Don’t be fooled by all the headlines that suggest climate investing is dead. True, there are many uncertainties that affect climate investing—the macroeconomic context, regulatory environment, administrative bottlenecks, and public support are just a few. But private equity transactions in the climate space amounted to $73 billion in 2024, according to Private Equity International, and Sightline Climate reports that climate-focused fundraising increased by 20% from 2023 through 2024, while overall capital raised by PE funds declined by 18%.

A 2024 S2G Investments survey found that 46% of asset owners plan to increase their climate investments. CalPERS, for example, doubled the size of its fund that invests in mitigation, adaptation, and transition solutions across multiple asset classes to $100 billion.

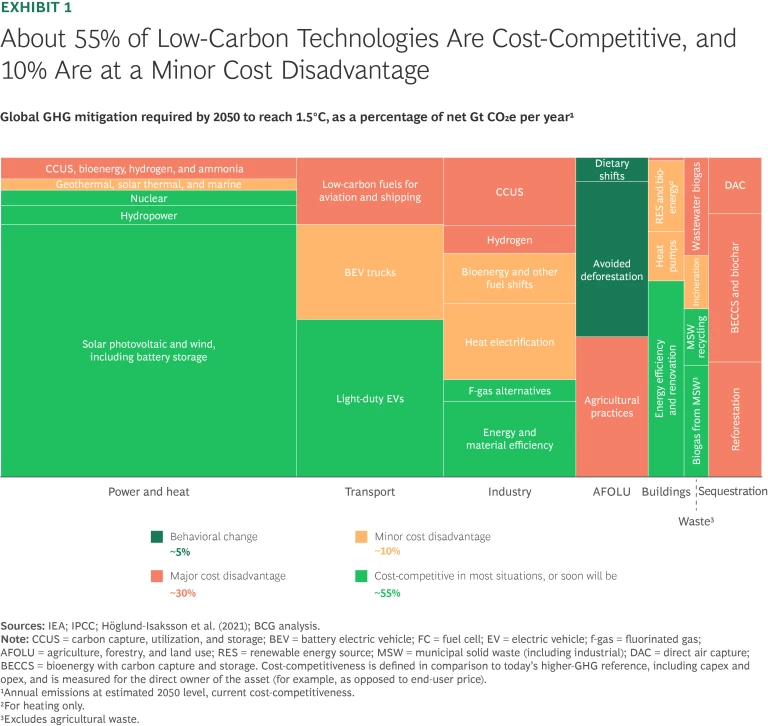

One reason for private capital’s continued focus on climate is that 55% of low-carbon technologies are already cost competitive in most situations or soon will be, and another 10% are only at a marginal disadvantage. (See Exhibit 1.) Moreover, a confluence of tailwinds is creating investment opportunities not just in low-carbon technologies but also in circularity, adaptation, and resilience solutions that are part of a broader sustainability ecosystem. Bolstering the case further, a BCG analysis of companies from 2016 through 2024 found that those pursuing green growth achieved higher revenue valuations.

The salient task then becomes finding the most attractive investment opportunities. Attractiveness varies depending on investor type, segment, and region. With this in mind, we took a close look at opportunities in eight segments across the globe that can be very attractive for infrastructure and PE investors. We then conducted a deep dive into 15 subsegments, finding that 5 in particular are the most promising.

Stay ahead with BCG insights on principal investors and private equity

Where Are the Attractive Opportunities?

