Over the past decade, the US natural gas industry has been playing an increasingly integral role in the national economy. Now, in addition to being the most dominant source of energy for power generation in the US today, the natural gas sector appears poised to dominate the world’s energy markets, the energy transition catalyzed by climate change, and even global geopolitics.

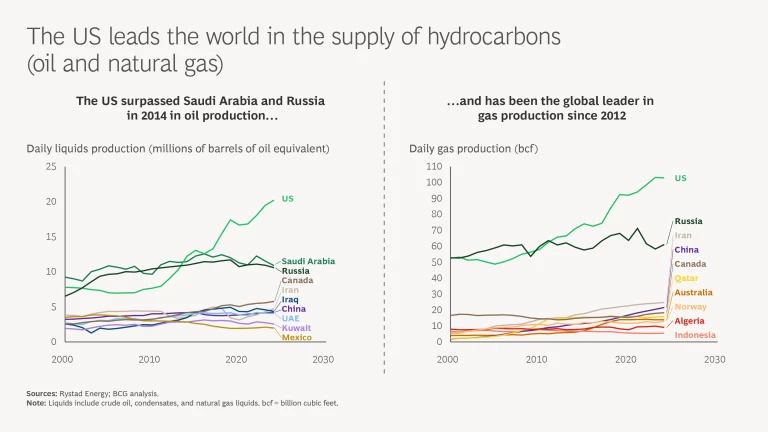

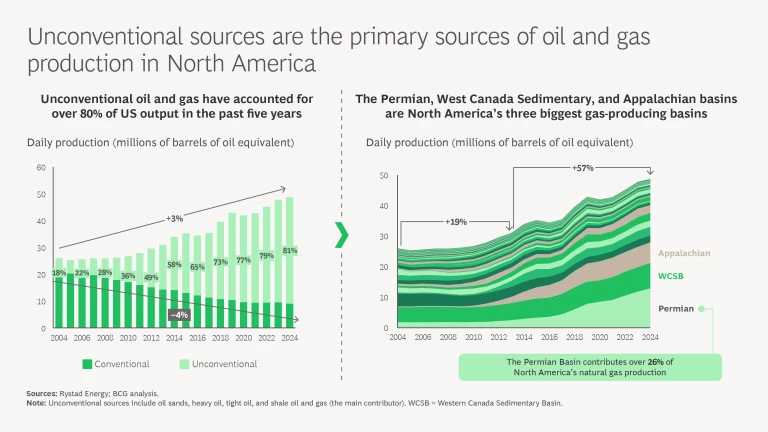

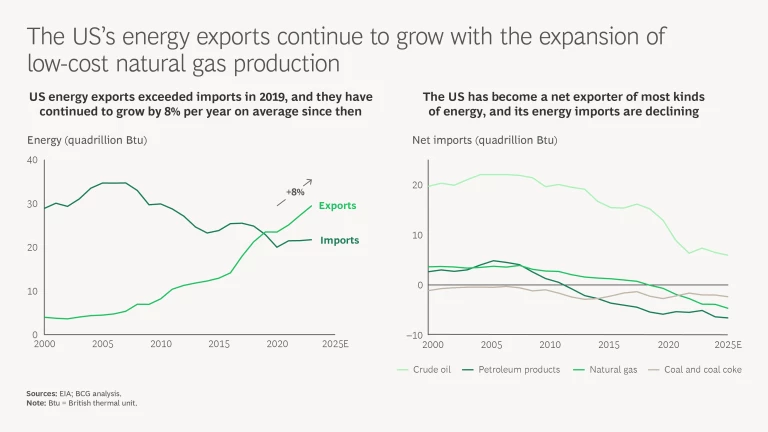

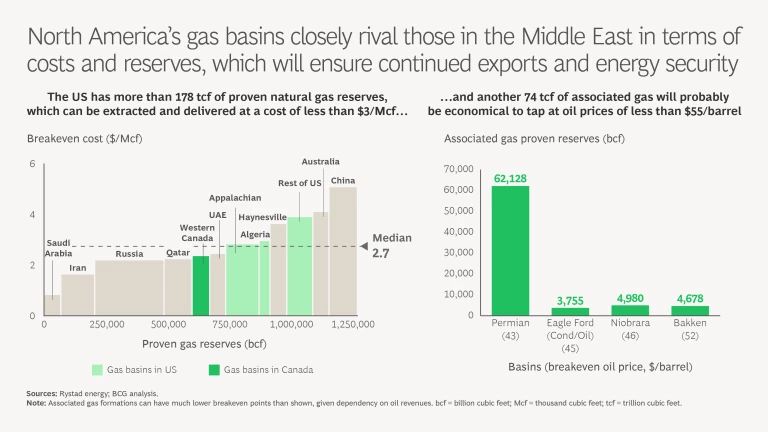

