Maximizing value from post-merger integration (PMI) hinges on rigorous program management, disciplined financial control, and effective integration of people and cultures. Zero-based transformation (ZBT), a methodology that rethinks how an organization allocates resources, can play a critical role by driving purposeful financial management, thereby enabling companies to capture the merged organization’s full potential.

ZBT is an approach to transformation designed to accelerate, enhance, and sustain value creation by rigorously challenging expenses and resource allocation from a "zero base." This provides transparency at a granular level, creating a unified view across different companies, functions, regions, and cost structures.

Supported by strong leadership and cultural change, ZBT delivers immediate financial benefits for the newly combined business. BCG research shows that leveraging ZBT reduces costs by 15% to 25%, with 70% realized in the first year. Critically, the approach provides funding for strategic growth objectives that support longer-term value creation.

Stay ahead with BCG insights on corporate finance and strategy

How ZBT Enhances PMI

PMI is critical to the success of any M&A transaction, which involves two companies combining their operations, organizations, and strategies into a cohesive entity. PMI often reveals overlapping functions, duplicate resources, and misaligned goals. ZBT addresses these challenges by requiring leaders to make decisions based on the organization’s future needs, rather than relying on legacy structures.

The key benefit of ZBT in PMI is that it fundamentally challenges the existing cost structures of both the acquiring and target companies, enabling organizations to do more than just remove duplicate costs. While PMI typically involves translating high-level synergy targets into actionable, quantifiable initiatives, ZBT goes further by systematically questioning spending patterns and resource demands at a granular level—by cost category, brand, and market. Cross-functional decision making by stakeholders ensures a rigorous redesign of organizational structures and ways of working. This deeper challenge to legacy cost bases not only identifies greater efficiencies but ensures that they are tracked, owned, and successfully delivered.

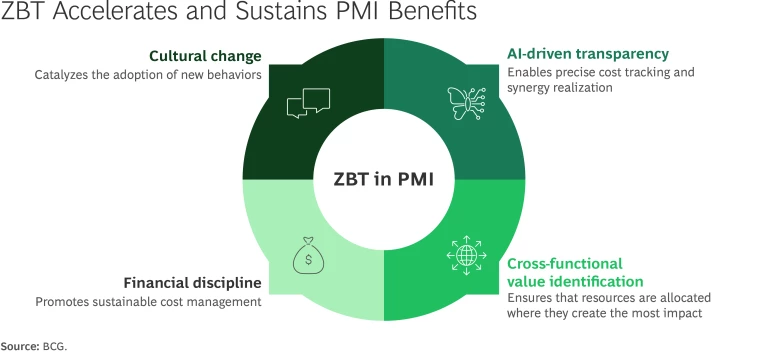

ZBT improves PMI outcomes through AI-driven transparency, cross-functional value identification, improved financial discipline, and accelerated cultural change. (See the exhibit.)

AI-Driven Transparency

One of the primary drivers of M&A is the opportunity to achieve cost synergies by eliminating inefficiencies, optimizing procurement, and streamlining operations. Although companies typically succeed in developing a detailed, standardized view of costs that offers clear insights across the merged entities, the effort often entails a great deal of organizational friction and stress.

To gain actionable insights quickly and efficiently, leading companies are deploying AI-powered cost transparency tools, such as BCG’s Synergy.AI. Precise, like-for-like cost comparisons reveal synergies that might otherwise go unnoticed. Through in-depth analyses of financial and operational data, these tools identify specific areas for optimization—whether by consolidating vendors, refining workflows, or restructuring the organization. (See “AI-Driven IT Consolidation Uncovers Hidden Costs and Unifies Governance.”)

AI-Driven IT Consolidation Uncovers Hidden Costs and Unifies Governance

The AI tool assisted in establishing a globally comparable cost baseline to manage the complexity of integrating multiple legacy ERP systems. The company identified hidden inefficiencies, particularly in IT spending. The analysis revealed that actual IT expenses were 15% higher than initially reported, owing to expenditures made outside the formal budget allocations by various departments and regions.

Armed with this insight, the company centralized IT expenditures under a unified governance framework, streamlining procurement and contract management. This centralization allowed the company to better leverage its economies of scale with vendors and make more informed make-versus-buy decisions. As a result, it achieved significant cost savings and improved operational efficiency—thereby accelerating and enhancing overall synergy realization.

Cross-Functional Value Identification

The introduction of cost category owners to oversee specific cost categories across the merged companies ensures focused, strategic cost management throughout the PMI process.

Category cost owners lead structured value identification workshops that bring together all stakeholders involved in a process across regions, functions, and legacy organizations. These workshops help establish the baseline level of service required—the “minimum viable product”—and identify the incremental improvements necessary to achieve the organization’s new strategic objectives.

A significant benefit of cross-functional discussions is that the people responsible for market- and function-level spending decisions participate in quantifying value drivers and create and own synergy realization plans. Category cost owners support this process by constructively challenging legacy cost structures and demand patterns, ensuring thorough analysis and the exploration of more efficient and innovative alternatives. This collaborative approach uncovers opportunities for optimization at a granular level.