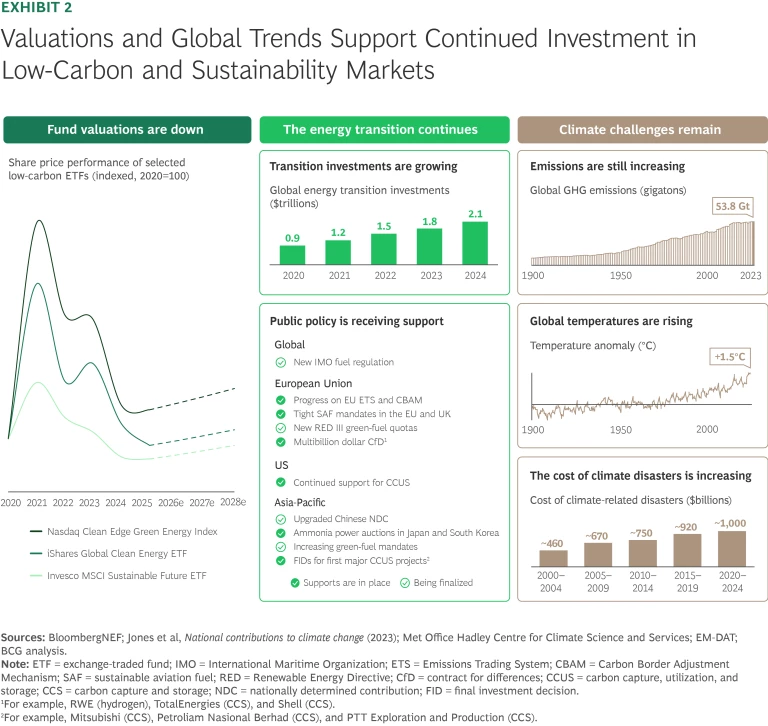

Climate investing is currently in a postbubble period: at $73 billion, the amount of 2024’s transactions is down from the high of $114 billion in 2021. However, we think there are real opportunities given that company valuations are down and that the green transition is largely continuing, public policy is still mostly supportive in the European Union (EU) and Asia-Pacific (APAC) region, and fundamentals are remaining relevant. (See Exhibit 2.)

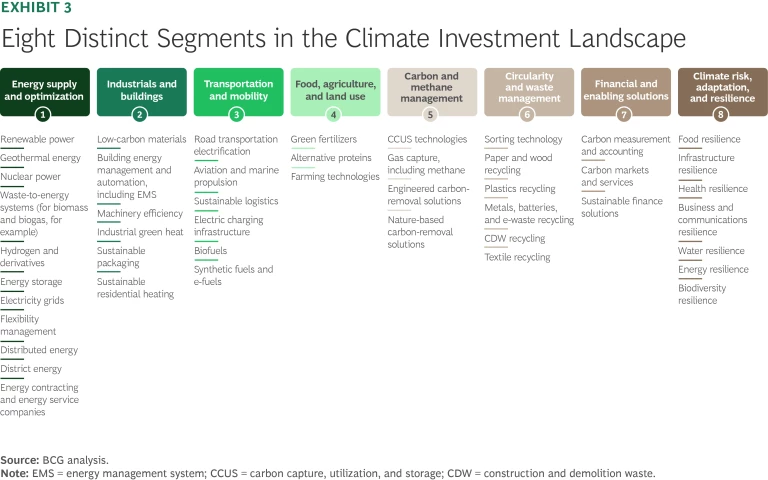

To more precisely identify the investment opportunities, we analyzed eight industry segments and 46 subsegments. (See Exhibit 3.) We gauged market attractiveness in terms of size, growth, regulatory independence, and scalability. We also assessed each subsegment’s natural fit for infrastructure and PE investors in terms of market growth expectations, the maturity of the technology and associated risks, value creation and typical returns, and the degree of market fragmentation.

For infrastructure investors, certain subsegments emerged as likely to offer strong market attractiveness or a natural fit, or both (depending on actual and expected interest rates):

- Electricity grids

- Electric charging infrastructure, notably for captive car fleets, in APAC, the EU, and North America (NA)

- Energy contracting and energy efficiency servicing

- Energy storage, installation, and maintenance in APAC, the EU, and NA

- Flexibility management in the EU

- Renewable power in APAC, the EU, and NA

- Selected recycling plays

- Sustainable finance solutions in the EU

- Waste-to-energy systems

- Alternative proteins in APAC

For PE investors, we also identified subsegments with strong market attractiveness or a natural fit, or both:

- Alternative proteins

- Biofuels

- Carbon measurement and accounting

- Distributed energy

- Electric charging OEMs and installation and maintenance in APAC, the EU, and NA

- Energy efficiency servicing

- Flexibility management in the EU

- Industrial green heat

- Recycling equipment, software, and operations

- Renewable power installation and maintenance, distribution, and OEMs in APAC and the EU

- Sustainable finance solutions in the EU

- Sustainable residential heating

A Deep Dive

As noted earlier, the outlook for climate investing is far less gloomy than current news reports make it seem. And for both types of investors, we have identified several promising investment plays. (See the sidebar “Emerging Investment Plays.”) As part of our research, we conducted deep dives into 15 subsegments, and we are particularly bullish on 5 of them. In many cases, these have a great appeal to both infrastructure and PE investors.