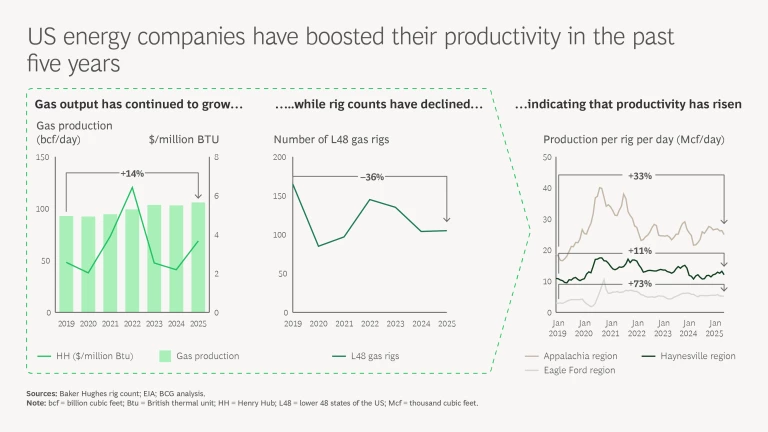

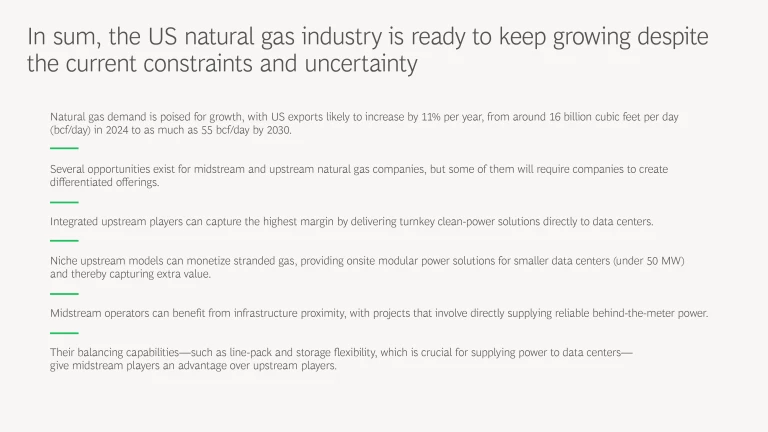

The US has become the world’s biggest producer of oil and natural gas. Over the past five years, unconventional sources of oil and gas, such as shale, have accounted for over 80% of US output. The country’s large reserves and low production costs suggest that the US will stay at the top of the global output charts for the foreseeable future. And it will remain a net exporter of energy, as US oil and gas exports have risen by around 8% per year since 2019 while energy imports have fallen.