By questioning existing ways of working, adjusting service levels, and redefining processes, stakeholders ensure that every cost is evaluated based on its strategic necessity and business impact. The result is a more actionable, data-driven transformation that aligns resources with value creation.

Improved Financial Discipline

A newly combined entity often faces significant financial pressure to meet shareholder expectations. The need to deliver on promised synergies while managing ongoing operational costs can strain resources and test the organization’s financial discipline. ZBT addresses this challenge by strengthening financial discipline in several ways.

Designing Costs from Zero. The core financial discipline embedded within ZBT is that every cost must be justified from scratch rather than from historical spending patterns. This approach goes beyond removing duplicate or overlapping expenses, compelling the newly merged organization to rigorously evaluate each expenditure based on its strategic necessity and value contribution.

Standardizing the Chart of Accounts. ZBT provides clarity and alignment by unifying the chart of accounts across both entities. This ensures that the newly merged company has a consistent way of structuring its general ledgers and cost centers, simplifying financial tracking and reporting.

Embedding Synergies Directly into Budgets. ZBT enables a bottom-up budgeting process in which synergies are built directly into financial plans. Travel and entertainment expenses, for example, are budgeted by each function at a granular level (price times quantity) for the full year, while media spending is allocated by type of investment. This precision ensures that budgets reflect actual business needs rather than historical spending patterns.

Establishing a Robust Track-and-Trace Process for Executional Certainty. A track-and-trace process monitors and sustains savings by proactively tracking financial and operational metrics in tandem for every initiative, maintaining accountability and transparency throughout the PMI. Ultimately, this disciplined approach ensures that the organization realizes savings in the P&L while also promoting its operational effectiveness. (See “A Track-and-Trace Process Streamlines Marketing Spend and Enhances Performance.”)

A Track-and-Trace Process Streamlines Marketing Spend and Enhances Performance

As part of the effort to optimize ad spending, the company reduced ad frequency and introduced gross ratings points as a critical KPI for monitoring audience reach. By pairing reduced ad frequency with closely tracked gross ratings points, the company safeguarded marketing effectiveness while pursuing targeted cost efficiencies.

This track-and-trace process and reporting framework enabled the company to precisely distinguish essential investments from potentially excessive spending, ensuring that resources were allocated efficiently without sacrificing impact. As a result, the company met its financial objectives for both growth and profitability.

A critical aspect of financial discipline is the ability to distinguish between synergies, investment returns, inflation, and other external factors that can impact financial performance. The track-and-trace process ensures a clear view of synergies as distinct from financial headwinds or tailwinds that could dilute or enhance the financial benefits expected from the merger.

Accelerated Cultural Change

Mergers are not just financial transactions; they involve the complex task of combining two distinct corporate cultures. Cultural misalignment is one of the main causes of post-merger failure, as it can lead to clashes in strategic priorities, operational practices, and employee engagement.

ZBT acts as a catalyst for cultural change by translating a high-level cultural roadmap into specific, actionable plans. By requiring all departments to justify their expenses based on their contribution to the organization’s strategic objectives, ZBT encourages new behaviors and promotes accountability across the entire organization.

Best Practices for Implementation

To maximize the benefits of ZBT during PMI, organizations should adhere to several best practices that have proven effective in various industry contexts.

Set ambitious objectives and clear priorities. Before implementing ZBT, it is crucial to establish ambitious goals and clear priorities for the merged entity. Rather than focusing solely on obvious or easily attainable synergies, organizations should set bold, aspirational targets that go beyond conventional expectations. Identifying ambitious synergy targets and clearly defining strategic objectives ensure that the ZBT process fully captures potential value, avoiding the common pitfall of leaving significant opportunities unaddressed.

Engage leadership and foster collaboration. Senior management must set the tone for the organization and ensure that all departments are aligned with the new approach. Managers and team leaders throughout the organization should play active roles in driving the ZBT agenda. In addition, fostering collaboration between departments can help identify opportunities for cost savings and efficiency improvements that may not be apparent to individual functions.

Use technology and data analytics. Advanced AI tools and analytics platforms can automate much of the data gathering and analysis required for ZBT. These tools provide valuable insights into spending patterns and facilitate real-time monitoring and reporting.

Monitor and adjust regularly. ZBT requires continuous monitoring and adjustment to remain effective. During PMI, it is important to regularly review KPIs and assess whether the expected synergies are being realized. This ongoing evaluation allows the organization to ensure that the budgeting process remains aligned with strategic goals and the evolving business environment.

ZBT is a powerful methodology for accelerating and sustaining the benefits of PMI. By adopting ZBT, organizations can align their resource allocation with current needs and promote long-term value creation. Capturing the advantages requires that they ensure strong leadership commitment, foster collaboration, and implement robust governance structures. With ZBT as a cornerstone of the post-merger strategy, companies can unlock significant synergies, drive sustained efficiency, and set a strong foundation for future growth.