Emerging Investment Plays

Infrastructure investors could focus on acquiring established assets and then implementing changes to improve performance and economies of scale—an especially attractive option if the asset has been poorly managed by a legacy player. Infrastructure investors could also invest in development platforms with a strong pipeline. This approach can facilitate quick capex deployment in mature technologies such as renewables, notably commercial and industrial solar power and biogas.

Another option would be to invest in “infra-at-exit” platforms that have business models that are expected to normalize or develop more infrastructure characteristics over time (such as electric-vehicle-charging and battery-storage models). Finally, infrastructure investors could acquire established assets and then make them more climate friendly. This may involve making investments that a capital-constrained local utility cannot (such as in a district heating network), reducing emissions (such as adding carbon capture and storage projects to gas-fired plants), or leveraging existing infrastructure for the green transition (such as using existing pipelines for biofuels).

Likewise, we see several specific investment plays for PE investors. They could purchase equipment manufacturing or assembly operations with an eye toward facilitating internationalization or converting the products. For example, they could convert gas boilers to heat pumps or repurpose oil and gas pipes for district heating or cooling systems. Another attractive option is investing in installers and service players for various green technologies—including solar, wind, and EV-charging solutions—creating value by either buying and building or improving performance. Also worth considering is investing in integrated solutions that, for example, consolidate solar and wind power generation and storage with EV-charging infrastructure installation, operations, and maintenance.

PE investors may also want to assess investing in control software to optimize intermittent energy systems. And it is worth noting that besides the subsegments identified as the most promising, many supporting niches can benefit from the green energy trend. One such niche is the decommissioning or the conversion of old assets (for example, repurposing refineries as biorefineries), which requires energy advisory and engineering services for the testing, inspection, and certification of their new use.

Besides traditional transactions, infrastructure and PE investors should also consider corporate carve-outs, which are becoming more common as a way to tap into attractive assets. They accounted for 15% of all deals in the first quarter of 2024, up from 7.6% the year before. Looking ahead, more than 80% of large companies expect to make a divestiture over the next 18 to 24 months. We expect that investors with the execution know-how to stand up these assets and build value will truly differentiate themselves.

Stationary Energy-Storage Solutions and Service Providers

Battery energy storage systems (BESS) are critical for grid flexibility, reliability, and the integration of growing capacities of renewable energy sources into the grid. Storage systems support the time-shifting of renewable generation, reducing curtailment, and providing ancillary services such as frequency regulation, voltage support, capacity reserves, and black-start capabilities. These systems also help to postpone or avoid grid augmentation for both transmission and distribution, and they can offer additional value streams in the EU, Australia, and the US where the technology is already economically viable and largely independent of subsidies. But clear regulations are required to ensure that the technology can be used in all the aforementioned applications. The APAC region is the biggest marketplace for BESS sales today.

The Outlook. Global utility-scale BESS sales—including battery packs; systems integration; power conversion systems; energy management systems; engineering, procurement, and construction (EPC); and installation—was $30 billion in 2024. Sales are expected to reach $70 billion by 2035, a CAGR of 7.5%. Declining battery costs, improving technology performance, and new business models—such as the co-location of solar and storage assets, the co-location of electric vehicle (EV) charging stations with solar and storage assets, and standalone merchant assets—are driving this pace of deployment. Every market with an increasing share of solar photovoltaic (PV) and wind assets will be spurring BESS sales—especially in the EU, given the massive blackout in Spain in April 2025. Going forward, scalability is mainly limited by the interconnection queue, the high cost of financing, and the rapid development of technology, which increases the risk of technology obsolescence.

The Opportunities. Investing in front- and behind-the-meter battery system operators is typically attractive to infrastructure investors, given the asset-heavy nature, long-term offtake agreements, and predictable cash flows.