Three trends in particular have driven the growth of the US natural gas industry over the past decade:

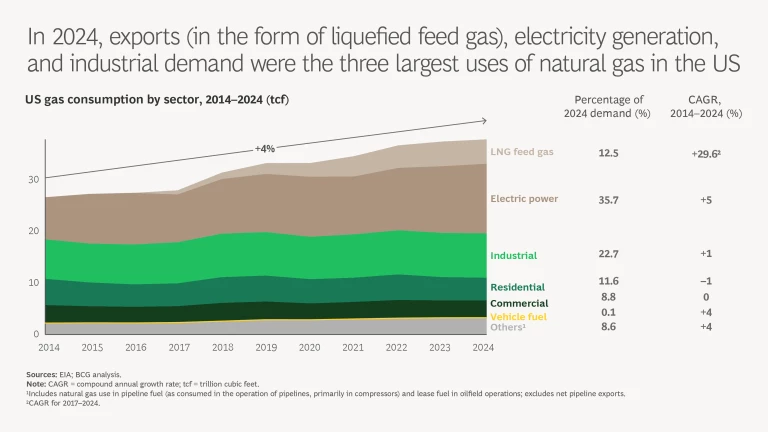

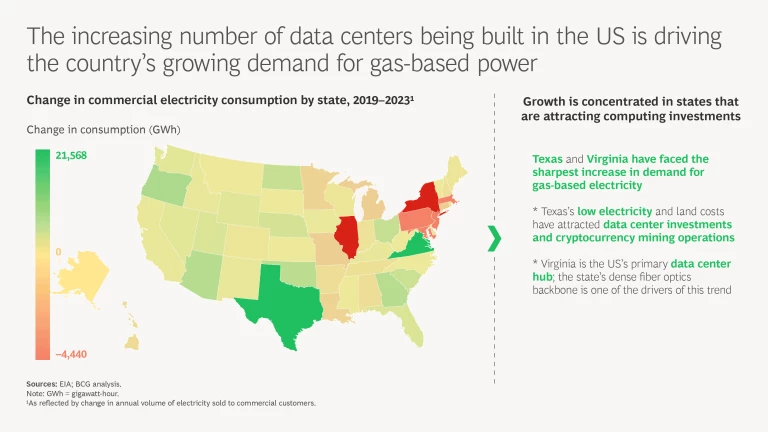

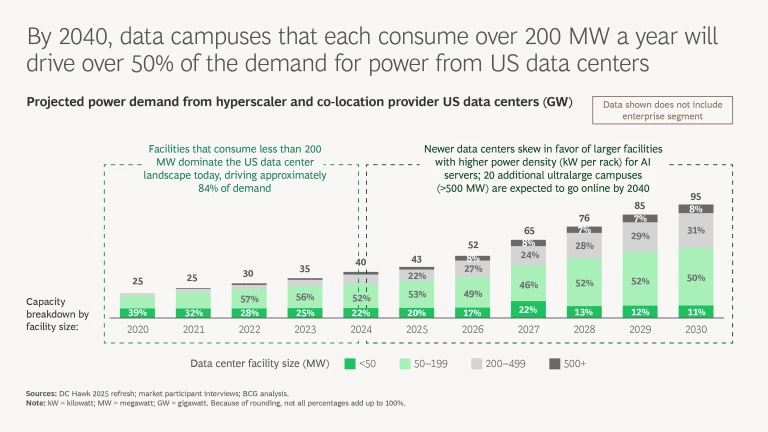

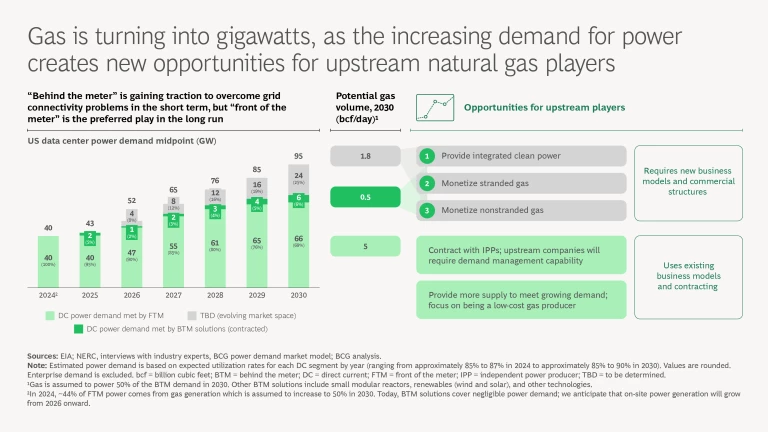

- Natural Gas–Based Power Generation. Around 44% of US’s electricity generation is now powered by natural gas. In fact, electricity generation has been shifting from coal-fired generators to gas turbines for nearly two decades, driven by better economics in a static market. The market is changing too; US power generation is now growing in response to rising demand from data centers that are proliferating around the country. By 2028, cloud computing may account for most of the additional demand for power, according to recent BCG projections.

- Liquefied Natural Gas Exports. Although the US has exported liquefied natural gas (LNG) for decades, it became the world’s biggest exporter in 2023. It supplies LNG to over 45 countries, and the volume of exports will increase by over 60% in the future. Canada, too, has started exporting LNG and may increase its capacity by 45 million metric tons per year by 2035. That will help meet the global demand for LNG, which is expected to rise 2% to 4% per year between 2025 and 2040.

