Circularity offers businesses a pathway to growth while addressing environmental challenges. However, scaling profitable circular models requires overcoming obstacles like consumer adoption, operational complexity, and integrating circularity into traditional linear business. The good news is that with careful planning and execution, circular models can drive growth, profitability, and sustainability simultaneously. Examples show circular offerings can deliver 15-20% topline growth, 10-15% material cost savings, and reduced supply chain and regulatory risks—all while maintaining margins comparable to linear models. Globally, circularity could cut greenhouse gas emissions and material extraction by

This is the second of three articles on circularity, which covers the challenges and key enablers to get in place to succeed with scaling circularity. The first article, “Seizing the Growing Circular Opportunity,” covers the circular opportunity—why circularity and why now. The final article will explore integrating circularity into an overarching business strategy and operating model to drive long-term sustainable growth.

The Challenges of Scaling Circularity

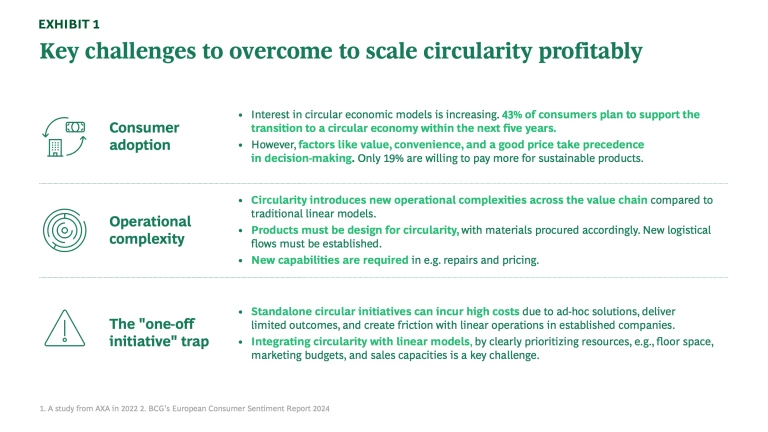

While circularity offers potential for revenue growth and decreased environmental impact, scaling profitably can be challenging. Unlocking circularity's full potential is a long-term journey and requires commitment and strategic planning from the very beginning to see the full potential. The challenges businesses face include consumer adoption friction, operational complexity, and running circularity as isolated initiatives. (See Exhibit 1.)

- Consumer adoption: As outlined in the first article in this series, “Seizing the Growing Circular Opportunity,” consumer awareness of sustainability is high, yet a gap remains between intent and action. Globally, 70-80% of consumers are concerned about sustainability, as shown in Exhibit 2, and 40% of European consumers consider sustainability in purchases, but value and convenience take precedence. In Europe, 19% are willing to pay more, compared to just 2-7% globally. (See Exhibit 2.) Familiarity with circular models like buybacks, rentals, and repairs remains low.

Circular models offer inherent cost benefits, but many companies face significant hurdles in achieving widespread adoption. A key challenge lies in matching the convenience of traditional linear options. Businesses often struggle to meet consumer expectations for service quality while maintaining competitive pricing, creating tension between affordability and convenience for consumers and profitability for the company. The critical obstacle for the success of circular models is striking that balance—crafting an offering that is both cost-competitive and as convenient as the linear, low-cost alternatives.

- Operational complexity: Circularity introduces new operational complexities across the value chain. Products must be designed for circularity, materials must be sourced accordingly, and product flows must be managed across multiple sales cycles—returns, diagnostics, repairs or refits, and resales. Logistics must be restructured to handle product returns, and companies need new capabilities in repair, refurbishment, and pricing. Proactively addressing operational challenges can significantly improve efficiency and outcomes. For example, one case demonstrated that standardizing repair processes and reducing spare-part lead times boosted repair efficiency by 20–30 percentage points. (See Exhibit 3.)

- The “one-off initiative” trap: For established companies, standalone circular initiatives often fall short, generating limited impact, higher costs from ad-hoc solutions, and friction with linear model goals. This can make such initiatives seem unattractive for scaling across the organization. A major challenge lies in the lack of strategic planning to integrate circularity with existing linear operations. To realize its full potential, circularity must be viewed not as a short-term project yielding immediate results but as a long-term transformation requiring sustained organizational commitment. Companies frequently face difficulties in setting clear priorities, such as allocating floor space, marketing budgets, and sales resources for circular offerings.

