such as Bangladesh and China, to shut down. And in the US, the January 2025 wildfires in California are estimated to have claimed at least 30 lives and caused over $250 billion in economic losses.

The Climate A&R Market Is Large—and Growing

To respond to this challenge, climate mitigation actions—such as renewable energy and nature-based solutions—continue to be the top priority. But Climate A&R solutions are also urgently needed. At current levels of mitigation activity, according to a recent study conducted by BCG and the World Economic Forum, the average global temperature is likely to remain on a trajectory to exceed a 3°C increase over pre-industrial levels, causing annual profit declines of 5% to 25% in industries such as telecommunications, utilities, food and beverages, and construction.

As the need to deploy Climate A&R solutions becomes more acute, it is catalyzing the creation, maturity, and growth of companies working to develop, deploy, and scale climate-related innovations worldwide. The effort is creating value pools of new enterprises and accelerating the growth of existing companies whose offerings—such as climate-resilient building materials, human-engineered flood defense solutions, and emergency medical products and services—are key elements of Climate A&R solutions and applications.

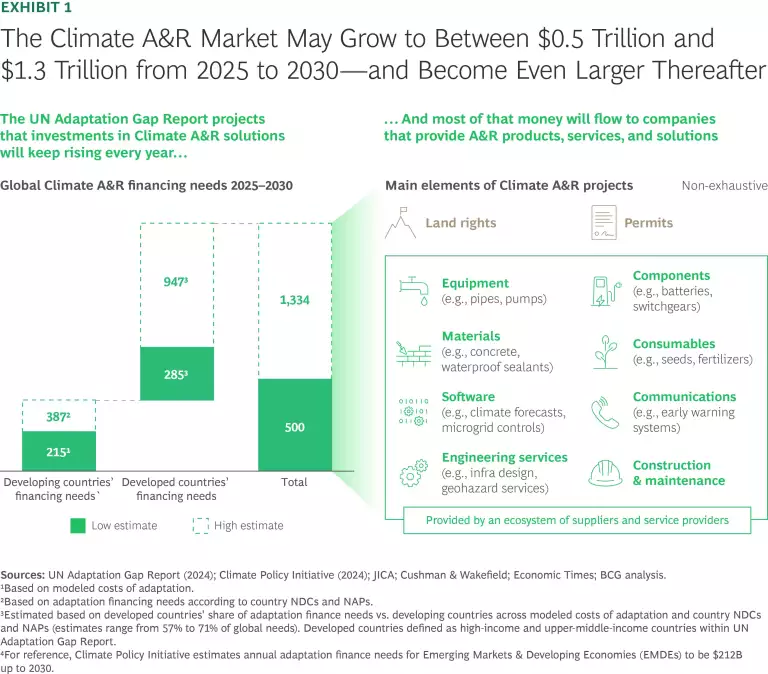

One projection of the Climate A&R market’s size comes from the 2024 UN Adaptation Gap Report, which estimates adaptation financing needs of $215 billion to $387 billion a year between 2025 and 2030 in the countries of the Global South alone. Including developed countries, the projected demand for Climate A&R investments rises to between $0.5 trillion and $1.3 trillion a year by 2030. (See Exhibit 1.)

Several Climate A&R classification frameworks already exist, but they usually classify solutions in terms of how they mitigate risks or prevent damage, not in terms of the demand they could create. What investors need is a classification system based on how markets are structured, with comparisons of market sizes and growth rates, competitive dynamics, and profitability.

Stay ahead with BCG insights on principal investors and private equity

Mapping the Most Promising Investment Opportunities

To identify the sectors and companies that will provide the goods and services for Climate A&R solutions, we’ve drawn our experience from numerous climate-related engagements in the private equity industry. We created a framework that laid out the universe of investible possibilities, quantified them, and assessed the relative attractiveness of subsectors across time horizons using a range of current and leading indicators.