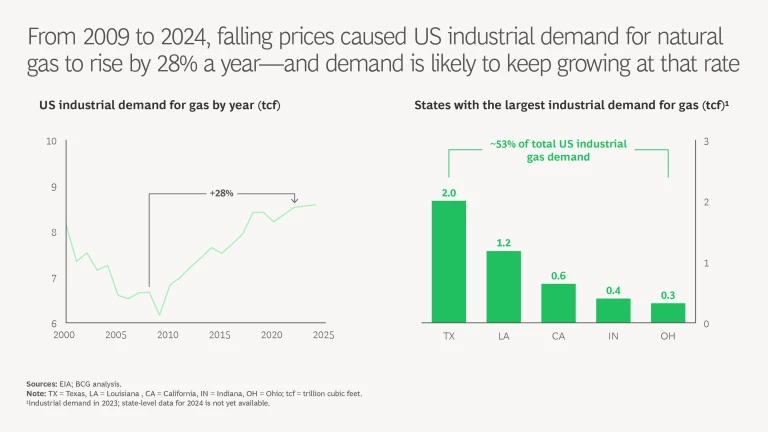

- Industrial Demand for Natural Gas. Commercial demand in the US for natural gas soared by 28% from 2010 to 2024. In particular, the chemicals industry has doubled its consumption in recent years. Demand is likely to keep growing at that rate, but it will be concentrated. Five states account for more than 50% of the demand for gas in the US, where the fuel is used either to generate heat and power or to serve as feedstock for manufacturers, mining and mineral extraction, and agriculture.

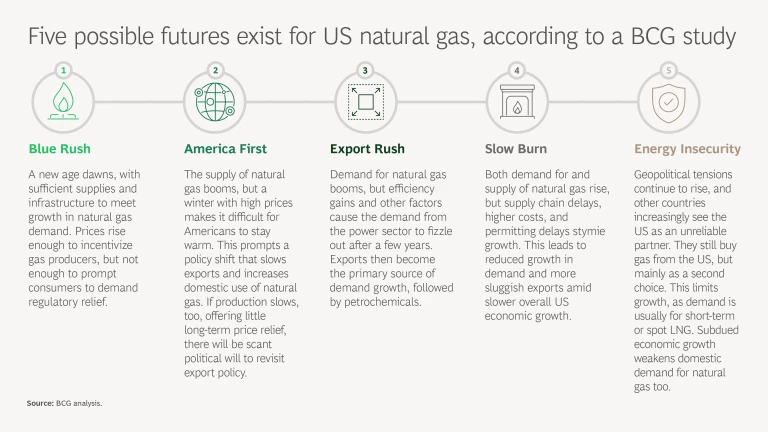

A BCG study indicates that the US natural gas industry could face any one of five futures, which we have identified as Blue Rush, America First, Export Rush, Slow Burn, and Energy Security. These scenarios, which this slideshow encapsulates, have the following key differences:

- In the Blue Rush scenario, a combination of supply increases and infrastructure meets demand growth. Prices incentivize producers but don’t stress consumers.