Stay ahead with BCG insights on climate change and sustainability

How To Make Circularity Work

These challenges can be addressed with a clear strategy. The first step is setting a well-defined ambition for circularity that balances growth, sustainability, and profitability. Prioritization is crucial, as some initiatives may drive revenue and reduce emissions but deliver low margins. For instance, accepting low-value products in a buyback program might boost growth or cut emissions but harm profitability if customer willingness to pay doesn’t cover costs. Striking the right balance between these trade-offs is essential for achieving sustainable success.

After defining the ambition, it is crucial to set clear organizational goals to align efforts and engage stakeholders. Scaling circularity effectively requires activating key enablers across critical areas, including circular offerings, marketing, retail and sales, logistics and operations, digital solutions, and product development. (See Exhibit 4.)

Circular offer

Product category selection

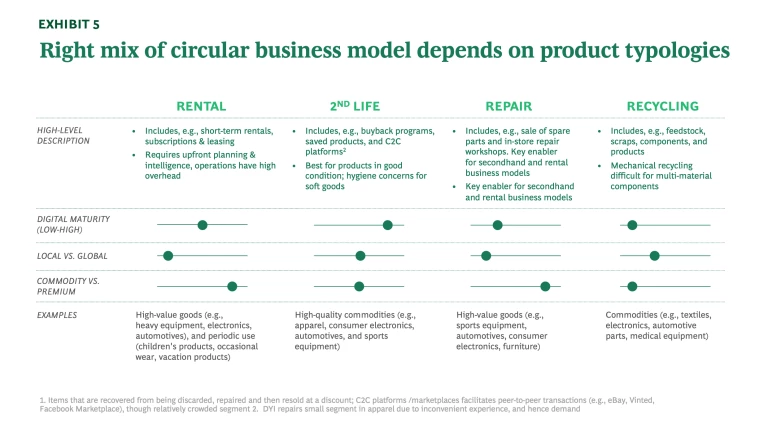

To design effective offerings, it’s crucial to assess costs and customer willingness to pay, which ensures a clear understanding of margin drivers. Rental models work well with high-value and periodic-use items like electronics or children’s gear, while recycling fits lower-value items like textiles, for which buyback schemes may not cover costs. Aligning circular models with product types, as shown in Exhibit 5, is key to driving growth and maintaining margins.

Assortment prioritization and simplification are crucial to avoid scattered efforts. Focusing on offerings with the highest potential to achieve a circularity ambition reduces complexity, cuts costs, and ensures resources are allocated for maximum impact.

Case example: Fnac Darty

Fnac Darty, a European leader in electronics and appliances, has prioritized repairs as a key focus of its circular strategy. With a product portfolio well-suited for reparability, the company launched Darty Max, a subscription-based repair service offering unlimited repairs for eligible products, in 2019. Since then, it has completed over 2.5 million repairs with 1.1 million subscribers and plans to double this by

Pricing strategy

Pricing strategy is a key component in designing circular offerings. To meet consumer expectations and convey value for money, circular offerings must be competitively priced against traditional alternatives.

In buyback schemes, the pricing strategy involves two key components. First, setting an appropriate purchase price for buying back products is essential to incentivize consumer participation while covering refurbishment costs to protect margins when reselling. Second, the pricing of refurbished products must strike a balance between profitability and affordability. This guarantees that they remain attractive to consumers while sustaining financial viability.

Secondhand items add a layer of complexity as they are unique and require individualized pricing. Additionally, the fact that the same product may have varying prices depending on the model—such as linear, subscription-based, or short-term rental—must also be carefully factored into the pricing strategy. (For tools that can help, see the section titled “Digital solutions” below.)

Marketing

Marketing plays a key role in driving demand and revenue growth. Using marketing to educate consumers about the benefits of circular offerings can nudge consumer adoption. Since convenience is a top priority for consumers, it is essential to present circular models as easily accessible. For example, a campaign that clearly explains a rental scheme can demystify and boost adoption of the concept.

CRM systems to nudge consumer

CRM systems and proactive followings can encourage consumers to adopt circular behaviors and secure stock. For example, a company could email customers two years after purchasing a child’s bike, inquiring if it has been outgrown and offering a buyback option. The returned bike can then be repaired (if necessary) and resold, seamlessly integrating circular practices into the customer journey.