Investing in BESS project developers, trading platforms, and operations and management providers often appeals to PE investors, given the potential for consolidation and the prospect for improving operations and building platforms.

Energy Contracting and Energy Efficiency-as-a-Service Solutions

Energy service companies (ESCOs) deliver reliable energy or reduce energy costs, or both, either by supplying energy as a service or guaranteeing savings by upgrading equipment such as heating, ventilation, and air conditioning (HVAC) systems; heat pumps; lighting; rooftop solar; and storage. ESCOs are widely adopted in public and commercial buildings, particularly where regulations require improvements in energy performance. APAC accounted for more than half of global sales in 2023, while the EU was the smallest market with $5 billion in sales.

The Outlook. The global ESCO market was $35 billion in 2023, and it is expected to grow to $50 billion by 2030. Aging infrastructure, rising corporate sustainability targets, and cost pressures create strong growth potential.

The Opportunities. Energy supply contractors design, finance, build, and operate onsite energy supply systems under long-term contracts based on fixed and variable energy charges. These companies are often attractive to infrastructure investors due to the large upfront investment, long asset lifespan, a steady but low-growth profile, and stable demand from industrial and municipal clients. Efficient, scalable project development—including obtaining permits, sizing, integration, and customer contracting—is necessary to drive growth.

Energy savings contractors attract PE investors due to high industry fragmentation, scalability through platform building, and the potential to professionalize a service-based model.

Energy-as-a-service contractors are later-stage players that can appeal to PE investors given the recurring cash flows and the potential for a roll-up or regional expansion.

Energy-as-a-service contractors are later-stage players that can appeal to PE investors given the recurring cash flows and the potential for a roll-up or regional expansion. Owning and operating both supply-side systems (such as solar and combined heat and power) and demand-side systems (such as HVAC and energy management controls) facilitate cross-selling services, locking in customers, and monetizing the life cycle.

Biofuels

Biofuels are renewable energy sources that are derived from biological materials (including plants, agricultural residues, and organic waste) and that can replace or supplement traditional fossil fuels. Biofuel types include bioethanol (usually made from sugar or starch crops) and biodiesel (often made from vegetable oils or animal fats), as well as advanced biofuels from nonfood biomass. Decarbonization mandates across regions are driving the adoption of biofuels by the aviation, maritime, and road transportation industries.

The Outlook. Biofuel is a large market that is expected to grow from $175 billion in 2024 to $215 billion in 2030, a CAGR of 3.5%. The demand for sustainable aviation fuels (SAF) and maritime fuels is expected to grow the fastest, while the demand for first-generation biofuels in developed markets (particularly the EU) is anticipated to either stagnate or decline. Sustainability concerns around first-generation fuels (including ethanol, biodiesel, and renewable diesel) will make it difficult to scale these fuels in the EU, although these can all be produced as second-generation fuels if second-generation feedstocks are used.

Producers of other second-generation fuels that are made from nonfood biomass sources (including agricultural residues, forest residues, and dedicated energy crops grown on marginal land) should expect competition for feedstock, especially after 2030. Scarcity could drive prices up, which would benefit producers with a high degree of upstream vertical integration into feedstock collection and aggregation. In the near term, APAC may be less exposed to a feedstock shortage due to higher availability. But in the long run, the region is expected to face similar constraints.

The Opportunities. APAC’s second-generation oily feedstock collectors and aggregators (such as cooking oil collectors) are the biggest investment opportunity because large amounts of feedstock are available and are not being collected. Over time, customer stickiness and increasing scarcity will increase the value of the product. There is also low technology risk. Both infrastructure and PE investors may like this opportunity depending on the regulatory environment and type of feedstock.

Biomethane is the lowest cost low-carbon fuel with a strong growth outlook, driven by new demand from maritime sectors. The biomethane market may be attractive to PE investors because it is fragmented and ripe for consolidation, and the technology is highly mature. There are also opportunities to monetize biogenic CO2 and digestate.

Renewable diesel and hydroprocessed esters and fatty acids fuels are a fast-growing market, driven by new SAF-blend mandates. The market is mostly dominated by large oil and gas players, although co-investment opportunities exist for financial players. Overcapacity is currently putting downward pressure on fuel prices and margins, emphasizing the importance of selecting competitive producers, while also creating investment opportunities at attractive valuations. This market could appeal to both PE and infrastructure investors, depending on their risk appetite.