- America First could emerge if a winter with high gas prices makes it difficult for Americans to stay warm, leading to a policy shift that limits exports and increases domestic use.

- Export Rush may happen if demand in the power sector flags, causing exports to become the primary source of growth in production.

- In the Slow Burn projection, demand growth will be constrained by supply chain delays, higher costs, and permitting delays.

- In an Energy Security future, countries will buy gas from the US as a second choice, hindering the sector’s growth even as domestic demand slows.

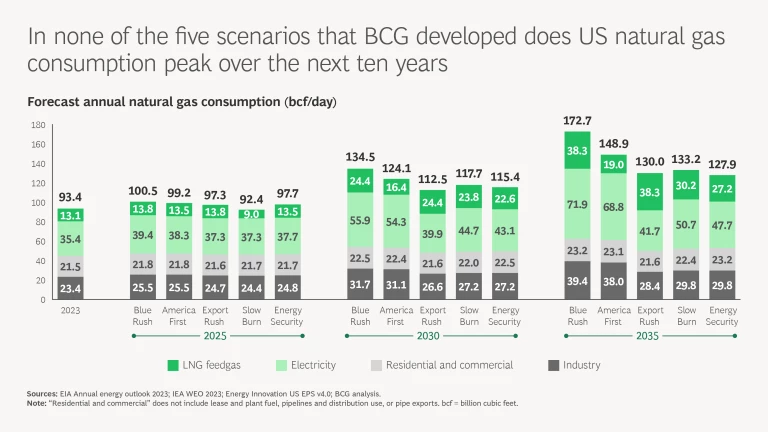

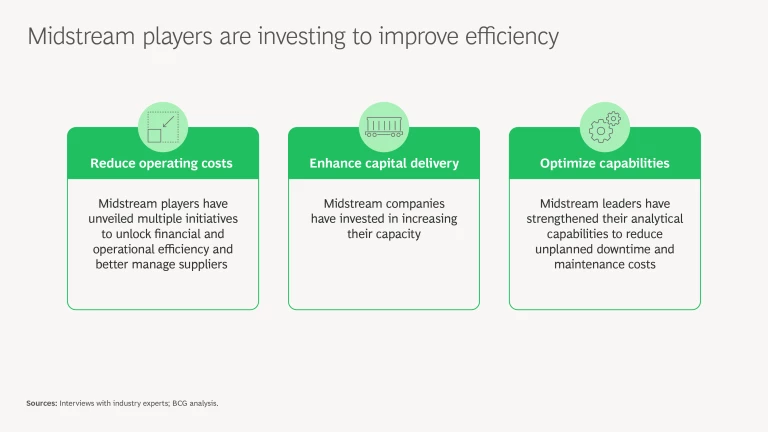

None of these scenarios suggests that either the demand for or the supply of natural gas will peak in the next ten years. Regardless of which sectoral scenario eventually unfolds, upstream and midstream players have several options. However, two responses—reducing costs and increasing agility to respond to rapidly changing environments—will be appropriate in all of them.