Retail and Sales

Example: Patagonia and Amazon

To make circular options more accessible, companies have incorporated them into their existing linear offerings. Patagonia prominently features its Worn Wear program in the top menu bar of its webpage, enabling customers to discover secondhand items alongside new

Stores will also need to evolve into multifunctional hubs, doubling as pick-up & drop-off points for rentals and buyback programs. Adequate warehouse space may also be needed to accommodate rental inventory and facilitate repair operations efficiently. The rollout strategy is also important; launching circular initiatives in high-traffic flagship locations can increase visibility, build awareness, and set the foundation for broader adoption.

Staff incentives

Case examples highlight the importance of engaged and knowledgeable store staff in driving circular sales. Employees who take the time to explain the circular offer to customers have a significant impact. To ensure that staff are motivated to promote these offerings, remuneration frameworks should be tailored to complement the unique dynamics of circular sales. Since secondhand or rental transactions typically have lower per-transaction values, incentives and bonuses must be structured to encourage the active promotion of circular options.

Upgraded POS system

Many retailers also discover that their existing point-of-sales systems are not designed to handle the added complexities of circular business models. This happened to Houdini, who saw an increase in complexity with their back-end solutions.

To successfully transition to circularity, retailers must evaluate their current systems and identify necessary adaptations. (See the section titled “Digital solutions.”)

Logistics and operations

Capacity forecasting

To build a strong business case and effectively manage costs and margins, companies must identify the requirements and investments necessary to enable efficient circular operations. Service blueprints help map processes, spot bottlenecks, and uncover synergies with linear offerings—for example, repurposing empty return routes, which currently account for 20% of truck miles in the EU, for buyback or rental

Case examples demonstrate that businesses can often capitalize on their existing infrastructure to support circular operations before making additional investments. One company discovered they could rely on current logistical capabilities until circular revenue reached 10% of total revenue, delaying the need for further investment. Identifying these inflection points requires breaking down growth targets into actionable steps—such as determining the additional volume of products to be transported and increased warehouse space required.

Logistical flows

A key growth driver is the ability to list secondhand items both online and in-store, which expands customer reach and enhances accessibility. Achieving this requires updated processes to effectively manage unique secondhand inventory. When a product purchased online is stored in a physical store, swiftly locating it and coordinating shipment is essential to minimize wait times and provide a convenient customer experience.

Repair capabilities and inventory management

Efficient repair and inventory management cut lead times, speed up delivery, and contain costs. A case example showed a 20–30% jump in repair efficiency could be achieved by standardizing repair processes and reducing spare-part lead times. Repairs can be streamlined by identifying common issues and providing technicians with pre-assembled kits. Forecasting spare parts demand can help meet needs without overstocking.

Inventory systems need to evolve to track rented products, monitor product condition, and manage spare parts availability efficiently without overstocking. This includes implementing features to follow up with customers who delay product returns. Solutions such as automated reminders for overdue rentals, real-time inventory tracking, and predictive analytics for spare parts can streamline operations and enhance efficiency.

Example: Hilti’s Fleet Management

Hilti has established an efficient circular logistics and operations system for its Fleet Management program, providing businesses with a comprehensive solution for managing construction tools. The program helps customers select the right tools based on their specific needs and includes regular maintenance and upgrades to keep tools in optimal condition throughout their life cycle. Hilti also manages repairs, replacements, and the recycling of end-of-life tools, reducing waste and ensuring minimal downtime for

Digital solutions

Omnichannel integration

Listing products both online and in-store is key for circular growth, with 60% of the secondhand market projected to be online in 2030. This omnichannel approach broadens customer reach and taps into niche segments that are otherwise difficult to access. Effective integration requires:

- Product listings: Consistent alignment across platforms to ensure circular offerings and new products are accurately listed across all channels with uniform descriptions, pricing, and availability. Additionally, point-of-sale systems must seamlessly manage both circular and linear sales, meeting the requirements outlined in the “Retail and Sales” section. This requires specialized software or modular solutions tailored to the unique demands of circularity.

- Stock management: Real-time inventory tracking ensures products are updated across channels, enables efficient transfers between locations, and reduces stock discrepancies.

- Customer accessibility: Systems that expose circular options alongside traditional offerings ensure customers can easily browse and purchase across platforms.