Waste-to-Energy Systems

Waste-to-energy and bioenergy systems convert municipal, industrial, and organic waste, as well as biomass, into useful energy. The systems serve to both manage waste and increase renewable energy supply, with growing relevance for electricity, heat, and renewable gas applications. The two main technologies are thermal conversion (such as incineration and gasification) and biological processes (such as anaerobic digestion).

The Outlook. The global market for waste-to-energy systems was $30 billion in 2024, and it is expected to reach $60 billion in 2032, a CAGR of 9%. With landfilling being reduced—especially in the EU—waste-to-energy systems are becoming the final disposal method in many jurisdictions. Export restrictions, feed-in tariffs, and carbon pricing are also encouraging the deployment of these technologies. And urbanization and rising waste volumes in emerging markets offer strong tailwinds. But growth could be constrained by public acceptance, feedstock logistics, and regional permitting.

The global market for waste-to-energy systems is expected to reach $60 billion in 2032, a CAGR of 9%.

The Opportunity. Waste collectors and sorters, anaerobic digestion operators, and municipal solid waste and industrial waste incineration plant operators have proven technologies, predictable cash flows, and strong regulatory support (such as landfill bans and waste-diversion mandates). These businesses are well suited for infrastructure investors because they can create value through plant-efficiency upgrades, asset bundling, and regional platform building.

Electricity Grids

Grid operators must modernize their infrastructure to manage higher loads, bidirectional flows, and solar and wind variability. For example, while EV charging can be a major source of high and unpredictable loads, vehicle-to-grid technologies may help operators better manage those demands. It will be necessary for grid operators to orchestrate storage and rooftop PV exports as part of their grid flexibility toolkit. Modernization efforts should focus on expanding capacity, improving resilience, and deploying smart technologies to enable flexibility and grid stability.

The Outlook. The global electricity market was $400 billion in 2024, and it is expected to reach $515 billion by 2030, a CAGR of 4%. Rising demand for electricity as well as for renewable integration is driving investment into grid upgrades, while public funding and national infrastructure strategies are accelerating new project development.

The Opportunity. Operators of transmission and distribution systems offer mostly stable, regulated, inflation-linked returns with low market and technology risk. Regulations in some markets shift from taking a capex-based approach to one taking total costs (capex and opex) into account. These characteristics appeal to infrastructure investors.

Investors may also want to consider supporting individual projects, including competitive connectors and interconnectors, renewable energy zone projects, and buyouts of brownfield assets.

Finally, EPC players are upgrading grid electrification and resilience. Margins are tight and come with execution and cost risks. But PE investors can look to unlock value through platform building, professionalizing delivery, and expanding into adjacent services, including operations and maintenance and digital construction.

How to Get Investing in Climate Assets Right

Many climate-related investments present evolving risk profiles (because of geopolitical and regulatory uncertainty) and significant value-creation opportunities. By improving identification and decision-making processes, investors can adapt to the changing landscape and have a financial and climate impact.

To take advantage of the opportunities that the subsegments offer, investors can make several moves:

- Continue to monitor the policy and geopolitical landscape and how that impacts investment decisions, both in terms of risks and opportunities.

- Identify opportunities early in the due diligence process to improve margins as well as to pursue interesting new growth pathways.

- Embrace complexity and look for creative ways—such as corporate carve outs—to identify investment opportunities that have not yet become highly competitive.

- Help portfolio companies de-risk large capital projects by building relationships with prospective offtake parties to support the conversion of offtake contracts.

Given that two-thirds of low-carbon technologies are already cost competitive or soon will be, and technologies are improving every day, investors should maintain their focus on climate opportunities. Although the headlines often suggest otherwise, the underlying drivers behind these technologies remain in place for many subsegments. Over time, we expect these drivers to become even more powerful, accelerating the need for mitigation, adaptation, and transition action—and, thus, opening new avenues for profitable investing. For infrastructure and PE investors, it’s critical to frame the climate market correctly and position themselves to seize opportunities today and tomorrow.