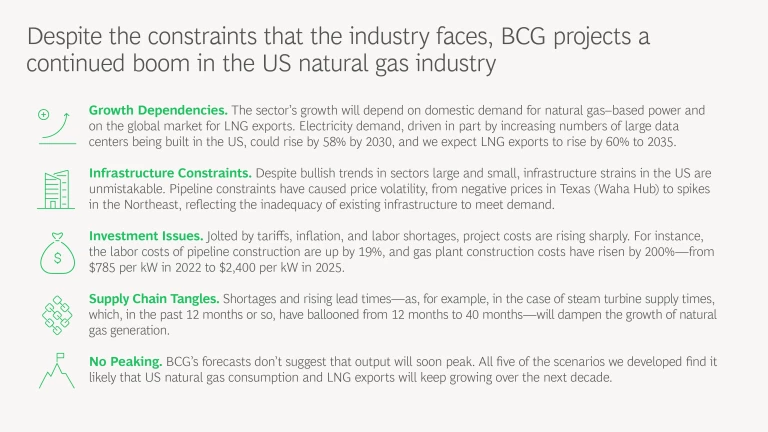

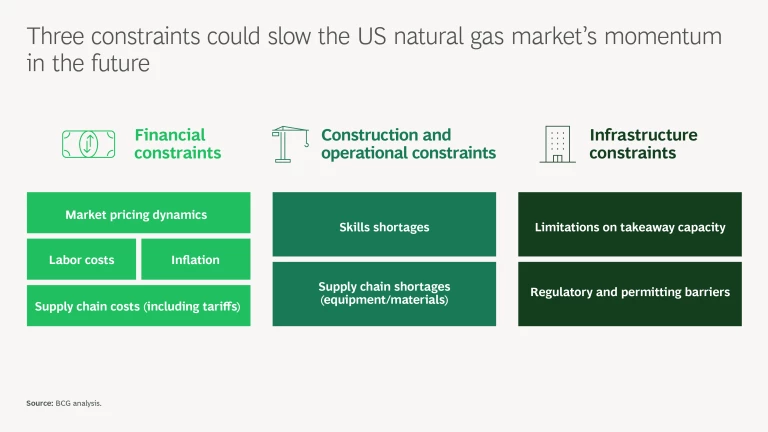

Although the years ahead will be positive for the US natural gas industry, companies that wish to outperform rivals will need to maintain a strategic focus in the face of three key constraints. The first of these consists of financial factors such as labor costs, supply chain costs, and inflation. The second comprises construction and operational costs, including skills shortages and supply chain shortages. And the third relates to infrastructure costs such as takeaway capacity limitations, permitting, and other regulatory barriers.

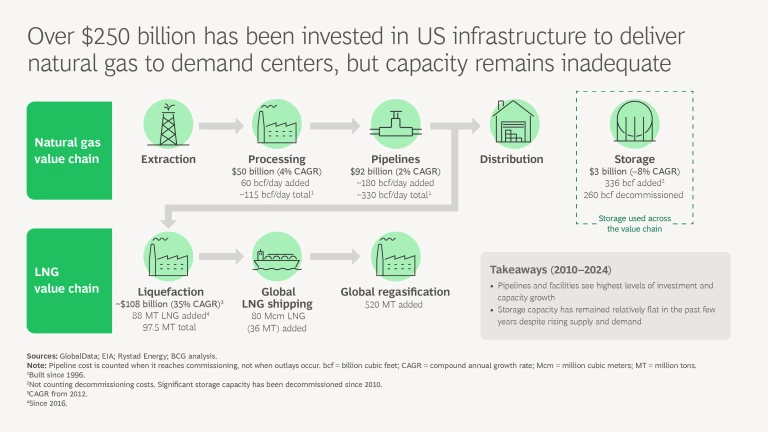

Despite attracting more than $250 billion in investment since 2010, infrastructure in the natural gas sector—pipelines, storage, and generation—has encountered continuing constraints, resulting in demand-supply imbalances and volatile prices. Tariffs, inflation, and labor shortages are pushing new gas project costs up while supply chain issues such as extended interconnection queues and long lead times for gas turbines are lengthening construction schedules.