Pricing engines manage the complexities of pricing circular products and ensure accurate and competitive pricing, as highlighted in the Circular Offer section. They can, for example:

- Maintain consistency and ensure alignment across pricing structures for resale, rental, and subscription models by cross-checking and standardizing prices.

- Generate adaptive pricing suggestions based on factors such as the circular model, product condition, refurbishment costs, and overall market appeal.

Product traceability enables businesses to track the entire life cycle of a product, providing detailed insights for efficient operations and improved customer transparency. Central to this is the use of "digital product passports," which allow access to a product’s complete history via a simple scan.

- In repairs/refurbishment, traceability reveals details such as rental duration, past repairs, and parts replaced, enabling faster diagnostics and more accurate repairs/refurbishment.

- In buyback schemes, traceability guarantees safer purchases by assessing a product's origin, materials, and usage history, enhancing both company and customer trust. Enable Dynamic Recommendations:

Simple digital solutions can boost customer satisfaction by offering convenient repairs and orderly time slot bookings. More advanced tools, such as machine learning-powered systems, can further enhance efficiency, reduce costs, and elevate the customer experience in product diagnostics and repairs/refurbishment. These tools provide accurate assessments of product conditions and reliable price estimations. Examples of applications include:

- Simplifying the buyback process by enabling consumers to scan products at home for suggested pricing and easy returns.

- Improving repair efficiency by diagnosing common issues and ensuring accurate spare part allocation.

- 3D Printing providing on-demand spare parts, which reduces lead times and minimizes inventory needs.

Product

Design principles must align with the circular business model. For rental models, durability is key, requiring robust materials and designs that can withstand multiple cycles to ensure profitability. For recycling, mono-materials, easy separability, and cost-efficient options must be prioritized.

The circular offering shapes procurement needs. For example, securing scarce recycled textiles to increase share of recycled material for apparel requires a clear supply strategy. In buyback schemes, a common challenge is acquiring enough products for repurchase. Businesses can incentivize customers with discounts, store credits, exclusive offers, or personalized CRM nudges to encourage returns, as detailed in the Marketing section.

Example: H&M group

H&M aims to reach 50% recycled materials in their products by 2030. A critical part of this strategy is ensuring the procurement of the materials. To achieve this, H&M has partnered with Vargas Holding to launch SYRE, a polyester recycling initiative, in 2024. As part of this effort, H&M has committed to a $600 million offtake agreement, ensuring long-term supply of recycled

Integrating circular practices into production reduces waste and lowers costs. Additionally, products made defective during production can be repurposed by selling them at a discounted price, unlocking further value.

Partnerships

Such partnerships are emerging across industries to accelerate circularity. For example, as mentioned earlier, H&M and Vargas Holding’s collaboration on SYRE. Similarly, Renault Group and SUEZ have teamed up to drive circularity in Europe’s automotive sector through The Future Is NEUTRAL, an initiative focused on recycling waste metals and recovering materials from end-of-life

From Scaling to Industrializing Circularity

Scaling circularity offers businesses a chance to create lasting value by rethinking how products are designed, used, and reused. Each challenge—whether consumer adoption, operational complexity, or integrating circular practices—presents an opportunity to innovate and build smarter, more resilient models.

Successful examples from companies show that it is possible to create circular offerings that are both attractive and competitive, meeting consumer needs while reducing environmental impact. Achieving this balance requires dedication, collaboration, and robust systems for logistics, repairs, and digital integration.

Circularity is more than a strategy—it is a pathway to a sustainable future in which businesses grow responsibly and contribute solutions that benefit both people and the planet. In the next article, Sustainable Growth Redefined: The Case for Embedding Circularity in Business Strategy, we will explore how to integrate circular practices into traditional operations for lasting success.

This article is written by the Nordic Circularity Team, a group of professionals dedicated to advancing circular economy solutions in the region. The team includes: Nanna Gelebo (Managing Director and Partner, Stockholm), Peter Jameson (Managing Director and Partner, Stockholm, Copenhagen), Davide Urani (Managing Director and Partner, Stockholm, Milan), Elina Ibounig (Partner, Helsinki), Trine Filtenborg de Nully (Principal, Copenhagen), Marcus Bruns (Project Leader, Oslo), Marie Holtorf (Consultant, Copenhagen) and Johanna Ihrfelt (Associate, Stockholm).