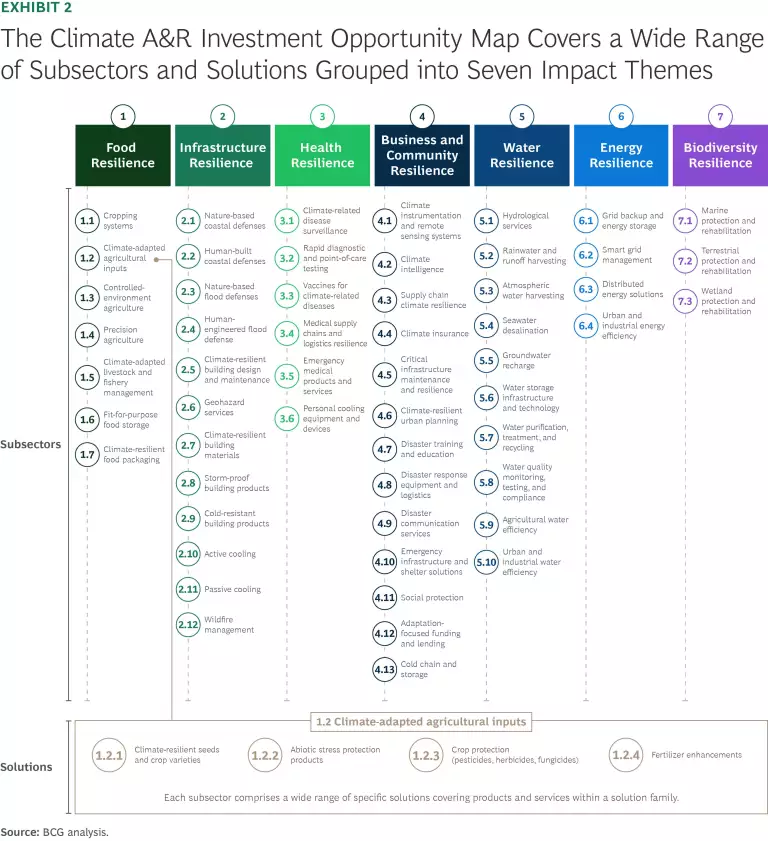

The map provides a three-layered segmentation of opportunities in Climate A&R.

Level 1. The first layer of impact themes covers areas where climate change is currently having the greatest impact. The seven impact themes we identified are food, infrastructure, health, businesses and communities, water, energy, and biodiversity.

Level 2. Each impact theme has subsectors based on the type of Climate A&R technology and its applications. Each subsector represents a family of solutions based on how those markets are organized, enabling investor analyses such as market segmentation and sizing.

Level 3. In each subsector, we developed a comprehensive list of solutions based on case studies, innovations, and stakeholder analyses. These solutions span products and services across mature and emerging technologies, business models, and value segments.

The Climate A&R Investment Opportunity Map shows the breadth and depth of climate-related investment opportunities available today. Each impact theme includes several subsectors with multi-billion-dollar markets, double-digit growth rates, healthy margins, and a sizeable pool of investable companies—characteristics that private investors typically look for before making investment decisions. (See Exhibit 2).

In some sectors and subsectors, mature Climate A&R business models will expand faster, creating tailwinds for growth or buyout strategies; in others, innovation will provide early-stage opportunities with high growth potential.

Our report projects growth, segments markets, and identifies investment opportunities for the following six subsectors:

- Climate Intelligence Solutions – Expected to grow by around 15% over the next five years (annual CAGR)

- Climate-Resilient Building Materials – Expected to grow by 6% to 8%

- Human-Engineered Flood Defense Solutions – Expected to grow by 7% to 10%

- Climate-Adapted Agricultural Inputs – Expected to grow by 4% to 7%

- Urban and Industrial Water Efficiency – Expected to grow by 6% to 8%

- Emergency Medical Products and Services – Expected to grow by 8% to10%

As temperatures rise and extreme weather intensifies, the market for Climate A&R solutions will continue growing. Regulatory tailwinds, such as green tax incentives and concessional financing, will further accelerate its growth. This will create sustained demand for the goods and services underlying Climate A&R solutions, especially in essential industries such as agriculture, water, and infrastructure.

We often hear that Climate A&R investment opportunities will materialize in the future. This report shows otherwise: the opportunity exists today. Right now, private equity investors can invest behind the swelling demand for A&R solutions and generate attractive returns. Some opportunities will be found in large incumbents or diversified conglomerates, but others will be found in middle-market enterprises, specialized service providers, and innovative technology companies. This report identifies several areas that are ripe for private equity investors to move, highlighting actionable opportunities for strategies ranging from venture to growth and buyout. Investors who act now can help shape the industries that will define climate resilience—capturing commercial opportunity while driving progress on one of the most important challenges of our time.