Moreover, coal could emerge as a potent rival if gas prices exceed $3 per million BTUs and if new policies ease the construction of thermal power plants. Of course, natural gas-based power generation is cleaner than coal-based generation, with 40% lower carbon emissions, and is less capital intensive, with 80% lower fixed costs.

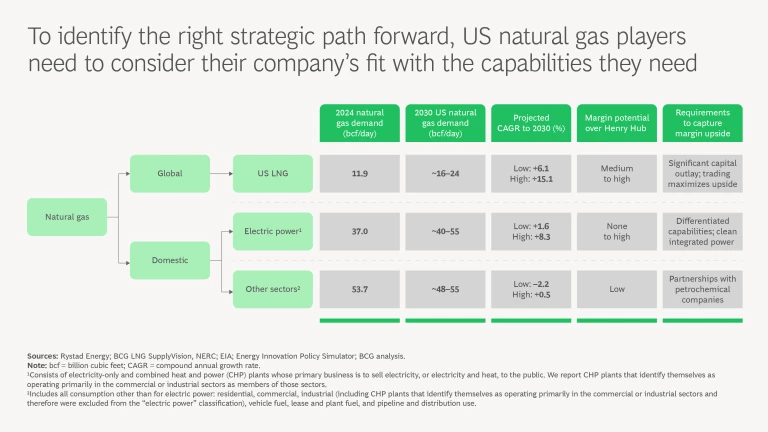

Despite these seemingly rosy prospects, many US natural gas companies are at a crossroads. CEOs of companies engaged in gas exploration, infrastructure, utilities, and LNG exports have many possibilities for growth, including developing new business models and differentiated offerings, as we discuss in-depth in the slideshow. But companies in each segment also need to assess where the best opportunities lie:

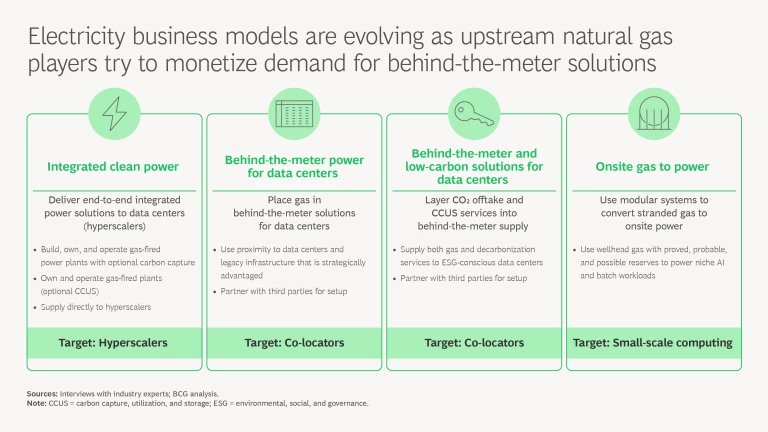

- To compete effectively, upstream players should aim to broaden their commercial and value chain integration strategies. They can capture the highest margins by delivering turnkey power solutions, particularly for large data centers. Niche upstream players can monetize stranded gas by providing modular power solutions for smaller data centers.

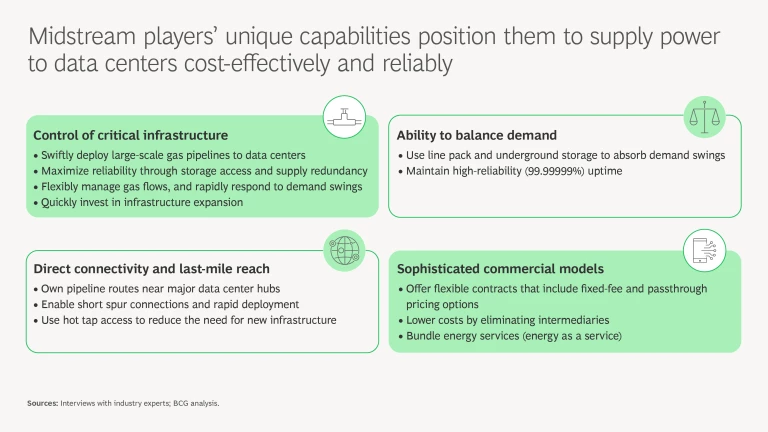

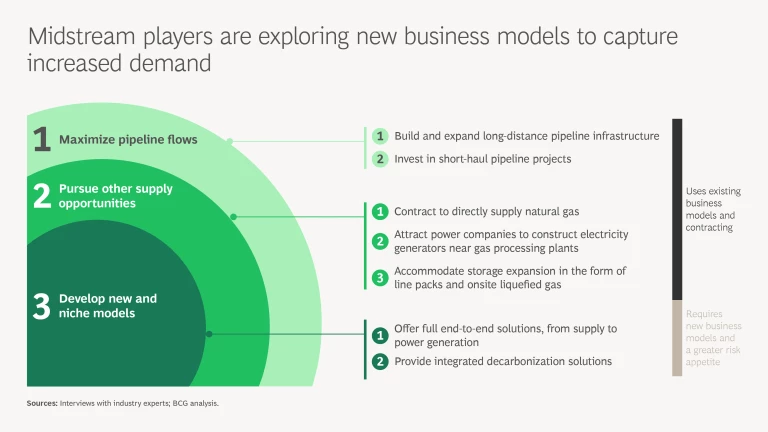

- Midstream operators will benefit from infrastructure proximity to supply reliable behind-the-meter power to consumers. They can compete effectively with upstream players because of their load-balancing capabilities, which are crucial for data centers.

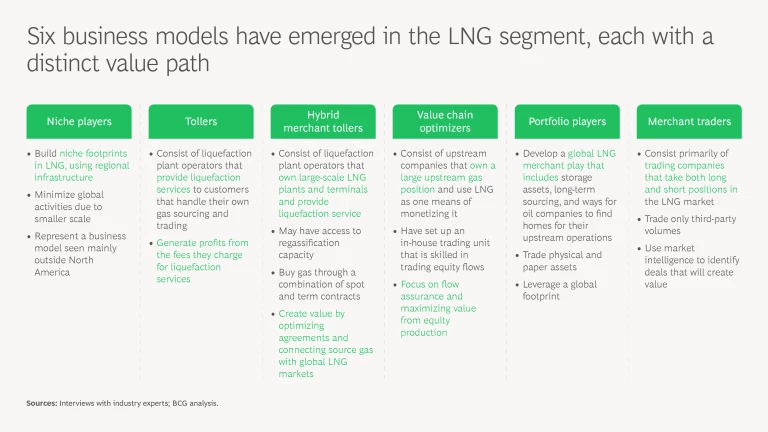

- The LNG segment will focus primarily on exports, where six potential business models could coexist: niche players, tollers, hybrid merchant tollers, value chain optimizers, portfolio players, and merchant traders.

- Novel opportunities could emerge in natural gas–based power generation, particularly in behind-the-meter power, energy as a service, data analytics, gas storage, and equipment development.

The strategy challenge in the natural gas industry is about navigating a world of local constraints amidst global opportunity. The future will mark neither an unbounded boom nor a slow decline; natural gas will remain integral to the US energy mix, with demand anchored by exports, industry, and power markets. Natural gas M&A may slow in 2025, but there will be sufficient consolidation to help midstream companies better cater to data center demand.

The level of growth will hinge on how companies navigate infrastructure gaps, decarbonization pressures, and geopolitical volatility. CEOs who lead with agility and adaptability will position their companies not only to ride the boom in America’s natural gas industry, but also to shape the future of sustainable energy.

The authors sincerely thank BCG’s Stephanie Muecke, Bas Percival, Fidel Nunez, Daniel Quijano, Andrei Sardo, David Paz, Michael McKissack, and Vivian Lee for all their contributions to this study.